The fintech industry has always taken great pride in doing things differently.

It is a young industry that is based on disruption. This attitude permeates many aspects of the way fintechs run their business as well as how they present their brands to market.

While it’s liberating to work in an industry that is so open to creative ideas and alternative approaches, sometimes it’s important to look outside.

In this blog, we’ll consider the views of marketing thinkers across industries and the insights we can take for fintech brand development.

Your brand is everything that helps people recognise your company, product or service.

It is like an identity and personality. It can contain nuances and contradictions, and show different sides to different audiences.

Like companies themselves, it can change or evolve. Amazon started out just selling books and Twitter started out as twttr – an SMS service for small groups.

It also exists independently of your business and marketing team. As Jeff Bezos once said:

“Ultimately, a brand is the things people say about you when you’re not there.”

Even a simple, minimalist banking app called ‘Banking App’ would still have a brand.

Its (very generic) name itself would leave an impression on people whether its owners intended it to or not. And it would need to be written in some kind of font and colour.

Its lack of other assets would itself be significant. What’s left unseen and unsaid still has an impact.

There are some outlier industries, such as mining, where branding really is kept to its bare minimum (though it’s still not non-existent). But for most industries, having a good brand is a requirement and having a great one is an advantage.

Advertising executive and author Rory Sutherland writes about another interesting reason for the existence of brands:

“Without the feedback loop made possible by distinctive and distinguishable brands, nothing can improve. The loop exists because people learn to differentiate between the more or less rewarding brands, and then direct their behaviour accordingly…. Branding isn’t just something to add to great products – it’s essential to their existence.” (Alchemy, p.209 – 210)

While you really do not have a choice in whether you have a brand, you are in control of the brand itself.

Branding is the process of creating and shaping your brand, especially its messaging, image-related and other sensory assets.

It is made up of many different strategies and activities (including planning) that influence how potential and existing customers (and your own employees) view your brand.

Marketing scientist Byron Sharp states:

“The fundamental purpose of branding is to identify the source of the product or service…. A distinctive element is anything that shows people what brand a product is.” (How Brands Grow, p.129)

The difference between marketing and branding is that marketing is a broader term used to describe several activities around promotion, whereas branding provides the guidelines that lead marketing.

For example, posting about your product or service on social media is a part of marketing. But how it gets posted – the tone of voice, the emphasis, visual identity, etc. – should be led by branding.

Whenever branding is mentioned, several different concepts are likely to come up, including:

(We have previously gone into some depth on many of these separate branding terms in our article: ‘4 Examples of Fantastic Fintech Branding’).

These terms are all relatively straightforward and each can be useful. But you don’t need to be able to recite them all alongside a precise definition in order to master branding!

For now, let’s stay focused on branding as a general concept.

Fintech branding is a broad term covering branding used in business-to-consumer (B2C), business-to-business (B2B) fintech and payments companies.

Its uniqueness lies in how it relates to fintech audiences and other fintech brands, trends, and cultures.

After all, branding has common features across all industries. But understanding any particular industry is a prerequisite for branding well in it.

Fintech is a relatively young and fast-changing part of the financial services industry, so branding for it can be challenging.

There are specialist terminologies, complex concepts, and changing financial regulations to consider and regularly update your knowledge with.

Traditional banks as we know them have been around for hundreds of years (since 1624 or 1472, depending on how you define it).

Most people don’t associate banks with innovative branding. Some even argue that, “when it comes to effective branding, the banking industry has been among the worst to achieve it.”

This could be because, like mining companies, banks purposely want to keep their branding relatively subtle and minimalist. ‘Exciting’, ‘eye-catching’, and ‘unforgettable’ aren’t often associated with stability, security and trust…

However, this isn’t to say banks haven’t experimented with branding at all.

Take Metro Bank, for example. It was the first new high street bank to launch in the UK in 150 years when it appeared in 2010.

Using bold red and blue colours with a distinctive ‘M’ logo made it unmissable, especially in when contrasted with other banks. This is especially significant when taking into account that Metro Bank’s USP is that it has high street presence.

Having such a prominent visual made Metro Bank distinct among traditional banks. It ensured that potential customers could see it from afar and it instantly communicated that it was doing something different. It made potential customers curious.

The term ‘financial services‘ covers a range of different types of companies, from accounting to investment banking and, of course, fintech.

Like banks, many other companies working within financial services create brands that stress trust and stability.

Investment banks often have relatively distinguished-sounding names and ‘corporate’-style branding. Whereas accountancy firms compete in a busier, more consumer-facing market, so they have more flexibility with branding practices.

A relative newcomer to the world of financial services, the fintech industry entered the public’s consciousness about a decade ago.

Advances in technology (APIs and smartphones) and regulatory changes (PSD2 and open banking) led to a range of new fintech companies appearing.

Back then, it was a relatively small world. The founders of two of the earliest fintech success stories (Starling Bank and Monzo) originally worked together.

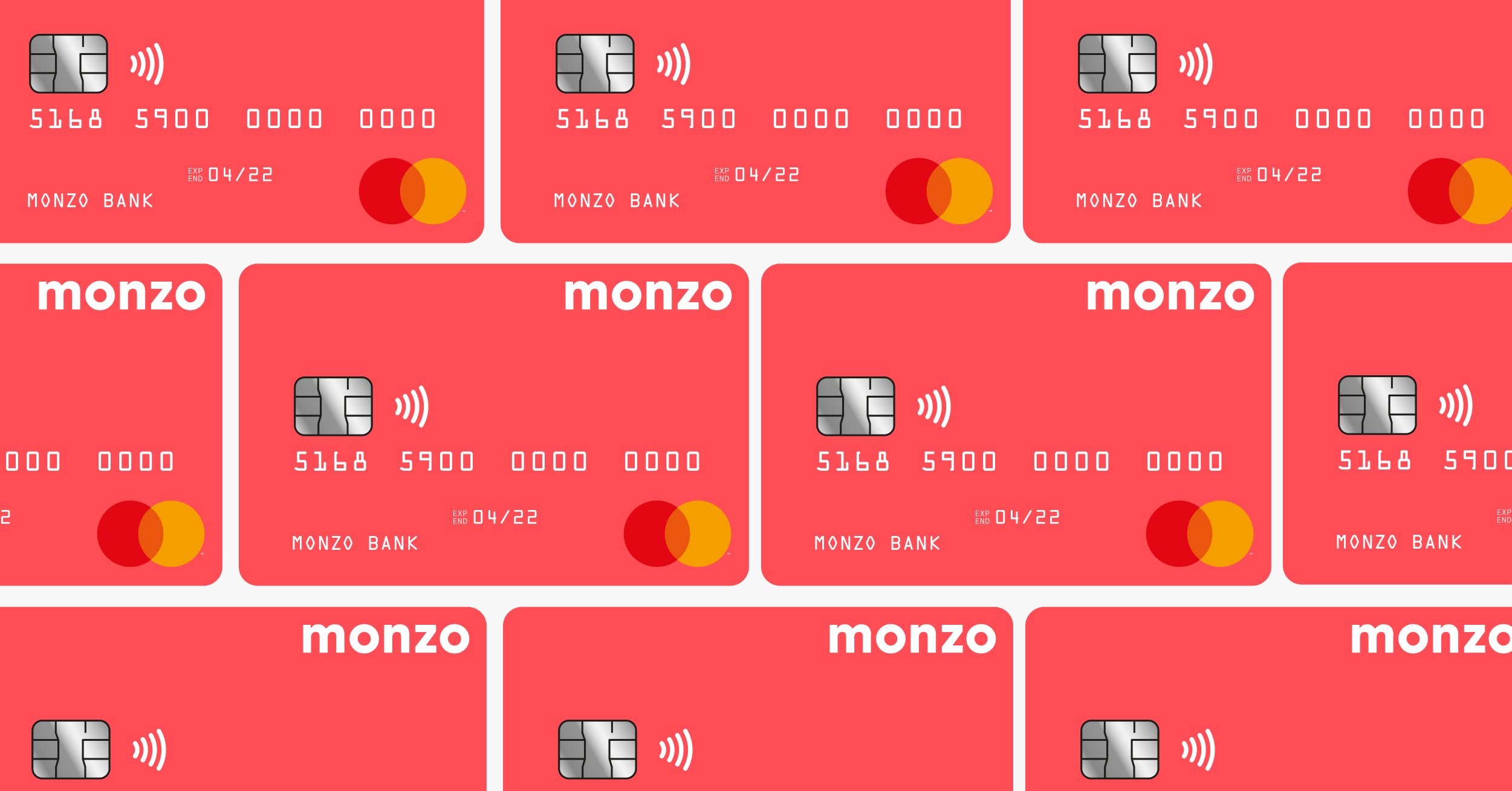

Early on, the bar was set with relatively bold and innovative branding that distinguished fintechs from traditional banks and financial services.

Take, for example, Monzo‘s iconic ‘hot coral’-coloured bankcard, something unlike any high street bank cards at the time.

Competitor Starling Bank went in a different direction with its brand.

Unlike many other challengers, it had a banking licence so could legitimately include ‘Bank’ in its name and branding. However it used a minimalist logo to help distinguish it from traditional high street banks.

It aimed to build “a brand that expressed a relationship between the user and Starling through the graphic representation of being ‘in-sync’.” (It originally emphasised its technological foundation by including the tag line: “In-Sync With You”.)

As the fintech industry has grown, different types of players have emerged. Perhaps the category with the most distinctive branding is eCommerce financing.

Klarna has long stood out with its bright and lively branding.

This reflects that it is competing in a space where standing out is not easy and where relatively small sums of money are exchanged in comparison to banking or many other financial services.

Many people, even in marketing, have misconceptions about the science of marketing and even whether or not there is any science to it at all.

Byron Sharp’s influential books How Brands Grow (2010) and How Brands Grow, Part 2 (2015) (co-authored with Jenni Romaniuk), made some very interesting points.

Let’s take a look at some of these and how they are relevant to branding.

The difference between differentiation and distinctiveness is essentially reasoning.

Differentiation is usually described as giving a reason for customers to select your brand over others. A cash transfer app, for example, that – unlike its competitors – also allows you to transfer shopping vouchers.

But Sharp says the data shows that the importance of differentiation is exaggerated:

“All the markets we have examined, whether using our own or others’ data, follow a similar pattern: an average of 10% of any brands’ users think their brand is different….. The main implication for marketing practice is that it isn’t essential for marketers to convince buyers that a product is different before they buy it.” (How Brands Grow, p.124 – 7)

Instead of ‘meaningful differention’, he offers ‘meaningless distinctiveness’ as an alternative to focus on.

Distinctiveness is simply how a brand is recognised over its competitors. Users don’t need to be able to describe the difference between your brand and its competitors (i.e., “this brand also offers shopping vouchers”), they simply need to be able to identify it amongst its competitors.

A brand name itself is a distinctive element and so too are logos, taglines, colours, and advertising styles. Sharp explains:

“The fundamental purpose of branding is to identify the source of the product or service…. A distinctive element is anything that shows people what brand a product is.” (How Brands Grow, p.129)

Another practical implication is that achieving engagement with your brand’s basic elements should take priority over developing elaborate communications around what’s different about your brand.

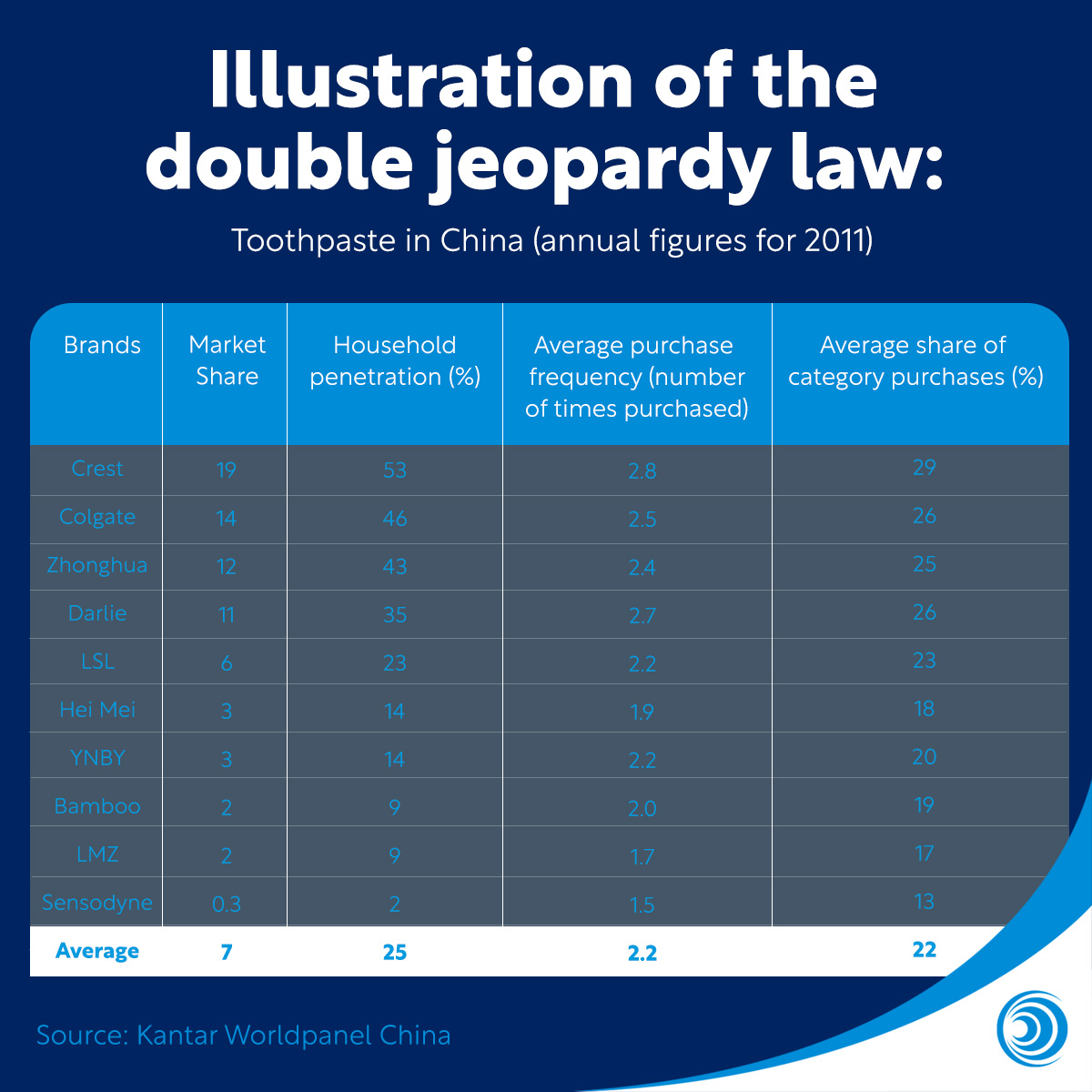

In marketing, the double jeopardy law describes how market share predicts market penetration (its customer base) and customer loyalty.

Brands with small market shares suffer the double jeopardy (risk of harm) of having fewer customers (the first jeopardy) who are less loyal (the second jeopardy).

In other words, as your brand grows – and only when it grows – its market penetration and brand loyalty grow, too.

It is a remarkably consistent law that – with a few exceptions – plays out across multiple industries.

So, for example, a soft drink like Red Bull will have the same market penetration and customer loyalty as another soft drink brand with the same market share.

This rule also applies to different geographies. Here it is in action for toothpaste brands in China:

What does this mean for branding?

Well, for a start it means that exclusively or primarily focusing on branding activities aimed at increasing customer loyalty would be a big mistake.

Instead, you need to remember that in order for your business to grow, you need to aquire new customers.

This doesn’t mean that customer loyalty should never be taken into account in marketing. It still exists and contributes to brand success.

However, your brand needs to stay accessible (and salient, see below) to all existing and potential customers in order to grow.

Salience (how well people recognise your brand) and mental and physical availability (how well they are able to recall and find your brand) are key concepts for branding.

According to Sharp, many marketers mistakingly believe their brand’s impact on customers is deeper than it is.

This means they spend too much time focusing on storytelling, meaning, ‘brand love’, etc. (Not that there isn’t a place for these… the first two, anyway).

The salience of your brand name, logo, and top-level messaging should be prioritised. Does it stand out from your competitors? Will it be easy to recognise and recall when it comes to customers being ready to convert? Will updating it make it unfamiliar to existing customers?

In the meantime, spend more time refreshing your customers memory structures of your basic brand assets than elaborating on what you have already exposed your audience to.

This builds mental availability, which will align with physical availability (their ability to find your brand) when it comes to the time to convert.

Sharp argues that despite the laws his and similar research has uncovered, there is still a lot of room for creativity in marketing.

He compares marketing to architecture: there’s scope for unique and innovative design in structures (brands) as long as the basic framework obeys the laws of physics (marketing).

Exactly which products and brands succeed can’t be pre-determined. But good branding is crucial if you want to increase your chances of success.

Creativity lies at the core of great fintech marketing, alongside and intertwined with competence. The same applies to branding.

Many books have been written that claim to explain creativity and where it comes from. Ten years ago, a book claiming to look at creativity from a neuroscientific point of view (Imagine: How Creativity Works) was derided for containing errors and fake quotes.

There have been many more books on the subject published since, including comedian John Cleese last year. Many offer great insights, but as far as we know, there is still no consensus on the origins of creativity and how to fully harness it.

Most of us can only rely on experience and best practices to guide the creative process. A big part of this is keeping focused on the basics.

Below is a list of the basic building blocks of a fintech brand. They collectively constitute the majority of areas branding is focused on shaping.

Alongside brand imagery, a fintech brand name gives an important first impression to audiences.

At the highest level, a name is more memorable if it’s easy to pronounce, its meaning is clear and is distinct from its competitors.

Bold brand names will make you stand out, but they make some marketers nervous. Rory Sutherland argues that they provide a powerful signalling advantage:

“[A brand name] is generally a reliable indicator that the product is not terrible… someone with a great deal of upfront reputational investment in their name has far more to lose from selling a dud product than someone you’ve never heard of…. When people snarkily criticise brand preference with the phrase, ‘Your just paying for the name’, it seems perfectly reasonable to reply, ‘Yes, and what’s wrong with that?'”

A classic example of this is the old adage that ‘nobody ever got fired by buying IBM’. Basically, choosing a trusted brand (even if they may be much more expensive) is far less risky than a lesser known brand that could be better and cheaper.

Brand imagery includes all visual assets (including colour-schemes, photos, illustrations, logos, icons, etc.) you use to represent your brand.

Like brand names, brand imagery also needs to be unique. This means looking at your competition is essential.

Salience and mental availability should also be key concepts you consider when creating it.

Imagine, for example, you are a fintech offering a currency exchange app and your competitors all use blue colour-scheme currency symbols as logos. Switching to an orange colour-scheme and an airplane logo will make your brand more distinct and therefore easy to remember (mentally available).

Brand messaging is the words and phrases you use to describe your products and services.

Messaging also contains multiple concepts, including: tone of voice, emphasis, the order information is presented in, and more.

It overlaps with brand narrative and brand values. Though it usually doesn’t go as in-depth on subjects associated with these (such as CSR/ESG policies, etc.).

Having a brand is both essential and unavoidable.

Shaping your brand through branding techniques will play a significant role in its success (or failure).

Each industry has its own branding trends but some staple elements never change, such as brand names, imagery and messaging.

Fintech branding is no different in this regard, but its use of branding techniques have reflected the emergence of a new industry. Fintech brands went out of the way to clearly differentiate themselves from legacy service providers and disrupt the status quo.

Marketing science has developed a lot in recent years. Data shows that some principles that impact how a brand grows apply across most industries and geographies.

While fintechs like to do things differently, understanding these broad trends across industries can still provide valuable context.

However, branding is still a creative undertaking. And like all creative undertakings, it involves a mysterious but powerful force: creativity.

When this creativity is coupled with competence, you’ll find that the odds are stacked in your brand’s favour.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.