Open banking survey 2025: Insights from 500 UK SMEs

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

Open banking and instant payments are reshaping how regulated sectors manage compliance, onboarding, and real-time money movement at scale.

QR code payments offer UK small businesses a fast, low-cost alternative to card terminals—boosting cash flow and meeting modern customer expectations.

Open Banking’s value lies in transforming raw transaction data into actionable insights—boosting accuracy, fraud detection, and customer understanding.

Banks must ditch rigid legacy cores—modular, decentralised architectures enable agility, resilience, and innovation for a truly future-ready enterprise.

Open finance is expanding data-sharing beyond banking, reshaping payments, lending, and financial services worldwide.

How are Finastra and Salt Edge advancing open banking? Discover their partnership’s impact and future vision.

How are changing consumer habits shaping the peak shopping season? Discover Tink’s insights and catch them at PAY360 2025.

Open finance is redefining data sharing, innovation, and growth in financial services.

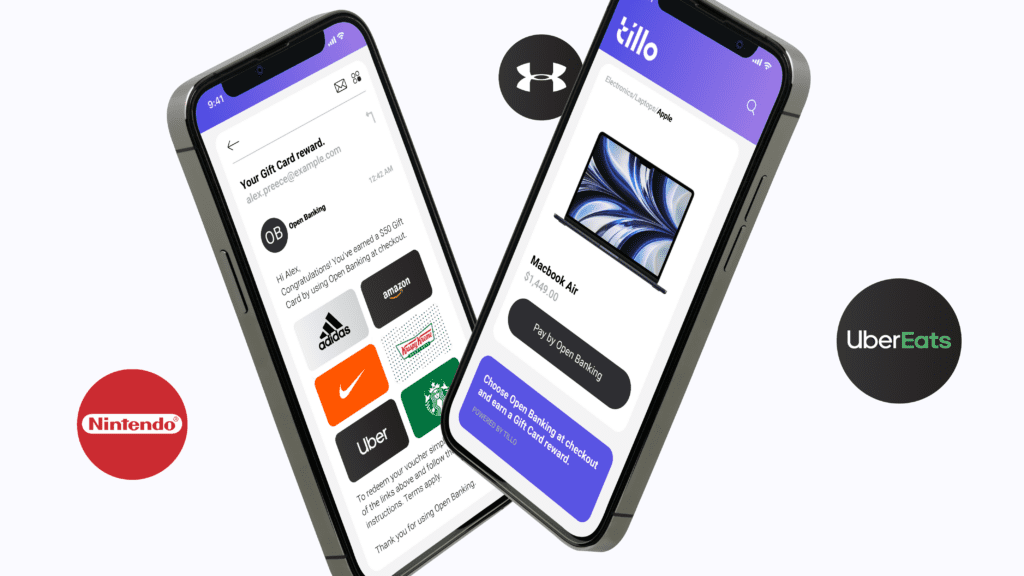

Open banking holds promise for e-commerce, but its success depends on targeted use cases, merchant incentives, and consumer trust.

The EU’s shift to open banking and finance presents both opportunities and challenges, demanding a balance between innovation, security, and regulation.

Open banking faces rising fraud risks, demanding industry-wide collaboration and smarter security solutions to build trust and resilience.

A2A payments, enabled by open banking, provide faster, cheaper, and more secure direct bank transactions, transforming industries like e-commerce and gaming.

Bahrain mandates corporate APIs in open banking, boosting fintech innovation and SME financial access.

In today’s globalised business environment, managing international payments, taxes, and compliance can be daunting. The Merchant of Record (MoR) model offers a solution, taking on the responsibility of payment processing, tax management, and regulatory compliance, freeing companies to focus on core operations and growth.

Open Banking set out to revolutionize finance by giving third-party providers access to customer data (with consent) to drive innovation and empower consumers. But while Europe’s PSD2 regulation has enabled new fintech services and a vibrant TPP ecosystem, adoption has fallen short of initial expectations. Complex regulations, security concerns, and, most critically, profitability challenges for banks have created hurdles. Discover how a shift in strategy, combined with data enrichment, could help banks embrace Open Banking as a growth opportunity rather than a regulatory burden.

Noda’s Pay & Go simplifies registration, KYC, and payment processing in one flow, enhancing conversion rates and user onboarding.

How open banking can reshape finance, enabling personalised services, streamlined verification, and improved fraud detection.

Open banking enhances financial convenience and transparency, but security depends on using regulated providers and careful data sharing.

Trust frameworks are the cornerstone of a secure and competitive open finance ecosystem, ensuring safe data sharing and fostering innovation across the financial services landscape.

Banks and criminals are locked in competition for customers and transaction revenue, using advanced technologies as weapons of choice. Technologies that deliver speed and convenience in modern banking, if unprotected,

UK banks’ reduced lending and account closures stress SMEs, highlighting the need for multi-service apps (MSAs) to streamline financial services with open banking.

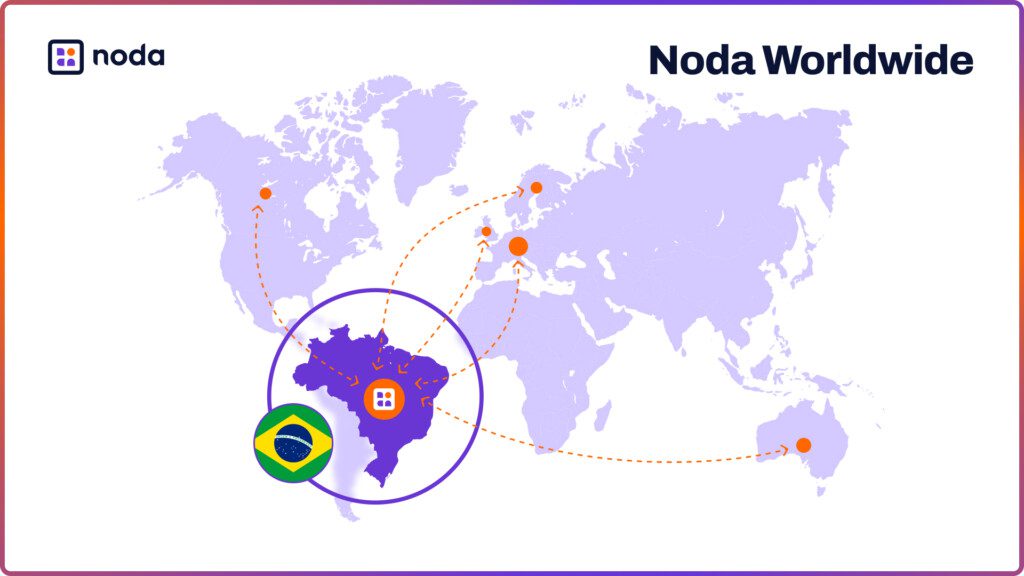

Noda is expanding its open banking network to Brazil, allowing merchants to access seamless cross-border payment services, unified reconciliation, and instant banking across Brazil, Europe, the UK, and Canada.

The payment operations sector is navigating significant challenges due to capped interchange fees, driving a need for digital transformation, cost reduction, and innovative revenue models to maintain profitability.

Open banking revolutionises financial services by enhancing user experience with seamless account integration, real-time transactions, and personalised services.

Open banking in the UK has yet to fulfil its potential, with apparent division between banks and fintechs regarding how best to proceed and establish viable commercial models.

Predicting customer lifetime value (LTV) equips businesses to allocate resources efficiently, focus on high-value customers, and enhance personalised marketing strategies, thereby increasing profitability.

Confirmation of Payee (CoP), a relatively new service in the UK banking landscape, has emerged as a powerful weapon in the fight against fraud. By verifying the name on a

The UK leads the open banking revolution, driven by the Payment Services Regulations and the revised PSD2, fostering competition, innovation, and secure data access, with significant adoption growth and benefits for businesses and consumers alike.

PSD2 mandated banks to share customer information with licensed third-party providers through secure application programming interfaces (APIs), contingent upon customer consent.

Open banking is helping to revolutionise financial services access via APIs, enabling secure data sharing and fostering innovation in the banking industry

There have been lots of discussions recently surrounding open banking. It’s bringing innovation to the financial world by opening up access to bank accounts. Yet, the technology is still in

Businesses using open banking report spending 150 hours less on operational tasks each year versus non-users1 Open banking users save on payment processing fees annually, versus businesses using other payment

Open banking unlocks customer data, driving competition and innovation while reshaping the financial landscape for a more inclusive future. Open banking, a revolutionary concept in the financial industry, has reshaped

London, UK, 23 January 2024 – Ozone API, the open banking API platform founded by the team that designed open banking in the UK, today announced that it has raised

As 2023 draws to a close, it’s time for us to take a moment to reflect on the past year and celebrate the accomplishments of our team at Salt Edge.

Open banking — a promised financial utopia where data flows freely, consumers reign supreme, and businesses can reduce their payment processing fees — but what use is this powerful innovation if you can’t get customers to actually adopt it?

As retail open banking continues to grow, mechanisms should be put in place to balance innovative products for consumers while ensuring adequate fraud protection.

The financial industry is experiencing a seismic shift, fueled by the advent of artificial intelligence (AI) and open banking. Far from being isolated phenomena, these two revolutionary forces are converging to redefine the very fabric

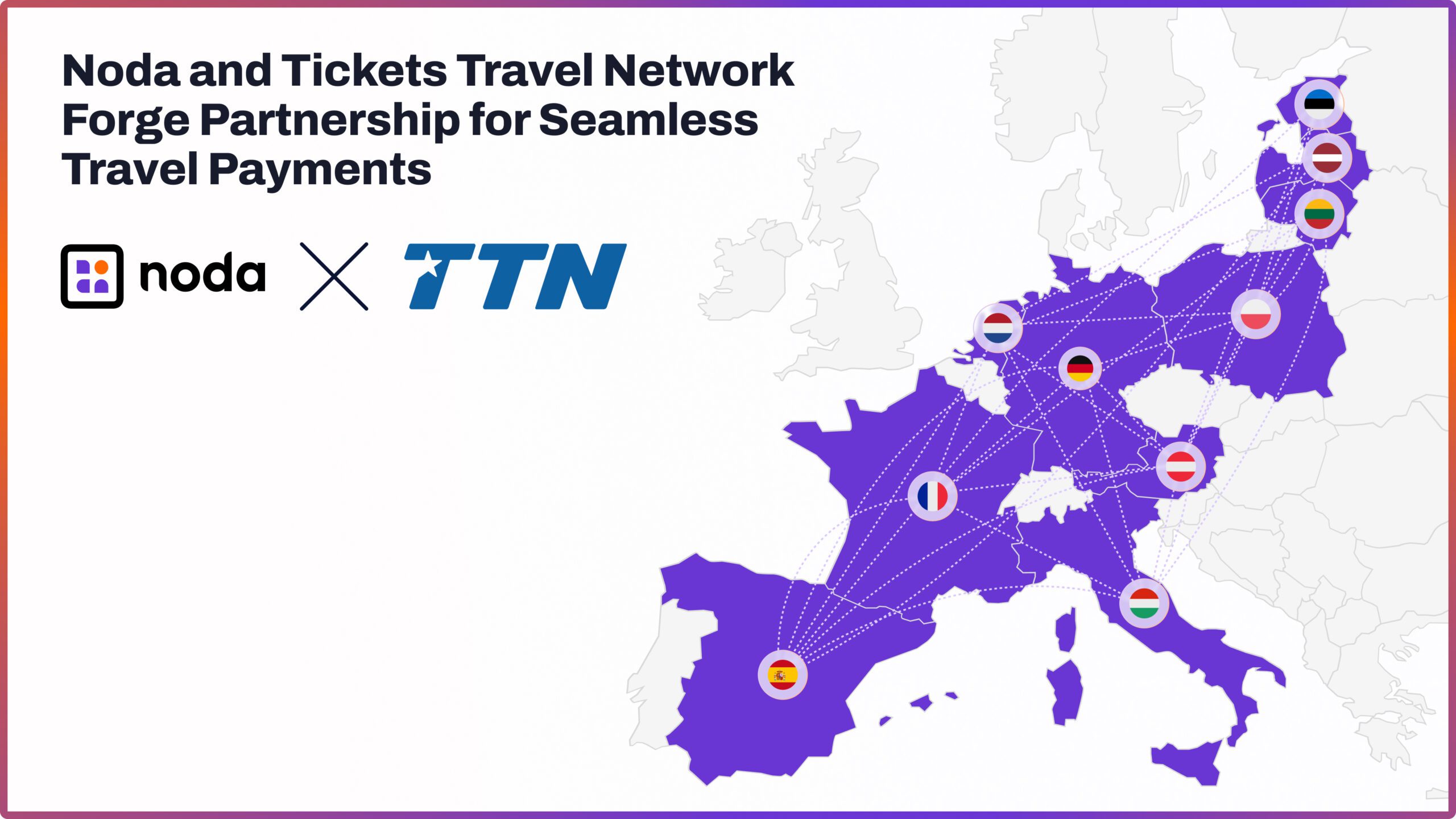

The partnership enables streamlined payment processes across multiple European destinations, with a focus on delivering convenient and efficient payment solutions to travellers. The global open banking provider Noda has joined

Open banking can address customer pain points from bill paying to shop checkouts, but consumers need reassurance to use it with confidence, says Holly Coventry, vice president, international open banking payments at American Express.

Open Banking is not just a trend but a transformative force, driving a sea change in how consumers and businesses interact with financial services. Central to this transformation are Application

NatWest’s open banking payment platform Payit has introduced a new way for businesses to make a payment without needing the recipient’s account details, by sending a secure, single-use payment link.

The neobank industry has grown immensely in recent years matching the rising demand for digital financial services. The convenience, 24-hour customer support, and paths to credit make neobanks appealing and

London, UK, September 5 2023, market-leading open banking solutions provider tell.money supports crypto banking platform, Colossos in expanding open banking capabilities to their customers by powering their PSD2 dedicated interface.

The banking and financial services sector has been thoroughly transformed by technology over the past decade. Previously slow to adapt and adopt new technologies, financial organisations have been so heavily

Open Finance is a financial ecosystem that enables customers to share their financial data securely with trusted third parties in order to access new and innovative financial products and services.

The Joint Regulatory Oversight Committee’s (JROC)’s open banking recommendations have the potential to revolutionise payments, but big investments will be necessary into digital transformation, legacy platform modernisation and cloud migration that is future-proof.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.