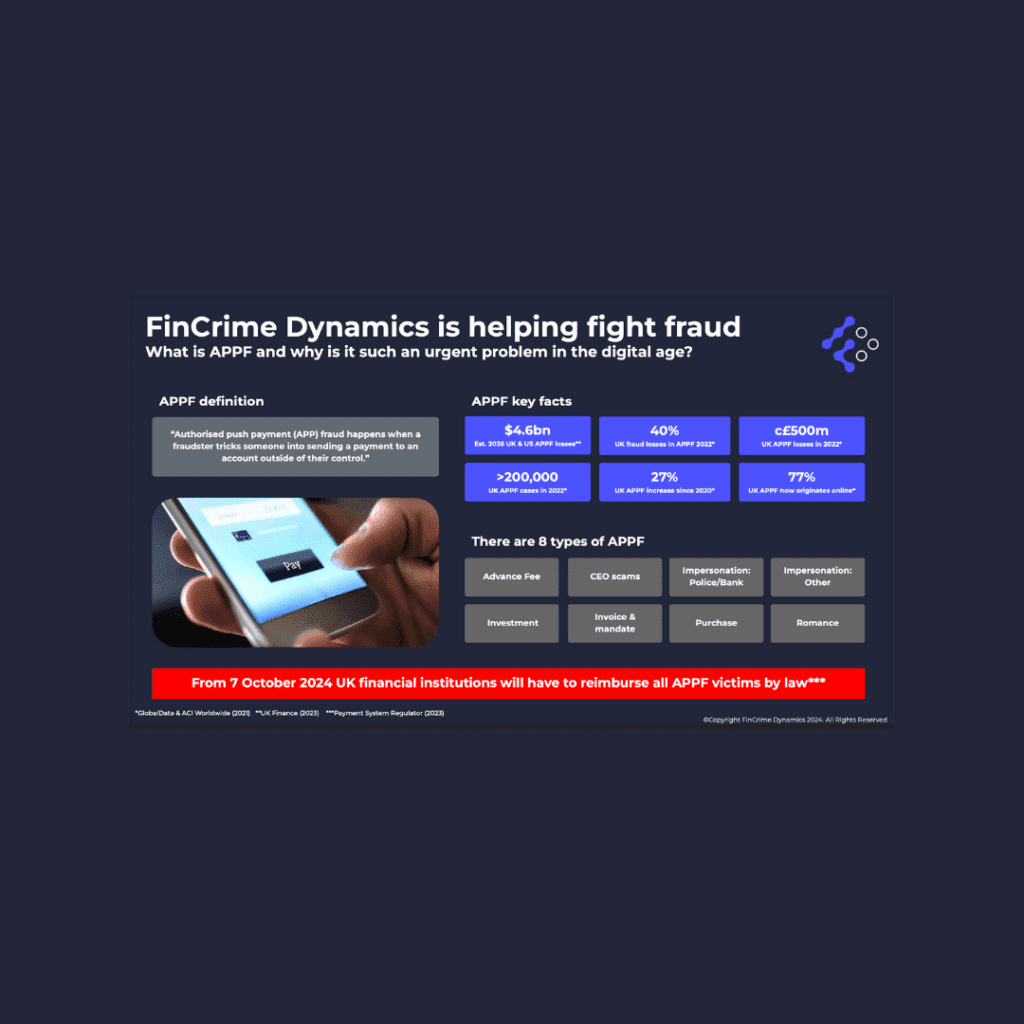

APP (Authorised Push Payment) fraud is a rapidly evolving threat in the financial sector, now accounting for roughly 40% of all fraud cases in the UK. The PSR has taken decisive action, and from 7 October 2024, both sending and receiving financial institutions will be mandated to reimburse victims of APP fraud. This new regulation creates urgency for banks and payment providers to bolster their defences against fraud, not only for the innocent victims affected but also to prevent significant financial losses for their institutions.

In response, FinCrime Dynamics has developed an advanced APP fraud testing SaaS service powered by their proprietary Synthetizor® technology. This innovative solution has been built together with the expertise of Money Laundering Reporting Officers (MLROs), Heads of Compliance, Heads of Fraud, and other industry leaders in the banking and payments sector. The goal is clear: to help financial institutions significantly reduce their operational and reputational exposure to APP fraud costs.

The FinCrime Dynamics SaaS solution offers a comprehensive solution to help institutions fortify their defences against APP fraud. Here’s how it works:

The SaaS solution is more than just a testing tool—it’s a strategic ally in the fight against fraud. By simulating hundreds of APP fraud scenarios, the platform enables institutions to rigorously test their controls and refine their strategies to stay ahead of fraudsters.

Financial institutions must act swiftly and decisively to enhance their defences with the impending regulatory changes mandating APP fraud reimbursement. FinCrime Dynamics’ APP fraud testing SaaS service is a critical resource. By identifying control vulnerabilities, quantifying potential losses, benchmarking performance, and improving controls, institutions can significantly reduce their exposure to APP fraud.

Staying ahead of the threat is paramount in an era where fraud tactics are continuously evolving. FinCrime Dynamics’ innovative solution empowers financial institutions to not only comply with upcoming regulations but also protect their customers and their bottom line from the ever-growing menace of APP fraud. As the industry moves towards greater accountability and consumer protection, tools like these will be indispensable in ensuring financial stability and trust.

Interested in building your dream APP fraud-fighting solution? Join our APP fraud-fighting community

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.