Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

What is this article about?

The findings of The Payments Association’s State of the Industry 2024 survey, which examines the current state and future challenges of the payments industry.

Why is it important?

It provides crucial insights into emerging trends, challenges, and opportunities in the payments sector, helping stakeholders make informed decisions.

What’s next?

The industry must focus on technological investments, enhancing security, and addressing regulatory and interoperability challenges to stay competitive.

The Payments Association recently published its State of the Industry 2024 survey, which gauged the current state of the payments industry. This survey, encompassing responses from key industry players worldwide, provides valuable insights into the sector’s evolving landscape, challenges, and opportunities. The findings reflect professionals’ perspectives across various seniority levels and industry segments, including banking, digital assets, and financial crime prevention, among others.

The survey results offer a detailed analysis of critical areas such as the adoption of emerging technologies, regulatory compliance, financial crime, and customers’ evolving needs. Furthermore, the survey highlights the key challenges faced by the industry, such as cyber-security threats and the need for interoperability between different payment systems. Additionally, it explores the industry’s outlook, with a significant focus on technological investments and customer experience enhancements.

This report aims to provide a comprehensive overview of the survey findings, offering a snapshot of the current trends and future directions in the payments industry. It serves as a valuable resource for stakeholders seeking to navigate the complexities of this dynamic sector.

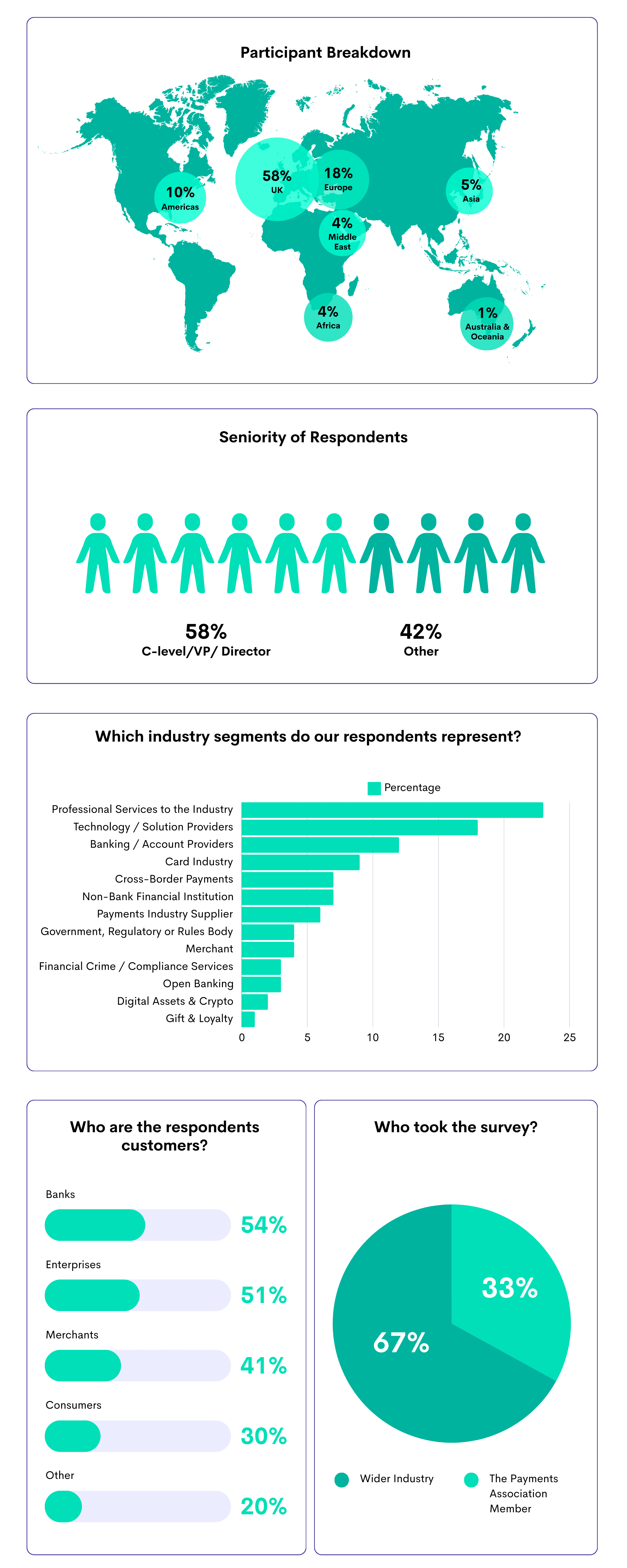

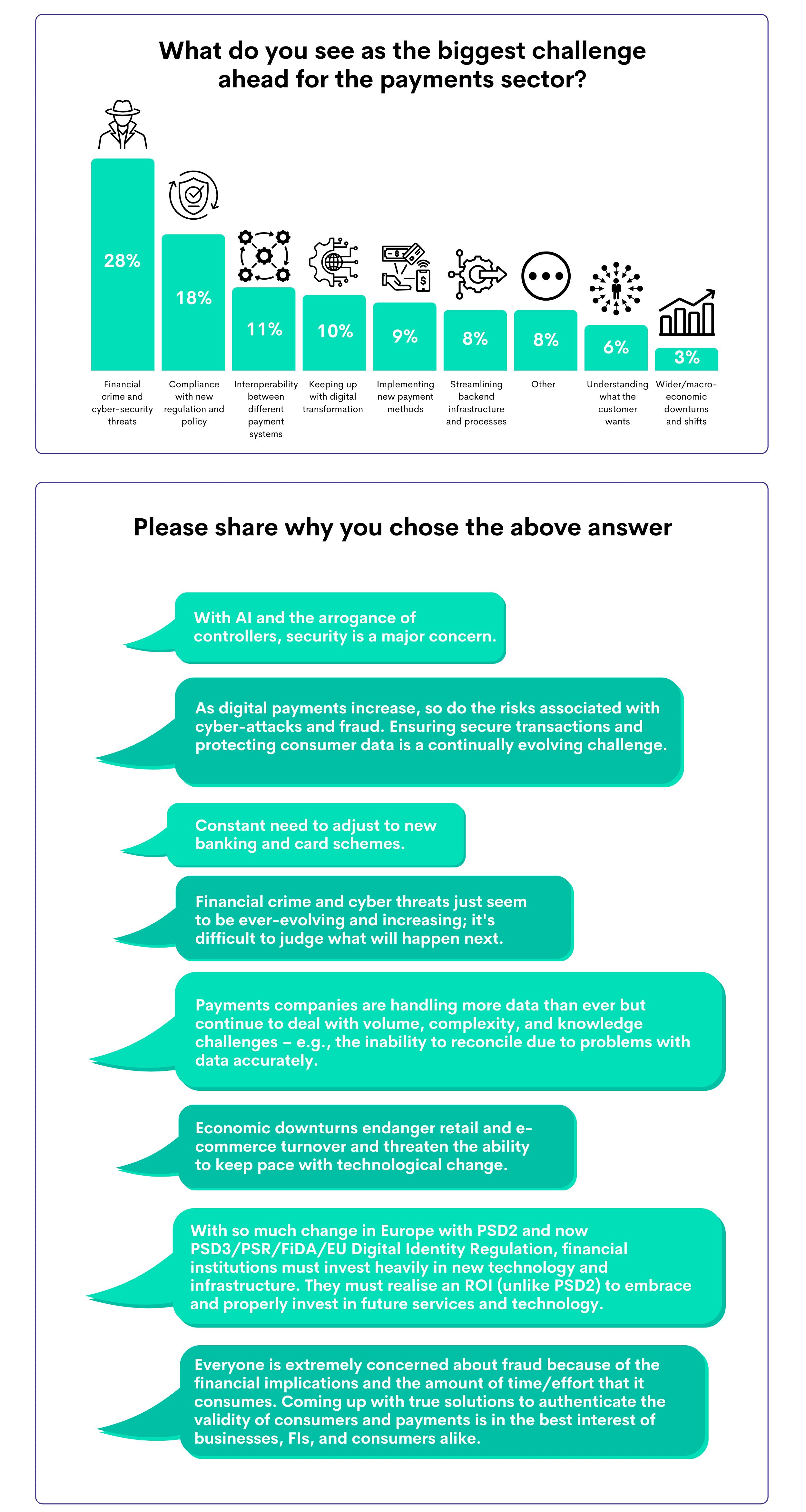

Regarding industry breakdown, 12% of respondents came from Banking and Account Providers, 23% from Professional Services, and 18% from Technology/Solution Providers. The survey results show that financial crime and cyber-security threats are the industry’s most significant challenges, with 28% of respondents highlighting this issue. Compliance with new regulations remains a critical concern for 18%, while 11% see the need for better interoperability between different payment systems as a pressing challenge.

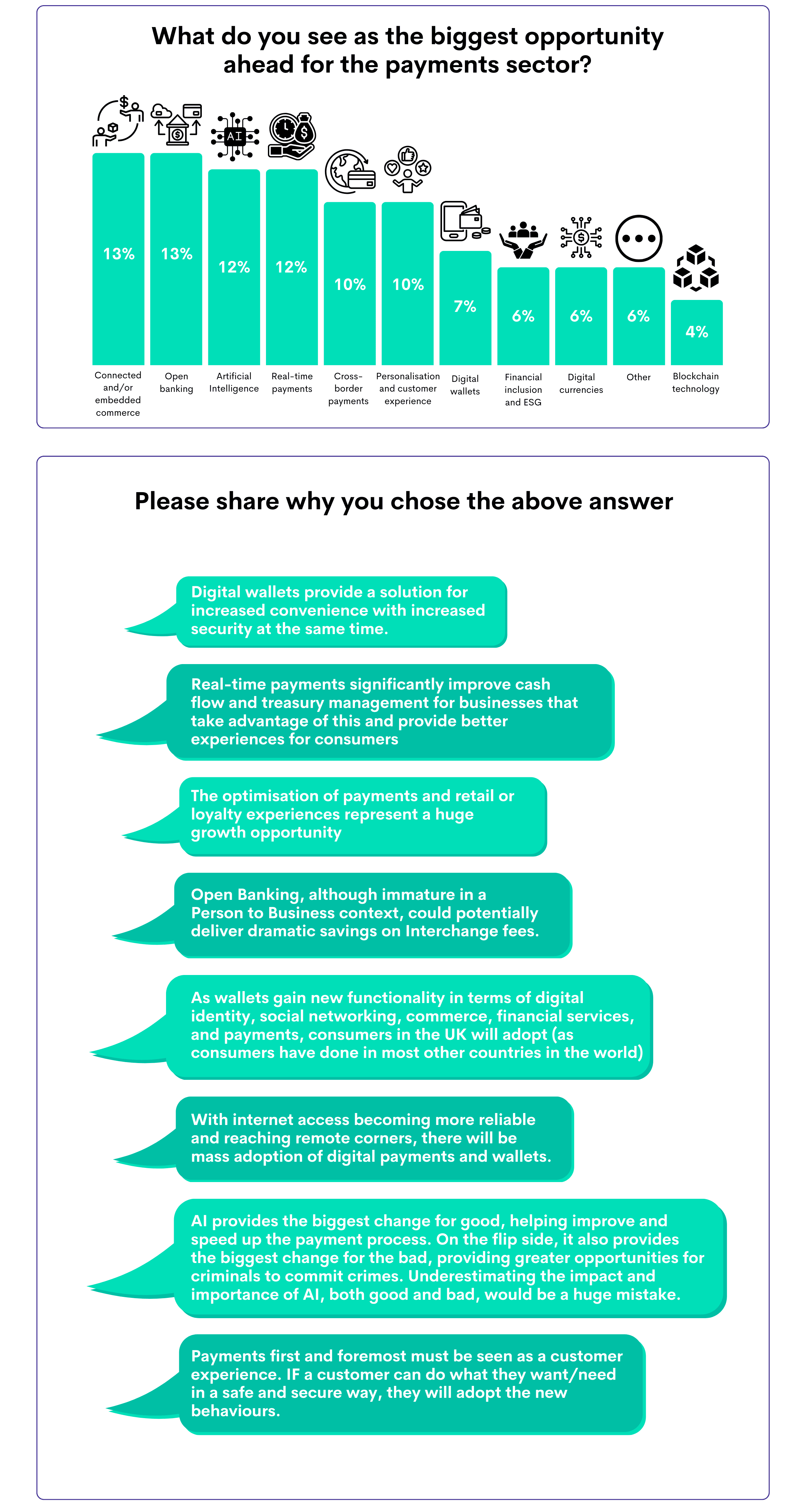

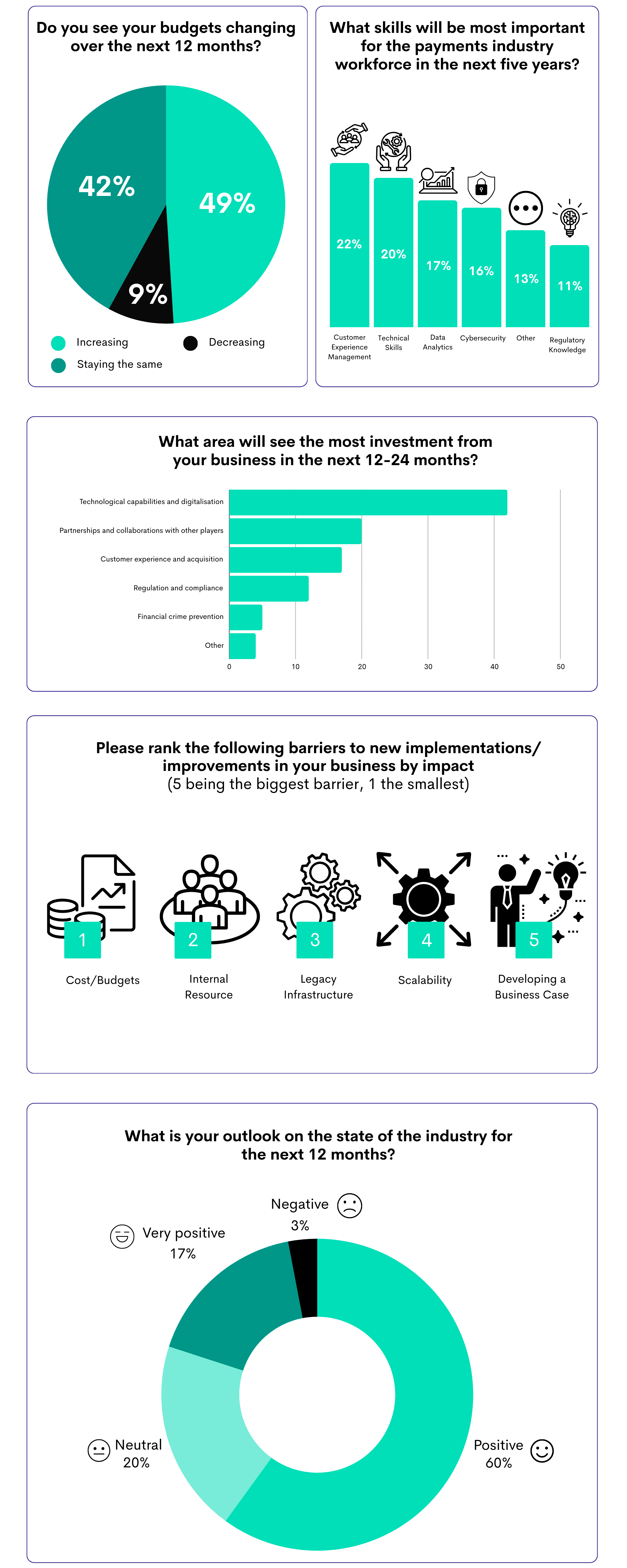

The survey also highlights opportunities in the sector, with 13% of respondents identifying connected and embedded commerce as a significant area of growth, followed closely by open banking and AI, each noted by 13% and 12%, respectively. When considering the skills needed for the future, 22% of respondents emphasized the importance of customer experience management, while 20% highlighted technical skills, and 17% pointed to data analytics.

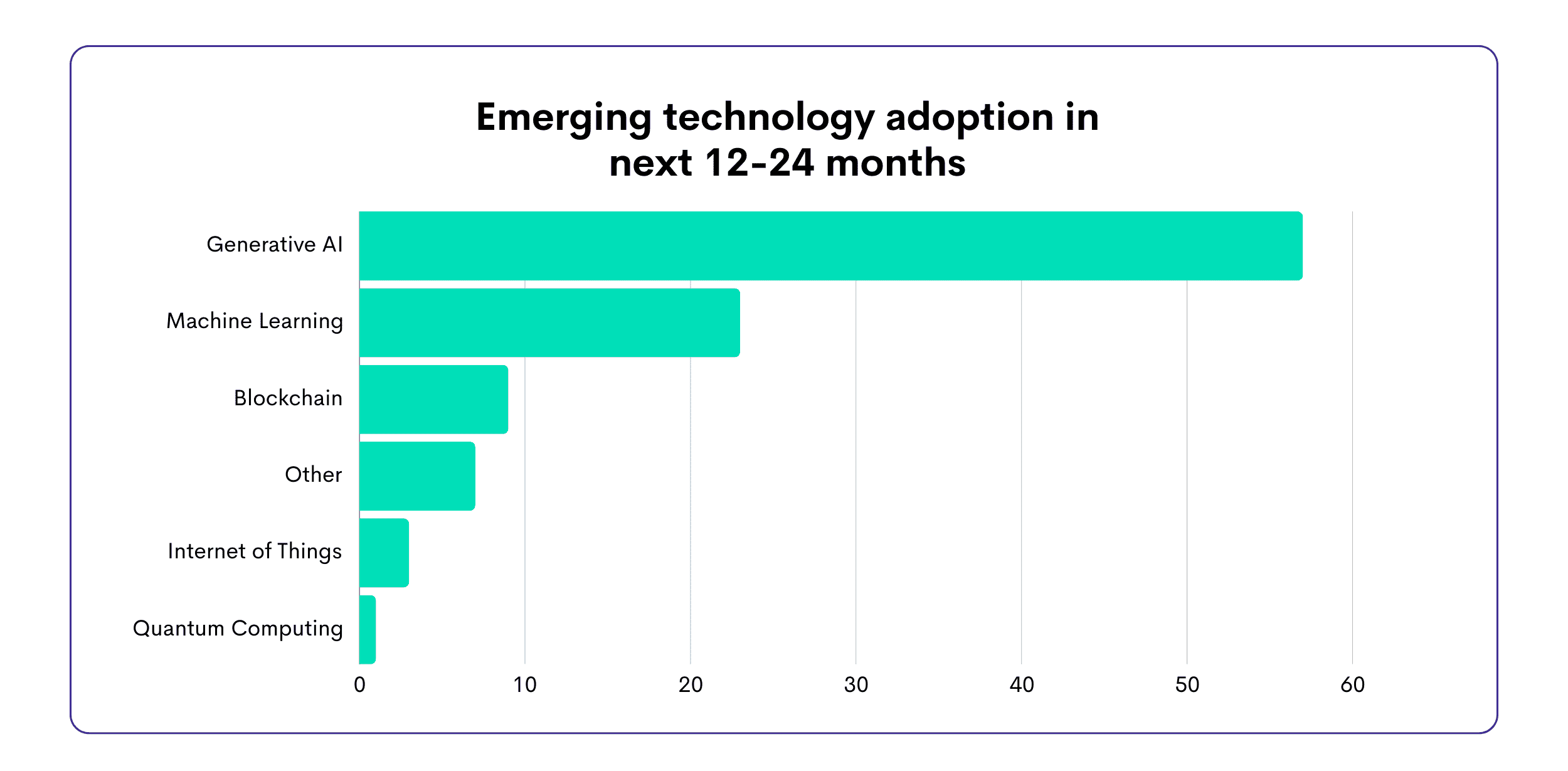

Budgetary trends are positive, with 49% of respondents indicating an increase in their budgets over the next 12 months. This suggests a continued investment in areas such as technological capabilities and digitalisation. In terms of emerging technologies, generative AI and machine learning are anticipated to be widely adopted, with 51% and 19% of respondents, respectively, planning to integrate these technologies into their operations. Despite these advancements, the overall outlook for the industry is predominantly positive, with 60% of respondents expressing optimism, while 20% remain neutral and a minimal 3% expressing a negative outlook.

The survey’s broad participant base, with 54% from the UK and notable contributions from other regions, reflects a well-rounded perspective on the payments industry. The significant presence of senior leaders—58% in C-level or VP roles—adds considerable weight to the findings, ensuring they represent the views of key decision-makers. The diversity of industry segments is also notable, with 23% of respondents from professional services and 18% from technology and solution providers, underscoring the importance of innovation and service delivery in shaping the sector’s future. Other key segments include banking and account providers (12%), the card industry (9%), and cross-border payments (7%), highlighting the broad representation of the payments ecosystem in the survey. This diverse participation ensures that the survey findings are comprehensive and reflect the industry’s varied landscape.

The survey reveals that 28% of respondents identify financial crime and cyber-security threats as the biggest challenge facing the payments sector, reflecting the growing concern over the security of digital transactions in an increasingly connected world. Compliance with new regulations and policy changes is also a significant challenge, cited by 18% of participants, underscoring the industry’s ongoing struggle to keep up with evolving legal frameworks. Issues like interoperability between different payment systems (11%) and keeping up with digital transformation (10%) highlight the technical complexities companies face as they try to innovate and integrate new technologies. These concerns are echoed in the qualitative feedback, where respondents showcase the importance of addressing security and compliance to maintain trust and ensure the seamless operation of payment systems.

The survey highlights connected commerce and open banking (both at 13%) as the top opportunities in the payments sector, underscoring the industry’s move towards seamless digital integration and financial inclusion. Artificial intelligence and real-time payments (12% each) also stand out, indicating a strong focus on innovation and efficiency. These opportunities reflect a broader trend toward enhancing user experience, improving cash flow, and optimising costs, particularly through emerging technologies like AI and digital wallets. This emphasis on technology-driven solutions signals a shift towards more personalised and efficient payment systems.

The survey reveals a strong trend towards AI adoption, with generative AI (57%) and machine learning (23%) being the top emerging technologies companies plan to adopt in the next 12-24 months. Interestingly, the adoption of blockchain and Internet of Things technologies are low priorities for survey respondents, selected by 9% and 3%, respectively,

The survey results also suggest a generally optimistic outlook for the payments industry, with 49% of respondents planning to increase their budgets over the next 12 months. This indicates a strong commitment to investment, particularly in areas like technological capabilities and digitalisation, which are expected to receive the most focus in the coming years. This investment trend is crucial as the industry continues to evolve and adapt to new challenges and opportunities.

Regarding workforce skills, 22% of respondents highlight customer experience management as the most critical area for the next five years, followed closely by technical skills (20%) and data analytics (17%). This emphasis underscores the industry’s need to balance technology adoption with a strong focus on enhancing the customer journey, a key driver of success in the competitive payments landscape.

The survey reveals that the most significant area of investment over the next 12-24 months will be in technological capabilities and digitalisation, with 47% of respondents indicating this as their primary focus. This strong emphasis on technology reflects the industry’s drive to innovate and remain competitive in a rapidly evolving market. Partnerships and collaborations with other players follow at 23%, highlighting the importance of strategic alliances in achieving growth and expanding market reach. Investment in customer experience and acquisition is also notable, with 15% of respondents prioritizing this area, underscoring the ongoing need to enhance customer interactions in a highly competitive environment. Regulation and compliance (9%) and financial crime prevention (6%) are also areas of concern.

However, despite the positive outlook and planned investments, the industry still faces significant barriers. Cost and budget constraints are the top concerns, identified as the biggest obstacle to new implementations. Internal resource limitations and legacy infrastructure are also notable challenges, reflecting the ongoing struggle to modernize systems and processes within existing budgetary and operational constraints.

Lastly, the industry’s overall outlook is predominantly positive, with 60% of respondents expressing optimism about the next 12 months. Only 3% have a negative outlook, which suggests that while there are challenges ahead, the general sentiment is one of confidence in continued growth and innovation within the sector.

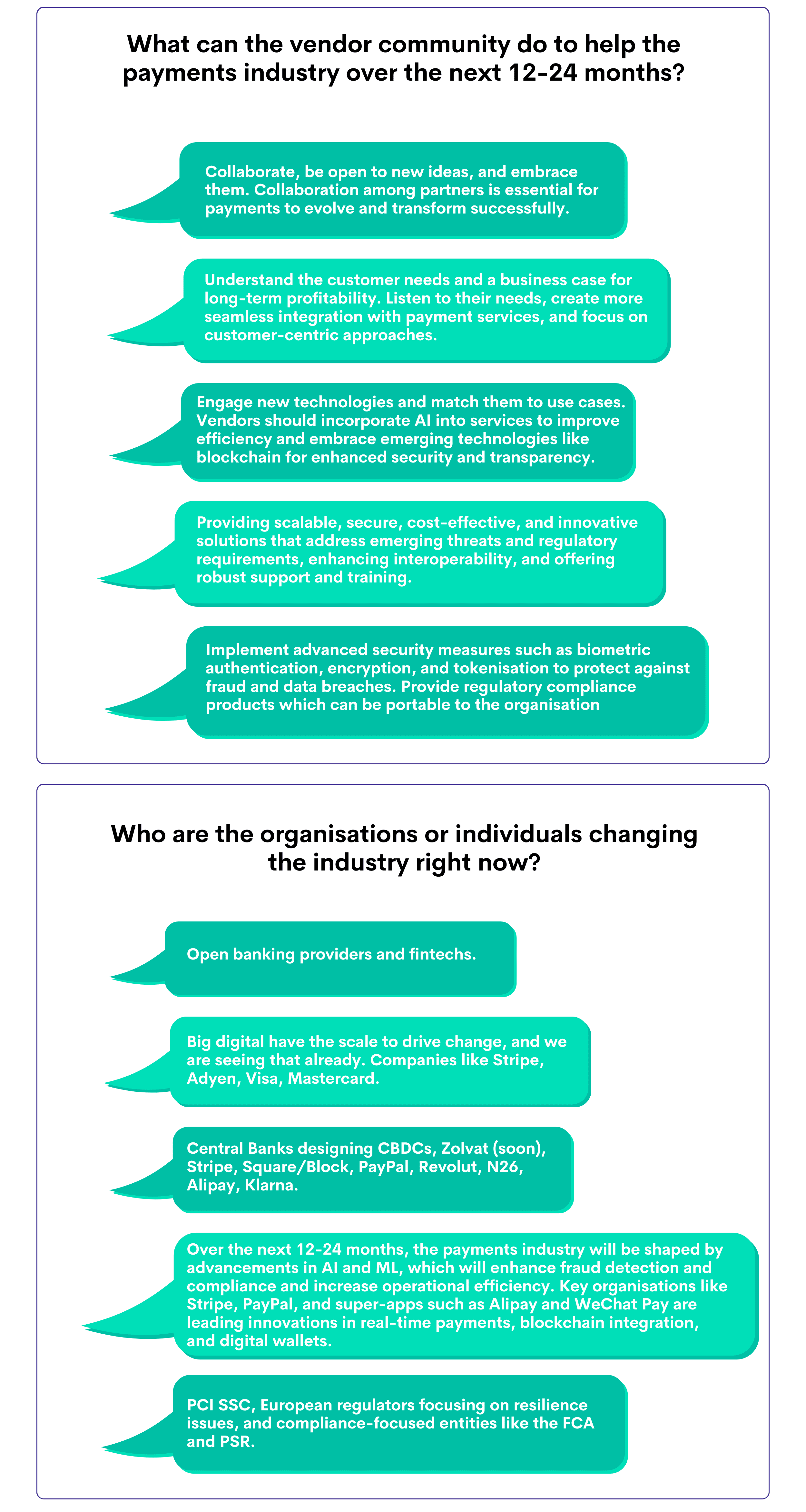

The insights gathered above showcase the critical role of collaboration and innovation within the vendor community to drive the payments industry forward over the next 12-24 months. Vendors are encouraged to embrace new ideas and technologies, particularly AI and blockchain, to enhance security, efficiency, and customer-centric services. The importance of understanding customer needs and developing scalable, secure solutions that address emerging threats and regulatory demands is also highlighted. Additionally, the text underscores the influence of key players such as open banking providers, fintechs, and major companies like Stripe and PayPal, alongside the regulatory focus on resilience and compliance, which will shape the industry’s future.

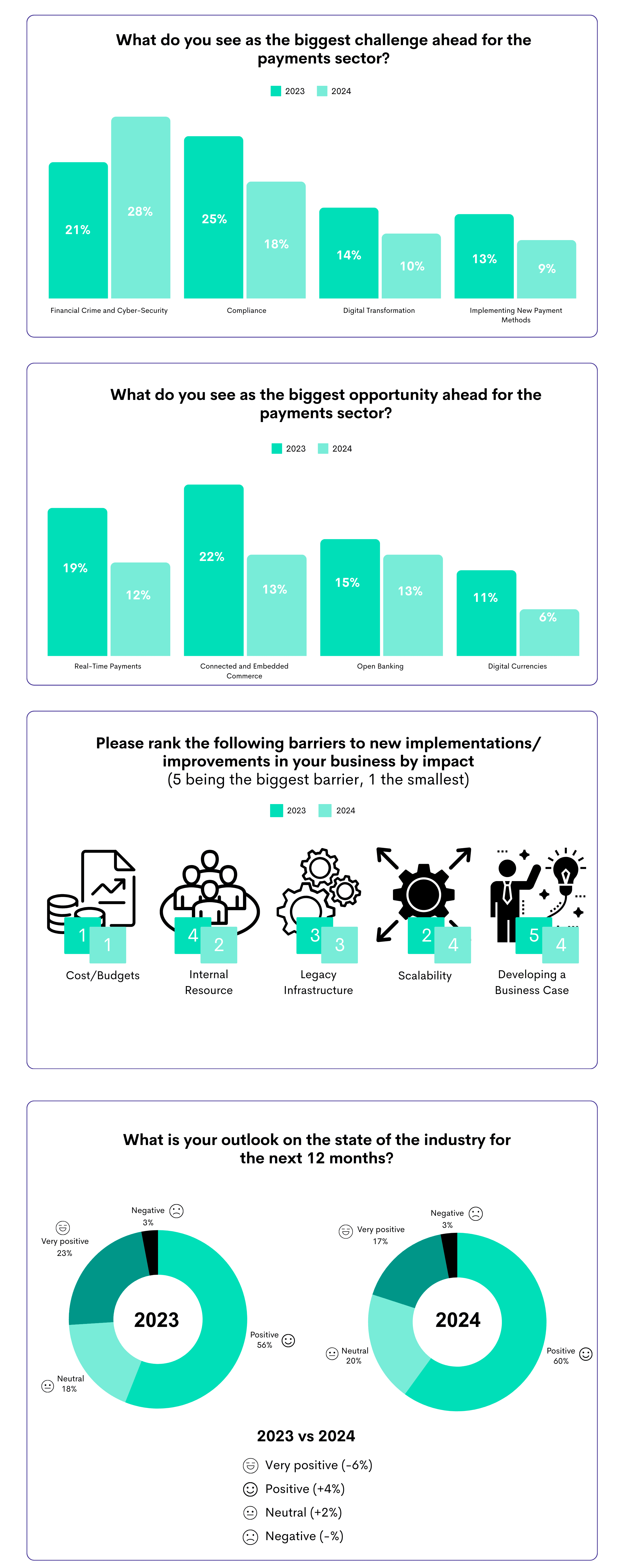

As the payments industry continues to evolve, the challenges and opportunities facing businesses are shifting rapidly. The following section compares findings from 2024’s State of the Industry survey to 2023’s findings, highlighting the changing priorities and perspectives among stakeholders. Understanding these trends is crucial for anticipating future developments and strategising effectively for the year ahead.

The data reveals that financial crime and cyber-security remain the top challenges for the payments sector, with concerns increasing from 21% in 2023 to 28% in 2024. This growing anxiety underscores the escalating threat landscape and the industry’s need to bolster security measures. Compliance issues have seen a slight decrease in concern, dropping from 25% to 18%, perhaps indicating some progress in adapting to regulatory demands.

On the opportunity front, connected and embedded commerce has gained prominence, rising from 13% in 2023 to 22% in 2024, reflecting the industry’s focus on integrating seamless digital experiences. Real-time payments, while still significant, saw a decline in perceived opportunity, decreasing from 19% to 12%. This could suggest that businesses are either moving past the initial phase of implementation or shifting their focus to other emerging technologies.

When it comes to barriers, cost and budget constraints remain the top concern across both years, highlighting ongoing financial pressures. However, internal resource challenges have grown in importance, moving from the fourth to the second most significant barrier, reflecting the increasing strain on human capital and expertise as businesses strive to innovate.

The industry’s overall outlook remains positive, with 60% of respondents expressing optimism for 2024, up from 56% in 2023. However, there has been a slight decrease in those who are very positive, dropping from 23% to 17%, suggesting a cautious optimism as businesses navigate the complexities of the evolving payments landscape. This mixed sentiment indicates that while there is confidence in the industry’s direction, there is also recognition of the challenges that lie ahead.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.