Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

What is this article about?

The prevalence and impact of Authorised Push Payment (APP) scams in the UK financial sector, highlighting the response of financial institutions and regulators

Why is it important?

It highlights the current trends, challenges, and performance of financial institutions in preventing and reimbursing APP scam losses, impacting consumer protection.

What’s next?

Implementing mandatory reimbursement requirements and enhancing fraud prevention and collaboration among financial institutions to better safeguard consumers.

Authorised Push Payment (APP) scams have become a prevalent issue in the financial sector, where fraudsters deceive individuals into transferring money to accounts under their control. These scams not only lead to significant financial losses but also cause severe emotional distress to victims. The growing sophistication of scammers and the increasing digitalisation of financial transactions have exacerbated the problem, making it a critical area of focus for regulators and financial institutions alike.

The Payment Systems Regulator (PSR) plays a pivotal role in publishing annual data on the performance of payment firms in handling APP scams. Its APP scams performance report July 2024 provides a comprehensive analysis of the effectiveness of these firms, including the 14 largest banking groups in the UK and 11 smaller firms that are disproportionately targeted by fraudsters. This report offers valuable insights into the prevalence of APP scams, the efficacy of preventive measures, and the levels of reimbursement provided to victims. By shining a light on these metrics, The PSR aims to encourage better practices and enhance consumer protection across the financial sector. The findings also serve as a crucial benchmark for assessing the industry’s progress in combating fraud.

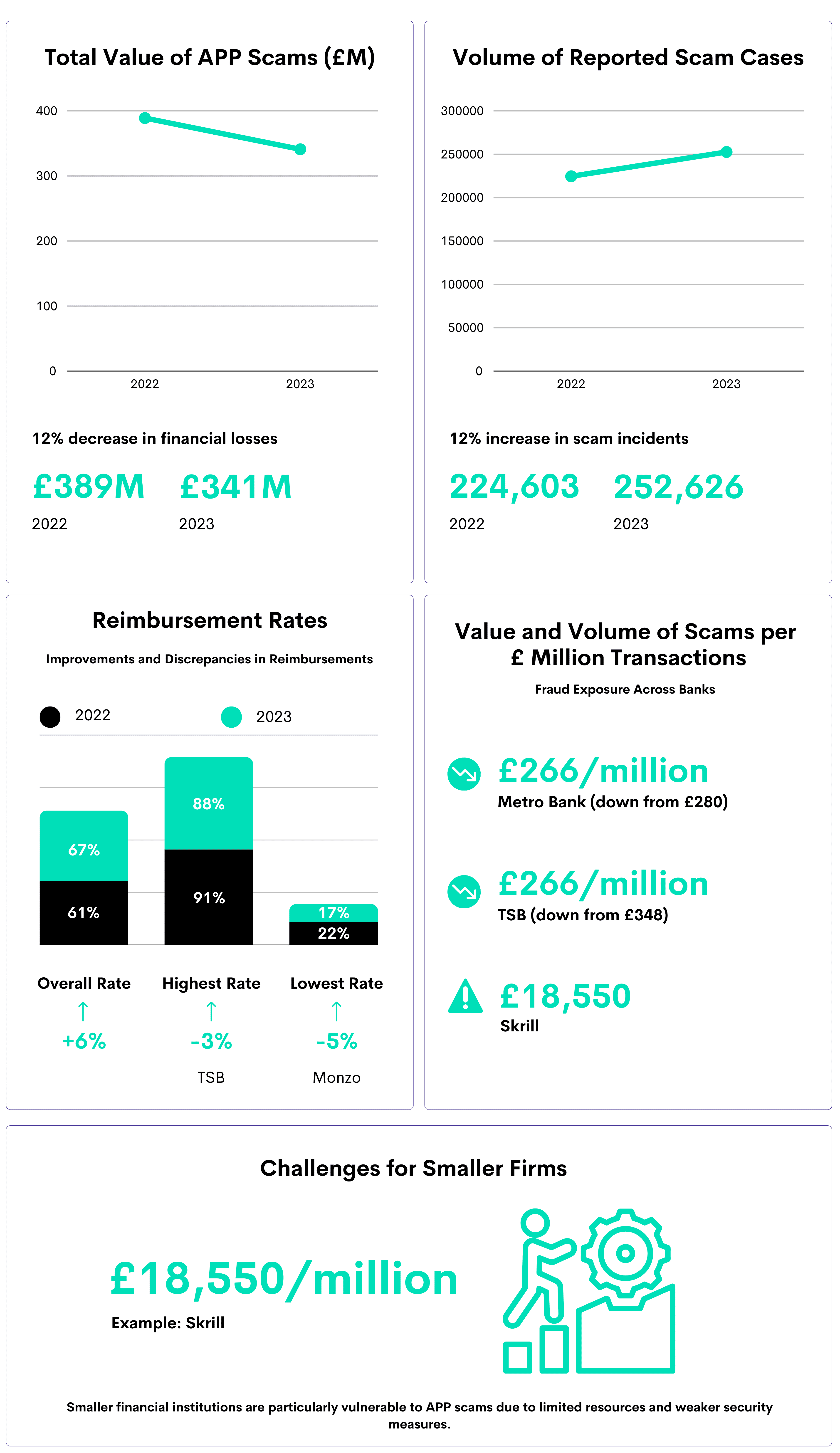

The 2023 report on APP scams reveals a nuanced landscape where both improvements and ongoing challenges are evident. A significant reduction in the total value of APP scams was observed, with losses dropping from £389 million in 2022 to £341 million in 2023, representing a 12% decrease. This positive trend suggests that heightened awareness and improved security measures have had a tangible impact. However, this progress is juxtaposed with a 12% increase in the volume of reported scam cases, rising from 224,603 in 2022 to 252,626 in 2023. This increase in case volume indicates that while the financial impact per scam may be declining, the frequency of these incidents continues to rise.

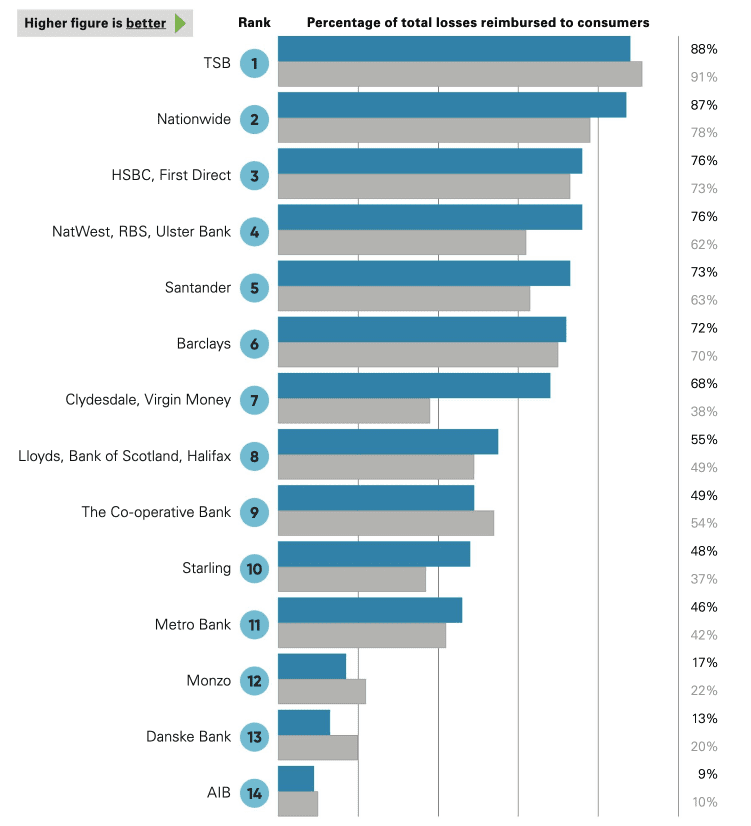

One of the most critical metrics in evaluating the response to APP scams is the reimbursement rate, which measures the percentage of scam losses refunded to victims. In 2023, the overall reimbursement rate across the 14 largest banking groups increased from 61% to 67%. Yet, the data reveals substantial discrepancies among different institutions. For example, TSB had the highest reimbursement rate at 88%, a slight decline from 91% in 2022. Other notable performers include Nationwide, which increased from 78% to 87%, and HSBC, which rose from 73% to 76%. However, banks like Monzo and AIB showed significant gaps, with Monzo’s reimbursement rate falling from 22% in 2022 to just 17% in 2023 and AIB’s rate dropping from 10% to 9%.

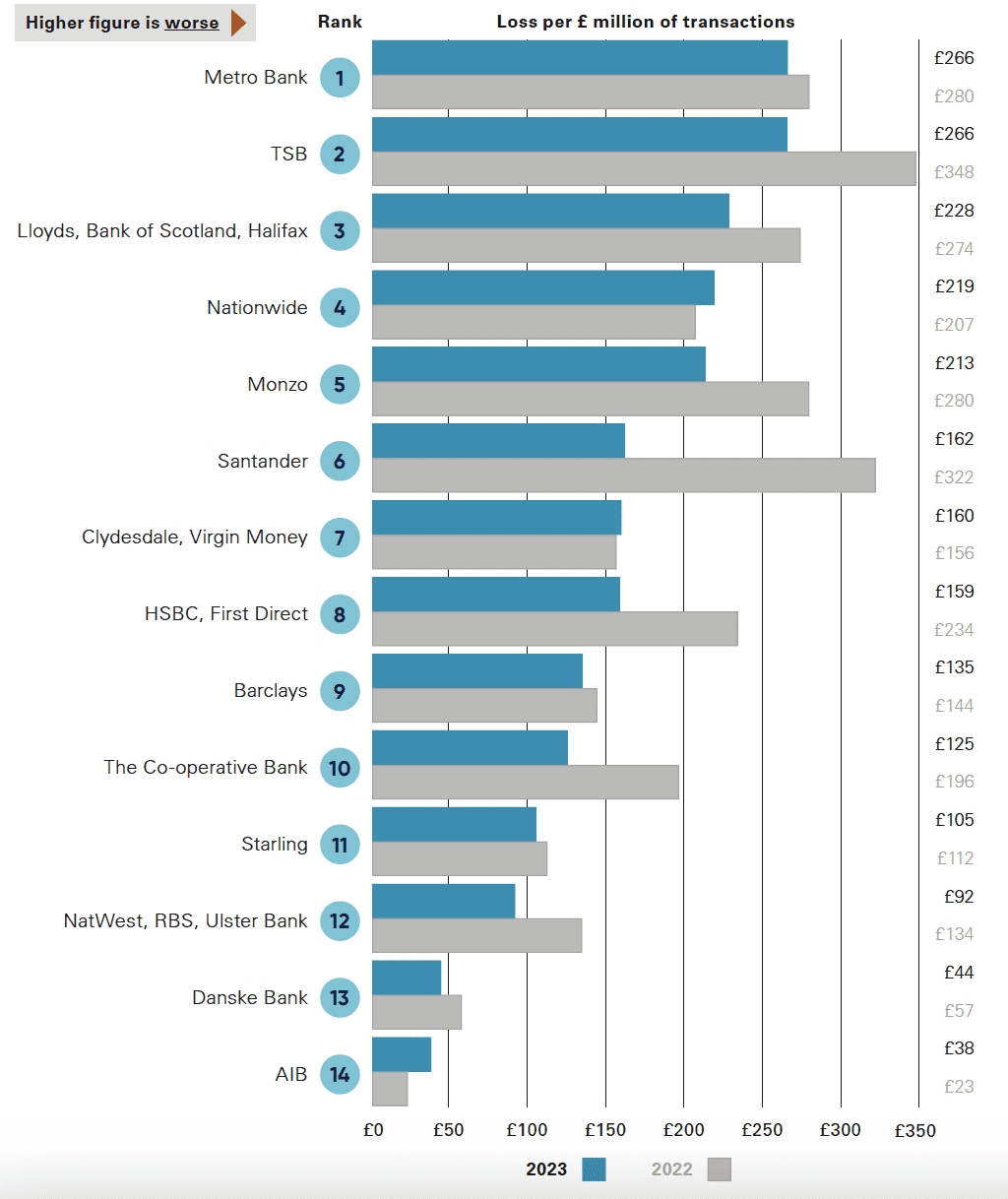

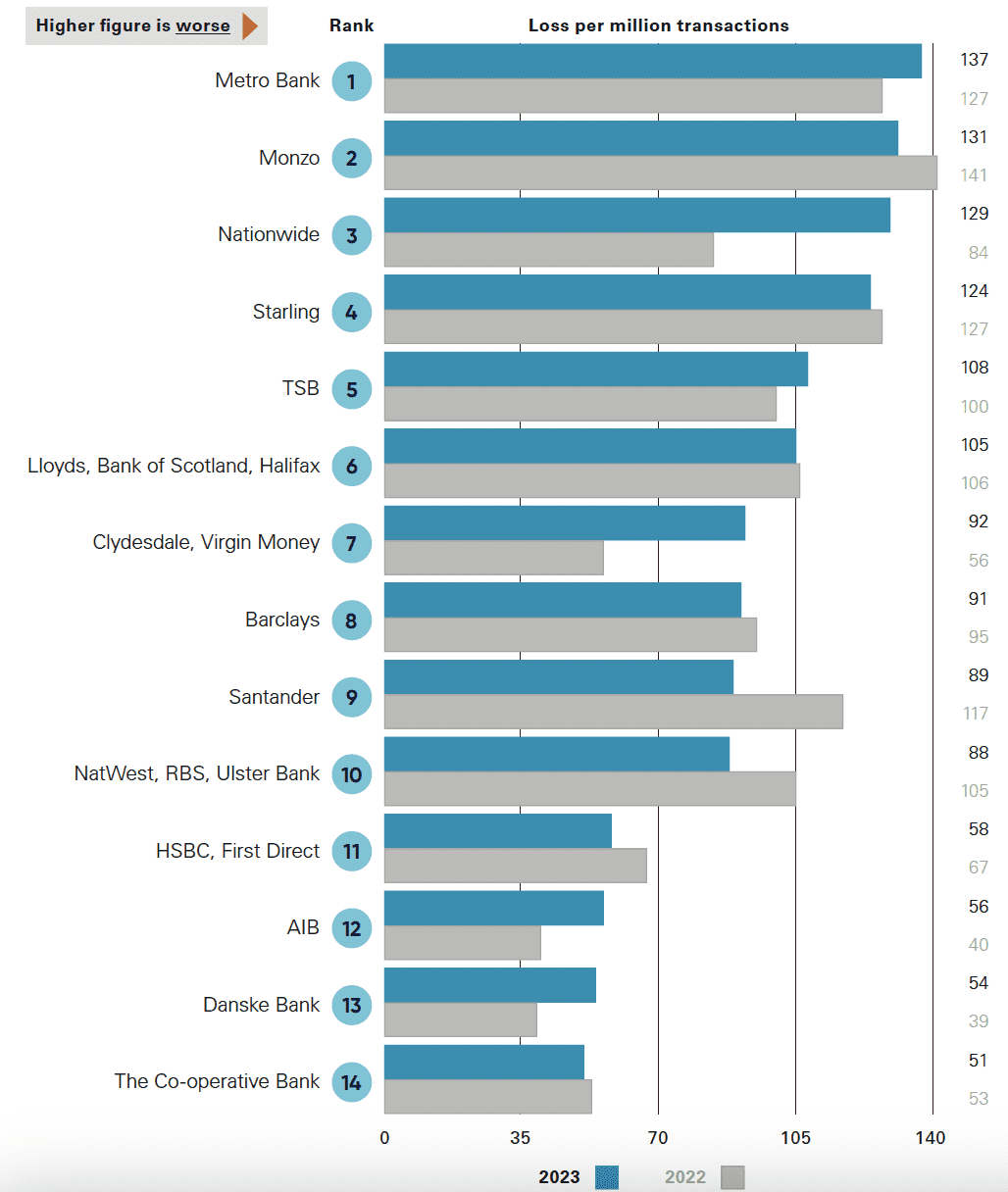

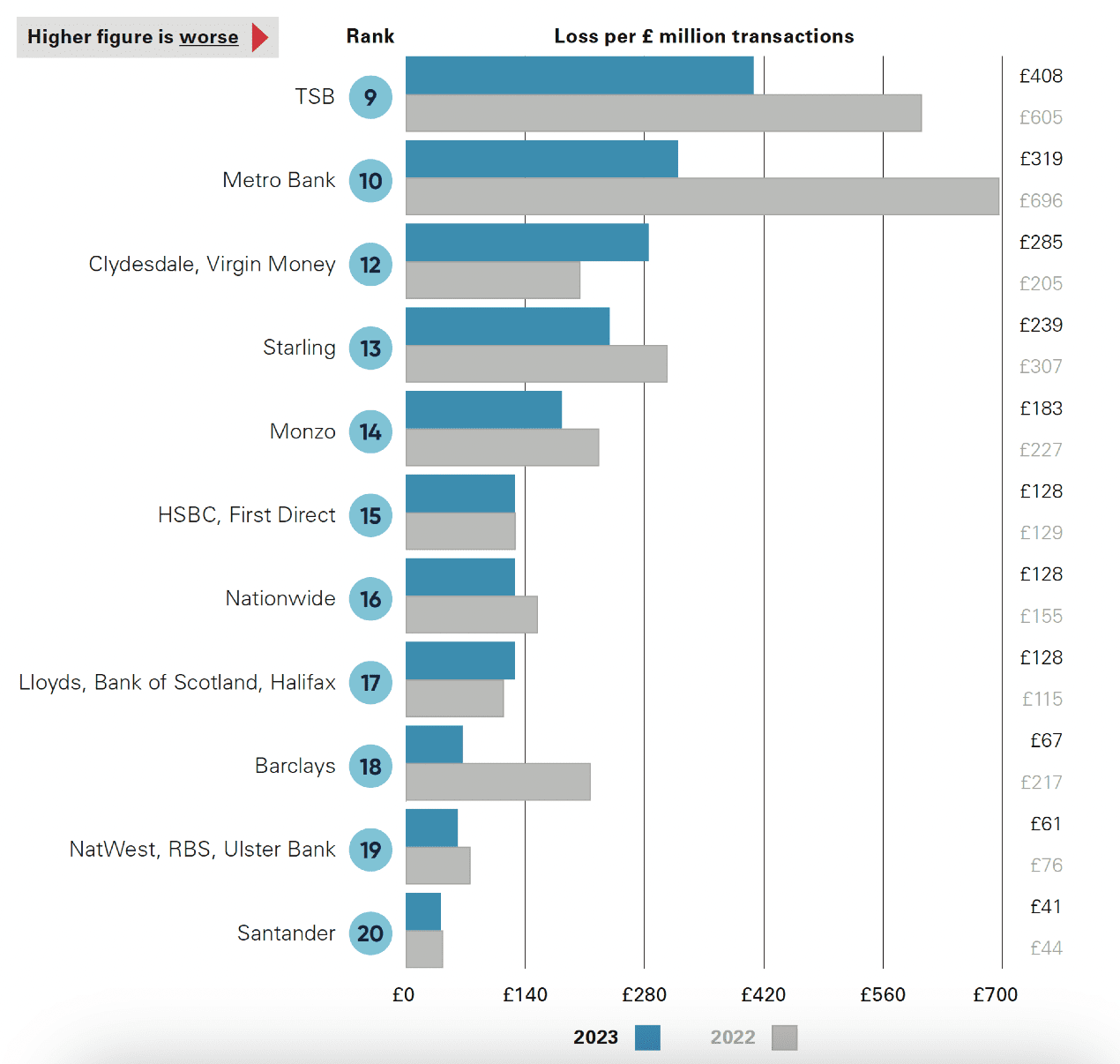

Another crucial aspect of the report is the analysis of the value and volume of APP scams per £ million of transactions. This metric offers insight into the exposure of each bank’s customers to fraud. For instance, Metro Bank and TSB recorded the highest values of fraud per £ million transactions, indicating vulnerabilities in their fraud prevention mechanisms. Specifically, Metro Bank saw a reduction in losses from £280 to £266 per £ million transactions, while TSB’s rate decreased from £348 to £266. In terms of the volume of scam transactions, Metro Bank and Monzo had the highest numbers, with 137 and 131 scam cases per million transactions, respectively, suggesting a high incidence rate of fraudulent activities among their customer base.

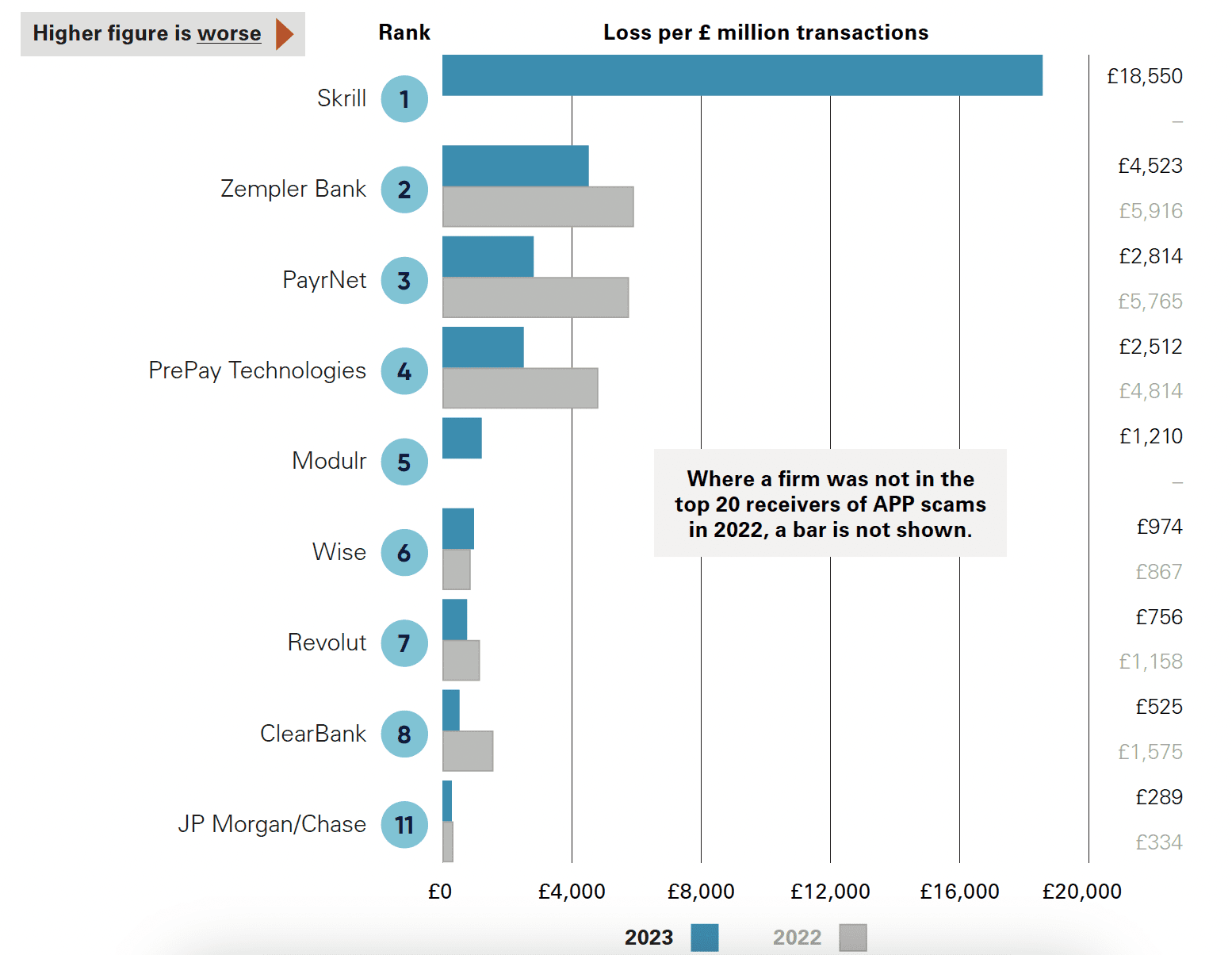

It is important to distinguish between directed (larger) and non-directed (smaller) PSPs, as scam rates vary significantly. Non-directed PSPs, such as Skrill and Zempler Bank, face disproportionately higher scam rates. Skrill reported £18,550 in scam losses per £ million transactions, a stark contrast to the much lower rates observed among directed firms. This highlights a critical need for enhanced security measures and oversight for these smaller institutions.

The introduction of mandatory reimbursement requirements in October 2024 represents a significant step forward. This regulation will require both sending and receiving firms to share liability for scam losses, aiming to standardise reimbursement rates across the industry and enhance consumer protection. The PSR expects this to reduce the current variability in reimbursement rates and provide a clearer, more consistent standard for all financial institutions.

The PSR’s APP scams performance report July 2024 provides a detailed analysis through various metrics that assess the performance of financial institutions in handling and preventing APP scams. These metrics include reimbursement rates, the value and volume of scams sent per million transactions, and the value and volume of scams received per million transactions. Together, these metrics offer a comprehensive view of how well banks and payment firms manage the risks associated with APP scams.

The reimbursement rate, or Metric A, is a critical measure of consumer protection. It reflects the proportion of scam losses that banks reimburse to their customers. This metric is broken down into two categories: the percentage of total losses refunded by value and the percentage of cases fully or partially reimbursed.

The data shows a range of performance among the largest banks. TSB stands out with the highest reimbursement rate at 88%, although this represents a slight decline from 91% in 2022. Other top performers include Nationwide and HSBC, with 87% and 76% reimbursement rates, respectively. Conversely, Monzo and AIB had the lowest reimbursement rates, with Monzo reimbursing only 17% of losses, a significant drop from the previous year.

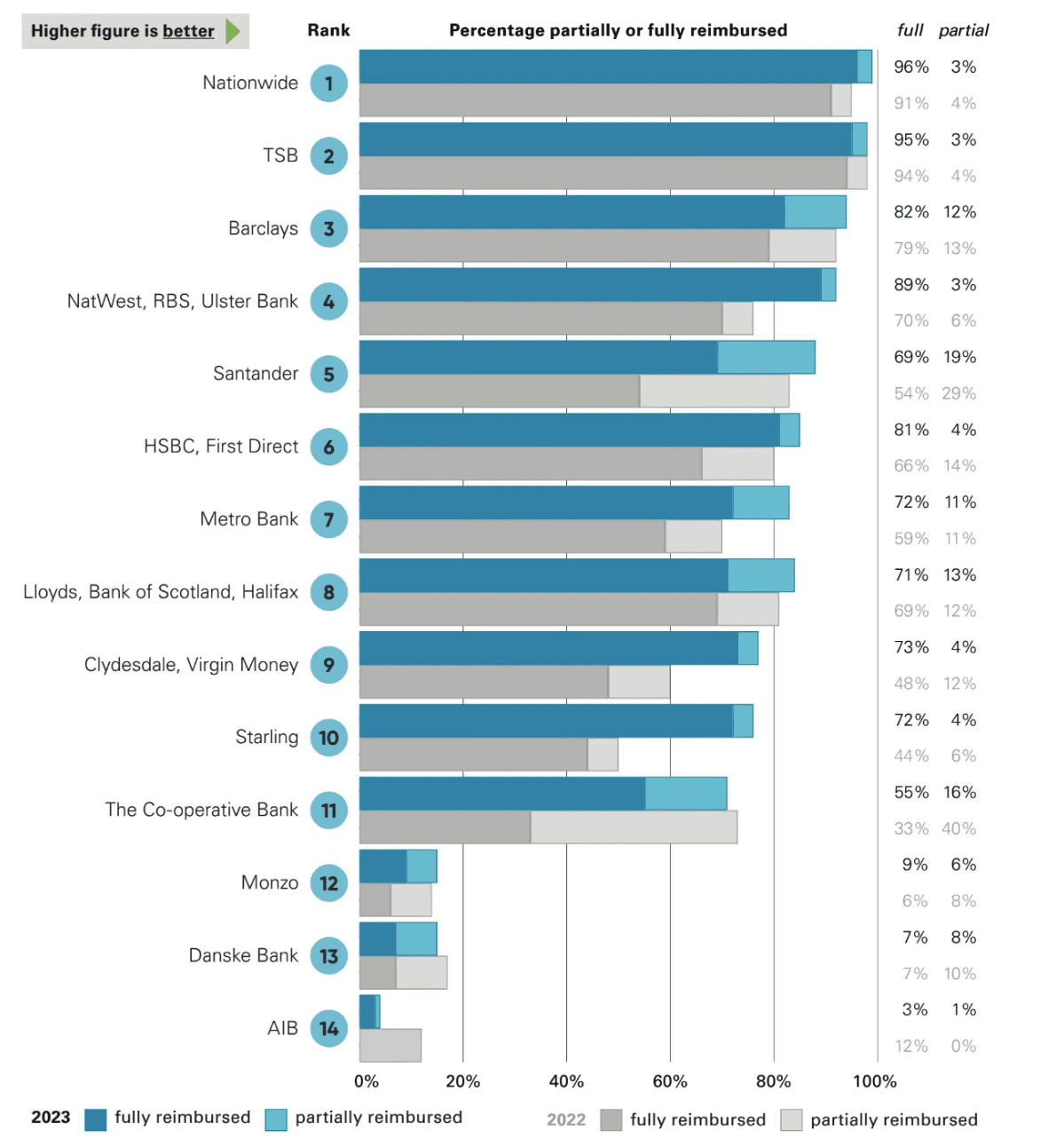

When examining the volume of fully or partially reimbursed cases, Nationwide and TSB lead with 96% and 95% of cases fully reimbursed. Notably, some banks like Barclays and NatWest showed significant increase in their reimbursement practices, reflecting a growing emphasis on customer protection. On the other end of the spectrum, Monzo and AIB lagged with full reimbursement rates of 9% and 3%, respectively.

This metric provides insight into how much money is lost to APP scams for every £ million in transactions processed by a bank, as well as the frequency of these scams.

Among the major banks, Metro Bank and TSB exhibited the highest loss rates per £ million transactions, with values of £266 each. However, both banks improved from their 2022 figures, indicating enhanced fraud detection and prevention measures. Nationwide, on the other hand, saw an increase in scam losses per million transactions, rising from £207 to £219, suggesting a need for more robust security protocols.

The frequency of scam cases is another crucial indicator. Metro Bank and Monzo reported the highest numbers, with 137 and 131 scam cases per million transactions, respectively. This high volume points to significant challenges in scam prevention and customer education. Notably, the volume of scam cases increased for several banks, including Nationwide and Clydesdale/Virgin Money, which saw rises of 53% and 66%, respectively.

Metric C focuses on the value and volume of scams received by both larger directed PSPs (payment service providers) and smaller non-directed PSPs.

Smaller firms continue to be disproportionately affected by APP scams. Skrill, in particular, had an exceptionally high scam rate, with £18,550 lost per £ million transactions received. Other firms like Zempler Bank and PayrNet faced significant challenges, with scam rates of £4,523 and £2,814, respectively. These high figures underscore these smaller firms’ vulnerabilities, often due to less stringent security measures and regulatory oversight (use graph 3).

Among the larger banks, TSB and Metro Bank recorded the highest value of received scams per £ million transactions, although they managed to significantly reduce these rates compared to 2022. For instance, TSB’s scam rate dropped from £605 to £408, while Metro Bank’s fell from £696 to £319. This reduction indicates a positive trend toward better scam detection and prevention. However, the data also highlights that larger banks generally fare better in managing incoming scams compared to smaller firms, possibly due to more sophisticated fraud detection systems and greater regulatory compliance.

The performance of the 14 largest banking groups and a selection of smaller firms in handling APP scams provides a deeper understanding of the varying levels of effectiveness in fraud prevention and customer protection. This section delves into the specifics of how each firm has fared, highlighting significant improvements, areas of concern, and trends in the data.

TSB continues to lead in terms of reimbursement rates, with 88% of the value lost to APP scams being refunded in 2023. However, this represents a slight decline from the previous year. TSB’s consistently high reimbursement rate is partly due to its comprehensive fraud refund guarantee, which automatically reimburses most scam victims. Despite this, TSB faced challenges in reducing the volume of scams, as they reported a relatively high number of cases per million transactions.

Nationwide has shown remarkable improvement in both value and volume metrics. The bank increased its reimbursement rate from 78% in 2022 to 87% in 2023, indicating a stronger commitment to customer protection. Additionally, the number of fully reimbursed cases rose, reflecting Nationwide’s proactive approach to handling scam cases. However, the bank also saw an increase in the volume of scams per million transactions, rising from 84 to 129, highlighting a growing exposure to fraudulent activities.

HSBC and its subsidiary First Direct also performed well, with a reimbursement rate of 76%, up from 73% in 2022. The bank has been proactive in implementing advanced fraud detection systems, contributing to a lower loss rate per million transactions. However, HSBC’s scam volume rate dropped.

Monzo’s performance in 2023 has been mixed. The bank saw a significant decline in its reimbursement rate, dropping from 22% to 17%. This reduction is concerning, especially as Monzo also reported high numbers of scam cases per million transactions..

Metro Bank had the highest rate of APP scam losses per million transactions among the major banks, alongside TSB. While Metro Bank improved its scam loss rate from £280 to £266, it still faces significant challenges. The bank also had one of the highest volumes of scam cases, indicating a persistent vulnerability to fraudsters. Despite these challenges, Metro Bank has made strides in increasing its reimbursement rate, which rose from 42% to 46%.

Among smaller firms, Skrill stands out for its exceptionally high rate of scam losses, with £18,550 lost per £ million transactions received. This figure is significantly higher than any other firm, highlighting a critical vulnerability. Skrill’s position as a digital wallet provider may make it more susceptible to fraud, necessitating stricter security protocols and oversight.

Zempler Bank also reported high scam rates, though it reduced its losses from £5,916 to £4,523 per £ million transactions. This reduction suggests some improvement in fraud detection and prevention, but the bank still has a long way to go to align with industry best practices.

PayrNet faced substantial challenges, with 2,705 scam cases per million transactions, a significant decrease from 4,459 in 2022. While this reduction is a positive sign, the firm still has a high scam rate, indicating the need for more robust fraud prevention mechanisms.

Revolut showed a mixed performance, with a decrease in scam losses from £1,158 to £756 per £ million transactions. However, the firm also experienced a high volume of scam cases, with 537 scams per million transactions. Revolut’s efforts in enhancing fraud detection and customer education need further bolstering to reduce these figures effectively.

The landscape of APP scams continues to evolve, presenting new challenges for both financial institutions and regulators. The data from 2023 highlights several key areas where improvements are needed and points towards future directions for combating fraud more effectively.

One of the foremost challenges is the inconsistency in reporting and classifying APP scams. Different firms have varied interpretations of what constitutes an APP scam, leading to discrepancies in data. For example, some firms may classify certain transactions, like “me-to-me” payments or those involving cryptocurrency exchanges, differently. This inconsistency complicates the comparison of data across firms and hinders the development of industry-wide standards. The Financial Ombudsman Service (FOS) rulings, which sometimes influence reimbursement decisions, add another layer of complexity. While firms are expected to exclude FOS-influenced reimbursements from their self-reported data, variations in compliance can skew the overall picture.

The disparity in reimbursement practices among different banks remains a significant issue. While firms like TSB and Nationwide have high reimbursement rates, others like Monzo and AIB show considerable gaps. These discrepancies are partly due to the voluntary nature of the Contingent Reimbursement Model (CRM) Code, which not all firms adhere to. The CRM Code establishes good practices but has not achieved uniform adoption across the industry, resulting in uneven consumer protection. This variability underscores the need for more consistent and mandatory guidelines to ensure fair treatment for all victims of APP scams.

Smaller firms, particularly those outside the traditional banking sector, continue to face a disproportionate burden of APP scams. These firms often lack the resources and infrastructure to implement robust fraud prevention measures. For instance, Skrill’s exceptionally high scam rate in 2023 points to vulnerabilities that need urgent attention. Smaller firms are also less likely to have comprehensive customer education programs, crucial in preventing scams. The data shows that these firms receive a disproportionately high volume of scams relative to their size, highlighting the need for targeted regulatory oversight and support.

Looking ahead, the introduction of mandatory reimbursement requirements in October 2024 represents a significant step forward. This regulation will require both sending and receiving firms to share liability for scam losses, aiming to create a more equitable framework for compensation. This change is expected to reduce the current variability in reimbursement rates and provide a clearer, more consistent standard for all financial institutions. The new rules will likely encourage firms to invest more in preventive measures, knowing they will be financially accountable for any lapses.

The future of APP scam prevention lies in better data sharing and collaboration across the financial sector. The PSR has highlighted the importance of intelligence-sharing between firms to identify and prevent scams in real-time. This collaborative approach could include sharing information on emerging threats, suspicious transaction patterns, and known fraudsters. Additionally, expanding the Confirmation of Payee (CoP) service to more institutions will help reduce the incidence of scams by ensuring that payments are sent to the intended recipients.

The 2023 report on Authorised Push Payment (APP) scams provides a comprehensive overview of the current state of fraud within the UK’s financial landscape. While there are clear signs of progress, such as a reduction in the overall value of APP scams and improvements in reimbursement rates by several major banks, the report also highlights ongoing challenges. The increased volume of scam cases and the persistent vulnerabilities faced by smaller firms underscore the need for continued vigilance and improvement.

Mixed performance across institutions: The performance disparity among financial institutions remains a critical issue. While some banks, like TSB and Nationwide, have demonstrated strong consumer protection through high reimbursement rates, others, such as Monzo and AIB, lag significantly. These differences highlight the necessity for more uniform industry standards and practices.

Challenges for smaller firms: Smaller payment service providers, including non-traditional firms like Skrill and Zempler Bank, continue to face a disproportionate impact from APP scams. The data indicates that these firms receive a high rate of scams relative to their transaction volumes, suggesting that more robust regulatory oversight and support are needed for these entities.

Future regulatory framework: The upcoming mandatory reimbursement requirements, effective from October 2024, are expected to standardize reimbursement practices across the industry. This regulatory change aims to ensure that victims of APP scams receive fair treatment regardless of their banking provider. The split liability between sending and receiving firms will incentivize both parties to improve their fraud prevention measures.

Importance of enhanced preventive measures: The expansion of the confirmation of payee (CoP) service and increased data sharing among financial institutions are crucial steps towards preventing scams. These measures, along with better consumer education and awareness campaigns, can significantly reduce the incidence of fraud.

The landscape of financial fraud is continually evolving, driven by advancements in technology and changes in consumer behaviour. As digital transactions become more prevalent, the methods employed by fraudsters are likely to become more sophisticated. This evolving threat landscape necessitates a proactive and adaptive approach from both regulators and financial institutions.

The findings of the 2023 report serve as a crucial benchmark for assessing the effectiveness of current measures and identifying areas for improvement. The financial sector must continue to invest in advanced fraud detection technologies, enhance inter-firm collaboration, and ensure consistent application of consumer protection standards.

In conclusion, while the report indicates positive trends in combating APP scams, the journey towards a fraud-resistant financial ecosystem is ongoing. The forthcoming regulatory changes and the industry’s commitment to better practices are promising developments. By building on these foundations and addressing the highlighted challenges, the UK can strengthen its defences against financial fraud, safeguarding consumers and maintaining trust in the financial system.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.