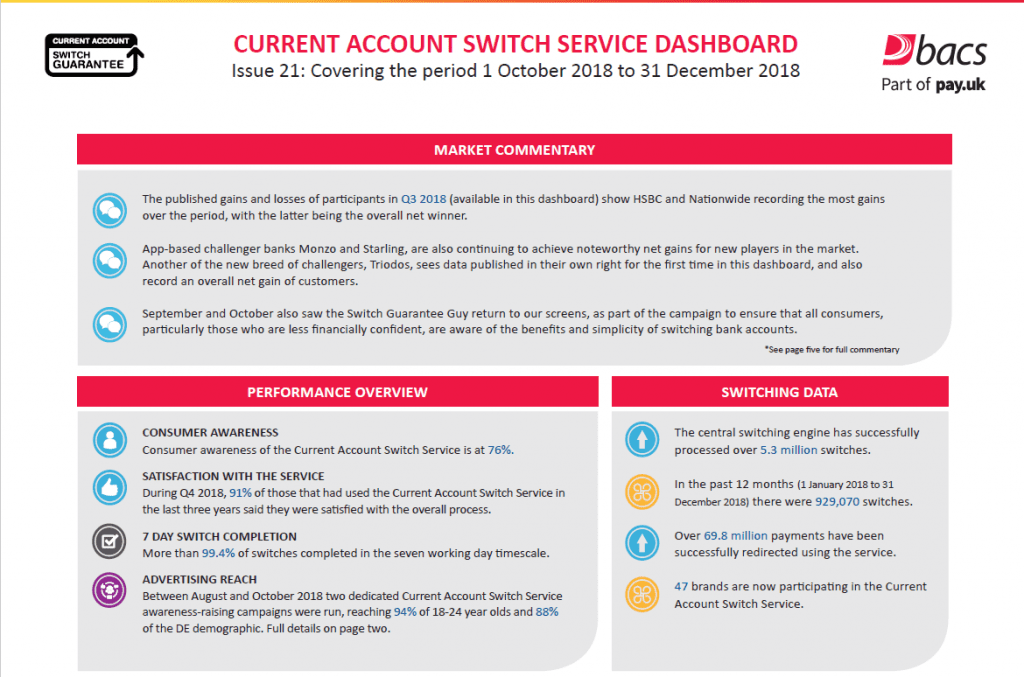

The latest figures for the Current Account Switch Service are published today (30 January), showing that over 5.3 million (5,381,216) successful switches have taken place since the service launched in 2013.

In the last three months of 2018, 235,648 account switches were successfully completed – up 22 per cent when compared to the previous quarter (193,621 switches), while a total of 929,070 switches took place last year (1 January – 31 December 2018).

Over 69.8 million payments have now been redirected by the service, which reports a seven day switching success rate of 99.4 per cent, with 91 per cent of those surveyed during Q4 who have switched their current account in the last three years saying that they were satisfied with the process.

During the second half of last year, two new multi-media marketing and advertising campaigns were launched. Encompassing TV, digital, out of home and social media, the awareness-raising activity targeted two groups traditionally considered to be among those which are harder to reach – 18-24 year olds and the financially vulnerable.

Part of leading retail payments authority, Pay.UK, the Current Account Switch Service has grown to include 47 participating banks and building societies, representing over 99 per cent of the UK’s current account market.

Full details are available in the latest edition of the Current Account Switch Service Dashboard (no.21), [downloadable here – www.bacs.co.uk/factsandfigures]; and includes the latest participant movement data for Q3 2018.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.