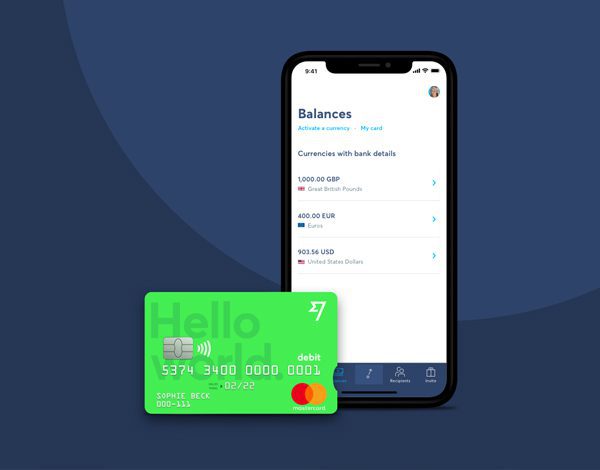

Global Processing Services and Revolut join forces for the launch of the startup’s multi-currency FX app in the APAC region

London and Sydney: Global Processing Services (GPS), part of Rt. Hon. Lord Mayor of the City of London’s UK Business delegation to Australia and New Zealand; announces today that it