Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

What is this article about?

The rise in current account switching in the UK, driven by cash incentives and the growing appeal of digital banks

Why is it important?

It highlights changing consumer behaviour, the cost to banks, and the challenge of building long-term customer loyalty amid short-term switching.

What’s next?

Banks may need to focus on offering lasting value through better services and digital experiences rather than relying on cash incentives, especially under new regulatory pressures.

Traditionally, consumers stuck with familiar banks, but there’s now a growing trend of current account switching. According to data from Pay.UK, the Current Account Switch Service (CASS) has completed 10.9 million switches since its launch and successfully redirected 152.7 million payments, with motivations for switching including higher interest rates, lower account fees and fewer charges.

Since its 2013 launch, CASS has simplified switching by allowing customers to move accounts within seven working days, ensuring smooth transfers of direct debits and payments. The service was introduced as part of a government initiative to increase competition in the banking sector, aiming to reduce the inertia that had kept 75% of account holders with the same bank for years.

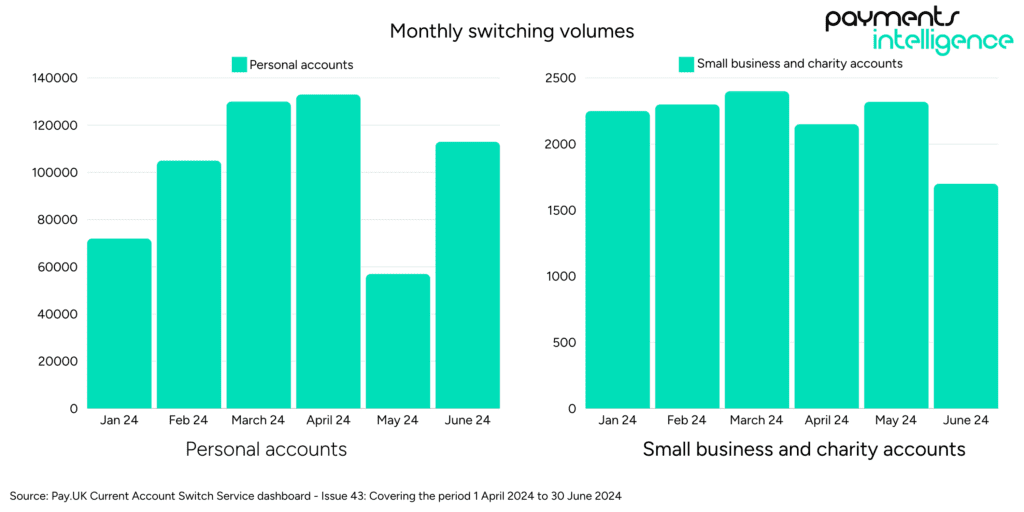

Between October and December 2023, CASS facilitated 433,701 switches, marking the highest quarterly total since it was launched over ten years ago. There were 313,293 switches in Q2 2024, with switches taking place across 53 participating banks and building societies.

Incentive-driven switching has become one of the primary forces behind the surge in current account switching in recent years. Banks have increasingly relied on cash bonuses to attract new customers, with offers sometimes reaching as high as £200 to switch accounts. For example, Nationwide’s £200 incentive in late 2023 led to a record 163,000 new customers in just a few months. These financial rewards are particularly attractive to customers during economic downturns, such as the recent cost-of-living crisis, which has left many looking for short-term financial relief.

However, this incentive-driven behaviour has also given rise to a phenomenon known as “savvy switching.” Some savvy switchers exploit these deals, moving between banks to claim bonuses without staying long-term. As a result, while banks see a short-term gain in customer numbers, they often face high churn rates once the incentives end.

Acquiring disloyal customers through switching incentives is costly for banks. Nationwide, for example, spent up to £39 million in 2023 alone. These short-term gains may erode profitability and divert attention from service improvements that foster genuine loyalty.

While cash incentives drive short-term switching, they often fail to build long-term relationships. In contrast, digital banks like Monzo and Starling are attracting customers by offering lasting value through user-friendly platforms and innovative features.

Rivero co-founder Fatemeh Nikayin tells Payments Intelligence: “Today’s surge in current account switching is driven by consumers seeking more than just basic banking services. They want value-added features like seamless self-servicing options and exceptional customer service, especially during critical moments like fraud or merchant disputes. Alongside these factors, traditional considerations such as competitive pricing and enhanced digital experiences—particularly better app functionality—are also motivating customers to switch.”

The cost-of-living crisis, especially during the 2023 holiday season, drove many consumers to switch accounts for financial relief. Banks, keen to capitalise on this situation, have responded by offering attractive cash incentives to lure customers to switch accounts.

During this period, switching offers became more than just a promotional tool; they were a lifeline for many consumers struggling with rising costs. For instance, according to data from Optima, Nationwide’s £200 incentive saw 163,000 customers switching to their accounts in 2023. This spike in switching numbers highlights how consumers, feeling the pinch of the economic downturn, were quick to take advantage of such offers to boost their disposable income, even if only temporarily.

This shift in customer behaviour shows how economic pressures can influence banking decisions. Many consumers are now driven by short-term financial incentives rather than long-term relationships, pushing banks to rely on these offers during economic challenges.

However, while these offers provide a short-term boost, they may not encourage lasting loyalty. Consumers who switch during a cost-of-living crisis might be more focused on securing quick wins rather than engaging with their new bank’s long-term offering, leading to higher levels of customer churn once the incentive periods end.

Digital-first banks like Monzo and Starling have transformed the UK banking landscape by focusing on convenience, competitive rates, and user-friendly platforms. Unlike traditional high street banks, these challengers have capitalised on the rise of mobile banking and the digital economy, offering customers seamless, tech-driven experiences.

Monzo, for example, built its reputation on offering an intuitive mobile app, instant spending notifications, budgeting tools, and no hidden fees for overseas transactions. Similarly, Starling Bank prioritised ease of use and transparency, earning praise for its user-centric features, such as real-time transaction tracking and fee-free foreign currency spending. These features have resonated particularly well with tech-savvy and younger customers, who increasingly expect their banking experience to match the convenience of other digital services they use daily.

What’s notable about these banks is that they have managed to grow their customer base without relying on traditional cash incentives to attract switchers through the CASS. Instead, their value proposition lies in offering innovative products that solve real customer pain points, such as better financial management tools and improved user experience. This approach has allowed Monzo and Starling to stand out in an industry where other banks often rely on short-term monetary rewards to encourage switching.

However, while these digital challengers initially saw strong growth, recent data suggests that even they are not immune to customer churn. Both Monzo and Starling have started to experience net losses in switching figures, indicating that even their loyal customer base is susceptible to moving on, perhaps drawn by the cash incentives of other banks.

As these digital-first banks mature, it remains to be seen whether their focus on user experience will be enough to retain customers in an increasingly competitive environment or whether they, too, may have to consider adopting short-term incentives to stay competitive.

This is a strategy undertaken by iFast, with its General Manager Simon Lee telling Payments Intelligence: ” Our three key strategies are simplicity, customer-centricity, and going beyond boundaries. Banking products must be simple, accessible, globally connected, and relevant to everyone.”

Accessibility is enforcing this, with iFast consumers having access to a range of features for its tech-savvy base of consumers. The ability to manage up to seven currencies in one place for example is one of the reasons helping challenger banks to capture switching gains.

Lee adds: “We focus on keeping things simple and accessible. Security and convenience are at the core of our digital banking service, ensuring it fits smoothly into everyday life. Additionally, we’ve integrated banking with our wealth management platform in Asia, offering customers more than just banking—think investment opportunities too.”

Optima Consultancy Director Mark O’Keefe says: “Our analysis shows that banks win big numbers of accounts when providing rich offers but when they stop them they then become big losers so customers are playing the game with them. It’s unsustainable to permanently offer these rewards.”

The rise of “savvy switchers” has introduced a new dynamic to the current account-switching landscape. This small but highly active group of customers has learned to exploit switching incentives, moving from one bank to another to take advantage of lucrative cash bonuses without any intention of staying long-term. These customers are often motivated purely by the financial reward, switching accounts as soon as the incentive criteria are met and then moving on to the next offer.

This behaviour is particularly evident in cases where banks offer high-value cash incentives—for example, Nationwide’s £200 bonus in late 2023 resulted in a record number of switches. Still, it was followed by significant customer churn once the promotional period ended. Such patterns suggest that many switchers are not seeking long-term value or better banking services; instead, they are gaming the system to maximise short-term gains.

Savvy switchers’ present a challenge for banks, as their frequent movement to chase incentives drives up customer acquisition costs. Nationwide’s bonus scheme is rumoured to have cost the bank around £39 million, according to thisismoney.co.uk. Banks spend millions on switching bonuses to attract new account holders, but these costs are often passed on to all customers through higher fees or reduced service levels.

Additionally, this frequent switching pattern undermines CASS’s effectiveness in fostering genuine competition as the emphasis shifts from long-term customer relationships to short-term acquisition targets.

Moreover, the focus on cash incentives may discourage customers from fully understanding a bank’s product offerings or building a meaningful relationship with their bank. Instead of exploring account features or considering long-term benefits, savvy switchers often prioritise immediate financial gain, making it difficult for banks to retain them once the incentive period ends.

As the number of savvy switchers continues to grow, the sustainability of incentive-driven switching is increasingly being questioned. Banks may need to rethink their strategies and focus on creating value beyond cash bonuses to encourage lasting customer loyalty and reduce the reliance on financial sweeteners to attract new customers.

The latest figures from CASS indicate that between 1 October 2022 and 30 September 2023, there were 1,399,571 switches. The summer months of June, July, August, and September saw the greatest hike, with a total of 344,195 switches being completed.

From April to June 2023, NatWest saw the highest net gains in account switching, followed by HSBC, RBS, and Ulster Bank, based on the most recent customer data. In Q3 2023, there were 344,195 switches, a rise from 222,108 in Q3 2022. An impressive 99.7% of switches completed from July to September 2023 occurred within seven working days.

In Q3 2023, 77% of people were aware of the Current Account Switch Service, with an 87% satisfaction rate and strong confidence in its speed, security, and ease of use.

Overall, 77% of individuals were aware of the Current Account Switch Service in Q3 2023, an increase from 75% in Q2 2023. Awareness varied by demographic, with men more aware at 79% compared to 75% of women. Among those under 25, awareness rose to 42% from 37% in the previous quarter. The highest awareness was noted in those aged 65 and older at 90%.

In Q3 2023, 87% of customers were satisfied with the Current Account Switch Service, and 71% preferred their new account. Approximately 15% are currently considering switching their current account. Core reasons for preferring their new current account include service-related, non-financial benefits such as online or mobile banking (45%) and customer service (32%).

Nikayin points out that when customer experience (CX) is discussed, the focus tends to be on positive scenarios, like a smooth checkout for merchants or frictionless onboarding for banks. However, he highlights that CX, during moments of distress, such as fraud or dispute cases, is often overlooked. In these situations, when a customer spots an unfamiliar transaction or a charge for an unreceived service, how the bank handles the issue can significantly strengthen customer trust. Nikayin explains, “Turning such a stressful situation into a great CX will increase the customer’s trust in the bank, and the next time they are about to pick a card to pay, that’s the bank they will remember!”

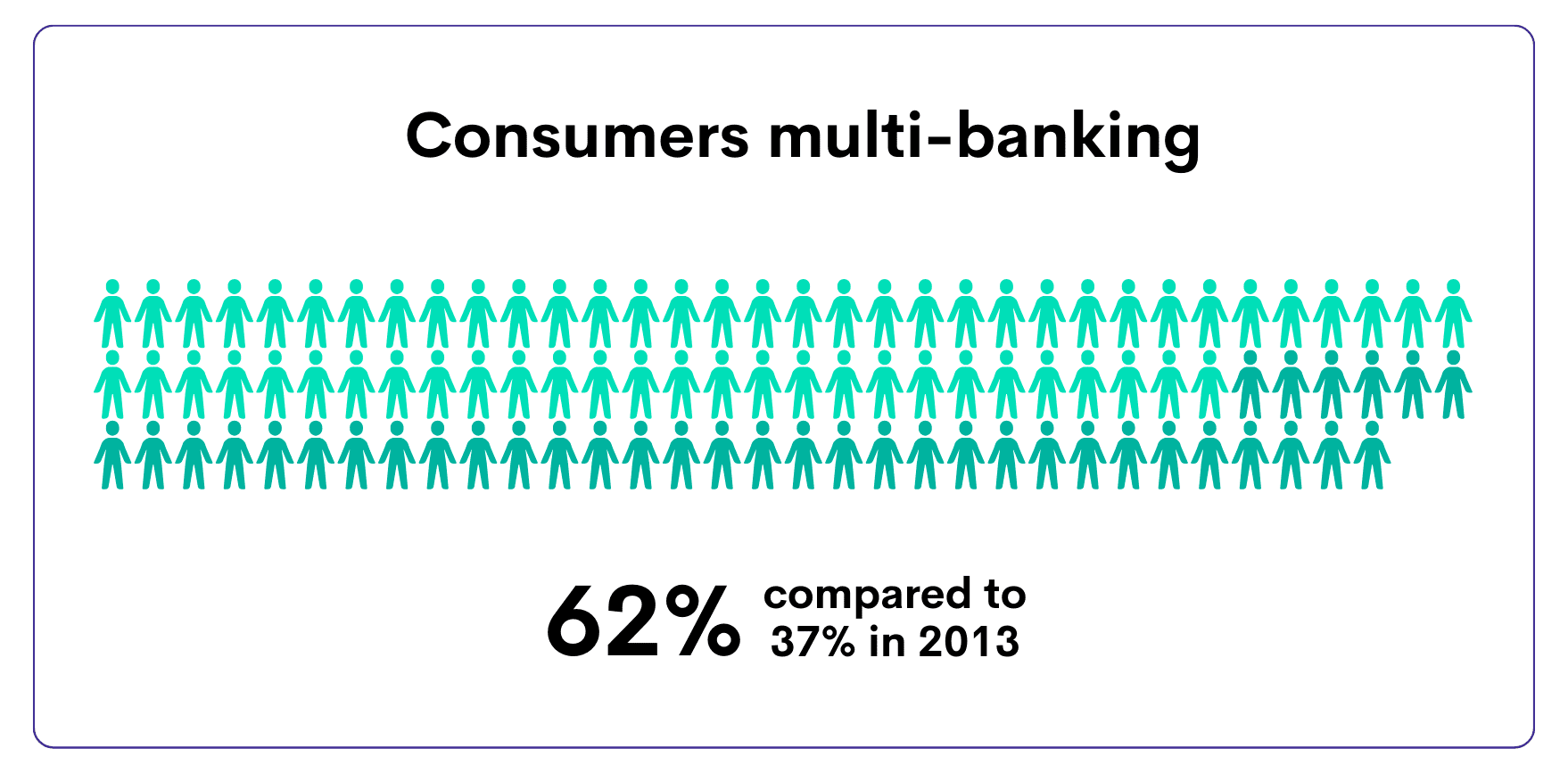

According to Optima, when CASS launched in 2013, 63% of consumers in the UK held just one personal current account, 28% held two, and 7% held three or more. More recent data from KPMG in 2022 found that 62% of surveyed UK had one or more bank accounts, while 19% had three. A surprising 12% had four or more bank accounts.

O’Keefe notes that technology has made it easier and faster for people to own and manage multiple accounts. He compares it to how we use different streaming services for various purposes, suggesting that people now treat their bank accounts similarly—one might be for travel, another for bills, and another for saving. “We are comfortable having multiple email accounts, multiple insurance products, multiple shopping accounts, so banking is now no different,” O’Keefe adds.

The multi-bank trend has changed the switching landscape by making customers more likely to chase short-term incentives without fully switching their primary banking relationship. For instance, a customer who already holds an account with a traditional bank might open a secondary account with a challenger bank to take advantage of a temporary cash bonus or higher interest rates without losing their original account. This flexibility allows customers to switch accounts easily whenever a new offer appeals to them.

The rise of multi-banking has made it easier for customers to switch frequently, reducing the chance for banks to foster long-term loyalty as customers jump between offers. They may use switching incentives to gain extra benefits without intending to move their main banking activities permanently. This leads to higher churn rates and makes it challenging for banks to measure the success of switching campaigns, as the influx of new accounts may not translate into sustained customer growth.

Similarly, multi-banking has led to a situation where customers can effectively ‘test drive’ different banks without fully committing, leading to a shift in consumer expectations. With greater access to competitive offers across multiple providers, consumers may view banks as interchangeable and focus on maximising rewards rather than developing a deeper relationship with any one institution. This has implications for how banks design their products and incentives, pushing them to look beyond traditional switching offers to attract customers in a more meaningful and lasting way.

New regulations, such as the FCA’s Consumer Duty, could impact cash incentives for current account switching by ensuring products offer fair value for all customers. Under these rules, banks must ensure their practices meet higher customer protection standards and deliver outcomes supporting customers’ financial well-being.

One area where Consumer Duty could curb the use of cash incentives is the concept of fair value. Incentives such as cash bonuses for switching accounts are often targeted at specific segments of customers who meet particular criteria, like minimum income levels or direct debit requirements. While these offers can attract new customers, they may also exclude more vulnerable groups who do not meet the qualifying conditions, such as individuals with lower incomes or those who do not have the means to set up regular payments. This exclusion raises questions about whether these incentives genuinely provide value to a broad customer base or merely benefit a select few.

Under the Consumer Duty, the FCA may view large cash bonuses as unsustainable if they focus on short-term gains rather than delivering long-term value. Banks will need to ensure these incentives align with fair treatment and customer protection standards.” The practice of offering incentives that lead to high levels of customer churn—where customers switch only to collect the bonus and then move on—might be seen as failing to support the financial interests of customers in a meaningful way.

Additionally, the FCA may view cash incentives as potentially encouraging irresponsible financial behaviours, where customers switch accounts frequently without fully understanding the new accounts’ long-term implications or suitability. Under Consumer Duty, banks would need to demonstrate that their switching offers contribute positively to customers’ financial lives, not just attract new account holders.

In light of these considerations, banks may need to rethink their approach to customer acquisition.

According to Thistle Initiatives Senior Associate Rohan Chakraborty, the FCA’s recent Payments multi-firm review of Consumer Duty implementation revealed ongoing concerns about vulnerable customers. The regulator noted there was “less evidence” of firms challenging policies and incentives through a Consumer Duty-specific lens, an issue especially relevant amid the recent rise in current account switching driven by cash incentives.

Chakraborty explains that it is crucial for firms to embed the Duty within both employee and customer relationships, ensuring that leadership sets the tone by understanding customer needs—especially those who are vulnerable. He adds, “The introduction of cash incentives only addresses the financial interests of the consumer and needs to be re-evaluated through the non-financial lens of stability to protect consumers.”

Rather than relying on cash incentives, firms could focus on enhancing the overall value proposition of their products—such as offering better interest rates, lower fees, or improved digital services—that provide lasting benefits to a broader range of customers. This shift would help ensure compliance with Consumer Duty and support more sustainable growth through genuine customer engagement rather than temporary financial rewards.

The surge in current account switching can be attributed to a combination of factors, including the allure of cash incentives, the impact of the cost-of-living crisis, and the rise of digital-first banks that have transformed customer expectations. While incentive-driven switching has been effective in boosting short-term customer acquisition, it has also led to challenges such as high churn rates and questions about the long-term value of these campaigns.

At the same time, trends like multi-banking have made it easier for consumers to chase deals without fully committing to one provider, further complicating the switching landscape.

Looking ahead, the future of current account switching may shift away from cash bonuses as regulatory pressures like the FCA’s Consumer Duty push banks to focus on delivering fair value and fostering sustainable customer relationships. To stay competitive, banks may need to move beyond temporary financial rewards and instead prioritise enhancing product offerings, improving digital services, and addressing the evolving needs of multi-banking consumers.

For banks to succeed, they must balance incentives with long-term strategies that build genuine customer loyalty in a switching-heavy market.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.