A tale of a not overly impressed FCA, intervention and s165s

The indie rock bank Arcade Fire have a song on their “Neon Bible” album titled “Intervention”. The song begins with crashing chords on a church organ, building up an ominous

The indie rock bank Arcade Fire have a song on their “Neon Bible” album titled “Intervention”. The song begins with crashing chords on a church organ, building up an ominous

Banking-as-a-Service provider Contis has completed a significant step in becoming further integrated within the Solaris Group, with the Contis brand being retired. The Solaris partnership was introduced in early 2022

With pressure from investors, customers and employees, financial institutions need to boost their ESG efforts or risk losing business. But meeting these lofty goals isn’t always easy. That’s where business

Adapt to the changing payments landscape with virtualized testing, now available on an SaaS basis Open Test Solutions – Open Test Solutions | FIS (fisglobal.com)

Enfuce was selected over Fiserv, Giesecke+Devrient, Vesta Corporation and Wallet Factory to win the coveted category at The FF Awards Win recognises the company for its fully cloud-based Cards as

Not all banking customers are tech-savvy. Many are not proficient in identifying common attacks, unintentionally creating opportunities for fraudsters to target these vulnerable customer bases. What’s more, institutions deploying different

Mobile wallets: taking the headache away from embedded payments cards Cited as one of the top 5 payment trends to watch for 2023, digital wallet adoption is set to grow even further

The Kingdom of Sweden expands across much of the Scandinavian Peninsula and is one of the largest countries in the European Union by land mass. But what do you know

Chargebacks in travel are up 50% compared to 2019 due to increase in travel disruption caused by COVID-19 Fully outsourced service automates chargeback management using Amadeus’ rich travel and payment

Despite Open Banking being quite a recent addition to the fintech industry, its market is already full with a diversified number of providers. In such a situation, merchants do not

Over the past two years, companies began to challenge their reliance on the legacy systems they were supposedly tied to and wondered how they could improve their daily processes. Research

As if AML compliance professionals’ jobs weren’t hard enough already! With criminals using multi-customer, cross-wallet payments to move funds and keep their money mule schemes hidden, it’s little wonder cryptocurrency

Fraud has become the most commonly experienced crime in England and Wales, and Fintech companies are working hard to develop solutions which help to reduce the number of victims. UK-based

Fintech infrastructure provider, Integrated Finance has announced the launch of its ‘Fintech Foundation’ incubator. The new programme will be supported by experts from leading banking service providers across the value

Open Banking provider Noda has launched direct bank payments in Europe, following a partnership with Open Banking payments platform Token, according to the press release. Noda enables merchants to receive

November kicks us off with Singles Day, followed by Thanksgiving, Black Friday, and Cyber Monday. Not to mention the continual shopping rampages in the lead up to Christmas! Shopping reaches

A new classic: billions of instant and secure payments with no chargebacks 🚀 We are excited to see the payment industry constantly improving in order to be able to provide

London, November 22, 2022 – Today, BaaS (Banking as a Service) fintech Griffin announced that its sandbox environment has officially moved out of beta. Free, unlimited sandbox access is now available

Year in, and year out, people continue to wonder how long the crypto hype is going to continue. The volatility of the market and the crashes it has faced keep

Developments in technology and ease of use contribute to the growing popularity of contactless payments in all their forms. What does it mean for banks? Over 50% of Gen-Z and

What Happens If Your Digital ID is Stolen? A Viewpoint From Norway… Digital identity became a much hotter topic once the EU identity eWallet was introduced in the summer of 2021. While

In the era of digitalisation, corporations expect more than an instant transfer from country A to country B. Corporations’ treasury departments need better predictability, transparency, cost control and an easy

Leading payment specialist allpay Limited has revealed the results of its latest consumer survey, providing insight into payment behaviours across UK household bills. To facilitate the research, allpay continued its

Memo Bank was the first French bank in 50 years to be licenced. With Jean-Daniel Guyot in the helm, and supported by Enfuce, Memo Bank built digital financial services and

London, November 10, 2022. Today, UK BaaS (Banking as a Service) fintech firm Griffin and global FS OS (Financial Services Operating System) 11:FS Foundry announced a new partnership to help businesses actualise the benefits of

The first metal payment card production facility in Europe has been opened by Thames Technology, one of Europe’s largest retail and financial card manufacturers, at its headquarters in Rayleigh, Essex.

Now that we have all had time to read the text of the proposal of the EU to mandate instant payments, and the commentaries on social media, do you feel

The digital revolution in payments has brought to the surface some of the acute challenges faced by the unbanked and financially excluded. But it’s not inevitable that a move to

Following closing of the acquisition of Ingenico by the investment funds managed by affiliates of Apollo Global Management (the “Apollo Funds”), Ingenico is pleased to announce the appointment of new

We are proud to announce that KYP have been accepted onto the London & Partners Mayor’s International Business Programme as one of the best FinTechs in London. The programme is

Building on its recent launch and in line with its growth plans for North America and Europe, KYP today announced the closure of its pre-seed funding round with total funds

November 1st, 2022 – Atlanta, GA and Vienna, Austria – Bluefin, the recognized integrated payments leader in PCI-validated encryption and tokenization technologies that protect payments and sensitive data, today announced the

Fintech is swiftly moving to become a concept offered nearly exclusively through software-as-a-service (SaaS). That’s a big claim, but one that is inescapable to make if you observe the

Global fintech Unlimint has, today, announced the launch of GateFi, marking their expansion into the crypto space. The solution allows users across the globe to seamlessly exchange fiat money to crypto and crypto

UK-based payments specialists, allpay Limited, have joined forces with Salt Edge, a leader in Open Banking solutions, to allow the business to provide clients, including people with vulnerable financial situations,

Weavr, a London-headquartered technology provider that empowers businesses with plug-and-play embedded finance solutions, sets up in Singapore as part of its mission to make embedded financial services available to any

Memo Bank was the first French bank in 50 years to be licenced. With Jean-Daniel Guyot in the helm, and supported by Enfuce, Memo Bank built digital financial services and

A major report has revealed the key financial crime and anti-money laundering (AML) compliance challenges facing financial services firms in 2022. Produced by leading governance, risk, and compliance consulting firm fscom, the

Why investors are still pouring their money into fintech firms. It’s no secret that the pandemic and now the global toll of the cost of living crisis have posed big,

International payment service provider and direct bank card acquirer, ECOMMPAY is celebrating its 10 year anniversary. The fintech company has grown exponentially from less than one million transactions per year

The fintech industry has always taken great pride in doing things differently. It is a young industry that is based on disruption. This attitude permeates many aspects of the way

ESG (Environmental, Social, and Governance) is one of the hot topics that’s been getting coverage across business sectors and it’s now getting attention in the fintech space. In this blog,

The VQF-regulated global settlement banking platform using Web3 technologies has raised $13m in a seed round with the participation of industry leaders including Circle Ventures, Hard Yaka, United Overseas Bank

ConnexPay, the first and only payments technology company that integrates payments acceptance and issuance inside a single platform, today announced a $110 million growth equity investment led by FTV Capital,

Chargebacks911, the leading dispute technology specialist that powers chargeback remediation for the largest global eCommerce businesses as well as the world’s financial institutions, has appointed long-time finance leader Pelwasha ‘Pel’

Embedded payments is a way for non-financial organisations to take their full service experience into their own hands. At their best, embedded payments can smoothen out the customer experience, help

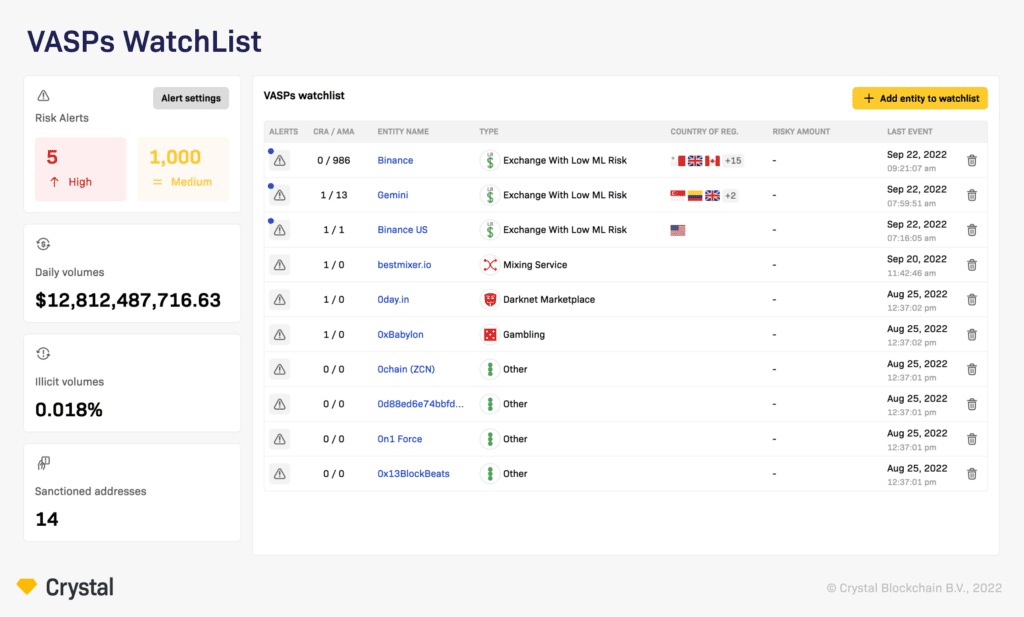

The all-new “watchlist” functionality sends alerts and helps to identify possible risks with VASPs for banks and FIs. The Crystal team is introducing new functionality in BETA that allows for

UK-based payments specialists, allpay Limited, have joined forces with Salt Edge, a leader in Open Banking solutions, to allow the business to provide clients, including people with vulnerable financial situations,

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.