PagoNxt Payments enables Getnet to offer multi-currency acquiring across 140+ currencies

PagoNxt Payments is driving Getnet’s cross-border expansion with embedded FX and DCC solutions, boosting international transactions and merchant growth.

PagoNxt Payments is driving Getnet’s cross-border expansion with embedded FX and DCC solutions, boosting international transactions and merchant growth.

TransferGo has partnered with Griffin to offer safeguarded GBP wallets and savings accounts for UK businesses, enhancing B2B payment services in 2025.

Cross-border payments are being reshaped by new tech, regulation, and partnerships—but legacy risks still demand smarter compliance.

Paysend expands card payout support in Uzbekistan, enabling instant transfers to Humo and Uzcard through its global cross-border payments network.

A new partnership enables instant, compliant movement between fiat and stablecoins, reducing friction in cross-border payments and supporting real-world adoption.

IFX Payments receives a category 3C licence from the Dubai Financial Services Authority to deliver cross-border transactions and currency management solutions to UAE customers. With extensive experience of the local

Ripple has integrated RLUSD into its payments solution, enabling faster, compliant cross-border transactions as the stablecoin nears $250 million market cap.

[London, March 2025] — Fyorin, a leading provider of innovative financial operations solutions, is excited to announce its strategic relationship with Discover® Global Network, a global payments network serving 345 million

AI is reshaping the fight against payment fraud, prompting financial leaders to adapt with smarter tools, better data, and cross-sector collaboration.

Unlimit names Simu Liu as its first global brand ambassador, launching a major campaign on versatile payment solutions worldwide.

How is Flutterwave driving enterprise payment growth in Africa? Discover key insights from its 2024 report.

Bottomline has been named ‘Cross-Border Payment Company of the Year: North America’ for its global connectivity solutions.

UPI is transforming cross-border payments, boosting India’s global digital payment reach.

Digital wallets are playing an increasing role in cross-border payments, shaping the way transactions are conducted globally.

Discover how AI-driven innovation, blockchain advancements, and evolving consumer behaviours are reshaping the payments industry.

The 2024 holiday shopping season set eCommerce records, but a surge in post-holiday returns and chargebacks highlights the costly “holiday hangover” for merchants.

The Digital Assets Bill introduces opportunities and challenges for PSPs, from stablecoin clarity to operational overhauls, as firms navigate legal uncertainty and evolving compliance standards.

International businesses face significant challenges when managing payments across borders. In addition to navigating multi-country operations and handling diverse currencies for payments and receipts, they must also address foreign exchange

Toqio and DSA partner to deliver embedded finance, enhancing liquidity and growth in the dropshipping market.

Dialect Communications, an award-winning Business Process Outsourcer (BPO) that provides front and back office solutions in the Payments sector across the globe is thrilled to partner with Yordex, a provider

DigiDoe provides an AI-driven solution for cross-border payments, ensuring compliance, fraud prevention, and operational efficiency.

Central bank digital currencies (CBDCs) could transform cross-border payments by reducing costs, improving efficiency, and enhancing transparency.

Join Deloitte’s webinar on 12 September to review CESOP challenges and discuss upcoming changes. Email Dawn Neill to register.

The payments industry must address cross-border inefficiencies to support SMEs, which are critical to global economic growth and financial inclusion.

Cross-border payments expand a business’s global reach, but their success hinges on secure, efficient processes, versatile payment methods, and strong partnerships with payment providers who offer seamless integration and robust fraud protection.

Despite significant advances, cross-border payments still face challenges like delays, high costs, and inefficiencies, but innovative projects like BIS’s Project Rialto and Nexus offer hope for a more seamless global payment system.

With the UK at the forefront, the future of cross-border payments is being shaped by technological advancements, regulatory changes, and the growing demand for efficient, secure, and cost-effective solutions.

The white paper, “User Reality vs. Industry Fallacy,” examines cross-border payment challenges for SMEs and their crucial role in the global economy.

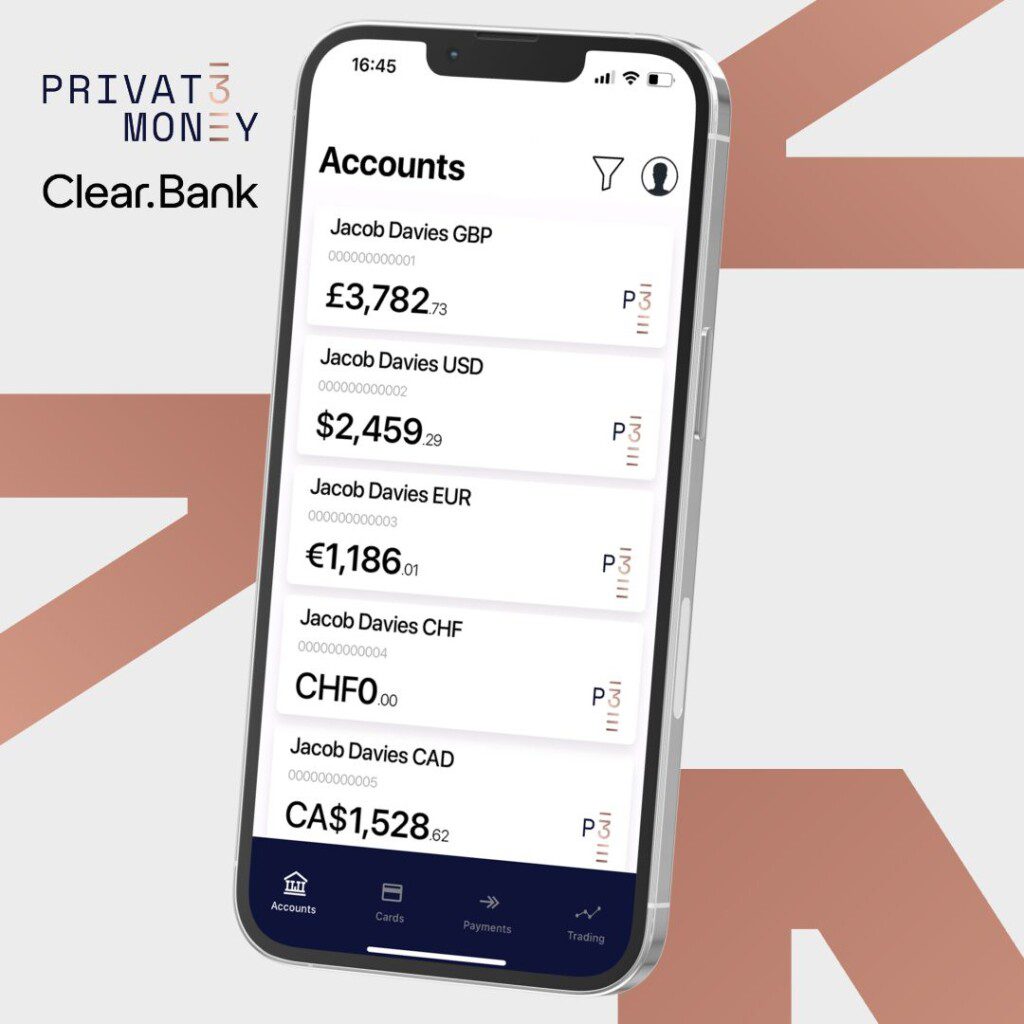

Privat 3 Money and ClearBank offer a multi-currency account with a single IBAN for seamless transactions and a new stainless steel P3 Debit Card, enhancing global financial management.

The payment operations sector is navigating significant challenges due to capped interchange fees, driving a need for digital transformation, cost reduction, and innovative revenue models to maintain profitability.

The cross border payments landscape is experiencing rapid expansion. New corridors, new customers and new technology and processes are seeing more money than ever move across the globe. Consumer and

Banks de-bank payment providers, disrupting cross-border transactions and financial inclusion.

Unlimit partners with Convera to simplify cross-border tuition payments for students in emerging markets, starting with Brazil using the PIX payment system.

The Bank of England is modernising its RTGS system to boost resilience, innovation, and cross-border payment efficiency.

Adopting ISO 20022 is essential for modernising cross-border payments, enhancing fraud prevention, and ensuring seamless interoperability and efficiency in international financial transactions.

Unlimit and DEUNA have partnered to enhance cross-border payments for enterprises in Latin America and beyond, aiming to improve approval rates, reduce costs, and lower fraud risks.

Global SMEs are shifting to fintechs for their financial needs, urging traditional banks to collaborate with fintech providers to offer flexible, innovative solutions, writes James Camilleri, CEO and co-founder of Fyorin

TerraPay and Multipass have partnered to enhance cross-border payment solutions for corporate customers, improving efficiency and cost optimisation

TerraPay and Al Ansari Exchange have partnered to enhance their remittance services by integrating TerraPay’s payment solutions with Al Ansari’s network.

Payall has partnered with Latvian regtech leader Huntli to enhance fraud prevention and transaction monitoring for a broad spectrum of financial institutions, bolstering capabilities in fraud and risk mitigation.

TerraPay, a company specialising in global cross-border payments, has recently been granted a Major Payment Institution (MPI) License by the Monetary Authority of Singapore (MAS). This development is part of

Fintech company Unlimit has announced its entry into the Tanzanian market and received the Bank of Tanzania (“BOT”) licence, marking another significant step in its regional expansion. The BOT’s approval

In recent years, the global financial landscape has undergone a notable transformation, characterised by a discernible decline in correspondent banking relationships. Several different factors highlight this shift, each contributing to

In an increasingly interconnected world, global commerce has become the lifeblood of the modern economy. Businesses of all sizes are expanding their reach beyond borders, opening up new opportunities and markets. However, the traditional financial systems have often lagged behind the speed and efficiency demanded by the globalised marketplace. Enter cross-border real-time payments—a concept that is reshaping international trade by breaking down barriers and providing a boost to global commerce.

HSBC’s January launch of Zing, an e-money institution and standalone money transfer app, is something of a strategic departure for the global banking behemoth for a number of reasons.

What it may imply for the bank strategically and what it signals for the future of international money transfers, fees, and product development are all valid questions. The true motivations behind the launch are likely more nuanced than may seem likely at first glance or that the bank may have you believe.

The founders of PAYSTRAX have decades of experience in the payments industry. In the past, they worked with internal software development teams who spent most of their time keeping up

As the digital landscape continues to evolve at an unprecedented pace, the payments industry finds itself standing at the intersection of innovation and transformation.

As the UK continues to try and place itself as a leader in the payments industry and fintech, maintaining a degree of pace, security and efficiency must remain a priority.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.