The UK and EU payments sectors continued to draw increasing regulatory scrutiny throughout 2023. Indeed, the need to deliver compliance with new regimes, such as the consumer duty in the UK, required a great deal of the firm’s attention and resources throughout the year.

Whilst waiting for the release of anticipated EU proposals, the UK remained in information-gathering mode with the launch of various new work programmes, including HMT’s ‘Payment Services Regulations Review and Call for Evidence’, ‘Consultation Response on Payments Regulation and the Systemic Perimeter’, and ‘Future of Payments Review: Call for Input’, to name just a few. This work will feed into the UK’s ongoing assessment of whether and how divergence might make sense for the UK market.

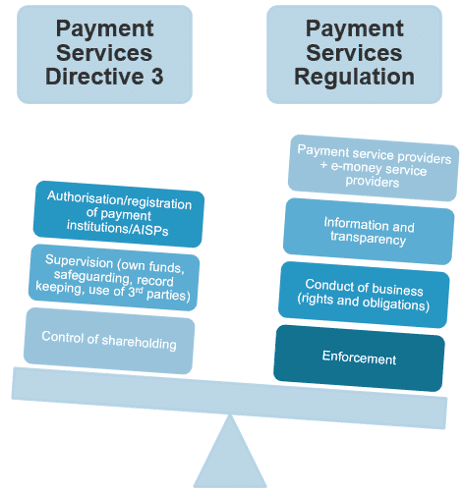

In the EU, the focus was firmly on the June 2023 announcement of the third Payment Services Directive (PSD3) package, with many characterising the proposals as an ‘evolution’ and not a ‘revolution’. In the spotlight for the sector was the proposal for:

Notably, the first proposals for PSD2 were published in 2013 and (mostly) came into application in 2018. Legislation of this nature takes time, and during 2024 we can expect to see ongoing negotiations of the text between the various EU institutions and potentially significant changes.

The pathway might take shape as follows:

[For further insight and analysis, watch the Latham & Watkins PSD3 webcast]

The pace is not expected to slow, and the UK sector can expect a busy transition from 2023 to 2024 with some significant changes on the horizon.

Top of mind for many in the sector is:

Evidently, firms must continue to meet the pace of complex regulatory and technological change whilst keeping one eye on the horizon for what is yet to come in 2024 and beyond.

Brett Carr is an associate at Latham & Watkins.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.