What is this article about?

The ESG Working Group’s initiative to develop a standard for measuring the carbon footprint of payment transactions in the payments industry.

Why is it important?

It aims to quantify and reduce the payments sector’s environmental impact, aligning with global efforts to combat climate change.

What’s next?

Finalise and promote widespread adoption of this new GHG emissions standard across the payments industry.

Imran Ali, payments consulting director at KPMG, has worked in payments for over 20 years. He knows the industry inside-out but is now advancing into the unprecedented by spearheading an ambitious initiative to measure payments’ carbon footprint.

Ali is co-head of The Payments Association’s (TPA) ESG working group and is attempting to design a standard that industry participants can use to measure greenhouse gas (GHG) emissions associated with payment transactions. Reflecting on the genesis of this project, Ali says he wanted to help the industry play a role in combating climate change.

“In my mind, there was a need to do something specific around reducing carbon emissions in payments,” says Ali. “With all these payments getting processed, both digitally and physically, there must be an opportunity for us to look at how we can reduce our carbon footprint.”

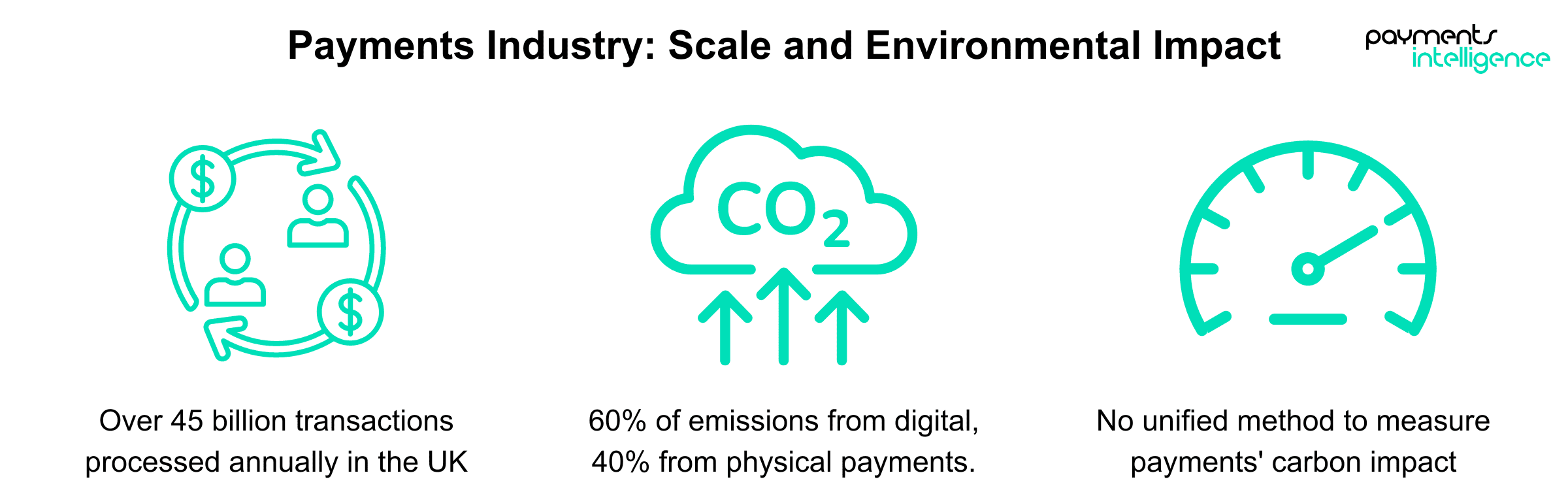

The initial challenge Ali faces is putting figures to payment transaction emissions, something that hasn’t been measured before. The payments industry has evolved and become even more vast in recent years, with electronic methods facilitating more transactions. In total, 45.7 billion payment transactions were made in the UK last year, according to UK Finance. Electronic payments require computing power and entire networks of servers and data centres, each creating its own GHG emissions. Physical payments also have an impact, including the manufacturing process behind cash and cards and emissions from collection trucks.

Sendi Young, a member of TPA’s advisory board and mentor to Ali and his team, supports the ESG working group. With extensive experience in fintech and payments, most recently as managing director (EMEA) at Ripple, one of her responsibilities is helping the team make an impact with their work.

“How do we, as a relatively small working group with everyone here on a voluntary basis, punch above our weight to make a significant impact?” she asks. “It’s an ambitious undertaking, but it has the potential to have a good impact, which everyone is super keen to take forward. So how can we leverage our partnerships in the industry to help?”

This leveraging of partnerships has seen the team look to progress made in the field by similar groups. For instance, the Partnership for Carbon Accounting Financials (PCAF) has begun assessing the GHG emissions around mortgage lending and capital markets. Ali has already been discussing the potential alignment of scopes with the PCAF.

“There is no existing agreed industry standard for measuring the carbon footprint of payment processing,” says Ali. “When we talk about payments, there are apps that show you your carbon footprint for the purchase, but that’s not what we’re talking about. We’re talking about when you make a payment, the carbon footprint of the bank or payment provider or card provider processing it.”

Collaboration is key to establishing a reliable standard for Ali’s work. The working group actively consults with industry participants to find out what work they have already done in this field. A helpful factor is that ESG has become mainstream. Numerous participants within the payments industry have adopted net-zero goals and are actively taking steps to measure their own environmental impacts. This has led to fruitful conversations with banks that have become increasingly active in tackling their GHG emissions – Ali refers to one bank that invested in new payment processing servers after discovering the harmful carbon footprint of its preceding infrastructure. This kind of information is crucial to Ali’s work and will help strengthen the standard he is seeking to create.

“We are keen to talk to as many parties as possible to see if they have anything we use or if they want to work together,” says Ali. “It won’t be a standard unless we get broad adoption and agreement. My ideal would be that this becomes an international standard, but we want to start small.”

Like the bank that changed its servers, Ali hopes a reliable standard could act as a beacon to encourage positive change in the industry. It has been decided that this standard will be voluntary. With firms already showing an appetite to reduce their emissions, Ali does not see cause to make it mandatory, with the aim of offering it as a tool to complement pre-existing work.

“Everyone is developing their own ways of measuring carbon, but there’s no consistency,” says Ali. “A bank could say they have reduced their carbon footprint by 50%, but is that good or bad? You need something independent to measure this against. We know there is an appetite from large banks to look at this, so we want to collaborate and help them create a benchmark to encourage consistency.”

The outcome of this project will be driven by what is most useful for the industry—for instance, it may be a case of giving examples of the GHG emissions a given transaction creates and then how they can be mitigated. Ali says initially establishing a standard with guidance, tips, and contacts may be the best approach, especially for smaller organisations lacking resources.

Elsewhere, the voluntary aspect is just one part of how the standard is being designed to be easily accessible. Ali wants this to be customisable and inclusive of Scopes 1, 2, and 3 of GHG emissions. Still, he admits this is challenging, especially when it comes to the nebulous nature of Scope 3 emissions. These are already difficult to measure in other industries’ supply chains, and the vast nature of payment networks is no different.

“Adoption is key here – the challenge is coming up with something practical that encourages adoption versus creating just another standard,” says Young, who is keen to design something specific to the payments industry and different to anything existing elsewhere in financial services.

“We need to make sure it’s comprehensive, relatable, accessible and addresses some of the confusion felt today around the standards already out there,” she adds. “The idea is simplifying it and getting continuous feedback on how to make it easier to adopt.”

With multiple parts of the payments ecosystem to consider, especially when international parties are incorporated, Ali says focusing on the integral role banks play makes sense: “They may outsource elements, but they will ultimately be responsible for payment processing. Which is why we would like to work with the large banks as they are in the best place to have the most influence on the reduction of the carbon footprint.”

Ali adds that, ultimately, he wants to capture best the GHG emissions footprint of payments across all scopes and is leveraging the work of the PCAF. The ambition remains to deliver something specific to the industry he knows so well: “The conversations we have had with the PCAF are around the work they have done on Scope 3 and what they are doing going forward, and if that aligns with what we want to do. Importantly, though, we don’t want to be so broad that it either becomes unachievable or irrelevant. We want something specific to payments.”

Creating an ESG standard specific to the payments industry requires high levels of collaboration from companies of all shapes and sizes in the space. These insights are directly influencing how the standard will look, with adoption at the forefront of Ali’s work.

Though he has a vast project ahead of him, with a diary full of virtual and physical meetings to gain insights, Ali is keeping in mind the long-term goal and what this initiative is pursuing. To have a real impact, this standard needs to be something that payment firms can adopt and actively use within their operations to fight climate change. Therefore, the co-lead of the ESG working group is choosing to be ambitious.

“I’m conscious this is a pan-industry working group, new to the industry, and we have to be realistic, but I would hope we have some kind of carbon framework in place by the end of the year,” he says. “We want this to be greater than just our work, with some kind of accreditation from an external body that this is a standard worth watching.”

With an ambitious timeframe, Ali doesn’t want to spend time piloting and is keen to roll the standard out as soon as it’s ready. He is confident once “large names” adopt it, this will create momentum and encourage adoption.

To make this happen, the ESG working group needs the industry’s help. Participants across the payment ecosystem are needed to volunteer insights, share data and exchange thoughts on how to be effective. Ali recently spoke about this project at the PAY360 event in London and was approached by people across the industry who wanted to help.

Invigorated by this, Ali is keen to foster more collaboration as part of this project: “I want to speak to as many people in payments who can contribute. We want this to be a community effort and work with all members to create a better environment for everyone.”

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.