Managing fraud cases has been a top challenge for card issuers, according to recent studies.

Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for issuers to meet chargeback deadlines and avoid cardholder write-offs. Developed years ago, legacy banking systems are ill-equipped to deal with current fraud volumes. Fortunately, modern SaaS-based solutions enable financial institutions to automate and scale existing dispute management systems in record time and with minimal investment.

Dennis Jones, senior marketing manager at Jack Henry, positioned payments-as-a-service, banking-as-a-service, and fintech partnerships as cost-effective ways to drive efficiencies and reduce fraud rates without replacing existing infrastructures. His article, “Payments play a major role for future-ready banks,” was published by BAI Banking Strategies in July 2024.

“Digital banking is firmly positioned as the foundation of the new financial services industry. But how banks innovate will determine whether they can meet account holder expectations, compete with traditional and nontraditional [organisations, realise] their growth goals and, ultimately, survive.”

Reinventing dispute management

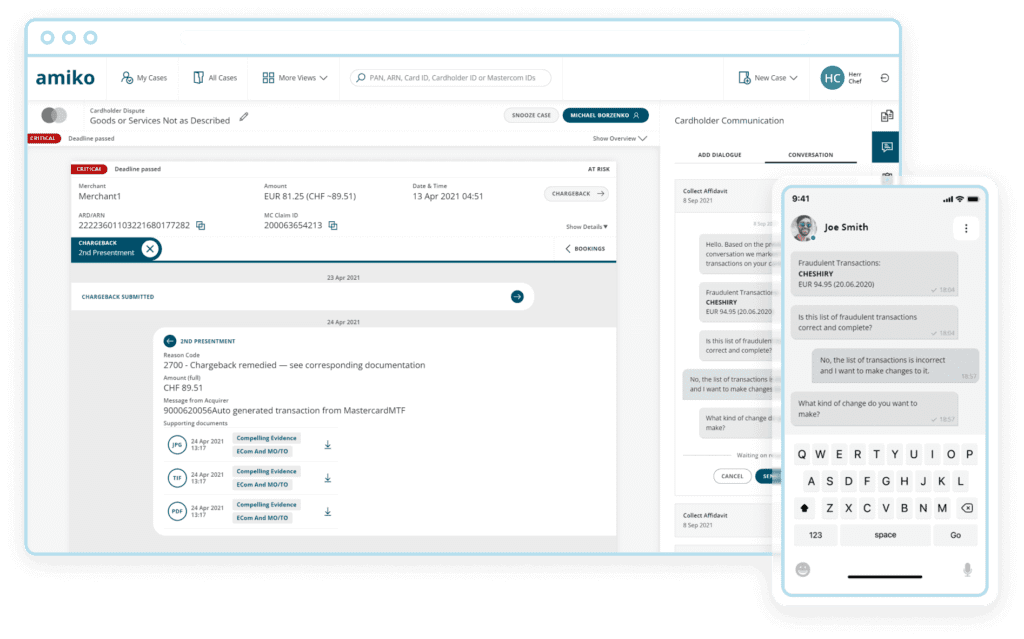

Jones advised banks to reinvent digital commerce through product strategies that combine proprietary development, best-of-breed fintech, third-party solutions and competition. One example of best-of-breed fintech solutions is Amiko, the virtual agent of Rivero’s dispute management solution. Amiko interacts with cardholders in real time and shares contextual data to help jog memories and demystify unrecognised transactions. In addition to deflecting claims, the purpose-built chatbot can handle all eligible fraud recovery cases.

The virtual agent of Rivero’s dispute management solution, Amiko, interacts with cardholders in real time and shares contextual data to help jog memories and demystify unrecognised transactions. In addition to deflecting claims, the purpose-built chatbot can handle all eligible fraud recovery cases and cardholder disputes related to the consumer protection framework of international card payment networks.

Amiko’s domain experience extends to all dispute reason codes, enabling card issuers to own every step of the dispute case management process. When a cardholder claim passes the virtual agent’s initial checkpoints and becomes a case, Amiko can populate Mastercard’s Dispute Resolution Forms and Visa’s Questionnaires in just two back-office-agent clicks. Affidavit PDF documents are created in a fully automated way.

Domain-specific chatbots with deep knowledge of payment scheme rules and access to transaction data can deflect disputes before they become cases simply by providing customer information on demand. This zero-touch approach has significantly improved response times and the customer experience through the instant presentation of digital receipts, transaction details, and contextual data in a customer’s native language.

Low-cost infrastructure upgrade

Amiko’s zero-touch fraud recovery reinvents legacy dispute management systems, enabling financial institutions to drive results and recover revenue at scale. Best of all, Amiko and its virtual agent are cost-effective to implement and designed to adapt to native issuer environments effortlessly. The SaaS product is not a licensed software toolkit but an intelligent resource equipped to manage all chargeback cases, whether created manually or from the issuer’s app.

Amiko integrates all issuer and payment scheme APIs through a lightweight, stateless edge connector hosted within an issuer’s perimeter. This uniquely hybrid architecture combines SaaS advantages with “on-premise” security, as the edge connector removes sensitive data fields and stores unstructured data, enabling issuers to control the entire system while protecting sensitive data.

Unlike legacy software solutions from payment processing enterprises with few, if any, automation capabilities, Amiko requires little effort to deploy and minimal investment to maintain. The dynamic platform continually evolves its capabilities and feature sets in response to changing regulatory trends, emerging threats and customer preferences. Through these continuous updates and its direct connection to Visa (VROL), Mastercard (Mastercom), Verifi, and Ethoca, Amiko balances the benefits of full integration with issuing processor autonomy.

Fatemeh Nikayin, co-founder of Rivero, mentioned that Amiko is the only SaaS product in the market that includes regular feature updates and compliance releases, stating, “Amiko’s zero-touch fraud recovery is a managed service that curates and continuously improves its scheme compliance and customer communications in multiple languages.”

Futureproof solution

Jones noted that partnerships between banks and third-party providers facilitate agile, accurate, and responsive solutions. PSD2 guidelines require issuers to contact credit cardholders on the next business day in cases of fraud disputes, so solutions that communicate with account holders in real-time will protect revenue streams and facilitate meaningful customer relationships.

AI-powered virtual agents can meet all of these requirements today and in the future by communicating with cardholders in real time and in their native languages. In addition to providing transaction details instantly and on the spot, these intelligent solutions manage fraud cases that card issuers would otherwise have to address by phone, email, or written correspondence.

The Amiko virtual agent uses rule-based AI to improve response times, providing transaction data, reports, and histories upon request to enhance the customer experience and minimise human error by pre-populating and validating forms and remaining vigilant to deadlines and high-risk cases. The always-on, always-connected virtual agent improves front-office efforts and back-office efficiencies by engaging with customers in real-time and enabling human team members to focus on high-value activities. In a world where machine learning, artificial intelligence, and multilayered technologies are baseline requirements, the Amiko virtual agent is a timely resource for issuers and a valuable self-service option for cardholders that can manage fraud caseloads end-to-end and at scale.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.