LINK moves to secure future of free ATMs

LINK, the UK’s main cash machine network, has today announced a series of measures designed to maintain and rebalance the UK’s ATM network – shifting incentives from deploying ATMs in

LINK, the UK’s main cash machine network, has today announced a series of measures designed to maintain and rebalance the UK’s ATM network – shifting incentives from deploying ATMs in

No policy change coming in 2018 promises to disrupt the payments industry more than the Revised Payment Services Directive, or PSD2. Read more here.

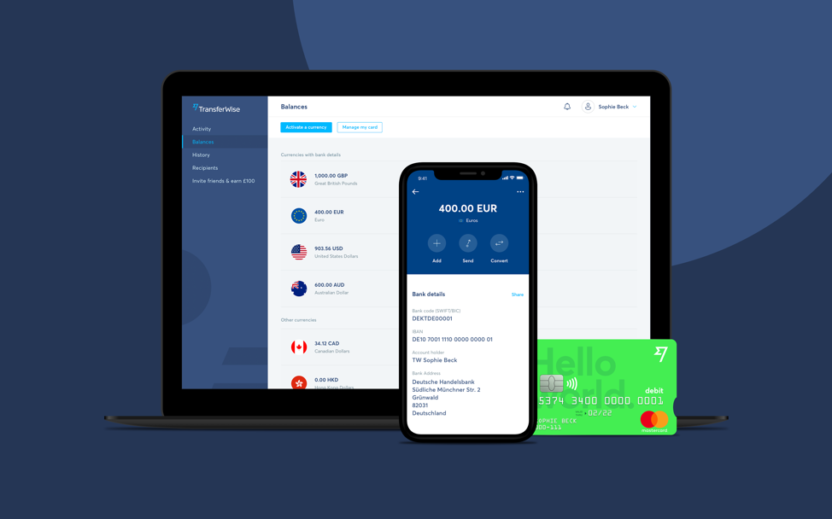

Money transfer innovators TransferWise introduce a borderless account, with real time debit payments. Last week, global money transfer company TransferWise announced the launch of the first truly multi-country/multi-currency “borderless” account.

Business payments company Bottomline Technologies is enhancing its Paymode-X solution with a focus on machine learning, according to an announcement the firm made on Thursday (Jan. 11). Read more here.

We visit small businesses in Shropshire and Northumberland to discover how Barclays’ cheque imaging technology is saving time, increasing efficiency – and helping to keep customers happy. Read more here.

Whatever shop you go into these days, you’re likely to see similar tactics to encourage you to buy. Does your local supermarket put fresh fruit and flowers at the front

NEW YORK, January 30, 2018 — American Express (NYSE: AXP) today announced it has acquired Mezi www.mezi.com, a personal travel assistant app that helps consumers plan and book trips. The Mezi app

Starling Bank has become the first of the UK digital challenger banks to become direct members and participants of the STEP2 SPayments Association Core Direct Debit and SPayments Association Credit

What’s in a name? It’s hard to tell at face value exactly what lies behind the latest raft of European payments regulation, PSD2; snappy an acronym as it is. But the

PSD2, which comes into effect this weekend, is an evolution and extension of existing regulation for the payments industry. It aims to increase competition in the payments industry, bring into

Just as the Wild Card Round is followed by the Divisional Round in the NFL playoffs, fraud and payments predictions are always followed by New Year’s resolutions. This year, in the

As a region, the Nordics is viewed as front-runners in digital adoption and fintech innovations. Denmark, in particular, has often shown a will to adopt new technologies in both private

Curve, the new app that connects your debit and credit cards to one Curve Mastercard, launched for UK consumers today. With over 50,000 people on the waitlist ahead of launch,

London 30 January 2018 – Today, leading payments provider Klarna has announced a partnership with Maplin – the UK’s number one specialist technology retailer. Maplin customers will now be able to

London – The London office of global law firm K&L Gates LLP has strengthened its investigations, enforcement and white collar practice with the appointment of Paul Feldberg as a partner. He joins K&L

Atlanta, Ga. (January 23, 2018) – InComm, a leading prepaid product and payments technology company, today announced it has significantly expanded the already extensive list of gift card brands it offers its retail

To some, 13 January and the implementation of the second Payment Services Directive (PSD2) will be a significant milestone in their business’s path. They will be joining the community of

BROOKFIELD, Wis.–(BUSINESS WIRE)– Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, announced today that it will enable The Home Savings and Loan Company of Kenton, Ohio, (HSLC) to provide a

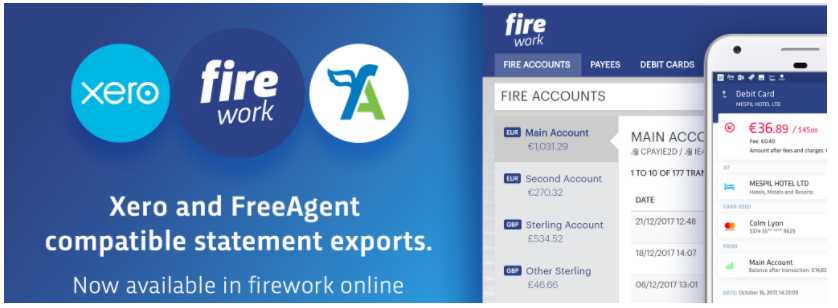

For many businesses the reconciliation of their bank account balance and transactions is a key control point. This will be easier now for fire.com customers who use Xero or FreeAgent

London, UK and Toronto, Canada, 30 January 2018 – Finastra has acquired Olfa Soft SA and its cutting edge FX e-trading platform for banks and financial institutions. The move enables Finastra to

Newtown, PA – January 11, 2018 – Payments AssociationM Systems (NYSE: Payments AssociationM), a leading global provider of digital platform engineering and software development services, and Black Box (NASDAQ: BBOX), the

RIVERWOODS, Ill. & TOKYO–(BUSINESS WIRE)– Discover Global Network, the payments brand of Discover Financial Services, will expand card acceptance at key merchants in Hong Kong by working with First Data and JCB International, the international operations subsidiary of JCB

The year 2018 promises significant changes for companies in terms of data management. In May 2018 the RGPD: the European Data Protection Regulation will come into force. It aims above all to

Visa has initiated pilots with Mountain America Credit Union and Bank of Cyprus of a new EMV dual-interface (chip- and contactless-enabled) payment card. The pilots will test the use of

Project Women in PayTech will be hosting an event on Wednesday 28th February – titled ‘Shaping the ‘gender agenda’ in PayTech’. This free event is open to both women and

Project Rome has published a thought leadership piece on the transposition of regulation 104 and regulation 105 from PSD2 and their impact on banking access. The article, penned by Andrea

The Payments Association is delighted to announce that FICO have come onboard as the Benefactor of Project Futures. FICO’s Benefactor status will allow them to be seen as the industry’s

Project Inclusion hosted a showcase event, in partnership with the Department for Work & Pensions and Mastercard, for 30 DWP executives including Baroness Buscombe. The event hosted twelve payments companies

‘- In-app payments forecast to be worth $1.2 trillion across North America and Europe by 2020¹ – Businesses in 190 countries now offered rapid, simple mobile payments integration whilst retaining

Project Women in PayTech will be hosting evening of insights and interaction to shape how to challenge the industry stereotypes of women within the payments sector. The event is set

Project Rome will be providing a high-level overview for Payments Association members regarding the outputs from the RTGS Blueprint Advisory Board meetings, the timescales regarding the transition and implementation, and

Project Retail hosted its third Retail PayTech Forum in November to discuss payments innovation and its implementation. The Retail PayTech Forum, held at the Montcalm Royal London House, brought together

Project Regulator hosted a Hot Topic Briefing on the New Payments Architecture, in conjunction with the New Payment System Operator (NPSO) and the Bank of England. The briefing addressed 40+

Project Media has raised the profile of the Payments Association this month with activities and insights from the The Payments Association being publicised in The FinTech Times, PaymentEye FinTech Finance,

Project International Trade, with the support of its Benefactor Banking Circle, has launched a new membership category called Payments Association ScaleUp Membership for early stage FinTech and PayTech companies. Payments

Project Futures formally launched at kick-off meeting for the project in November and discussed strategy for the forthcoming year, identify the upcoming industry-critical innovations and issues, and to shape the

Project International Trade will be launching a brand-new partner association in January, titled Payments Association Africa. The launch event will be held at Durbanville Hills Wine Estate in Cape Town,

Project Media’s lead, Angela Yore, penned a thought leadership piece on the benefits of Payments Association membership and how actively engaging with the community can drive business growth – amongst

Project Retail will be launching the next iteration of the Retail PayTech Forum in April. The event, which will be held at a central London location on Tuesday 3rd April,

Project Regulator will be developing briefing paper on NPSO/NPA and what it means for players within the industry. One of Project Regulator’s areas of focus in 2018 includes facilitating the

Project Media has launched a national consumer survey to gauge the public’s knowledge of Open Banking. The survey will poll 1,000 UK consumers with questions to evaluate the awareness of

Project International Trade, in collaboration with Banking Circle, has launched a FinTech Regulation Helpline to provide guidance for PayTech companies struggling to navigate payments-related regulation. The service, operated by Banking

Project Futures launched a survey to Payments Association members to gain insight on the themes, technologies, and innovations that are of most interest to shape the content of workshops in

Members of the Project Inclusion team were actively involved at the London Assembly Economy Committee’s report launch event. The report on access to money for Londoners followed input from several

Project Women in PayTech will be launching a LinkedIn group to provide a platform for mentorship, networking, and facilitate discussion on barriers to women within the payments industry. This private

In 2018 Project Rome will be providing updates and thought leadership to the Payments Association membership on the ISO 20022 working groups and what it means for the payments industry.

In 2018, Project Retail will develop a group of senior retailers who will guide the Forum’s content and direction, called the Payments Association Retail Payments Leaders. This is a recognition

Project Regulator penned a briefing piece that articulated the implications and impact of the upcoming changes pertaining to real time gross settlement (RTGS). The piece, penned by Project Regulator lead

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.