Build vs buy? Strategic decisions in financial crime management

Choosing between building and buying systems is key as financial institutions face escalating financial crime challenges.

Choosing between building and buying systems is key as financial institutions face escalating financial crime challenges.

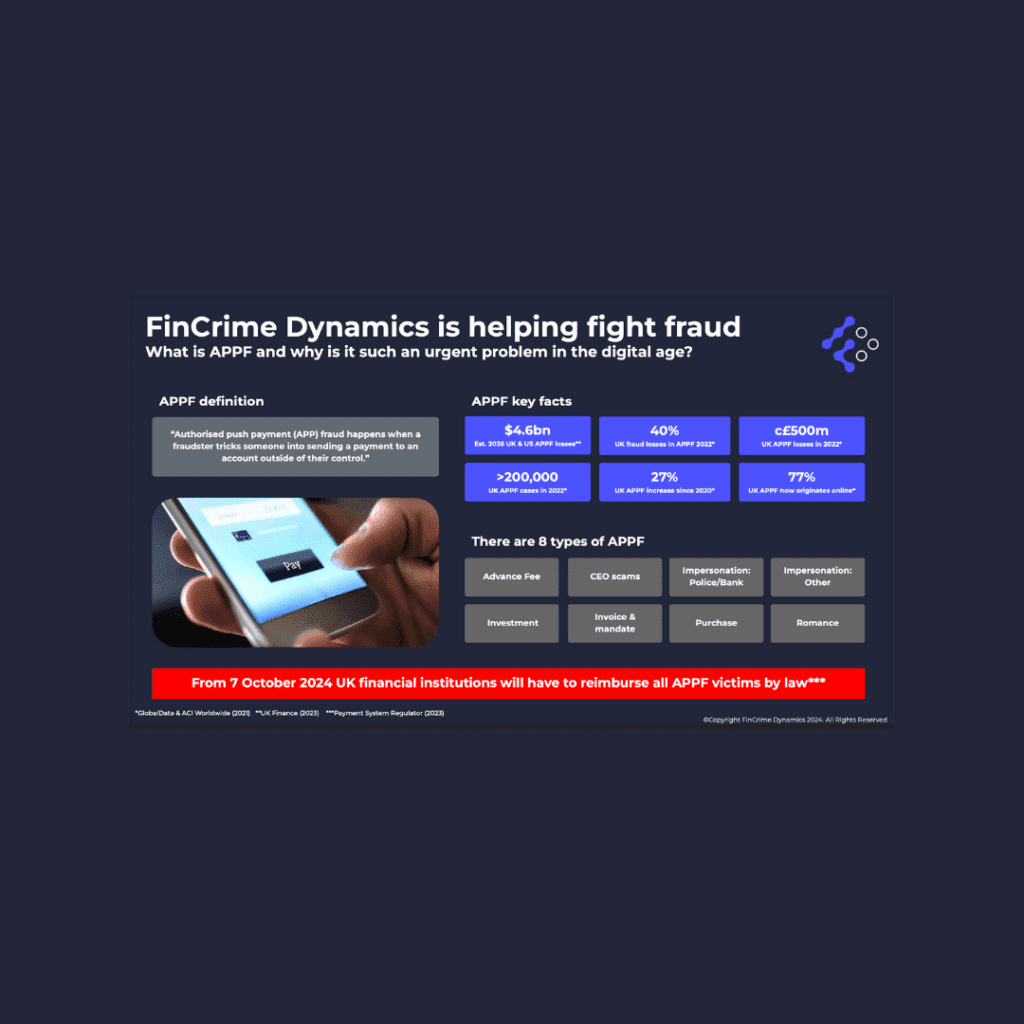

New fraud data highlights growing threats and the need for stronger defences ahead of regulatory changes.

Chargeback abuse costs billions, but merchants can reduce fraud with proactive strategies like customer engagement and better security.

Seon Technologies’ November 20th webinar will explore how advanced pre-KYC processes can improve customer onboarding and fraud prevention for financial businesses.

The PSR’s new refund rules strengthen fraud protection, but concerns remain over the reduced compensation cap and evolving scam tactics.

New rules mandate automatic reimbursement for APP fraud victims, raising concerns about industry costs and fraud exploitation.

A new fscom report analyses compliance challenges in financial services, highlighting improvements and ongoing areas of regulatory non-compliance.

Lucinity’s new US patent enables secure sharing of AI insights between financial institutions, with the aim of improving global crime detection while protecting data privacy.

Linklaters LLP will host a webinar on 2 October 2024, covering upcoming FCA safeguarding rule changes for payments firms.

The Combatting APP Fraud report outlines how upcoming PSR rule changes will drive banks to adopt inbound transaction monitoring and collaborative intelligence.

The new Reimbursement Claims Management System (RCMS) aims to simplify APP fraud claim processing, enhance PSP cooperation, and ensure adherence to updated compliance standards

The challenges financial institutions face under SEPA Instant Credit Transfer regulations and explores how advanced technologies can help overcome them.

The FCA’s latest guidance proposes a risk-based approach allowing payment service providers to delay outgoing payments to combat APP fraud, balancing fraud prevention with consumer protection.

As the threat of quantum computing looms, how can the payments industry safeguard against the quantum decryption capabilities that could undermine global financial security?

The Financial Crime 360 survey reveals how the industry is tackling evolving threats like AI-driven fraud, emphasising the need for collaboration, innovation, and updated regulations to effectively combat financial crime in 2024.

PostFinance improved dispute management and fraud prevention with Rivero’s Amiko solution, boosting efficiency by 500% and enhancing customer experience.

As mobile wallets rise, so do fraud risks—this BPC guide highlights top threats and essential strategies to protect your digital transactions.

The PAY360 State of the Industry 2024 survey reveals key trends, challenges, and opportunities in the payments sector, emphasising the need for technological investment, enhanced security, and regulatory adaptation.

Entersekt has been recognised as a leading vendor and the highest-rated authentication-focused vendor in the July 2024 Liminal Link Index for Account Takeover (ATO) Prevention in Banking report.

The PSR’s July 2024 report on APP scams highlights growing fraud sophistication and the challenges for financial institutions, stressing the need for improved regulations and consumer protection.

From 7 October 2024, UK financial institutions must reimburse APP fraud victims. FinCrime Dynamics’ SaaS service helps banks identify vulnerabilities, quantify losses, and improve fraud defences.

The rise in online payment fraud has led nearly 98% of industry leaders to enhance security with identity verification and facial biometrics.

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

APP fraud is surging, with UK Finance reporting £42.6 million lost in early 2023, prompting calls for stronger consumer protections.

Key findings from Cifas highlights the rising threat of identity fraud and the need for advanced, collaborative solutions.

The new APP fraud reimbursement policy mandates up to £415,000 per claim from October 2024, raising industry concerns over its implementation and impact on smaller fintech firms.

Payment businesses must leverage AI technologies to combat increasingly sophisticated fraud networks and protect digital transactions.

Adopting ISO 20022 is essential for modernising cross-border payments, enhancing fraud prevention, and ensuring seamless interoperability and efficiency in international financial transactions.

With Financial Crime 360 around the corner, Payments Review spoke to some of the leading figures working tirelessly to combat the growing issue of financial crime within the payments ecosystem.

Tony Sales, a former fraudster turned fraud prevention specialist and co-founder of WeFightFraud, shares his perspective on effective strategies and technologies businesses can use to protect against evolving threats.

Exploring the transformative impact of social commerce on consumer behaviour and the lurking risks of online scams.

Exploring Australia’s comprehensive strategy to tackle payment fraud and enhance security across the national payments system.

AI’s data analysis superpowers are revolutionising financial crime prevention, spotting fraud patterns in real-time, even for small transactions, but good data and industry collaboration are key.

From 7 October this year, all consumers who are victims of automated push payment (APP) fraud paid via faster payments must be reimbursed within 5 business days, with the cost split equally between the paying and receiving payment service providers (PSPs)

In 2023, the UK government committed £100 million and 400 new fraud officers to reduce fraud by 10% by 2025, amid increasing social media and deepfake scams, according to IDnow’s UK Fraud Awareness Report.

The 2024 assessment reveals evolving financial crime trends, including AI fraud and social media exploitation, providing crucial insights for payment firms to fortify consumer trust and operational security.

ComplyAdvantage acquires Golden to enhance its AI-driven financial crime risk management solutions with advanced data integration capabilities

As real-time payment adoption grows, 50% of European firms are already involved, with another 42% planning to join, highlighting the balance of challenges and benefits in managing financial crime.

The Payment Systems Regulator (PSR) has set 7 October 2024 to implement the new mandatory reimbursement rules for victims of authorised push payment (APP) fraud. Why it matters The proposed

AI has been a hot topic in the financial services sector for some time and the topic keeps gathering momentum. It is clear, AI has many potential use cases, such as: helping firms scale up their business; making better informed strategic business decisions; and supporting the efficient and effective delivery of regulatory compliance to name just a few potential use cases.

Exploring how to combat AI-powered identity fraud without reverting to outdated physical verification methods, amidst a rising tide of sophisticated fake ID creation tools

Recent findings by PwC reveal that in the past two years, over half of all businesses have faced incidents of fraud, corruption, and other economic crimes. Additionally, 49% of CEOs

In the first half of 2023, UK Finance reported authorised push payment (APP) fraud losses amounting to £293.3 million, with the total number of APP cases increasing by 22%. The nature of authorised push payment (APP) fraud was harrowing – victims were willingly initiating and authorising payments into controlled accounts, often driven by criminal manipulation or misinformation.

There is an increasing need for enhanced data sharing in the payments industry to combat the rising threat of financial crime, specifically money laundering and online-enabled fraud.

Andrew Novoselsky, Chief Product Officer at SumSub explores why Payment fraud poses a substantial challenge to the payments industry, and why its severity is anticipated to escalate in the coming years.

After the peak of APP Fraud losses in 2021, CoP contributed to a 17% reduction in 2022, despite over 100,000 cases amounting to £482 million. However, implementing CoP takes a

In a decisive move to fortify the financial sector against the ever-evolving threat of authorised push payment (APP) scams, the recent policy statement PS23/4, issued in December 2023 by the

The 2024 Veriff Fraud Report is compiled after extensive analysis of our global customer data throughout 2023. This data shows the real story of what it’s like on the frontline

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.