Paymentology’s predictions for 2025

2025 will bring rapid growth in digital payments, AI innovation, and financial inclusion, transforming the payments landscape.

2025 will bring rapid growth in digital payments, AI innovation, and financial inclusion, transforming the payments landscape.

AlixPartners names Jonathan Hughes partner, highlighting his 30 years in global FinTech and financial services.

Mitto’s AI-powered Mobile Intelligence ensures accurate, secure, and efficient communication through real-time number validation and fraud detection.

International businesses face significant challenges when managing payments across borders. In addition to navigating multi-country operations and handling diverse currencies for payments and receipts, they must also address foreign exchange

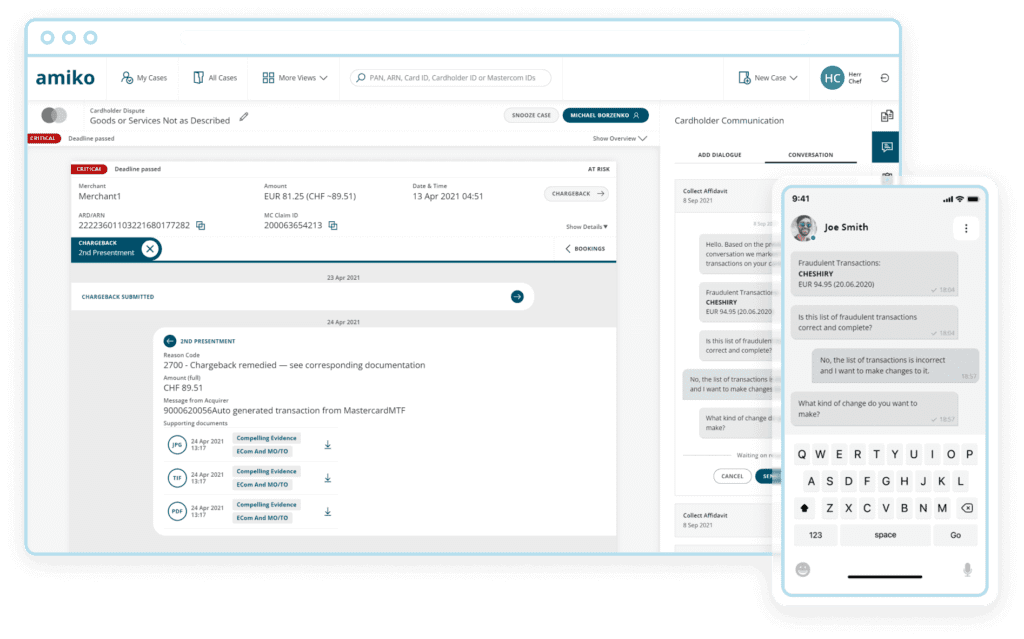

Managing fraud cases has been a top challenge for card issuers, according to recent studies. Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for

KPMG’s report shows payments modernisation is accelerating across finance and retail, driven by innovation and demand.

PSD3 and PSR reshape EU payments with stronger protection, competition, and stricter fraud rules, influencing banks and providers.

Aryze and BCIFGOLD unveil eGOLD, a gold-backed digital token, using Aryze’s platform to digitise assets for secure, global transactions.

Garanti BBVA Kripto partners with Ripple and IBM to enhance its crypto platform with institutional-grade security, governance, and scalability.

Monavate’s API-first platform offers flexible and scalable payment solutions tailored to business needs.

Dialect collaborates with Caxton to provide integrated customer support solutions, enhancing service delivery in the payments sector.

Bahrain mandates corporate APIs in open banking, boosting fintech innovation and SME financial access.

Stay ahead of fraud with FIBR, Sift’s benchmarking tool to compare fraud metrics like ATO and 2FA rates across industries.

Toqio and DSA partner to deliver embedded finance, enhancing liquidity and growth in the dropshipping market.

Trust Payments has appointed Laurence Booth as CEO, bringing his extensive paytech expertise to lead the company’s next phase of growth.

Paydock and Forter partner to deliver AI-powered fraud prevention, enabling seamless, scalable protection across payment providers and methods.

Paydock and Aevi unite to simplify omnichannel payments, bridging digital and in-store transactions for businesses.

Embedded finance is transforming B2B commerce, driving growth, loyalty, and innovation, making it essential for businesses to stay competitive.

OTP Group used Iliad Solutions’ t3 platform for seamless payment migration, ensuring accuracy and supporting digital transformation.

AI is transforming eCommerce fraud prevention, tackling scams with real-time detection and advanced analysis.

MyGuava Business now enables merchants to accept American Express®, expanding payment options and customer reach.

Launching a card product can boost business success, but simplicity, clear goals, and the right partnerships are key to a seamless rollout.

Is your card programme provider meeting your needs today and tomorrow? Join our From Why to Wow – Migration Considerations & Success Factors webinar where industry experts who have successfully

Independent UK law firm Burges Salmon has announced the appointment of partner Martin Cook as the new head of the firm’s significant and fast growing Financial Services sector. In his

Games aren’t the first association we make when we think of financial services apps(!) but gamification is transforming this. If you aren’t familiar, gamification is the process of adding games

In today’s globalised business environment, managing international payments, taxes, and compliance can be daunting. The Merchant of Record (MoR) model offers a solution, taking on the responsibility of payment processing, tax management, and regulatory compliance, freeing companies to focus on core operations and growth.

Paytently, a leading fintech firm known for its innovative payment orchestration platform, is thrilled to announce the appointment of Paul Marcantonio as General Manager. With over 20 years of experience in regulated payments and the interactive entertainment industry, Paul brings extensive knowledge and expertise that will further strengthen Paytently’s position in the global payments landscape.

This case study demonstrates how PAYSTRAX successfully leveraged the Dispute Help chargeback management tool to prevent over 98,000 chargebacks—representing 75% of total chargebacks and 83% of all fraud-related chargebacks.

dash.fi, in partnership with Episode Six, launched a net 60 charge card with high limits and 3% cashback, enhancing cash flow for brands with large ad spends.

Personalised, digital-first benefits are boosting employee retention and satisfaction through AI-driven flexibility.

Convera’s “Are You Ready for 2025?” report offers insights on global economic trends and FX risk management for businesses.

BPC’s report, “Next-Generation Card Processing,” highlights the rapid growth of challenger processors, driven by cloud-native technology and innovation, outpacing incumbents.

PXP Financial and Phos by Ingenico partner to offer a SoftPoS solution for contactless payments on Android devices without additional hardware.

IATA and Outpayce partner to enable airlines to accept faster, secure account-to-account payments via IATA Pay.

DigiDoe provides an AI-driven solution for cross-border payments, ensuring compliance, fraud prevention, and operational efficiency.

Equals Money research shows 90% of financial leaders face 2024 Budget uncertainty, with 70% delaying investments, and 81% planning to adopt new financial tools.

The FCA’s CP24/20 proposes significant changes to safeguarding rules for payment and e-money firms, requiring operational and compliance upgrades.

LHV Bank has appointed Mike Goodenough as director of banking services to lead growth and strengthen UK and European operations.

Ripple has upgraded Ripple Custody with new features like transaction screening and XRP Ledger integration, providing secure and scalable crypto asset storage.

Noda’s Pay & Go simplifies registration, KYC, and payment processing in one flow, enhancing conversion rates and user onboarding.

Seon Technologies’ November 20th webinar will explore how advanced pre-KYC processes can improve customer onboarding and fraud prevention for financial businesses.

Gladius Assurance has launched a Safeguarding microsite to help firms navigate the FCA’s proposed changes to the Safeguarding Regime outlined in Consultation Paper 24/20.

A&O Shearman’s webinar will explore HM Treasury’s draft BNPL legislation and its impact on lenders and the UK retail credit market.

iFAST Global Bank has introduced instant FX trading for iFAST GB Business clients, enabling faster fund settlements and improved efficiency for EMIs and regulated firms.

The FCA is consulting on new safeguarding rules for payment and e-money institutions to improve fund protection and compliance.

Tide has partnered with Adyen to enable small businesses to accept contactless payments using only an iPhone and the Tide app, eliminating the need for payment terminals.

A new fscom report analyses compliance challenges in financial services, highlighting improvements and ongoing areas of regulatory non-compliance.

A new BDO report highlights challenges in attracting talent and concerns over remuneration for non-executive directors.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.