Two million of Britain’s small businesses fall victim to late payments

27% of UK SMEs are owed between £5,000 and £20,000 in unpaid invoices Over half (55%) of SMEs say that late payments have increased over the course of 2023 31%

27% of UK SMEs are owed between £5,000 and £20,000 in unpaid invoices Over half (55%) of SMEs say that late payments have increased over the course of 2023 31%

Cellbunq, a leading platform provider for B2B and B2C onboarding, is announcing its latest feature to its compliance platform; a merchant onboarding system that can be completed in less than

Going back in time, during the Ethereum period, when we first embraced the smart-contract blockchains, all the operations that go into mining and validating a transaction, like data availability, consensus, execution

The financial sector has long been a bastion of stability and reliability. However, where technology evolves at a breakneck pace, the financial sector stands at a critical juncture. In light

The advent of instant payment systems, a reflection of our increasing reliance on digital immediacy, has unfortunately opened the gates to various forms of financial deceptions. Over 77% of all

Blockchains have created a narrative that they are an underlying technology that powers cryptocurrencies that challenge the traditional financial system. However, in reality, blockchain is way more than that, with a

Despite significant advancements in artificial intelligence and machine learning for profiling customers, a crucial issue remains among industry bodies: the lack of effective information sharing.

A lot has gone on in the payments sector in the last 12 months, but have you been paying attention? There’s only one way to find out, we’ve devised a quiz to test your mettle below.

Plenty has happened in the payments space over the past 12 months. Landmark legislation has been passed and new technologies such as artificial intelligence (AI) have integrated themselves further, irreversibly changing the way transactions will be made. As the year draws to a close, we take a look at other triumphs and challenges faced by the industry in the past 12 months.

The UK and EU payments sectors continued to draw increasing regulatory scrutiny throughout 2023. Indeed, the need to deliver compliance with new regimes, such as the consumer duty in the UK, required a great deal of firm’s attention and resources throughout the year.

In recent years, the UK has been keen on positioning itself as a global crypto asset hub, however it’s currently facing critical obstacles which are hindering its effort.

While there is efforts by the BRICS countries to reduce their dependency on the US dollar as the global reserve, experts cast doubt whether the process of de-dollarisation could actually be help ease payment friction.

Christien Ackroyd explains how the ethical grade concept works, covering best practices, benefits, and which banks are getting it right.

As the UK continues to try and place itself as a leader in the payments industry and fintech, maintaining a degree of pace, security and efficiency must remain a priority.

In Britain, 13 years of Conservative government will come to an end. The US will face its most divisive, and potentially destabilising presidential election in decades. Markets will find out whether central banks have managed to control inflation and normalise interest rates, or whether a replay of the monetary turmoil of the 1970s and 1980s is on the horizon.

The UK holds a strong position in the rapidly developing fintech and digital payments world, but experts are divided over whether this will lead to a major breakthrough next year.

Authorised push payment (APP) fraud has been steadily climbing the charts of global payment frauds with nearly £240m lost to UK consumers and businesses in the first six months of 2023.

Born in New Zealand, trained lawyer Cheyenne Datuin speaks to Payments Review about how she got into the payments industry and why London is an attractive city for working in fintech.

The Payments Association’s annual Financial Crime 360 conference took place at the Royal Lancaster Hotel in London on Tuesday, 21 November. Hundreds of industry professionals from across the payments industry heard from some of the sector’s most important voices on the ever-present issue of financial crime and its solutions.

It’s not easy being green, especially when environmental, social and governance (ESG) obligations are mounting amid an uncertain economic picture. But businesses can no longer ignore the voices of consumers worldwide who are demanding immediate and impactful climate actions – and this is where fintechs have a vital role to play.

Monica Eaton explores how augmented reality is used in the marketplace and what impact it might have on the payments industry.

This article was originally published by leading bank orchestration platform Numeral and recently featured in the Payments:Unpacked newsletter from Mike Chambers – subscribe for free at: www.payments-unpacked.com.

Daniel Holden explains the meaning and significance of unified commerce and why it is vital to the customer experience.

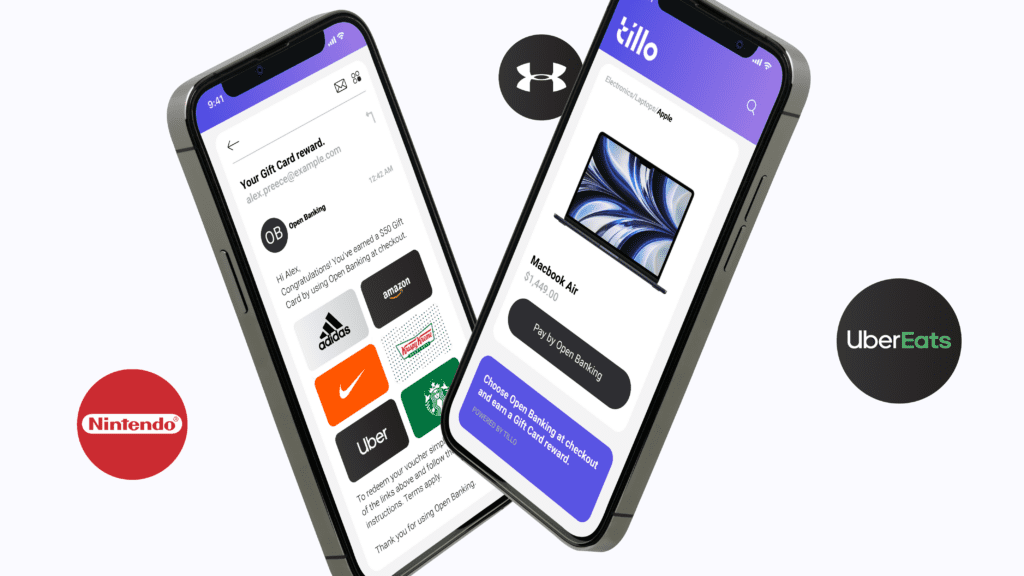

Open banking — a promised financial utopia where data flows freely, consumers reign supreme, and businesses can reduce their payment processing fees — but what use is this powerful innovation if you can’t get customers to actually adopt it?

Clear Junction CEO Dima Kats sat down with our reporter George Iddenden to discuss how challenges to the cross-border payments sector are becoming bolder with the increase in geopolitical tensions and, contrary to some within the payments space, how he believes the regulatory frameworks offer enough security.

Key Takeaways Phase 1 — Regulation of fiat-backed stablecoins The issuance and custody of fiat-backed stablecoins in or from the UK will be subject to regulatory authorisation requirements under

Our new report, Commercial payments, reinvented, combines input from 211 banks and payments providers with a survey of 223 commercial payments clients from retail, auto and industrial, insurance, travel and rail, telecom and health and public service to explore where expectations and perceptions overlap — and where they diverge. It captures the state of play for today’s commercial payments market and maps its future trajectory.

After a year of development, the royal assent of the UK Financial Services Markets Act (FSMA 2023) signifies that change is on the horizon for the UK’s financial landscape and its players.

As part of yesterday’s 2023 Autumn Statement, the Future of Payments Review was published. Commissioned by HM Treasury and led by Joe Garner, the review provides a number of recommendations on the

Dialect, a customer experience solution provider within the Fintech and Payments industry is excited to announce they won the “Judges Special Award” at the North East Contact Centre Awards (NECCA),

PayAlly has been recognised as the 19th fastest-growing business in London. This is part of the Fast Growth 50 index for 2023, which identifies the fifty fastest-growing companies across six

Thames Technology, one of Europe’s leading card manufacturers, has partnered with IDEX Biometrics, a leading provider of fingerprint identification technology, to accelerate the commercialisation at scale of biometric payment cards.

Introduction: Getting noticed in the competitive world of fintech can be tough. But you probably have at least one unique asset that you are not making the most of –

As regulatory thinking evolves, firms must ensure that any current or planned use of AI complies with regulatory expectations. As financial services firms digest FS2/23, the joint Feedback Statement on Artificial

FERO is delighted to announce the successful closure of a $3 million seed round from Coatue, Volta Ventures, and Antler. This capital will enable FERO to expand and enhance its unique online payment solution

FinCrime Dynamics, the financial crime prevention AI solution, gears for growth with this new appointment. Cambridge, 20th November 2023. FinCrime Dynamics, the financial crime prevention AI company, is pleased

Inpay is looking a bit different today, you may have noticed. But what’s behind our brand refresh? We’ve been working hard to strengthen and differentiate our commercial proposition during 2023

Form3 to provide SEPA Instant, Credit Transfer and Direct Debit connectivity for Klarna’s 150m active customers across more than 500,000 merchants. Form3, the cloud-native account-to-account platform, is delighted to announce

Environmental, social and governance (ESG) values are here to stay, thanks to consumer and investor demand for greater transparency and social responsibility from businesses.

From the growing risks of fraud and cybercrime to digital adoption, Jonathan Tyce provides a strategic look ahead to 2024 in the European payments space.

On 8 October 2023, detailed new rules on the financial promotion of cryptoassets came into force in the UK, representing the very first set of conduct rules to apply to the crypto industry.

Extended partnership between PXP Financial and Foregenix to include best-in-class eCommerce cyber security monitoring October 31, 2023 – PXP Financial, the experts in global acquiring and payment, services, today announces a new partnership agreement

Technology, in any industry rarely fails to make its impact and improve nearly all aspects of the sector. Cloud-based banking is no different.

The Payment Systems Regulator (PSR) has published its inaugural APP Scams Performance Report, which presents data from the year 2022. This report aims to provide transparency on the state of

As retail open banking continues to grow, mechanisms should be put in place to balance innovative products for consumers while ensuring adequate fraud protection.

We are excited to invite you to the Modulr GEN AI Summit, scheduled for Tuesday, December 5th at Scale Space in White City, London. The summit will focus on exploring the impact

Due to a dwindling economy, higher inflation and a cash-starved population, retailers are facing a tough battle from the standpoint of acquiring new customers or retaining the existing ones. Adding

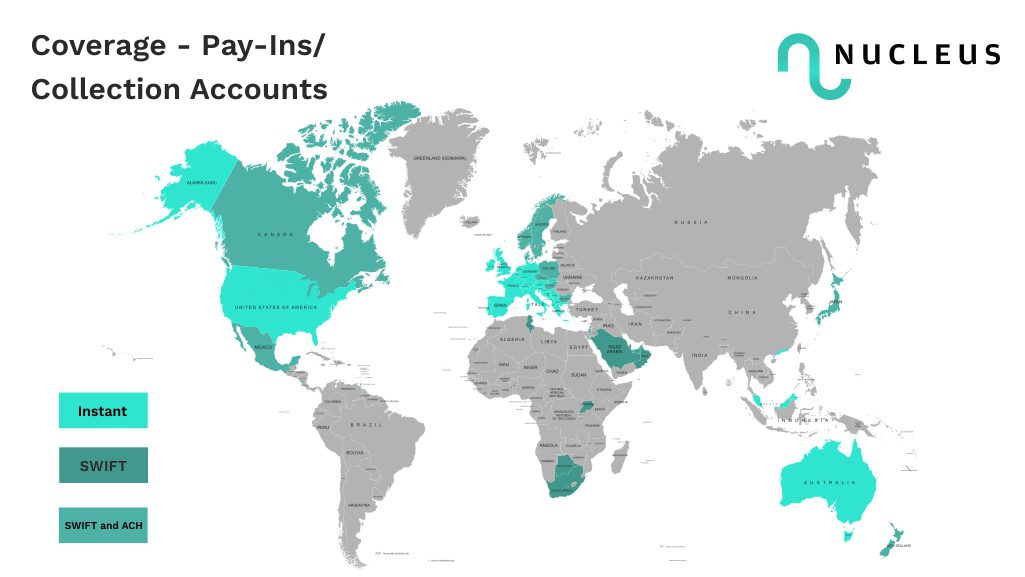

This addition to the Nucleus365 platform unlocks global payments with over 92 licences supporting operations in 30 different currencies, enabling merchants across the globe to make and receive payments in

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.