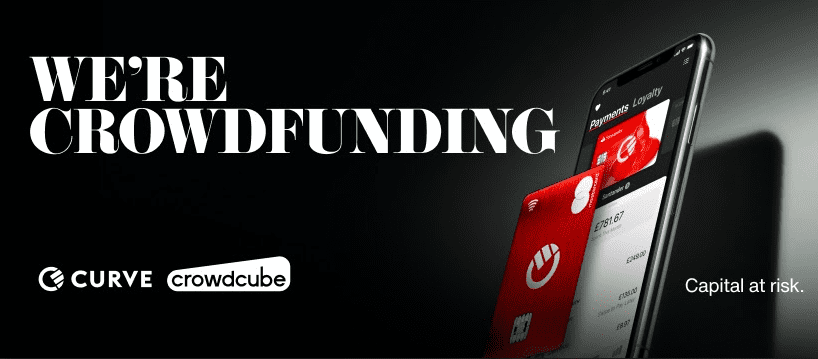

Curve’s crowdfunding round to go live after 21,000 sign-ups within first 24 hours

Curve’s crowdfund, designed to bring customers closer to its growth journey, will go live on May 25th, following hugely popular pre-registration stage. Curve saw 21,000 sign-ups within first 24 hours of launching its pre-registration campaign.