Have you been paying attention to the comings and goings in the payments industry over the past year? There’s only one way to find out, we’ve devised a quiz to test your knowledge.

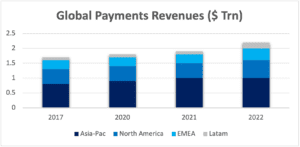

1. From a base of $2.2 trillion in 2022, what does McKinsey forecast total global revenues for the payments industry will be in 2027?

a) $2.8 trillion

b) $3.2 trillion

c) $3.8 trillion

2. Which payments company acknowledged in November that it would have a far higher margin than expected this year because it was “unable to return interest to customers at the level it would like”?

3. What do the following payment acronyms and initialisms stand for?

a) CVM

b) NFC

c) MoR

d) SCA

4. According to UK Finance, financial fraud cost victims £1.2 billion in the UK last year. What % of the £727 million of unauthorised losses were incurred via payment cards?

a) 33%

b) 50%

c) 75%

5. What % of authorised fraud losses — namely where a customer is tricked into authorising a payment to an account controlled by a criminal — was driven by a fraudster impersonating police or bank staff?

a) 8%

b) 22%

c) 41%

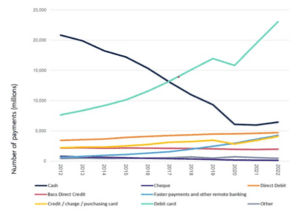

6. 2022 marked the first time that half of all 45.7 billion payments made in the UK were made by debit card. In 2012, cash payments represented 54% of all payments; by 2022 this had fallen to 14%. What does UK Finance expect this to fall to in the next decade?

7. UK Buy-now-pay-later gross merchandise value (GMV) is widely expected to double in the next five years to comfortably top $50 billion. Klarna, the self-labelled first AI-powered bank in Europe, expects AI to contribute how much to the global economy by 2030?

a) $160 billion

b) $1.6 trillion

c) $16 trillion

8. Payment Services Directive 3 (PSD3), which will include a new Payments Services Regulation, will bring the current PSD2 rules into the digital age with a focus on the efficiency and security of electronic/digital payments and financial services in the EU.

9. What is the biggest shift in focus that it will bring when it supplants PSD2, likely in 2026?

a) Open banking

b) Transparency

c) Strong customer authentication

9. The CEO of which payments company is stepping down at the end of 2023 after spearheading about 15% annual revenue growth over a decade from $8 billion to $30 billion?

a) Adyen

b) Worldpay

c) PayPal

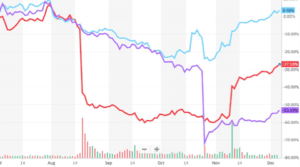

10. Label these three European payments companies’ share prices — all three of which endured a tough 2023 but only one of which did NOT have to issue a profit warning.

a) Adyen Nexi Worldline

b) Nexi Adyen Worldline

c) Worldline Nexi Adyen

d) Adyen Nexi Worldline

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.