What is this article about?

HSBC’s launch of Zing, a standalone money transfer app, marking a strategic shift in its approach to international money transfers and competing with fintechs.

Why is this important?

It represents a significant move by a traditional bank to adapt to the growing digital money transfer market and compete with fintech companies.

What’s next?

HSBC will likely focus on expanding Zing to attract a new customer base and gather insights, while keeping its existing products and fee structures the same.

HSBC’s January launch of Zing, an e-money institution and standalone money transfer app, is something of a strategic departure for the global banking behemoth for a number of reasons.

What it may imply for the bank strategically and what it signals for the future of international money transfers, fees, and product development are all valid questions. The true motivations behind the launch are likely more nuanced than may seem likely at first glance or that the bank may have you believe.

The disparity in service, transparency and levels of pricing between today’s fintechs offering money transfer and incumbent banks remains something of an open secret that must, eventually, change.

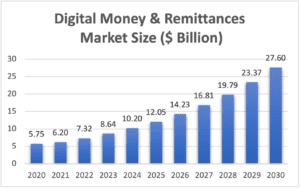

One thing all constituents can agree on is the appeal of the digital money transfer and remittance market. With a forecast annual growth rate just shy of 20% through 2028 (Business Research Insights) and a market size likely to breach $20 billion before the end of the decade, the attraction is clear. Wise, for example, has enjoyed a 3-year compound annual growth rate of 31% in personal customer growth, and a 34% CAGR in volumes. With a profit margin comfortably above 20%, even if interest rates fall back to about 2%, the economics far outpace what banks can make in more traditional businesses, with little or no capital requirements or drag.

Banks are slowly but surely losing their highly profitable fee pools to more efficient, low cost fintechs and FX and money transfer players. To avoid this, the options are limited. An unappealing option is to begin to disclose how much they already make here, and quickly lower their own pricing.

The route that HSBC has taken is to launch a standalone app to slow the cannibalisation of its own highly profitable retail payments and FX franchises while also gathering new customers to onboard to its other retail products further down the line. There are other, more idiosyncratic reasons detailed below, but the direction of travel for banks in this space is abundantly clear: margins will converge with fintech leaders.

By way of explanation of the launch, Zing’s CEO, James Allan, stated that “now is the time for a new kind of international payments solution, one that combines cutting-edge innovation with the support of an experienced global bank.” An obvious question to this bold statement is, “Why now?”. An easy follow-up – “What is actually new about Zing”?

Nuno Matos, CEO of HSBC’s global wealth and personal banking business, goes one further, claiming that “it’s a bold move for us. This is HSBC playing outside of its traditional perimeter of customers and really attacking, if you want, of taking advantage of a contingent, which is big, is growing, looks like us, and it’s here for us.”

Clearly, new customers to whom it can cross-sell is part of the appeal but only a small part of the bigger picture. Marc Rubinstein, ex-Hedge Fund Manager and long-time banking and financial services analyst, summed up the wider and somewhat surprised reaction to the move succinctly: ” If you look at the history of banks launching standalone, branded financial services products and companies, it normally hasn’t ended well!”.

As he goes on to point out, the dirty secret of how much money the banks really make on overseas money transfers was laid bare some years ago. What this launch will ultimately mean for competitors – think Revolut, Wise, Barclays’ foreign currency account etc – is worth analysis. But first, a little history lesson to remind readers what is really at stake.

In 2017, the British newspaper The Guardian published an expose suggesting that the bank’s innovation director had warned Banco Santander’s senior executives in January of that year that a large chunk of its profits was at risk – Why? Because new competitors could potentially destroy the fat margins it was earning on money transfers.

To prove just how juicy these margins really were, the newspaper cited leaked documents revealing that Santander made €585 million from money transfers – equal to nearly a tenth of its 2016 global profit of €6.2 billion – and that it charged six times as much as rival TransferWise (now known as Wise) for sending £10,000 from the UK to Spain.

Back then, the FX margin generated about half of the total money transfer revenues and nearly double the standard advertised fees, with its ‘correspondent banking’ fees still boosting profitability.

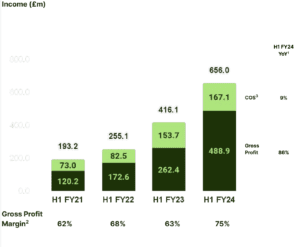

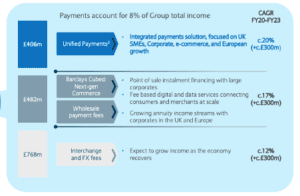

Fast forward to early 2021, and Barclays suddenly began to break out its payments revenue streams – hitherto underheard of by the banks. Targeting a three-year income growth opportunity, it put at £900 million for the payments businesses; the bank forecast that its interchange and FX fees would generate a third of this, pushing annual FX and interchange fees comfortably through the £1 billion level, a staggering figure.

To the cynical eye, it could be inferred that this disclosure was provided to reflate Barclays’ share price by disclosing how big the payments component of its revenue base was. Then-CEO Jes Staley eyed the growing gap between his own stagnant share price and payments companies’ valuations skyrocketing in the aftermath of the Covid-19 lockdowns and a shift to online.

It is also worth noting that Barclays no longer shares such detailed payments income breakdown, while Adyen and PayPal’s share prices are respectively 55% and 80% lower in the interim. Coincidence? Unlikely.

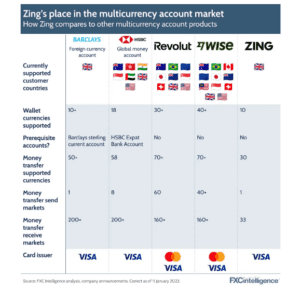

Zing’s most obvious peers include Wise and Revolut, leaders in an interesting and relatively niche space where providers combine multi-currency cards and money transfer services.

Confirming how specialist and tight knit this arena is, Zing liberally made use of fintech peers as it launched, hiring Dario De Angelis from Revolut as senior treasury manager, Eduardo Mercer for engineering and Neil McKeown, previously of Monzo, as head of product and brand marketing.

So, to the question ‘What is new or unique about Zing?’ the answer has to be “In truth, not a lot.” As to “Why now?”, the fate of a $35 million investment that HSBC made in Monese in 2022 has likely been a significant catalyst.

Monese is a UK-based startup that went live in late 2015 to offer current accounts to customers under-served by traditional banks. Announcing in January of this year that its 2022 losses had nearly doubled to more than £30 million in 2022, the fintech warned of “material uncertainty over the success of raising future fundraising and therefore the going concern status of the company”.

HSBC’s Zing is built on Monese’s XYB platform, according to AltFi. While the jury is very much out on whether Monese will be around this time next year – given the tough environment for fintech funding – Zing almost certainly will be. The investment may be lost, but lessons learned, market information gleaned, and a useful platform gained have underpinned Zing’s development.

The surprising nature of HSBC’s decision to quietly build a stand-alone app set tongues wagging. Despite years of break-up speculation as Chinese shareholder Ping An (owner of about 8% of HSBC) agitated for change, it is unlikely that the Zing launch had anything to do with break-ups nor an attempt to bolster the valuation as Barclays’ Jes Staley once tried. Ping An is too busy fighting fires with its Chinese real estate exposures to continue that fight.

The target demographic for Zing, internationally mobile consumers, is a large and growing one and, no doubt, Zing’s global ambition will be reached. Still, as ever with HSBC, there will be no hurry and no fanfare. Starting with ten currencies that members can hold in the app and 30 currencies in which users can transfer funds initially, Revolut and Wise offer far more choices. In many ways, they are also cheaper.

So, there appears to be no hidden agenda. As to the why now, taking Monese’s staff, tech, and knowledge looks sensible and timely. Will HSBC’s Global Money offering or other retail products suddenly change direction or cut fees? Unlikely. In short, Zing is a new customer acquisition vehicle, complimentary to HSBC’s existing offers, a lot cheaper and a sensible branding move for those Millennials who shun the traditional, old-school colonial finance names. It is also market research for the most global bank on the planet.

Wise’s near 10% intraday share price fall on the day of the announcement looks premature. HSBC won’t be attacking payments any time soon, but in its typical way, it has laid the foundations to service the next generation of customers and understand their habits. This is HSBC keeping up with the times in a very un-HSBC way.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.