What is this article about?

The FCA’s Consumer Duty and how payments firms must prioritise consumer outcomes in their operations.

Why is it important?

It represents a major regulatory shift, requiring firms to enhance governance, fair value assessments, and customer support, with significant compliance challenges.

What’s next?

Payments firms need to close compliance gaps, continuously monitor outcomes, and adapt their strategies, while seeking clearer guidance from the FCA to navigate these requirements effectively.

The FCA’s Consumer Duty represents a shift in how payments firms must operate, seeing consumer outcomes take centre stage in business practices. With the publication of the FCA’s Payments Consumer Duty Multi-Firm Review on 9 October 2024, firms face increased scrutiny to ensure they meet these heightened standards. This examination of firms highlights both the successful strategies and obstacles they face in implementing the Consumer Duty.

Who does the FCA’s Consumer Duty apply to?

A wide range of firms in the payments sector are affected by the FCA’s Consumer Duty, with specific responsibilities applying to each to ensure good consumer outcomes are being delivered. The scope of the Consumer Duty covers payments service providers (PSPs), e-money issuers, money remitters, merchant acquirers, and open banking firms, amongst others. These firms must adhere to the Duty’s requirements, ensuring their approach adheres to their business models and services offered.

Although the review largely targets firms within these categories, retail-facing financial services are affected, according to the FCA’s findings, reflecting the broader implications of the Consumer Duty. With the growth of the financial ecosystem, firms of all sizes and specialities must ensure compliance with the Consumer Duty. According to the FCA, every firm is expected to assess the risks their products and services carry to consumers and act accordingly to prevent potential harm.

What payments first need to be made to meet the Consumer Duty requirements?

To meet the FCA’s Consumer Duty standards, it’s vital that payments firms proactively review their products, services, and internal operations. The FCA’s Consumer Duty Multi-Firm Review emphasizes that firms must ensure good consumer outcomes across their entire business, rather than treating the Duty as a regulatory checkbox.

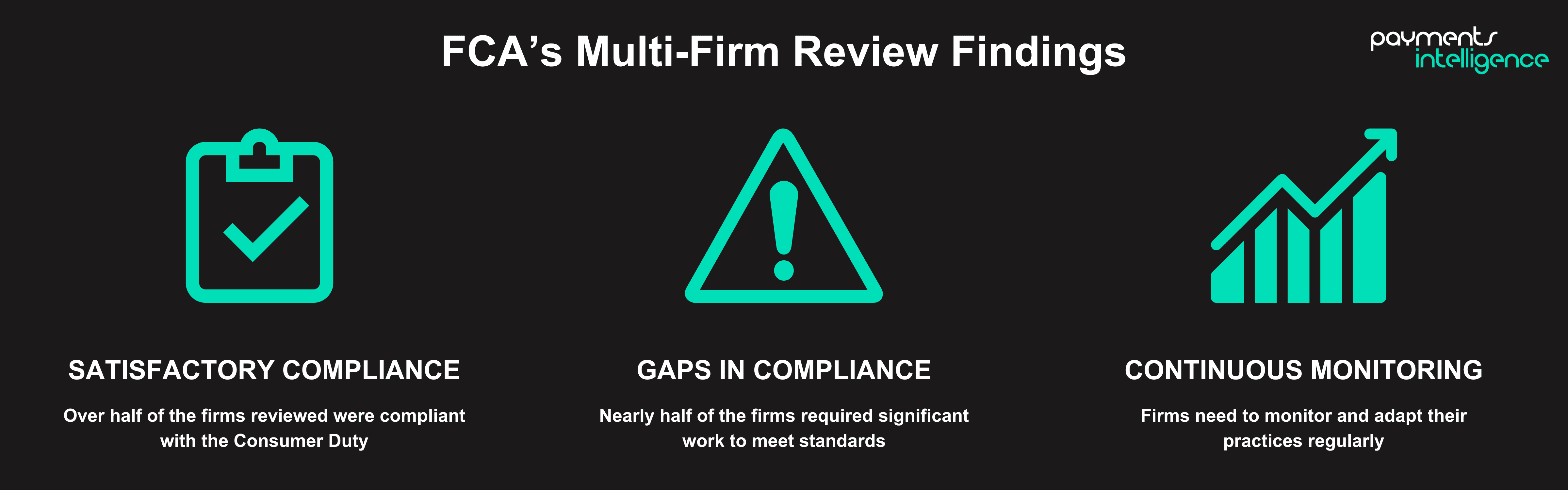

Continuous monitoring is a core expectation, with firms required to reassess their compliance regularly and make improvements where necessary. If a compliance gap is identified, immediate action must be taken to resolve it. The FCA’s recent findings provide a useful benchmark for firms to assess whether their business practices meet the required standard and make adjustments accordingly.

Successful firms, as noted by the FCA, have integrated the Consumer Duty into their governance and control frameworks. This includes making it a core part of their business operations. Additionally, these firms regularly provide management information (MI), such as Red, Amber, and Green (RAG) rated metrics, to their boards. This approach enables them to monitor the delivery of good consumer outcomes and address shortfalls promptly.

The FCA’s review shows that firms should adopt a proactive and focused approach to delivering positive consumer outcomes as part of their business strategy rather than reacting to compliance issues after they arise.

Why the FCA conducted the multi-firm review

The FCA aims to determine how firms are implementing the Consumer Duty, particularly for open products, since it came into force in July 2023. As the FCA states, “With the Duty in force for open products, we wanted to understand firms’ compliance with it.” In February 2023, the FCA detailed its expectations for how payments firms should implement the Consumer Duty, requiring firms to review all products to ensure they meet the expected high standards.

Moreover, the FCA is interested in how firms have approached these reviews. As they explain, “We wanted to understand how firms had approached their Duty-related reviews, the information they used to inform their gap analyses, and the actions they had taken.” Alongside compliance checks, the FCA is committed to ensuring firms deliver good customer outcomes: “The Duty… is a cornerstone of the FCA’s 3-year strategy and a fundamental way in which we have set higher standards for firms.”

According to a recent review of FCA requirements by members of The Payments Association, many firms have found it challenging to interpret what constitutes a “good outcome” for a consumer. One participant noted, “The challenge is that while we understand the need for good outcomes, the specifics are sometimes difficult to pin down, particularly when trying to balance commercial realities with regulatory expectations.”

Another member shared, “We’ve found it hard to evidence that we’re meeting these standards because the FCA hasn’t provided clear examples of what ‘good’ looks like in practice.” These concerns highlight the need for more clarity and guidance from the FCA, with some firms calling for more prescriptive standards to ensure compliance. Many are struggling to align their internal assessments with the regulatory benchmarks for “good” outcomes.

Key findings from the FCA’s review

The FCA’s Payments Consumer Duty Multi-Firm Review examined 23 firms, of which just over half were found to be satisfactory. In contrast, just under half of the firms reviewed were only partially compliant, with significant work required to meet the expected standards.

For firms that demonstrated strong compliance with the Consumer Duty, the review identified well-defined processes, including clear customer-centric purposes, systematic approaches, and robust governance frameworks. As the FCA pointed out, “The best firms considered that implementation of the Duty and improved customer outcomes aligned with their own long-term interests.” These firms also had strong governance structures and clear management information (MI) processes, allowing for regular monitoring and timely reporting to their Boards.

However, the review also revealed that a significant number of firms had not fully implemented the Consumer Duty. The challenges included difficulties in defining good outcomes, managing consumer risks, and improving existing systems: “Just under half of the firms…required significant work to comply…These firms present either a moderate or higher risk of delivering poor consumer outcomes.”

This finding was mirrored by members of The Payments Association, who expressed similar concerns. One member stated, “We’ve found it hard to evidence that we’re meeting these standards because the FCA hasn’t provided clear examples of what ‘good’ looks like in practice.” Firms struggled to interpret the requirements of the Consumer Duty and understand what compliance should look like in their operations.

Common implementation shortcomings

Among the firms that struggled to implement the Consumer Duty, the FCA found challenges around recognising the higher standards the Duty requires. Some firms wrongly assumed that their payment products did not present the same risks as other financial services products. However, as the FCA noted, “Payment products may differ from other regulated financial products, but they still pose significant risks to consumer outcomes.” This misjudgment led to firms underestimating the need for changes to comply with the Duty.

In addition, many firms relied on pre-existing management information (MI), such as complaints or product reviews, without effectively linking these metrics to the Consumer Duty outcomes. This created difficulties in monitoring consumer outcomes and identifying areas for improvement. As the FCA pointed out, “Firms with a less effective approach…applied existing MI measures…without linking them to the Duty outcomes.”

Furthermore, members of The Payments Association echoed concerns about the complexity of regulatory requirements. Some firms mentioned that the overlap of different regulations was adding to the challenge of implementing the Consumer Duty effectively. One participant noted, “We’re dealing with multiple layers of regulation, which adds to the burden. It would help if there was more alignment between these rules.”

According to a Payments Association survey involving a number of members, 56% of firms reported that the Consumer Duty had an impact on customer retention, citing low impact in this area, while 44% found that the Duty had a limited impact on financial performance. This suggests that although the Duty is improving customer experience, the financial benefits are less immediately clear for some firms.

Good practices observed in successful firms

Firms that have succeeded have demonstrated clear identification of their target markets, regularly assessed MI, and used RAG-rated measures to flag issues early: “The best firms tended to have a systematic implementation approach…including regular summary MI aligned to each of the 4 outcomes reported to their boards.”

Additionally, firms with clear governance structures faired better, delivering on the Consumer Duty’s requirements and taking action swiftly when necessary. Members of The Payments Association likewise corroborate this, underscoring the importance of top-down support. According to one member, “Board engagement has been crucial for us—without that top-down support, it’s difficult to implement these changes effectively across the business.”

According to the Payments Association member survey, 56% of firms noted a significant or high impact of Consumer Duty on improving their management information processes, highlighting the importance of data-driven oversight in meeting regulatory requirements. However, 44% reported a medium or significant impact on IT costs, underscoring the challenge of adapting existing systems to comply with the Duty.

Specific areas requiring improvement

The FCA states that payments firms are responsible for ensuring both their agents and distributors comply with the Consumer Duty. However, many firms have fallen short in agent monitoring: “Payments firms are responsible for the actions of their agents and distributors… We expect them to have appropriate systems and controls to oversee their activities effectively, including compliance with the Duty”. The Payments Consumer Duty Multi-Firm Review found that firms had onboarding and training for their agents but failed to implement systems for ongoing monitoring to ensure compliance with the Consumer Duty. “It was less clear what ongoing monitoring was in place to confirm that principal firms and their agents complied with processes set out in this training.” Additionally, firms that have clearly and consistently provided intermediary oversight have enabled themselves to identify shortfalls early.

According to a member of The Payments Association, managing agent oversight can be complex, particularly for firms with extensive distribution networks: “One of our biggest challenges has been ensuring that our agents are aligned with the Duty. It’s hard to monitor everyone consistently without clearer frameworks.”

Fair value assessments

The FCA expects firms to ensure that their products offer fair value to consumers. This means firms need to go beyond just comparing their prices to competitors and must assess the overall value provided by their products in terms of costs, benefits, and limitations. However, the review found that many firms fell short of these expectations, focusing primarily on price benchmarking without considering the broader customer experience.

As the FCA notes, “Many fair value assessments fell short of our expectations, particularly in the nature of the supporting analysis provided.” Some firms relied solely on competitor pricing data without a comprehensive evaluation of the benefits their products offer to consumers. Successful firms, however, took a more thorough approach, considering how different consumer groups are impacted by costs and benefits.

In the Payments Association review, smaller firms expressed concerns over the costs of conducting detailed fair value assessments, with one participant commenting, “As a smaller firm, the cost of conducting detailed fair value assessments is substantial. It feels like we’re being compared to much larger players with more resources.”

According to the Payments association member survey, smaller firms have raised concerns over the costs of conducting detailed fair value assessments. 67% of respondents reported low or no impact on financial performance as a result of implementing Consumer Duty. This suggests that, while the Duty is improving transparency and fairness, the immediate financial benefits for smaller firms are less pronounced.

Supporting consumer understanding and decision-making

One of the core components of the Consumer Duty is ensuring that firms support consumers in making informed decisions. This means that all communications with consumers should be clear, easy to understand, and tailored to their needs. Unfortunately, the FCA review found that many firms did not significantly change their communication processes after the introduction of the Consumer Duty.

The FCA noted, “In some firms, we found it difficult to see much change in their approval processes for customer communications from those that existed before the Duty came into force.” This lack of adaptation risks consumer confusion and poor decision-making. Additionally, firms were found to be relying on inadequate metrics such as email open rates to assess whether their communications were effective, which the FCA found insufficient for demonstrating consumer understanding.

Firms that demonstrated best practices in this area conducted regular testing of their communications through pre-testing with consumers and post-testing surveys to gauge understanding. As the FCA highlighted, “The best firms had clear arrangements in place to ensure their customers received the support they required to make informed decisions.”

According to feedback from The Payments Association review, firms are still seeking clarity on the best methods for measuring consumer understanding. One participant commented, “We’re still figuring out the best way to measure whether our customers understand the information we provide. The FCA needs to offer clearer examples of how firms can test this effectively.”

Additionally, according to The Payments Association member survey, 56% of firms reported that Consumer Duty had a medium or significant impact on improving customer understanding of their products and services. This demonstrates the importance of clear and effective communication in achieving good consumer outcomes.

Improving consumer support

Firms must provide consumer support that meets customer needs and ensures good outcomes. The FCA’s review identified instances where customer support services were not properly signposted, leading to confusion and difficulty for consumers in accessing help. In particular, firms with high volumes of complaints often had underlying issues in delivering adequate consumer support, which further exacerbated poor customer experiences.

Firms that excelled in this area showed clear consideration of their customers’ needs, particularly for vulnerable consumers, and had strong internal service level agreements (SLAs) to ensure prompt resolution of issues. The FCA noted that, “The best firms were able to demonstrate that they had considered the support needs of their customers, including those who were vulnerable.”

However, the Payments Association review indicated that smaller firms, in particular, struggled to offer the same level of customer service as larger firms. One participant commented, “It’s hard to match the level of consumer support that larger firms can provide.”

Next steps for payments firms

As the FCA’s findings make clear, many payments firms still have significant work to do in embedding the Consumer Duty into their operations. Firms must now take a proactive approach to identifying and addressing any gaps in compliance. The FCA has made it clear that ongoing monitoring and assessment of consumer outcomes are critical, with a particular focus on governance, fair value, communication, and support.

Moving forward, firms must ensure that their boards are regularly reviewing their progress in delivering good consumer outcomes and that any issues are promptly remediated. As the FCA warns, “Firms should expect us to ask for the results of their monitoring and Board reports. We will use this information, as well as the information that we already gather from firms and other data sources, to assess them against the Duty and identify then tackle harmful practices.”

According to the Payments Association review, firms are calling for clearer guidance from the FCA to help them navigate these challenges. One participant suggested, “Simplifying the rules and providing more prescriptive standards would make it easier for firms to meet these requirements without excessive cost and complexity.”

Conclusion

The implementation of the Consumer Duty represents a critical shift for the payments sector, with firms now required to place consumer outcomes at the centre of their business practices. While some firms have made significant progress in embedding the Duty into their operations, many are still facing challenges in areas such as governance, fair value assessments, consumer communication, and support.

Payments firms must now take immediate action to address any gaps in compliance and fully integrate the Consumer Duty into their long-term strategies. As the FCA continues to monitor firms’ progress, those who fail to meet the required standards will face increased scrutiny and potential regulatory action. By adopting a proactive and consumer-focused approach, firms can not only meet their regulatory obligations but also foster greater trust and loyalty among their customers.

Read more Payments Intelligence

Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

Open banking survey 2025: Insights from 500 UK SMEs

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

Offline settlements with a digital pound: Lessons from the BoE’s report

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.