What is this article about? This article provides a strategic overview of the European payments space and what it has got to look forward to in the coming year.

Why is this important? Businesses looking to make gains in the payments industry will need to take strategic considerations for the coming year, including cost-cutting measures, efficiency improvements, and the potential impact of economic factors.

What’s next? In 2024, an economic slowdown is expected, posing challenges for smaller payments players, driving regulatory changes and emphasising technology’s role in efficiency.

From the growing risks of fraud and cybercrime to digital adoption, Jonathan Tyce provides a strategic look ahead to 2024 in the European payments space.

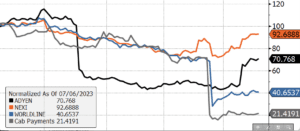

One of the abiding memories of 2023 across the European payments space will be the rollercoaster ride for share prices. This, and the factors behind it, heralds a number of key industry challenges for 2024.

Key topics will be efficiency focus and likely headcount reduction; lower investment spend; more fraud and cybercrime risk, in some cases from merchant partners; and M&A. For smaller start-ups, the disappearance of funding thanks to a spike in interest rates, and the slide in cashflow conversion rates spell pain ahead.

Rollercoaster ride

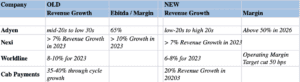

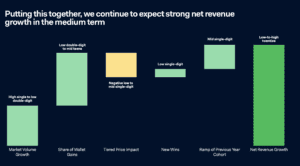

A refocus on cost cutting and efficiency, as witnessed in late-2021/2022, will almost certainly lead the charge. The triple threat of (1) a consumer shift towards lower margin, non-discretionary purchases from the more lucrative discretionary buys, (2) steeper competition, and (3) an inflationary squeeze on operating costs will hurt margins.

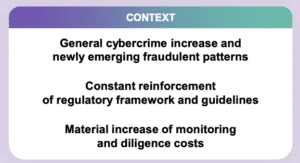

Worldline’s October Q3 23 press release — that drove shares closing more than 60% lower on the day — noted that rising fraud and cybercrime is a growing issue. Coupled with the rising cost of monitoring and risk management, this will erode margins and profitability.

Fraud and cybercrime a growing risk as slowdown looms

As a result of these pressures, the company is looking for €100 million of efficiency gains in 2024 from a consensus cost base of nearly €4 billion. This need to cut resonates closely with conclusions drawn in the article ‘’ (September 2023).

A primary takeaway from the article, that recent company results reinforce, is that while volume growth will remain healthy, it is “margin and productivity” which remain very much the “key deltas for profits next year.”

Revised company guidance

Cashflow conversion squeeze

Worldline’s small downward revision to its 2023 revenue growth guidance (from 8–10% to 6–8%) was not the big issue on the day. It was the hit to operating margin and more importantly, a deep cut to expected cash flow conversion – the lifeblood of payments companies – that worried investors.

Lowering this to 30–35%, before any new cost cutting measures are implemented, from 46–48% previously, the worst case loss of free cash flow this year is expected to be about €200 million.

In similar fashion, newly UK-listed player, Cab Payments plunged more than 70% in late October when it cut its revenue growth guidance to 20% this year. This was virtually half of the levels confirmed only weeks earlier, though in this case emerging market currency volatility was behind much of the cut so a fairly idiosyncratic issue.

Again, the top-line was not the issue but the fact that this cut would cut free-cash-flow, in this case by double digit millions of pounds. Again, the response was a plan to cut costs and boost efficiency.

Worrying read-across for start-ups

The lower cash conversion rates that the industry is now suffering, due in large part to the factors discussed above, is most worrying for smaller players and start-ups. Combined with a wholesale squeeze on cost and availability of funding as interest rates reset permanently higher, this spells trouble for availability of fresh capital and cash-flow pain for the fintech start-up space.

Are we there yet? €9 billion says ‘yes’

Adyen’s precipitous share price fall earlier in the year was driven by comments that US competition had stiffened significantly, and that Adyen’s cost growth and investment in engineers and build out would drive margins far below it’s 65% goal.

The good news for the sector is that at its November investor day in San Francisco, Adyen’s new and importantly, realistic 2026 targets were met with relief and a 38% bounce that boosted the market capitalisation by €9 billion. All this with a margin goal cut from 65% to 50%.

Importantly, Adyen also discussed investment and spending plans and announced that it would slow its hiring pace for the rest of 2023, and adopt a more targeted approach focused on focused on commercial and tech hubs next year. With market growth of 7–10% still likely, and share prices and expectations now reset, M&A will be back on the agenda.

Nexi in private equity crosshairs to kick off M&A

Nexi’s confirmation of 2023 guidance was well received at its Q3 earnings, but a 10% bounce on the day had as much to do with the belief that Nexi is in the crosshairs of private equity buyers as it did relief.

CVC, Brookfield, Blackstone, Silver Lake, The Canada Pension Plan and Francisco Partners are all believe to be interested in buying Nexi, according to various press articles. With buyers circling, and very few available targets, it is highly likely that the next few months will bring new deals including big ticket M&A and takeovers.

Next stop, 2024….

After a very turbulent 2023, an economic slowdown next year seems all but inevitable across Europe and the US. The structural drivers of the payments industry (shift from cash, digital adoption, etc.) can however help to neutralise the cyclical effects of the economy.

It will be a tough year for smaller new entrants and start-up technologies and no doubt, some of the more mature players in the space will continue to apply for banking licences to compete.

Regulatory change, consumer protection and the continued growth of the likes of buy-now-pay-later will also drive the 2024 agenda. Open banking, embedded finance and digital wallets will blur the lines further as payments and traditional banking services continue to converge.

The bottom line though? Technology is an enabler of efficiency and 2024 will be all about efficiency.