What is this article about?

The evolving dynamics in the payments industry, highlighting the end of effortless growth for traditional firms and the increasing emphasis on customer-centric strategies for sustained success

Why is this important?

It highlights a crucial turning point for the payments sector, where customer focus and innovation become essential for enduring competitiveness and growth.

What’s next?

The industry is likely to see intensified innovation, more strategic partnerships, and an increased focus on digital and customer-centric solutions, along with greater emphasis on regulatory compliance and sustainability practices.

As the performance and outlooks of the world’s largest payments players continue to diverge, one thing is increasingly clear: For many of the long-established, more traditional incumbents, the years of easy growth—in revenue terms, not volumes—are over.

As for the battle ahead, it really is now all about the customer, customer rewards and customer innovation. And the focus on customer extends beyond the individual to Merchants and the roll-out of merchant services (think software solutions, accounting packages), as well as the SME space.

Full-year 2023 reporting, presentations and analyst calls for companies from PayPal to Worldline and Nexi to Block Inc. once again drove home a key point. To paraphrase the famous maxim from George Orwell’s Animal Farm, “All payments companies are equal, but some are more equal than others”. PayPal is an increasingly apposite example of this phenomenon, with many of the pitfalls of early success and scale now becoming apparent.

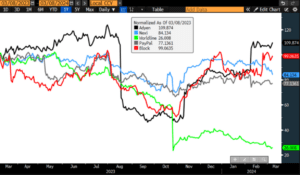

Share price performance on day of 4Q results

Source: Bloomberg

Adyen and Block Inc. both delivered upbeat guidance and results, with a revenue outlook that drove shares higher on results day. The shares reacted very positively. By contrast, PayPal, Nexi, and Worldline all pointed to plans to drive operating margins higher over the next 12-18 months while guiding to sub-consensus, mid-single-digit revenues and citing a tough macro backdrop as the reason.

Sitting alongside Visa, Mastercard and the largest global banks including JPMorgan and HSBC, PayPal remains firmly among the top 5 largest payments players globally. With consensus forecast revenues of $34.4 billion for 2025, PayPal sits neatly between Visa ($39.6 billion ) and Mastercard ($31.6 billion) on this metric.

However, after a fall from grace that has plunged its market capitalization from highs above $300 billion at the peak to $65 billion currently, recent management and strategic changes sum up the challenges facing what may now fairly be called the ‘old guard’. As the wheeling and dealing in the account-to-account (A2A) market shows, competition and partnerships are redrawing the playing field in this, as in other, payments markets.

Source: WhiteSight

Source: WhiteSight

Alex Chriss, CEO since last Autumn, opened the Feb. 7 full-year results presentation by discussing his ’new, world-class team’. This includes a new CFO, new president of global markets, new heads of SMB and consumer, and a chief people officer. All well and good, but the very next slide in the deck spoke volumes.

Summing up, in a very nuanced way, the sea-change in outlook, competition and what is needed to rediscover the company’s mojo in coming quarters, PayPal’s principles for value creation are a nod to battles ahead and minimum requirements for success.

Principles for value creation:

Source: PayPal 4Q23 Investor Update

According to Alex Chriss, PayPal CEO, “Number one, start with the customer. I believe in working customers back. We will start by defining our customers and their most critical needs. Then we will use that knowledge to inform everything, including investments and innovation.”

Everything is now about the customer, the customer experience, and increasingly retaining and rewarding the customer. PayPal is the perfect example, with over 27 million active accounts using PayPal Rewards in the US. Its rewards accounts enjoyed higher engagement and average revenue per account, which was almost double that of non-rewards accounts in 4Q23. More strikingly, the average revenue per account of someone who adopted the PayPal Cashback Mastercard is running at about 5x higher than the average checkout-only account.

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| JPMorgan Chase | $22.2 billion | $17.9 billion | $13.6 billion | $14.5 billion | $13.3 billion |

| American Express | $14.0 billion | $11.0 billion | $8.0 billion | $10.4 billion | $9.7 billion |

| Citi | $12.3 billion | $10.2 billion | $8.7 billion | $9.6 billion | $8.8 billion |

| Capital One | $7.6 billion | $6.4 billion | $4.9 billion | $4.9 billion | $4.4 billion |

| Bank of America | $8.8 billion | $6.9 billion | $5.5 billion | $6.2 billion | $5.8 billion |

| Discover | $3.0 billion | $2.5 billion | $1.9 billion | $1.9 billion | $1.8 billion |

| Total | $67.9 billion | $54.9 billion | $42.6 billion | $47.5 billion | $43.8 billion |

Of course, the cost of these increasingly competitive rewards will challenge margin, growth, and profitability, but that is an analysis for another day. The credit card payments space is the best place to get a glimpse of the sort of cost these rewards programs can become in pursuit of customer spending.

Add in the fact that rewards programs will require companies to defer increasing revenue to cover the cost of yet-to-be-redeemed rewards, and a new headwind looms large on the horizon.

As revenue growth momentum stalls and investors and shareholders no longer reward the pursuit of growth simply for growth’s sake, payments companies will continue to target expansion or recovery in operating margins and a slowdown in capital expenditure. This will be achieved by further headcount reductions, implementation of AI and new software to boost productivity, restructuring, and divestments. The heady days of big-ticket M&A look long gone.

Here again, PayPal leads the way with a leaked internal memo from January of this year confirming that big is not always beautiful. Explaining plans to reduce its global workforce by 9%, the CEO noted that “our size has been slowing us down and that “this change is necessary to execute with the focus and speed required to drive our next chapter of growth and allow us to invest in our future” . In keeping with the full year analyst call that mentioned innovation 24 times, Criss re-emphasised that cuts were necessary to “reprioritize and invest in the innovation and delivery of products and solutions that offer the greatest impact for our customers.”

‘Measurable goals’, ‘consistency’ and the plan to return excess cash in PayPal’s insightful slide also show that as the credibility of high-octane payments growth has waned, investors in the space or looking for more mature metrics to measure and value success. The outlook for the larger incumbents is far from ex-growth, but it is looking increasingly pedestrian. As high-interest rates have starved the start-up payments space of valuable funding, so too high-interest rates have dulled the growth potential for the largest payment players.

Competing in a world where JPM spends $10 billion annually on its technology, communications, and equipment base and Apple has a cash pile in the tens of billions of dollars, incumbent payments companies that have reached significant market share face an uphill task.

Worldline’s $1.25 billion goodwill impairment taken at 4Q, virtually identical to Nexi’s goodwill and intangible assets charge for the same period, is a sign of the times. PayPal retained $11 billion of goodwill on its balance sheet at year-end. Watch this space, and expect to hear lots more about ‘consumer focus and rewards’, ‘organisational simplification’, ‘technological optimisation’, and whatever they may really entail.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.