Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

What is this article about?

How central bank digital currencies (CBDCs) can improve cross-border payments by addressing inefficiencies in the traditional banking system, highlighting projects like Project Jura and Dunbar.

Why is it important?

CBDCs offer a solution to inefficiencies in global payment systems, potentially improving liquidity and reshaping the role of dominant currencies like the US dollar.

What’s next?

Successful CBDC implementation requires a focus on global interoperability, standards like ISO 20022, secure infrastructure, and collaboration between central banks, fintechs, and regulators.

Central bank digital currencies (CBDCs) have gained significant traction as a potential solution to further enhance cross-border payments, addressing areas such as cost, speed, and regulatory alignment. The G20 has emphasised the need to enhance cross-border payment systems, identifying CBDCs as a critical tool in this transformation. By offering a more streamlined, transparent, and secure alternative, CBDCs could complement the existing flow of global trade and finance, offering new avenues for transactions while working alongside the traditional correspondent banking model.

Projects such as Jura and Dunbar have demonstrated the feasibility of CBDCs in real-world scenarios, focusing on the use of wholesale CBDCs for cross-border transactions, such as foreign exchange and securities settlements. These initiatives underscore the importance of global interoperability, where CBDCs can operate seamlessly across borders, enabling a more efficient and cohesive financial ecosystem. As tokenisation continues to grow, the demand for programmable digital money to support complex, high-value cross-border transactions is set to increase, positioning CBDCs at the forefront of innovation in global payments.

While the current cross-border payments infrastructure has made significant strides in recent years, with systems like Swift facilitating most payments reaching beneficiary banks within an hour, some challenges, particularly in the final leg of payment, such as compliance costs and currency exchange mechanisms, still persist. Initiatives like Swift GPI have played an important role in increasing transaction speed and transparency. CBDCs hold the potential to further complement these systems by streamlining transaction processes, reducing some intermediary steps, and enhancing liquidity management for central banks. As more central banks advance their CBDC initiatives, the development of a globally interoperable CBDC network could revolutionise how businesses and individuals conduct cross-border transactions, fundamentally reshaping the future of international payments.

The traditional correspondent banking model in cross-border payments faces some challenges that have been the focus of ongoing discussions. According to Payall CEO Gary Palmer, the availability of correspondent banks has been declining, “shrinking the network available to payment providers”. This reduction is especially problematic as core banking systems and digital platforms were “never built” to fully support the complexities of cross-border payments through correspondent relationships.

Graham Ridley, strategy director at IFX Payments, adds that banks have traditionally viewed correspondent banks primarily as “liquidity providers” in specific regions rather than focusing on enabling efficient payment flows. He adds that this approach has contributed to the “high compliance costs” often associated with correspondent banking.

In response to such challenges, payment networks, including Swift, have been working to simplify cross-border payments. For instance, 84% of payments on its network are now conducted directly or via a single intermediary, reflecting ongoing efforts to simply transactions and align with the G20’s cross-border payment roadmap.

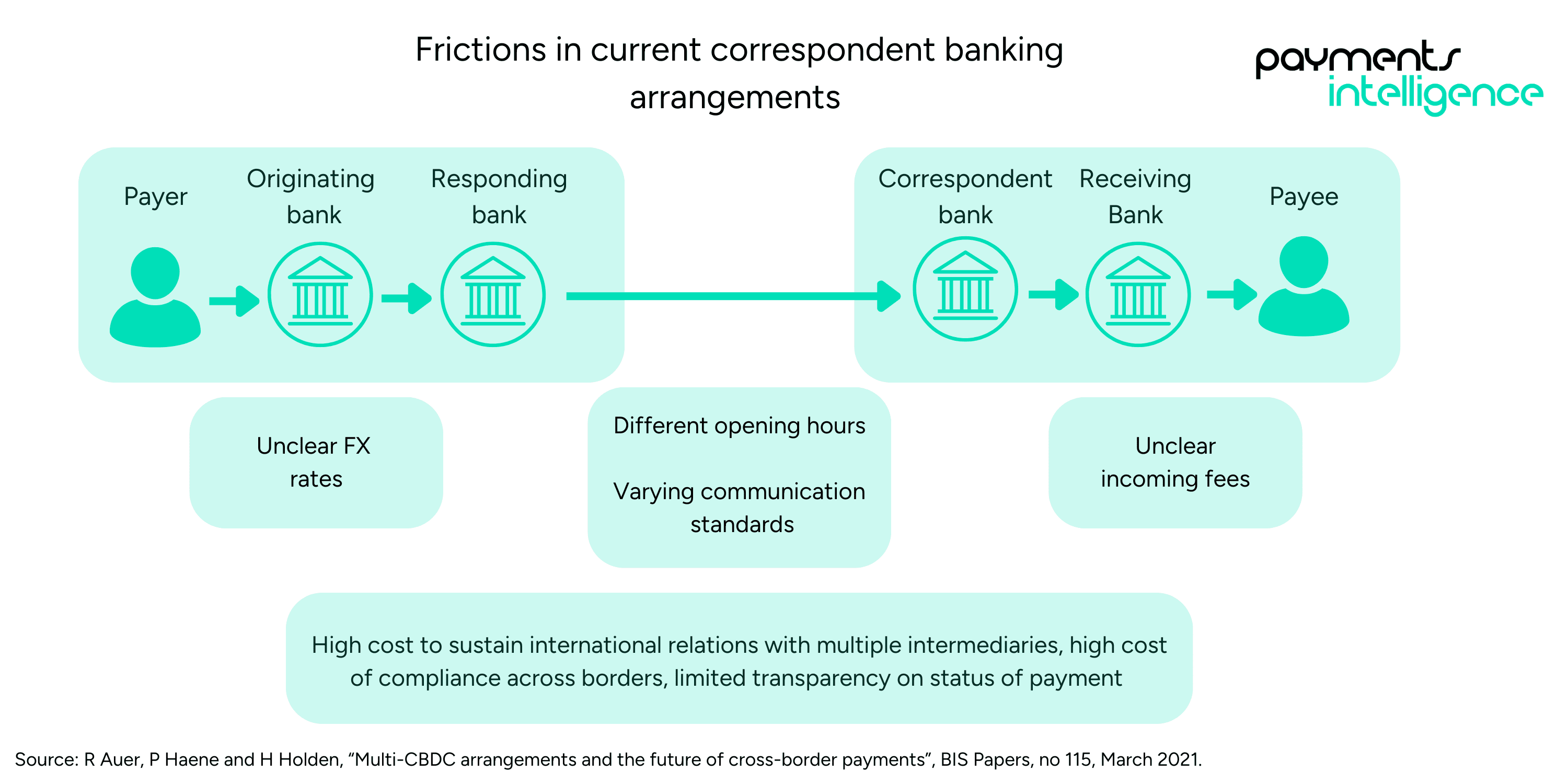

Palmer points out areas within the current correspondent banking infrastructure that could benefit from improved integration, particularly regarding technology and software connecting originating institutions with their correspondent partners. He notes that more seamless and direct connectivity between originating institutions and correspondent banks is still an area for development, telling Payments Intelligence, “There is no infrastructure, there’s no software that connects the originating institution from their correspondent bank or correspondent bank partners. While progress has been made in data sharing and compliance checks, there are still areas where the current system can be improved to achieve greater efficiency and transparency. Unclear FX rates, varying bank operating hours, and differing communication standards add complexity to cross-border transactions, often leading to higher costs for maintaining international relationships and ensuring compliance. Despite efforts to streamline these processes, further improvements are needed to reduce these inefficiencies.

Swift’s Head of Innovation, Nick Kerigan, acknowledges the progress made in cross-border payments, noting that: “Over recent years, significant strides have been taken in cross-border payments.” According to Kerigan, the Swift network now enables 90% of payments to reach the beneficiary bank within an hour, offering increased transparency. While these advancements mark notable progress, there remain areas where CBDCs can contribute to further enhancing efficiency and reducing friction in the global payments ecosystem.

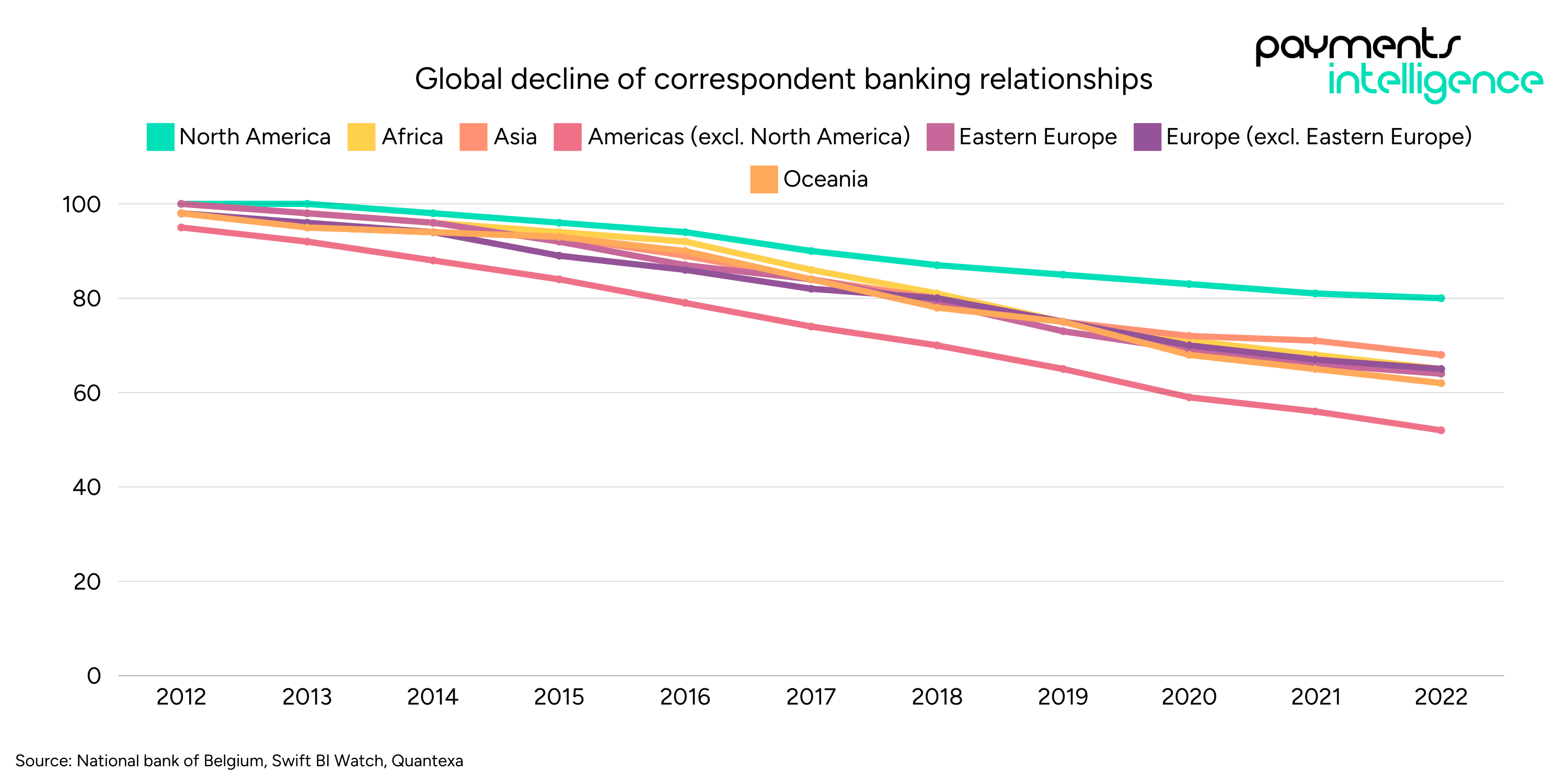

For instance, the Americas (excluding North America) have seen over a 30% decline

in their active correspondent banking relationships since 2012, while North America has experienced a 10% decline. This comes even as the volume of messages has increased, highlighting the growing demand and the ongoing efforts to optimise the system to handle higher transaction volumes.

The reduction in correspondent banking relationships has far-reaching repercussions, particularly impacting regions with smaller economies, perceived higher risks of financial crime, regulatory challenges, and geopolitical tensions. Major banks are terminating these relationships due to their inability to adequately manage and mitigate the associated risks. On the other hand, smaller banks seeking to access the services and networks of larger banks are also hindered by their lack of sufficient controls, making it challenging for them to identify anti-money laundering (AML) issues within their client base.

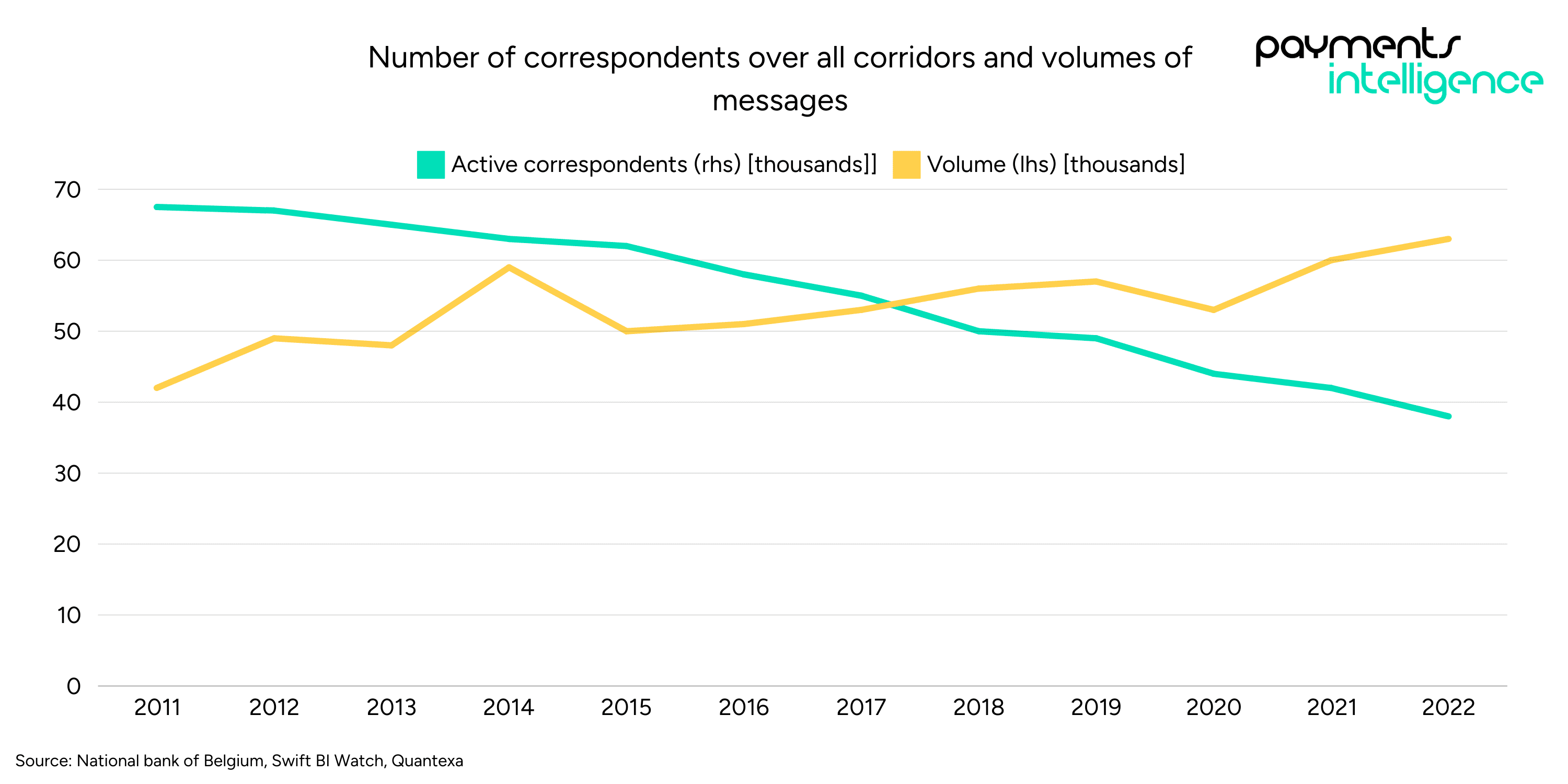

Over time, the number of active correspondent banks has been declining, which could be due to factors such as consolidation in the banking industry, cost-cutting measures, or increased reliance on alternative payment solutions. Despite this decline, the volume of messages has increased, indicating that the remaining correspondent banking networks are handling more transactions.

Tokenisation has emerged as a significant trend driving the need for new forms of digital money, such as CBDCs. As this tokenisation of assets grows, there is a corresponding need for programmable digital money that can facilitate the transactions involving these tokenised assets. CBDCs are seen as one potential solution as central banks explore ways to design these digital currencies to enable use cases like delivery versus payment for securities or trade transactions.

However, central banks’ CBDC design has an inherent domestic focus, which raises the challenge of achieving cross-border interoperability to avoid creating “digital islands” and fragmenting the global financial system.

Kerigan adds: “If assets are in token form, they will still require a cash leg for transactions. Therefore, the question arises: what is the most suitable form of digital currency to support these transactions?” According to a report published by Standard Chartered and Synpulse, the demand for overall tokenised real-world assets could reach up to $30.1 trillion by 2034, making trade finance assets one of the top three tokenised assets globally, taking up a 16% share.

“These are the kinds of use cases that people encounter every day. For example, managing a supply chain and shipping goods across the world, or banks trading foreign currency with each other,” he explains. “These are real-world scenarios, and people are exploring the best form of digital or programmable money to facilitate these types of tokenised transactions. This often leads to the concept of CBDCs as the preferred form of central bank digital money.”

The promise of CBDCs in helping to ensure cross-border transactions are more efficient in the future is clear to see, according to Cohesive Architecture CTO Sudeepta Das. “In addition to currency dominance and exchange rate, cross-border CBDC will introduce enhanced liquidity in the international market, impacting how central banks hold their reserves,” he tells Payments Intelligence.

Enhancing the prominence of certain national currencies by making them more accessible would challenge the existing dominance of major currencies like the US dollar, potentially leading to a more multipolar currency system, Das says.

CBDCs facilitating faster and more transparent transactions could make exchange rate mechanisms more responsive and stable. Real-time data on cross-border flows may enable more effective monetary policy interventions to mitigate volatility.

A further positive of a CBDC revolution in cross-border payments includes improved liquidity due to streamlined settlement processes. “This will reduce the need for intermediary currencies and lower the transaction costs”, Das testifies. Not only this but an influx of CBDC usage across the globe could encourage central banks to adjust their foreign exchange reserves to include more CBDCs, “influencing global capital flows and the traditional dynamics of reserve currency utilisation,” he explains.

While CBDCs are seen by many as a promising solution to address inefficiencies in cross-border payments, some industry experts suggest that other methods might also be effective. Palmer expresses this viewpoint: “I don’t view CBDCs necessary to address the root cause issues of the high-risk, inefficient, opaque, and lack of inclusive nature of cross-border payments—although they may be added to the mix of payment options.” This highlights the ongoing debate within the industry, with CBDCs positioned as one of several possible tools in the effort to enhance global payment systems.

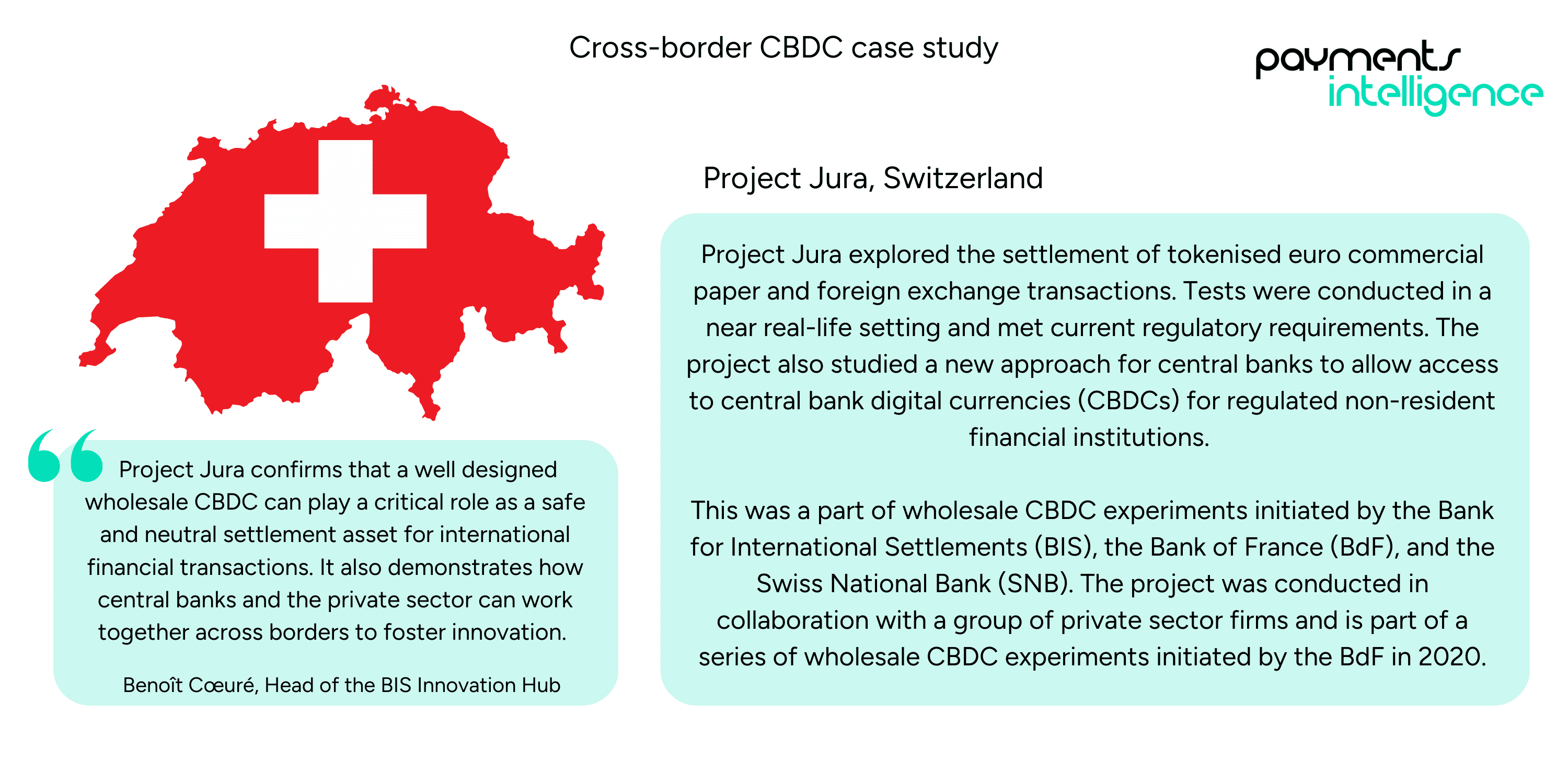

Project Jura was an initiative led by the Bank for International Settlements (BIS) Innovation Hub, the Banque de France, and the Swiss National Bank. Launched in 2021, its goal was to explore cross-border settlements using wholesale CBDCs (wCBDCs) and distributed ledger technology (DLT). The project specifically focused on the settlement of foreign exchange transactions and securities trades between France and Switzerland using wCBDCs.

Throughout the project, the central banks of France and Switzerland, along with private financial institutions, tested the use of wCBDCs for cross-border payments. Leveraging DLT, they aimed to enhance the speed and efficiency of transactions by enabling the simultaneous settlement of foreign exchange transactions and tokenised securities. Tokenised versions of the euro and Swiss franc were used, with a particular emphasis on “delivery versus payment” (DvP) mechanisms—where securities and corresponding payments are exchanged simultaneously to reduce counterparty risk.

The results showed that CBDCs could be exchanged more efficiently and with reduced counterparty risk compared to traditional systems, highlighting their potential for real-world interbank payments, especially in cross-border scenarios. The project also addressed legal and regulatory considerations associated with CBDC use in an international context.

Project Dunbar was an international collaboration spearheaded by the Bank for International Settlements (BIS) Innovation Hub, working in partnership with the Reserve Bank of Australia (RBA), Bank Negara Malaysia (BNM), Monetary Authority of Singapore (MAS), and the South African Reserve Bank (SARB). Launched in 2021, the project explored the potential of wholesale Central Bank Digital Currencies (wCBDCs) to enable faster, cheaper, and more secure cross-border payments across multiple countries through a shared distributed ledger technology (DLT) platform.

The key objective of Project Dunbar was to test a multi-CBDC platform, demonstrating how multiple central banks could issue and settle transactions using their respective CBDCs. The project sought to simplify cross-border payments by showcasing how a unified platform could facilitate transactions between countries, bypassing the complexities and high costs associated with traditional correspondent banking. By allowing central banks and financial institutions to transact directly, the initiative aimed to accelerate payment speed, lower intermediary costs, and improve the overall efficiency of cross-border settlements.

The results of Project Dunbar confirmed the technical feasibility of a multi-CBDC platform, significantly enhancing cross-border payment efficiency. The project demonstrated that such platforms could eliminate traditional intermediaries in cross-border payments, leading to faster, cheaper, and more transparent transactions. Leveraging DLT increased transaction security and minimised counterparty risks. The initiative also allowed commercial banks to directly hold and transfer wCBDCs from multiple jurisdictions, improving liquidity access while identifying legal and regulatory challenges related to governance, privacy, and compliance across different regions.

Swift’s Nick Kerigan explained that the argument for CBDCs arises from real-world, everyday transactions involving businesses and individuals across borders. These include common use cases like supply chain transactions, international shipping, and currency trading between banks, as well as scenarios like “delivery versus payment” for securities, trade transactions, and foreign currency exchanges.

Kerigan highlighted that these real-world applications are driving the development of CBDCs as a form of programmable digital money to facilitate cross-border, tokenised transactions. These practical use cases are at the heart of the CBDC exploration, aiming to address longstanding challenges in the current cross-border payments landscape.

Kerigan introduces the concept of interoperability between different CBDC networks, with the aim of avoiding the creation of “digital islands.” He explains that the design of CBDCs by central banks is inherently focused on domestic use cases within their own country or monetary policy area, such as the Eurozone.

This raises the challenge of how to enable the use of CBDCs across borders, as each country or monetary union may have its own CBDC network. To address this, Kerigan says the industry must be able to “interlink” these different CBDC networks, rather than having each financial institution connect individually. He describes this “interlinking solution” as a “fancy way of basically saying we’re making the networks talk to each other” through a “hub and spoke model” facilitated by Swift.

The key goal, according to Kerigan, is to avoid fragmenting the global financial system and instead connect the different CBDC networks to enable smooth cross-border transactions. By facilitating this interoperability, he highlights the importance of ensuring that the introduction of CBDCs does not lead to the isolation of these new forms of digital money within individual jurisdictions.

Swift’s connector is an experimental solution developed by Swift to address the challenge of enabling interoperability between the diverse CBDC networks built by central banks worldwide. The goal is to facilitate the smooth transfer of CBDCs between banks, payment companies, and corporates across borders without creating the digital islands Kerigan refers to.

The connector—which has been developed and tested in a sandbox environment in collaboration with 38 financial institutions from around the world—uses a hub-and-spoke model to connect the different CBDC networks with each other and with traditional fiat currencies, rather than requiring each institution to connect to each network individually.

Swift is exploring solutions for interlinking various forms of digital assets, including CBDCs, as part of broader industry efforts to achieve interoperability. The ongoing tests, such as enabling multi-ledger delivery-versus-payment and payment-versus-payment transactions, aim to address some of the challenges faced in cross-border payments. These efforts complement the work being done across the industry to integrate CBDCs into a cohesive global financial system. Importantly, Swift’s interlinking solution is designed to accommodate the varied technology choices made by central banks in implementing their CBDCs, leveraging standards like ISO 20022 to provide a common language for payments.

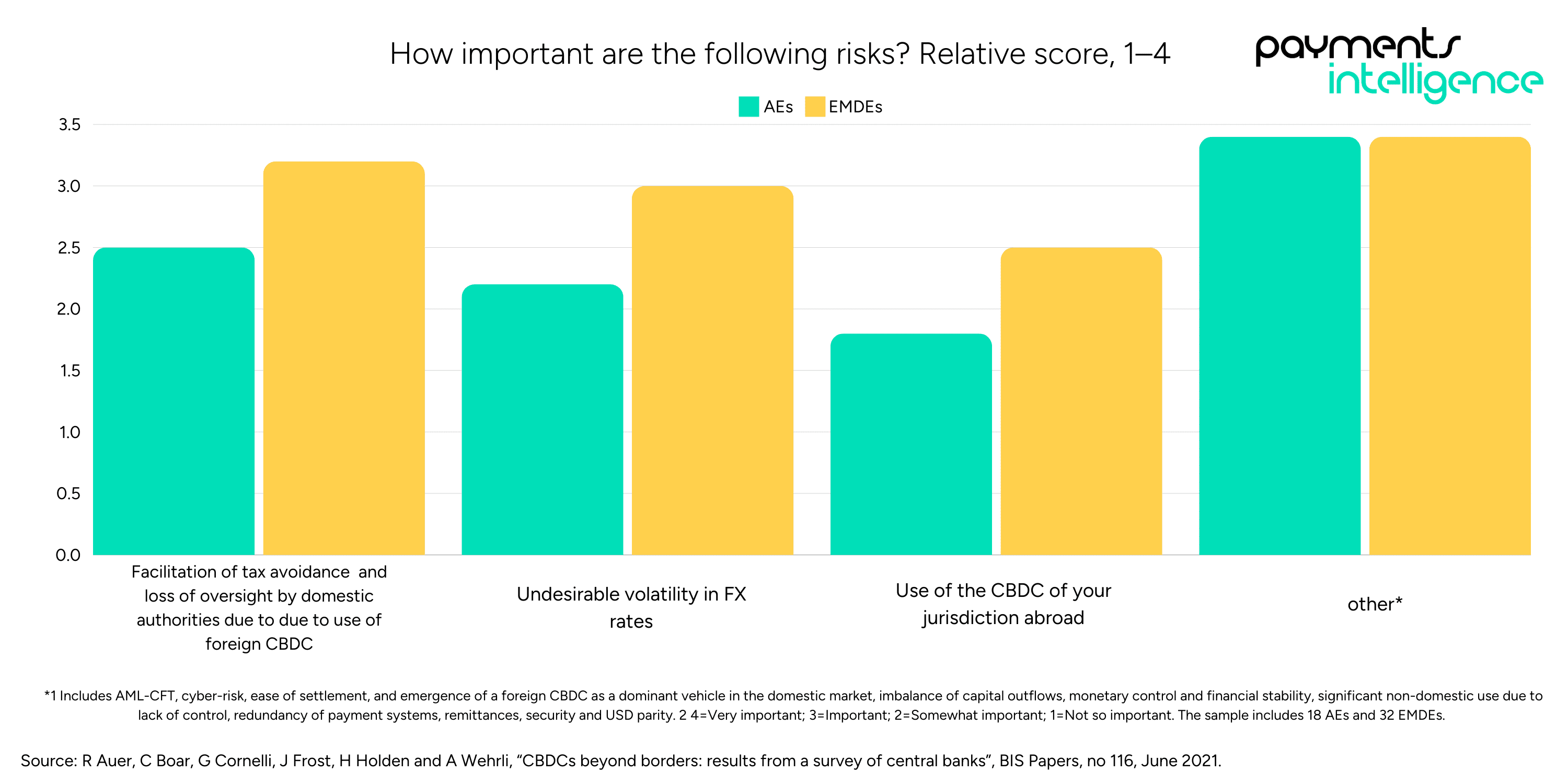

While CBDCs present numerous opportunities for enhancing cross-border payments, they also come with certain risks that central banks are actively evaluating. A survey conducted by the BIS among central banks assessed the perceived importance of specific risks associated with the cross-border use of CBDCs. Central banks ranked these risks relative to their domestic CBDC motivations on a four-point scale, ranging from “not so important” to “very important.”

The survey results reveal that emerging markets and developing economies (EMDEs) view the risks of cross-border CBDC use as more significant than advanced economies (AEs). EMDEs expressed strong concerns about issues like undesirable FX rate volatility and the use of foreign CBDCs leading to tax avoidance and loss of domestic oversight, while AEs showed more moderate concern. Both groups, however, consider risks such as cyber threats, AML-CFT compliance, and payment system redundancy to be highly important. Notably, the use of a jurisdiction’s CBDC abroad is less of a concern for AEs compared to EMDEs, highlighting the differing risk perceptions between these economies.

However, as a counter to the risks, PXP Financial Founder and CEO Kamran Hedjri notes that the transparency and traceability inherent in CBDCs can help mitigate some of these risks, particularly by improving regulators’ ability to monitor money laundering and tax evasion. He also mentioned that the reduced time and fewer intermediaries in CBDC transactions could help alleviate exchange rate risks. While Hedjri acknowledges the challenges and risks involved, he believes that with proper design and implementation, the benefits of CBDCs could outweigh the risks.

CBDCs represent a potential solution to further enhance cross-border payments, offering the possibility of faster, cheaper, and more transparent transactions, complementing the existing improvements in the traditional system. However, to fully realise their potential, payment leaders must take decisive steps to guide their development and implementation. Global collaboration, regulatory harmonisation, and infrastructure readiness are key to ensuring CBDCs become widely adopted. Existing payment networks, including Swift, are exploring ways to integrate with CBDCs, highlighting the importance of a collaborative approach in creating a seamless transition and mutual support between traditional and emerging systems.

To ensure the successful adoption of CBDCs for cross-border transactions, payment leaders should prioritise user-friendly design, making CBDCs accessible and straightforward for businesses and individuals. As Hedjri notes, “Making things more tangible and relatable to people in real life requires a simplistic approach that needs to be implemented.” Additionally, securing the CBDC infrastructure with strong cybersecurity measures is critical for fostering trust in these systems, especially as digital threats continue to evolve.

Scalability must also be top of mind; CBDC systems should be built to handle increasing transaction volumes without compromising performance. Equally crucial is the need to champion international cooperation and regulatory alignment, as the absence of harmonised standards across jurisdictions could hamper the global reach of CBDCs.

Lastly, embracing private sector innovation will be essential. By partnering with fintechs to build out new use cases and services on top of CBDC infrastructure, payment leaders can drive widespread adoption and maximise the benefits of this technology. By addressing these priorities—accessibility, security, scalability, global collaboration, and innovation—payment leaders can lead the way in transforming cross-border payments with CBDCs.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.