70% of UK financial leaders halt investments, awaiting autumn budget clarity

Equals Money research shows 90% of financial leaders face 2024 Budget uncertainty, with 70% delaying investments, and 81% planning to adopt new financial tools.

Equals Money research shows 90% of financial leaders face 2024 Budget uncertainty, with 70% delaying investments, and 81% planning to adopt new financial tools.

The FCA’s CP24/20 proposes significant changes to safeguarding rules for payment and e-money firms, requiring operational and compliance upgrades.

LHV Bank has appointed Mike Goodenough as director of banking services to lead growth and strengthen UK and European operations.

Ripple has upgraded Ripple Custody with new features like transaction screening and XRP Ledger integration, providing secure and scalable crypto asset storage.

Noda’s Pay & Go simplifies registration, KYC, and payment processing in one flow, enhancing conversion rates and user onboarding.

Seon Technologies’ November 20th webinar will explore how advanced pre-KYC processes can improve customer onboarding and fraud prevention for financial businesses.

Learn how payments firms are tackling the challenges of the Consumer Duty, from compliance gaps to improving customer outcomes and governance.

Gladius Assurance has launched a Safeguarding microsite to help firms navigate the FCA’s proposed changes to the Safeguarding Regime outlined in Consultation Paper 24/20.

The FCA’s new safeguarding reforms strengthen consumer protection in payments and e-money sectors. This article outlines key changes and steps firms must take to comply.

The PSR’s new refund rules strengthen fraud protection, but concerns remain over the reduced compensation cap and evolving scam tactics.

A&O Shearman’s webinar will explore HM Treasury’s draft BNPL legislation and its impact on lenders and the UK retail credit market.

iFAST Global Bank has introduced instant FX trading for iFAST GB Business clients, enabling faster fund settlements and improved efficiency for EMIs and regulated firms.

The FCA is consulting on new safeguarding rules for payment and e-money institutions to improve fund protection and compliance.

New rules mandate automatic reimbursement for APP fraud victims, raising concerns about industry costs and fraud exploitation.

Tide has partnered with Adyen to enable small businesses to accept contactless payments using only an iPhone and the Tide app, eliminating the need for payment terminals.

A new fscom report analyses compliance challenges in financial services, highlighting improvements and ongoing areas of regulatory non-compliance.

Visionary leadership is crucial for driving innovation and navigating the rapid changes in the payments industry.

A new BDO report highlights challenges in attracting talent and concerns over remuneration for non-executive directors.

The PSR has lowered the APP fraud reimbursement cap to £85,000, raising concerns over fraud prevention

PEXA collaborates with Metro Bank to enhance the remortgaging process, aiming for faster completions and increased transparency for customers and brokers.

A surge in current account switching is being driven by cash incentives, economic pressures, and the rise of digital banking.

Flawed assumptions in CBDC designs around accounts, wallet control, and privacy call for a more innovative, privacy-focused approach.

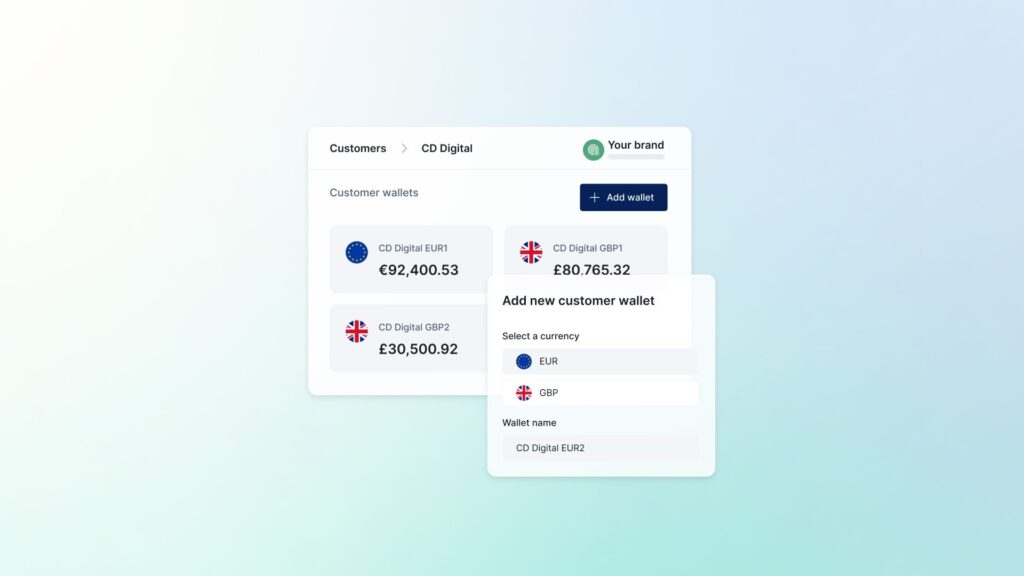

BVNK has introduced Customer Virtual Accounts, enabling fintechs and payment service providers to facilitate EUR, GBP, and stablecoin payments on a unified platform.

MyGuava has partnered with Queens Park Rangers to offer exclusive fan cards, featuring physical and virtual options with cashback rewards and other benefits.

The card payment industry must adapt to technological disruption, competition, and evolving consumer behaviours to stay competitive.

Traditional banks must modernise their tech stack to stay competitive with fintechs and meet shifting consumer expectations.

Ripple has begun beta testing its stablecoin, Ripple USD (RLUSD), on the XRP Ledger and Ethereum, with plans to expand to other blockchains, focusing on security and reliability before full release.

Merchants face new challenges as payment innovations like open banking and tokenisation reshape the industry.

Lucinity’s new US patent enables secure sharing of AI insights between financial institutions, with the aim of improving global crime detection while protecting data privacy.

Webinar: Join Linklaters LLP to learn how upcoming FCA safeguarding rule changes will impact payments firms on Wednesday, 2 October 2024, at 2:00 pm BST.

Paytently unveiled its new branding at the SBC Summit, highlighting its innovation and investment in streamlining the payment process.

Tasc is an automated back-office platform that streamlines KYB/KYC, transaction monitoring, and dispute management for faster and more scalable operations.

Linklaters LLP will host a webinar on 2 October 2024, covering upcoming FCA safeguarding rule changes for payments firms.

Despite the growth of digital payments, cash use is rising in the UK, supported by emerging cashtech innovations.

The Combatting APP Fraud report outlines how upcoming PSR rule changes will drive banks to adopt inbound transaction monitoring and collaborative intelligence.

Self-checkout systems reduce wait times, boost efficiency, and enhance customer experience, becoming essential in modern retail.

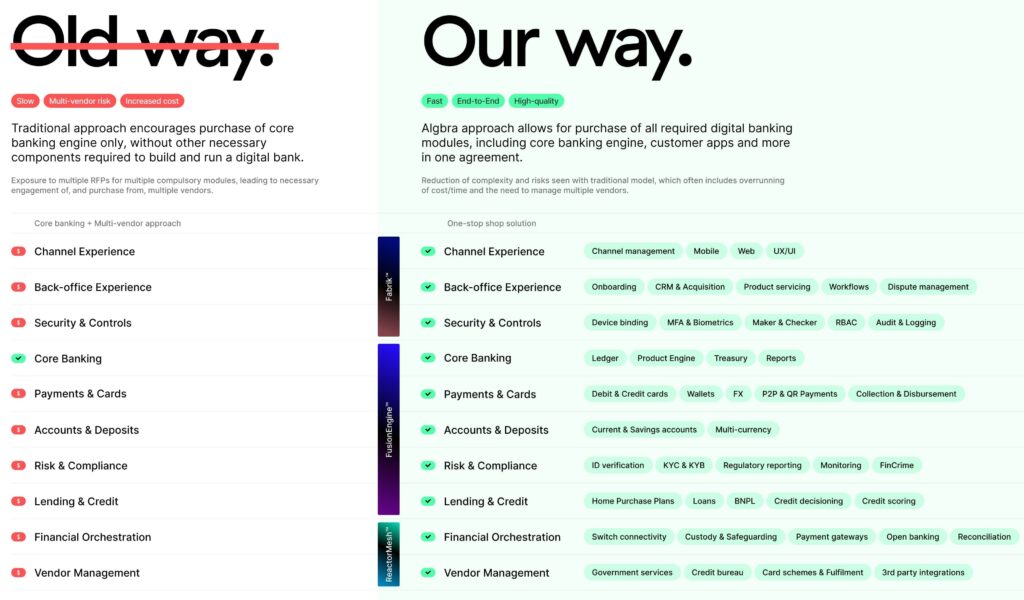

Algbra Labs’ fintech-as-a-service (FaaS) simplifies building digital financial platforms, cutting costs and time, as seen with Standard Chartered’s Shoal.

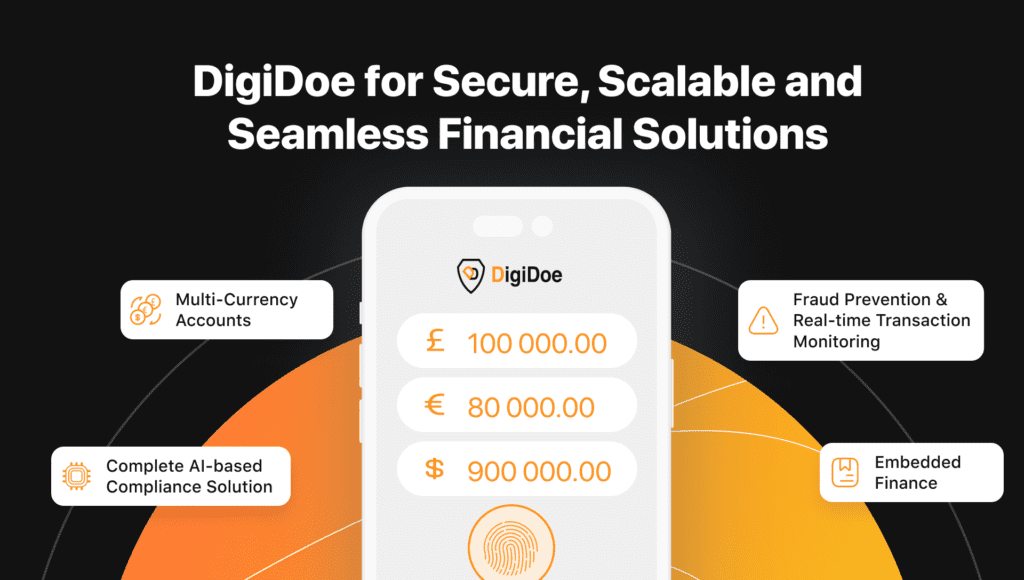

DigiDoe revolutionises global payments with AI-powered fraud prevention, multi-currency solutions, and simplified compliance for secure, efficient business growth.

The merged R&D tax credit scheme in April 2024 introduces new rules for contracted-out R&D, benefiting larger businesses but requiring careful planning and documentation.

Navigating the challenges of payments, open banking, and compliance in a changing financial landscape.

Rising maintenance costs in social housing, driven by damp remediation and regulations, are pushing providers to adopt preventive strategies and modernisation.

Blockchain is transforming digital payments with faster, more secure, and transparent transactions, driving mainstream adoption and new applications.

The new Reimbursement Claims Management System (RCMS) aims to simplify APP fraud claim processing, enhance PSP cooperation, and ensure adherence to updated compliance standards

How open banking can reshape finance, enabling personalised services, streamlined verification, and improved fraud detection.

New SEPA regulations in 2024 will require instant payments, fee parity, and improved fraud prevention, posing compliance challenges for financial institutions.

Latham & Watkins has launched the Markets in Crypto-Assets Regulation Tracker, an online tool providing crypto businesses with up-to-date information on navigating the evolving MiCA regulatory framework.

The challenges financial institutions face under SEPA Instant Credit Transfer regulations and explores how advanced technologies can help overcome them.

Chargebacks911 appoints fintech veteran Mike Elliff as Chief Revenue Officer and EMEA CEO to drive global expansion and tackle rising post-transaction fraud.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.