Sustainable payments: Innovating for our financial ecosystem

As sustainability gains ground, card issuers and payment providers are exploring practical strategies to meet ESG goals and shifting consumer expectations.

As sustainability gains ground, card issuers and payment providers are exploring practical strategies to meet ESG goals and shifting consumer expectations.

UK’s first Financial Inclusion Strategy aims to tackle vulnerability with better cash access, KYC innovation, community finance, and financial education.

EML Payments is supporting Fair for You’s new Shopping Card loan, a prepaid solution helping underserved UK families access essential household goods responsibly.

As cash use declines, UK regulators push for inclusive payment systems to protect vulnerable groups and ensure access across all demographics.

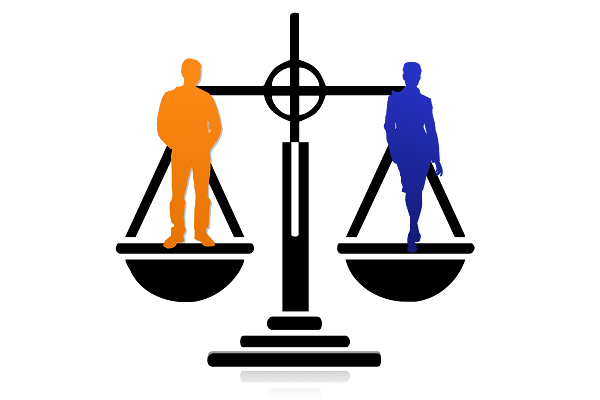

The fintech industry remains male-dominated, but fostering mentorship, challenging stereotypes, and supporting gender equality initiatives can pave the way for more women to rise into leadership roles and create a more inclusive future.

Paynetics has acquired Novus, the UK’s first “impact neobank,” to enhance ESG initiatives and allow users to support causes and track their carbon footprint with each transaction.

The “Redefining Community Finance: Unlocking Pathways to Financial Inclusion” whitepaper by the Payment Association provided crucial insights and recommendations emphasising the need for enhanced innovation and support for the community

The Trust Retail partnership with Pennies and Well Pharmacy won the Retail Charity Partnership of the Year award for integrating micro-donations into purchases, benefiting the mental health charity Mind.

Griffin, a UK fintech bank, has achieved B Corp certification, demonstrating its commitment to high standards of social and environmental performance, transparency, and accountability.

As the CEO and founder of Sibstar, I am immensely proud to share our journey and the impactful work we’re doing to support people living with dementia. I recently had

In a speech in April 2024, Simon Stiell, Executive Secretary of the United Nations Framework said the next two years are “essential in saving our planet”. Steill laid out a

Financial inclusion, as defined by the World Bank, is crucial for economic development and social progress, ensuring equal access to financial products and services tailored to the needs of both individuals and businesses. The United Nations emphasises financial inclusion as a crucial driver of economic and social development, evident in its inclusion as component eight of the 17 Sustainable Development Goals for 2030.

Disability has the potential to impact anyone in society. It can be visible or hidden, temporary, or permanent, and can be influenced by a number of factors. More than one billion people around the world have some level of disability, equating to roughly 15% of the global population. At the same time, the world is ageing as people live longer, and the number of people aged 60 and over will double to 2.1 billion by 2050.

Financial inclusion initiatives are transforming the global economic landscape by making financial services accessible to underserved populations. These efforts are about broadening access and empowering individuals to participate more fully

Having a good credit score is life changing. For many, it can open the door to opportunities they would never have been able to access otherwise, whether it’s getting a

Christien Ackroyd explains how the ethical grade concept works, covering best practices, benefits, and which banks are getting it right.

This month is Attention deficit hyperactivity disorder (ADHD) awareness month, so it seems fitting to talk about how feature-rich banking products can make a huge difference for those with ADHD. But first,

What is SRE? Google introduced Site Reliability Engineering (SRE) in 2003, and it gained widespread recognition through their 2017 publication. SRE encompasses various methodologies, tools, and cultural principles intended to

In the last seven years, Tillo has grown from a start-up with a handful of employees to a multi-national company employing nearly one hundred individuals across three continents.

In the face of economic uncertainty and rising inflation, Housing Associations in the UK are faced with the challenge of providing support to vulnerable communities while ensuring their own financial

As businesses continue to navigate a changing landscape, the Ecosystem Economy has emerged as a concept that is reshaping how businesses operate. The Ecosystem Economy represents a collaborative and interconnected

After our recent Women in Banking Event: What’s your bank balance? guest speaker author Dr. Leda Glyptis’ PhD thought-provoking talk revealed only 15% of people in senior roles in banking are held

Touchscreens are increasingly being used for payment and while they offer many benefits for users, we must ensure they are accessible for all. Martin Doherty, CSO for Northern Europe and

As technology continues to advance, fintech companies are becoming more prevalent, highlighting a greater need for diversity and inclusion. Women, in particular, have been underrepresented in fintech, but allpay Limited

As we approach the one year mark of the 2022 Russian invasion of Ukraine on 24 February; we’re hosting a Fintech Without Frontiers webinar event on 1 March to discuss

With consumer spending likely to fall over the next two years, the payments sector must be innovative to grow and serve the most financially vulnerable groups.

Miranda McLean from the European Women in Payments Network (EWPN) examines how the culture has changed for women in the payments, but argues why more needs to be done in what is still a traditionally male-dominated sector.

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

Project Inclusion, led by Josh Berle of Mastercard, showcased the best fintechs offering sustainable and inclusive payments products in 2022 to energise the industry towards better practices. The team engaged

allpay and Payzone are passionate about giving cash users easy and accessible platforms to achieve their financial obligations. It’s been six months since allpay Limited partnered up with Payzone, a

The digital revolution in payments has brought to the surface some of the acute challenges faced by the unbanked and financially excluded. But it’s not inevitable that a move to

ESG (Environmental, Social, and Governance) is one of the hot topics that’s been getting coverage across business sectors and it’s now getting attention in the fintech space. In this blog,

Ukraine Initiative Aiming To Create Borderless Ecosystem Enters New Phase Fintech without Frontiers (FWF) initiative today moves to a new phase of its mission to support Ukrainian fintech and talent,

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.