Lloyds consults on plans to move customer accounts to new core

Lloyds Bank is looking at a £750 million annual saving in tech spend as it plots a move to a new core banking platform from tech startup Thought Machine. Read

Lloyds Bank is looking at a £750 million annual saving in tech spend as it plots a move to a new core banking platform from tech startup Thought Machine. Read

BRD enhances their mobile application within Europe via Coinify’s in-wallet trading solution. Read more here

Wirecard, along with our Partners: B4B Payments, Curve, Glint, Marq Millions, MuchBetter and PCT have been shortlisted for this year’s Card and Payments Awards. Now heading into its fourteenth year,

WEX Corporate Payments, London – December 2018. WEX announces two new senior appointments within the Netherlands. Since heading up the WEX office in Europe, Vice President Anant Patel has

PrePay Solutions (PPS), Europe’s leading digital banking and payments provider, has enabled functionality for current account service providers, Coconut, to launch a limited company accounting and invoicing product. The powerful

Fiserv has struck a $22 billion, all-stock deal to buy First Data, creating a payments and fintech behemoth. Read more here

NEW YORK, LONDON, DUBAI, MEXICO CITY, 15 January 2019 – Volante Technologies Inc., a global provider of software for accelerated end-to-end payments processing and financial message integration, today announced that

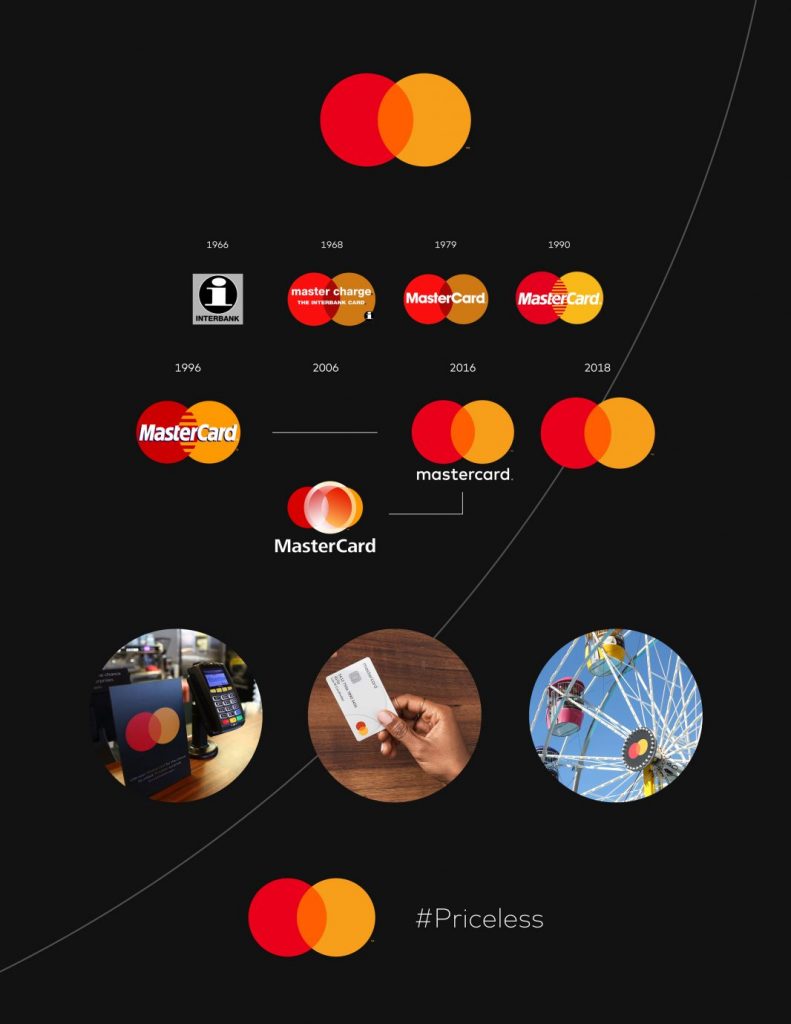

Mastercard today announced that it is dropping its name from its iconic brand mark in select contexts. The interlocking red and yellow circles, referred to as the Mastercard Symbol, will

Read the case study on how Fire is helping GRID get an innovative solution that complemented their product offering and supported their commitment to excellence: a simple to use, fast and

Anna Tsyupko, CEO, Paybase spoke to Katia Lang, CEO TFT about her drive for enabling platform and crypto businesses to succeed through Paybase’s API-driven solution. Read the entire interview

FICO’s Krzysztof Nalborski has written about fraud analytics for open banking. Read the blog here

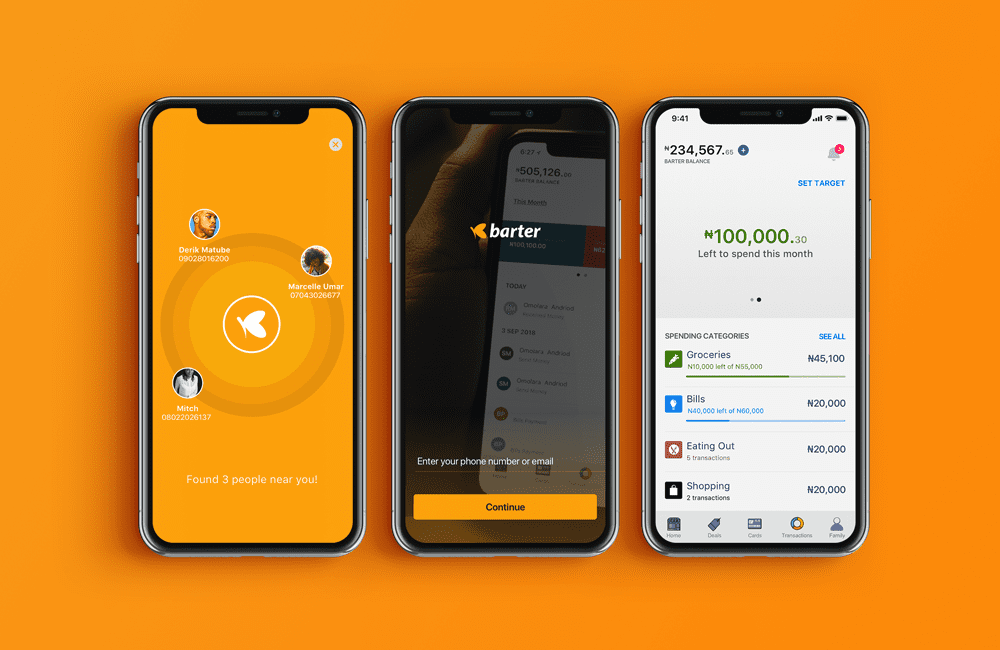

Fintech startup Flutterwave has partnered with Visa to launch a consumer payment product for Africa called GetBarter. Read the entire story here

See the company listing

Download it here

TJ Horan from FICO gives his predictions for 2019.

Mobile ordering and hospitality guest engagement technology specialists wi-Q Technologies are pleased to announce that Judopay is the latest payment provider to join its growing global Partner Programme. Read the

David Parker from Polymath Consultancy joins Robert and Suresh for the 2nd episode of Fintech Unplugged, Series 5. Find out what David’s views are on cryptocurrencies and if we should

Along with many wonderful individuals at the top of their fields, Starling Bank CEO Anne Boden was recently honoured with an MBE and presented her medal by His Royal Highness

Better customer service, cleaner user interfaces, simpler language, spending insights and even gambling blocks…digital banks or ‘challenger banks’ as they are commonly referred to, have taken the UK banking market

New fraud rules under PSD2 demand extra fraud checks, but customers not ready to hand over phone numbers. Read more

UKGCVA Conference 2019 – The Future is Now UKGCVA Conference 2019 is just six weeks away – the flagship Gift Card Industry event of the year takes place over

Kriya Patel from Transact Payments joins Robert and Suresh in this next episode of Fintech Unplugged. Find out what Kriya believes Brexit will mean to payments, what are his views

Bottomline’s general manager Ed Adshead- Grant explains explains the Faster Payments Scheme and why banks should be taking notice.

Whether you call them cryptocurrencies, cryptoassets or virtual assets, these tokens and their underlying technology, Distributed Ledger Technology (DLT), remain at the forefront of regulators thoughts, often operating in an

Payment Service Providers are pushing to implement their PSD2 Strong Customer Authentication (SCA) solutions ready for the September deadline. But of course it’s not just them that will be affected

UK-based fintech Arro Money has launched a crowdfunding campaign with plans to tackle the issue of financial exclusion in the UK and beyond. There are currently 1.5 million people in

Is this the end of vouchers for your business? Does your company give gift vouchers as part of its employee recognition or incentive schemes? If so, you need to be

Bottomline Technologies, a leading provider of financial technology that helps make complex business payments simple, smart and secure, today announced it has added The Access Bank UK Limited to the

PYMNTS’ Karen Webster talks with Dewald Nolte, CCO at Entersekt. Listen to the interview here

“It’s been a busy start to 2019 as we have undergone a big transformation through rebranding and also moving office location. Previously we were known as Fortytwo Data. Now we

Contis, the award-winning banking, payments and processing services provider is on a turbocharged growth mission for 2019, launching a new brand design, new website and initiating a hiring push for

B4B Payments is proud to announce that its CEO, Paul Swinton, has been appointed as the next Chairman of the Prepaid International Forum (PIF), the not-for-profit industry body representing the prepaid

As fraud continues to increase year-on-year, a new survey launched 30th January from Bottomline Technologies and Strategic Treasurer reveals that after years of corporate security spend, the level of losses sustained from fraud has stopped

I remember a conference almost a year ago. Bitcoin (and other cryptocurrencies) had started its major run; everyone was excited. In the panel discussions, the bitcoin proponents were talking about

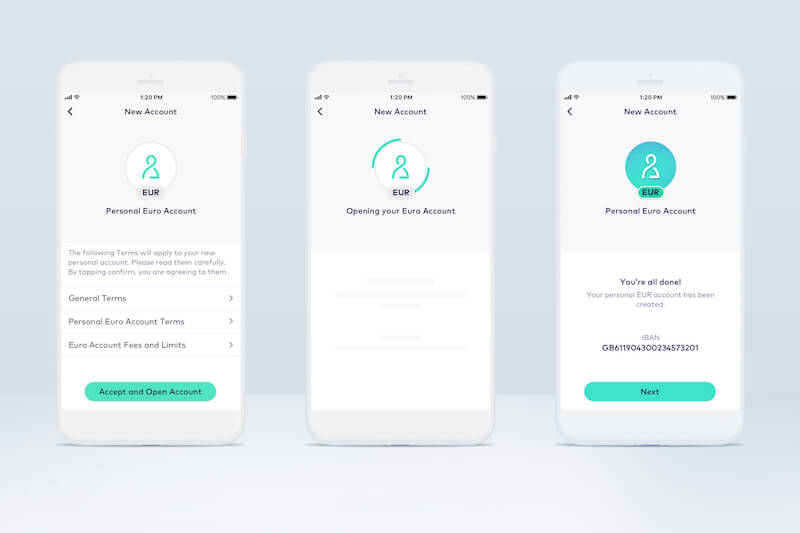

Starling Bank has taken the wraps off a new Euro Account offering as it begins preperations for life after Brexit. Read more

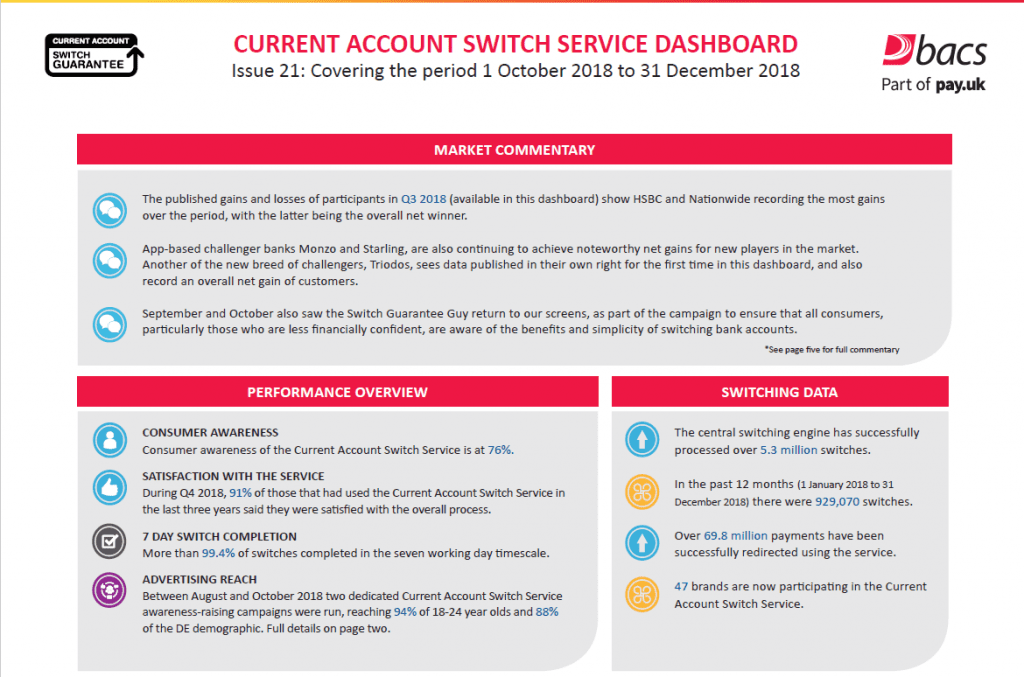

Over 5.3 million switches since launch of Current Account Switch Service Switching levels between 1 October 2018 and 31 December 2018 up 22 per cent compared to Q3 2018 Participant

Newport, Wales 01/02/2019– W2, a provider of SaaS, B2B software solutions and services is very pleased to announce the appointment of Sara West to the Executive Board of Directors. Sara

Improving the customer experience in banking is simpler than banks think. Brian McLaughlin, Chief Experience Officer at Bottomline Technologies, on improving the customer experience.

In the last three or four years, social media (SM) giants such as Facebook, Twitter, and Snapchat have harnessed high levels of user trust and engagement to tap into the growing SM

K Wearables has launched its contactless payment K Ring with ABN AMRO in the Netherlands, linking the ring direct to ABN AMRO issued bank cards. The contactless payment wearables are

Konsentus today announced that they have been selected by Mastercard to deliver Third Party Provider (TPP) identity and regulatory checking solutions, as part of Mastercard’s new suite of Open Banking

Vitesse Company Overview: Vitesse is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuance of e-money and is registered as a Money Transmitter with

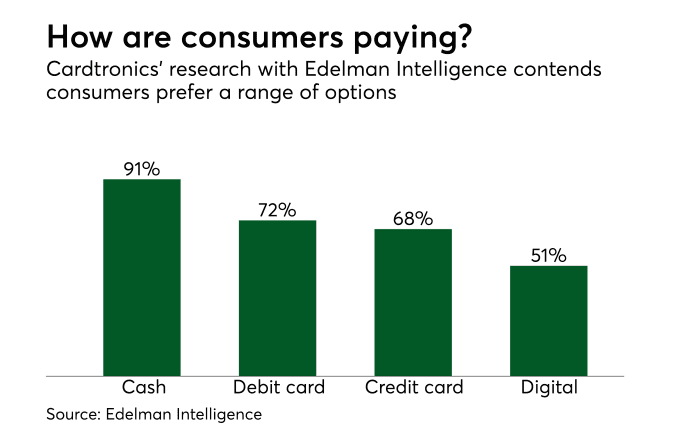

According to Peter Hazou, Director of Development for Microsoft’s World Wide Financial Services Industry Group, the industry is at a pivotal moment and the success of financial services organizations “depends on how

A new generation of bank customers is bypassing physical branches and banking via the web almost entirely in favor of completing transactions and accessing services from their mobile devices. Read

Millionaire American rapper Snoop Dogg, a.k.a. Calvin Broadus, has become a minority shareholder in the Klarna, which offers buy-now-pay-later services at 100,000 retailers in Europe and across the U.S. Read the

Paybase dived straight into 2019 by hosting their 2nd Collaborative Workshop. Their supportive community for platform businesses is definitely growing, stay tuned for information on their third workshop in March!

Keith Briscoe discusses the chargeback problem, outlines some truly astounding chargeback stories (hackers aren’t the only fraudsters), and explains Ethoca’s role in this space, in episode 85 of the Payments on

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.