Clearhaus opens office in London, appoints Paul Barclay as Commercial Director

London & Aarhus – European merchant acquirer and payment institution, Clearhaus, today announced the opening of its new office in London. Headed by online payments expert

London & Aarhus – European merchant acquirer and payment institution, Clearhaus, today announced the opening of its new office in London. Headed by online payments expert

Cost-effective, GDPR-compliant method free of paper, processing & postage The i-movo PayIN service allows organisations to send payments, refunds or claims to individuals in the

Simplified supply & maintenance arrangements of prepaid payment solutions for central government and the wider public sector The Payment Solutions framework announced by the Crown

The partnership between Vocalink and Cámara de Compensación Electrónica allows for the processing of 24/7 real-time payments, bulk payments and checks. This total modernization of

London – 11 December, 2018 – Pay.UK’s Faster Payments team is today announcing the official launch of the anti-fraud Mule Insights Tactical Solution (MITS) following

(COPENHAGEN, December 14, 2018) – Coinify ApS, an established global virtual currency payment platform, has successfully acquired BetterCoins, a fast-growing virtual currency broker founded by Mads

Tuesday, February 05, 2019, 04:00 PM Greenwich Mean Time Join ACI and SWIFT to hear first-hand how they are creating and monetizing new customer propositions,

Join ACI Worldwide, European Central Bank, EBA Clearing and STET as they discuss instant payments trends, best practice in Europe and globally. Register Now

Visa and Gemalto are partners with McLEAR, inventor of the EMV-compliant contactless payment ring. From a plant in China, McLEAR has manufactured more than 350,000

Kuala Lumpur, Malaysia – 19 December 2018 – Compass Plus, an international provider of retail banking and electronic payments software to processors and financial institutions,

Financial institutions are thinking beyond compliance but report difficulty recruiting talent, and many that have already implemented say they would have executed differently BROOKFIELD, Wis. & LONDON–(BUSINESS

10 December 2018, London, UK: Contis Group, the award-winning banking, payments and processing services provider, has launched a new fast-track programme in partnership with Visa,

Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, announced today that Mi BANK will leverage Fiserv technology and expertise as

Watch the interview here.

We are hosting our 2nd collaborative workshop for founders of platform businesses on January 17th 2019. More info on what to expect here: https://paybase.io/blog/paybase-workshop-2

Anna Tsyupko is the CEO and co-founder of the B2B payments company, Paybase. They provide the most flexible payment solution for platform businesses – such as

Paybase hosted the Sharing Economy UK festive networking event last night! It’s great to see the success platform businesses have had this year and hear

Konsentus, a RegTech solutions business who facilitate checking the regulatory status of Third-Party Providers enabling Financial Institutions to be PSD2 open banking compliant is pleased

Gerhard Oosthuizen, CTO of Entersekt, contributed the following piece as part of PYMNTS’ 2018 year-end eBook. I remember a conference almost a year ago. Bitcoin (and other

A new generation of bank customers is bypassing physical branches and banking via the web almost entirely in favor of completing transactions and accessing services

Almost five years ago (on Dec. 19, 2013), Target was breached. Roughly 40 million consumer credit cards were hacked, and the public outcry of shock was massive.

Banking is an age-old industry built on relationships and trust: face-to-face interactions in particular. But in the digital age, banks need to reinvent themselves and

Integrating Token’s infrastructure delivers open banking capabilities; reduces cost and time of API development and testing. 10 December 2018 – Turnkey open banking platform provider, Token.io

On December, 21st, 2018, Arkea Banking Services, the Arkea group’s subsidiary dedicated to white label banking services, and Docomo Digital Germany GmbH signed an agreement

Keep the festive spirit going just a little bit longer! Blue Train Marketing presents classic crowd-pleasing panto antics lovingly mixed with a large helping of

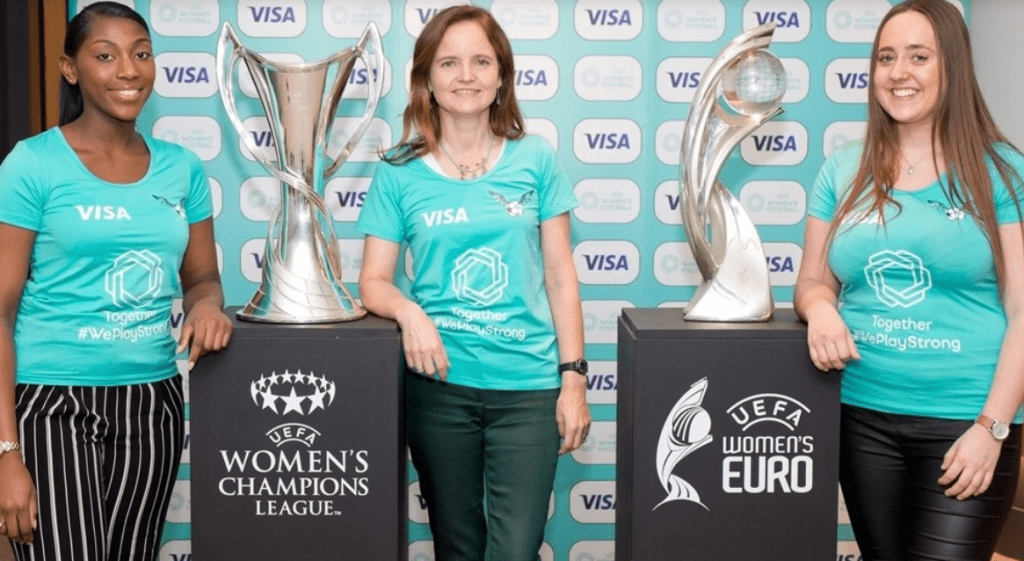

Robert Courtneidge and Suresh Vaghjiani are joined by Bill Gajda from the global payments technology company, Visa. Discussing the latest innovations in Fintech, secure payments

Visa will build upon success of 2018 FIFA World Cup Russia™ to bring more one-of-a-kind experiences to football fans globally Expanded presence will include new

At Visa, we believe in acceptance everywhere – from the pitch to the boardroom. It’s because of this, that we’re proud to announce our ground-breaking

UEFA has announced a landmark multi-year partnership with Visa. The global payments technology company becomes the first ever UEFA sponsor dedicated to women’s football, following

SINGAPORE – Apple Pay users can now make near-field communication (NFC) payments worldwide on Singtel’s mobile wallet app, Dash, which has just been accepted on Apple Pay.

Last June, at Money20/20, we published our inaugural “Mobile Banking App Review”, a comprehensive benchmark of UK mobile banking and finance apps. Mobile banking has

A comprehensive benchmark study of UK mobile banking apps. View the full document here.

More information on Transactive Systems here.

We’re excited to have launched an Open Banking early adopter programme after receiving permission to operate as an Account Information Services Provider (AISP) from the Financial

TransUnion is continuing its work to tackle the gender pay gap in the technology sector, with our recently-formed ‘Women in leadership’ group now taking their skills to

View the list of finalists here.

Jane discusses how AML systems are a powerful tool to help protect against fraud in the system, and help big banks better address issues of

Cybertonica’s Technical Advisor and Director for Partnerships and Training, Dr. Ekaterina Safonova, wrote an abstract on payment fraud prevention and management for The PayTech Book. Launched

Job Description – Business Admin & Marketing Intern Who We Are? Cybertonica is a state-of-the-art FinTech business based in London’s Old Street area in the heart

Andrea Dunlop, project lead of Project Banking Access, endorsed the Bank of England’s activity in upgrading RTGS. Published in PaymentsSource, Andrea commended the Bank’s focus

Project Inclusion penned a letter to Guy Opperman MP, Parliamentary Under-Secretary of State at the Department for Work and Pensions, regarding the activities of the

The findings of ‘Facing up to Financial Crime’ report will be announced at a briefing event on Thursday 31st January. The event, supported by Refinitiv

Project Futures has announced the dates and themes for its workshops in 2019. At the December Project Futures workshop, which focused on the technologies and

The Payments Association has received a response from HM Treasury following a letter on how UK government can best support the growth and development of

Project Regulator has launched a consultation register. This register, which details consultations that the Project Regulator team recommends an organisational response, highlights all live payments

Project Retail is rebranding to Project Payments in Commerce. Following a review of the activities and scope of the project, Project Payments in Commerce helps

Few places are left for Project Women in PayTech’s January event. The event, which will host speakers and panellists from Visa, EWPN, Cashplus, Post Office

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.