Open banking — a promised financial utopia where data flows freely, consumers reign supreme, and businesses can reduce their payment processing fees — but what use is this powerful innovation if you can’t get customers to actually adopt it?

While the concept is simple enough and the potential is clear, there’s still a bit of hesitation in the air around open banking and until this trust gap is bridged, businesses looking to use it to its full potential are facing a frustrating waiting game.

Fighting fear with the familiar

It’s not rocket science to understand that new can be scary, and handing over precious financial data to third-party apps is no small ask, which makes you think — how can we encourage consumers to give open banking a try when they’re wondering what they get out of it?

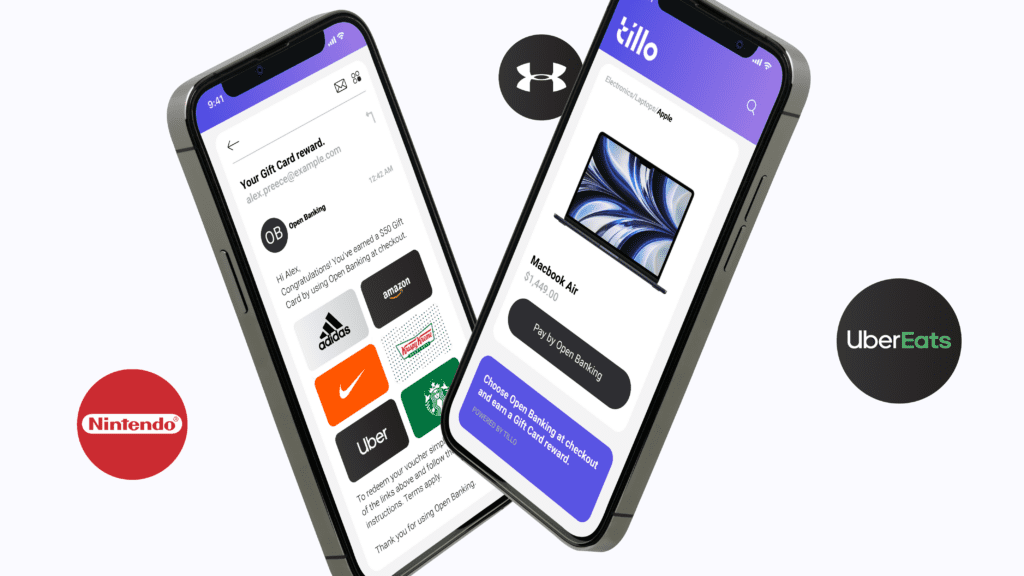

The answer is simple — by adding additional value to their experience and providing a sense of familiarity through the offer of a reward or incentive in the form of a well-trusted digital gift card that they can use at brands they love or even get a free dinner!

Everyone loves a freebie, right? I certainly do! And what better delivery mechanism than one that is already perfectly placed and well-nestled within a comfortable corner of a customer’s mind?

While open banking may be new and scary, digital gift cards are familiar and well-trusted, making them the ideal digital incentive to encourage consumers to tiptoe into a world they would otherwise rather turn a blind eye to.

Prioritising personalisation and unique storytelling

Beyond their tried and tested status, the power of digital gift cards also lies in their ability to tie into open banking’s broader strategic narrative — one where consumers can experience superior choice and freedom when making their online purchases.

Rather than simply offering a one-size-fits-all reward to customers at checkout, businesses using digital gift cards have the opportunity to personalise the rewards and incentives they offer either through the use of AI tools and customer analytics or through choice-based products like Tillo’s ChoiceLink — a single digital link that empowers consumers to choose where to redeem their reward at over 1,000 best-loved brands.

By bringing hyper-personalisation and choice into the mix, digital gift cards go from intriguing to irresistible, giving them the potential to dramatically increase the adoption of open banking at checkout and change consumer behaviour in favour of using open banking moving forward.

“Banked’s research has found that including an incentive at checkout has the ability to raise the adoption of Pay by Bank and its share of checkout by 130%.” Powerful!

Looking back to leap forward

So, while we may all be raring to embrace the future, let’s not forget to pause and consider how the familiar still has a role to play in helping us do just that, and as we march into the future of finance, it may just be the tried-and-true digital gift card that helps us bridge the gap to open banking and whatever’s next!

Jamie Challis is a senior business development manager at Tillo.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.