Frank Breuss on Fortune: payments landscape in Ethiopia

Frank Breuss, CEO of Nikulipe, sat down with Fortune, to discuss how mobile money is uniquely suited to Africa’s experience to bolster financial inclusion and e-commerce.

Frank Breuss, CEO of Nikulipe, sat down with Fortune, to discuss how mobile money is uniquely suited to Africa’s experience to bolster financial inclusion and e-commerce.

DIGIDOE, the UK-based startup which is on a march to revolutionise the world’s outdated payments infrastructure, has secured more than £850,000 from new investors. The initial funding round was closed early because of high levels of customer interest in DigiDoe’s unique next generation, fraud-inhibiting, multi-currency payments system. DigiDoe is the first company in the UK to offer biometrics-based payments to merchants without the presence of a card or phone.

It seems like every annual recap or outlook for the past ten years has mentioned “the year of data.” Ed Adshead-Grant, Director of Strategic Business Development, Bottomline talks on how data is the new “green energy” that drives customer relationships in financial services, and we’ve travelled from “big data” to “actionable data” to “open data” in short order.

Bottomline (NASDAQ:EPAY), a leading provider of financial technology that makes complex business payments and financial messaging simple, smart and secure, today announced that ENTRIS BANKING AG, a new Swiss customer, has selected Bottomline’s SaaS-based payment connectivity platform to provide customers with an enhanced, more flexible domestic and international payment experience.

BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy, announced today that it has closed a Series A funding round co-led by Foundation Capital. This is the largest Series A funding round for a company in the blockchain industry in the UK.

New research from Codat has revealed SMBs’ strong appetite for the benefits of Open Finance, but regulation must prioritize the right data.

Currently, conversations on Open Finance focus on consumer-oriented datasets, like mortgages, investments. and savings, ignoring the most vital financial data to small businesses, their accounting and sales data.

This manifesto makes the case for a fresh approach to Open Finance that will benefit SMBs and their financial service providers, and in turn fuel economic growth. Download our report to find out more.

– NatWest brought Tink and Cogo together to launch a carbon tracking solution in their mobile banking app.

– The feature works by combining Tink’s financial data enrichment technology with Cogo’s proprietary platform to create carbon tracking insights for users.

– After a successful collaboration, Tink and Cogo joined forces to help more banks bring similar solutions to market.

Check out this recent Financial IT interview featuring Currencycloud’s Co-Founder & VP Strategic Partnerships, Stephen Lemon and ComplyAdvantage’s Founder and CEO Charles Delingpole as they discuss all things Fintech.

Watch the interview here: https://www.youtube.com/watch?v=XG9JlvilL10

In our latest industry report, we partnered with FinTech Futures and Informa Engage to survey more than 50 senior banking and payments professionals to learn how their firm handles payments and plans for operational enhancements in 2022.

The fintech industry is highly competitive, so sustainable differentiation is an absolute must if you want your business to emerge from the pack. That places an emphasis on superior capabilities, agile delivery, and calculated decision making. Hence why it’s so important to embed data insights into the commercial and product development processes.

Payments: One of the Most Dynamic Markets?

This report sets out our view of Five Key Trends that will take place over the next five years. It will show you the areas that your business will want to focus on and the impact these will have, helping you build a solid foundation for success. As leaders in the industry, we work across a wide range of industries, which is why we’re so well placed to advise you on yours.

DOWNLOAD THE REPORT NOW: https://bit.ly/3FqNnG4

EML Nuapay helps Cocoon deliver a smarter way for customers to pay for vehicle purchases.

Global Processing Services (“GPS”) announces the closing and upsizing of its latest fundraise at over US$400 million. Temasek the global investment company headquartered in Singapore, and MissionOG, a US-based growth equity firm, joined the over US$300m initial round, co-led by growth investors Advent International – through Advent Tech and affiliate Sunley House Capital – and Viking Global Investors.

Mobile payments in sub-Saharan Africa are predicted to grow by over 60% in the next 5 years, showcasing that Local Payment Methods like these are key for more expansive e-commerce opportunities.

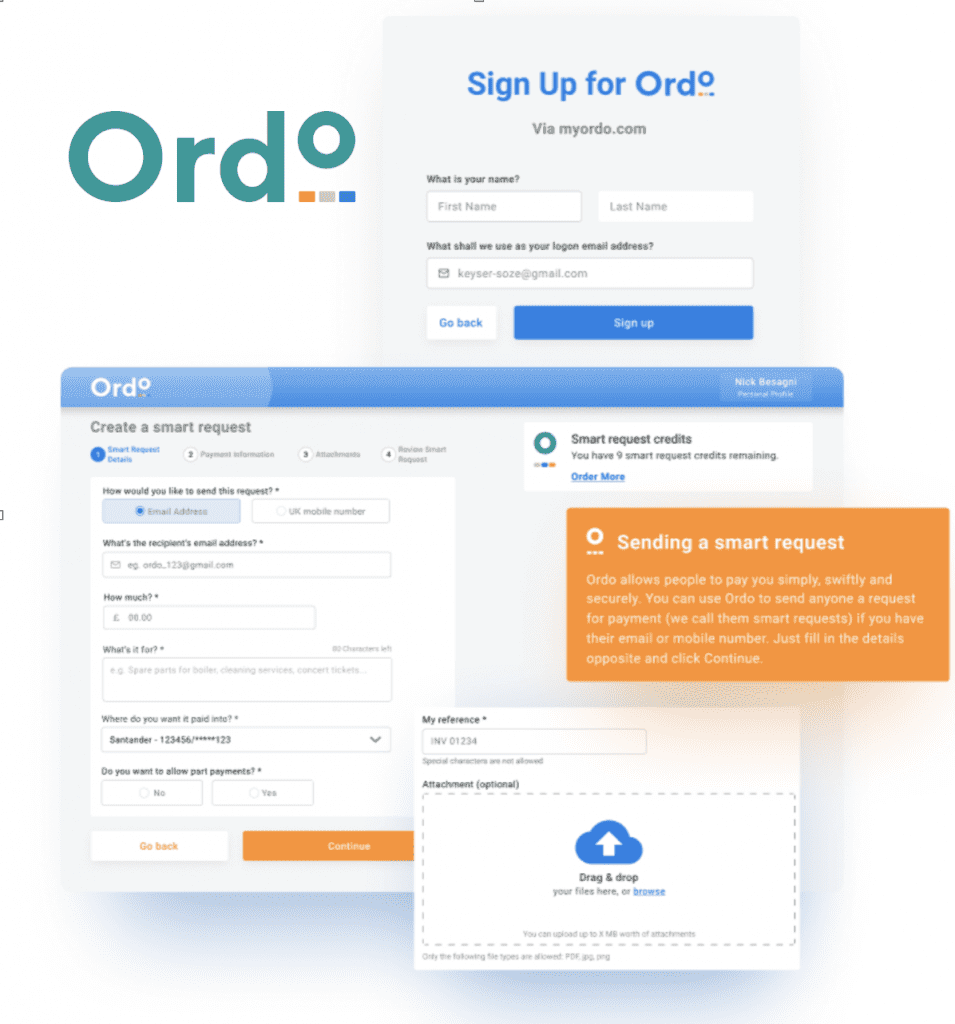

Ordo partners with Pay360 by Capita to bring Open Banking payments to the public sector

The Payments Association’s recently issued report, Navigating the New Opportunities for Corporate Cards, takes a close look at the world of corporate card payments, finding that there is much to do to make them as seamless as personal payments or even those for small businesses, but that there are innovative FinTechs who are solving the specific problems of making payments in a business setting.

EML’s sporting digital footprint expands through REPX’s exclusive partnership with the Italian soccer team, AS Roma.

Moorwand CCO Luc Gueriane and four other industry experts recently spoke to FinTech Magazine about what’s next for payments in 2022. Find out why Luc said that any fintechs that don’t spend time on getting the right resources in place will have difficulty competing.

It’s vital to your company’s success and longevity to promote employee health and remove stress from your culture. While that’s no small feat, it can do wonders for your productivity, employee retention, customer satisfaction, and bottom line.

Today, we’re going to share two practical yet surprisingly simple methods for combating different types of stressors in the workplace — task stressors and acute stressors.

In the last few years, financial inclusion has become widely recognized as one of the most important engines of economic development. Frank Breuss, CEO of Nikulipe, says that there is much more to the term than is widely assumed since financial inclusion does not necessarily mean access to global e-commerce.

fscom’s experts in financial crime, cyber security and regulatory compliance offered their advice in a recent webinar. This article article explains how firms can become operationally resilient.

In the following article, fscom’s Senior Manager of Fincrime, Fred McDowell discusses best practice guidance to help you with Suspicious Activity Reporting (SAR).

Boarding new merchants from a sales perspective is both an art and a science. The art of sales is a well-trodden field with numerous different approaches. We see it in every industry with experts imparting their advice on Youtube, reality television programmes and even in our everyday lives where we all try to employ our own techniques to get what we want. The science or the “precision of tech” is the key to unlocking conversions, reducing fraud, and complying with the ever-changing rules and regulations surrounding the industry…

EML’s partner AptPay is focusing on launching several new programs in Canada and the United States in 2022.

Okay is about security. But to uphold our commitment to the most sensitive part of the payment process, it means we are also committed to compliance. Taking the next steps in our compliance journey didn’t just cover our bases in the event of an audit, but ensured that we are constantly challenging ourselves when it comes to risk, business decisions, and customer satisfaction. In this week’s blog, we talk about our 2021 compliance process with SOC2, and how we landed there.

Collaboration shows the potential of VRP as the next phase of Open Banking in the UK, accelerating the adoption of faster, more secure payments.

Mainstream banks can compete more effectively in the digital-first world with risk mitigated by adopting leading, proven technology.

ClearBank, the cloud-based clearing bank, announced on the 7th of December its partnership with e-money scale-up PRIVAT3 MONEY (“P3”). The partnership will improve the experience of clients using P3 accounts and e-wallets for deposits and payments, as well as multi-currency accounts and foreign exchange in the near future. ClearBank’s infrastructure will improve transaction speed and efficiency for P3’s clientele, which is primarily comprised of professionals, entrepreneurs and high net worth individuals

EML is partnering with retailers, corporates, and employers worldwide to help spread gratitude and festive cheer with same-day virtual gift cards.

BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy, is delighted to announce today that Max Heinr. Sutor oHG (Sutor Bank) is joining the group. Adding a fully licensed bank to the group will enable BCB Group to better service its clients in the EU and drive growth across its business lines.

The FCA and PSR have published a joint response to the Cash Action Group’s (CAG) announcement that retail banks and building societies will create an independent body to assess the cash needs

In this article, Vicki Gladstone, Moorwand CEO looks into the fintech and payment predictions she thinks we’ll see more of in 2022.

Entersekt attracts investment from US private equity company.

The UK Financial Conduct Authority has set out changes to rules on strong customer authentication, payment account access by third-party providers, and parts of its guidance on the regulation of payment services and electronic money. This update sets out key points for affected firms.

New report from Mambu and AWS forecasts embedded finance is worth $3.5 trillion to the retail sector amid Buy Now Pay Later boom.

The Hospitality sector is evolving like never before. The rapid adoption of digital and mobile technology is changing how we engage with our customers and guests. It’s been accelerated by the pandemic and is here to stay. Planet’s new #Hospitality report ‘A five-star experience: Delight guests with technology and service’ looks at…

Take a look at Planet’s new Retail report, ‘the best of online in-store: Retail’s next big prize’, and discover what #retailers can do to build an exceptional personalised shopping experience for shoppers from start to finish. One that combines the immediacy of being in-store, with the unlimited inventories, safety and speed of online shopping.

Mambu, a market-leading, modern SaaS banking platform, has announced raising €235 million in an EQT Growth-led Series E funding round, the largest financing round to date for a banking software platform. The funding brings the company’s valuation to €4.9 billion post money, making it one of the highest-valued B2B SaaS companies founded in Europe.

Ordo’s Point of Sale QR Code solution perfect for race day entry fees

B2B cross border payment provider, Verto, has joined forces with Payments Bank, Banking Circle, to streamline international payments for its clients. Utilising the multi-award-winning Banking Circle Virtual IBAN solution, alongside access to Banking Circle’s local payment rails, Verto is addressing the pain points of complicated pay-ins and cross border payments.

Innovative all-in-one payment solutions provider and card issuer, Wallester, is providing its clients with more opportunities in more jurisdictions with multi-currency settlement accounts as a result of a new partnership with Banking Circle. Working with the ground-breaking Payments Bank, Wallester can now give its clients easy and efficient access to settlements accounts in 25 major currencies.

Nuapay confirms significant expansion in top European open banking markets.

The gaming industry is proving that the desired metaverse is one that is decentralized in terms of control but hyperconnected for easy transfer of value between platforms.

Having become accustomed to a plethora of units of value, and their extreme portability, today’s gamers will not welcome a centralized institution locking their value inside any particular system such as Facebook’s virtual world.

Flash forward where banks and digital banking make all units of value portable too… imagine:

– crypto into consumers’ digital wallets

– holding cash as central bank digital currency.

By 2030, 60% of global consumers will have made a transaction using a unit of value other than a fiat currency.

AccessPay add another big name to their growing list of collaborators, forming a new partnership with 3RP, who offer tailored Oracle NetSuite ERP consultancy services.

Open banking has gained strength over the past 18 months, ever since Europe began enforcing the Payment Services Directive 2 (PSD2). Now we are starting to watch similar initiatives pop up across the globe, all the way from Australia to Canada. But what about the (possibly biggest) payment market, the United States? Has PSD2 had any impact there, and can we expect a similar set of regulations to be implemented?

Virtual IBAN and corporate account provider, Monneo, is excited to announce the launch of its new card acquiring service. The development allows the company to offer a full payment ecosystem to its customers and represents a true end-to-end solution.

Reflective of Singapore’s position as a fintech hub, Transact365 has shifted its Asian headquarters from Hong Kong to Singapore as a very important base for its future growth. They are now in two of the world’s fastest growing markets for fintech, which is a prime position for their global expansion.

EML and Cadillac Fairview have innovatively transformed festive digital gifting.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.