Financial Crime 360 – 3 November 2025

INNOVATE. EDUCATE. ACCELERATE. Tackling fraud and money laundering head on through industry collaboration and adoption of new technology. Financial Crime 360 is a conference and exhibition that helps the full

INNOVATE. EDUCATE. ACCELERATE. Tackling fraud and money laundering head on through industry collaboration and adoption of new technology. Financial Crime 360 is a conference and exhibition that helps the full

New fraud data highlights growing threats and the need for stronger defences ahead of regulatory changes.

Chargeback abuse costs billions, but merchants can reduce fraud with proactive strategies like customer engagement and better security.

Gladius Assurance has launched a Safeguarding microsite to help firms navigate the FCA’s proposed changes to the Safeguarding Regime outlined in Consultation Paper 24/20.

The FCA’s new safeguarding reforms strengthen consumer protection in payments and e-money sectors. This article outlines key changes and steps firms must take to comply.

Please note: You must be registered for Financial Crime 360 to attend this event. If you aren’t registered for Financial Crime 360, your registration will be declined. This interactive workshop

The PSR’s new refund rules strengthen fraud protection, but concerns remain over the reduced compensation cap and evolving scam tactics.

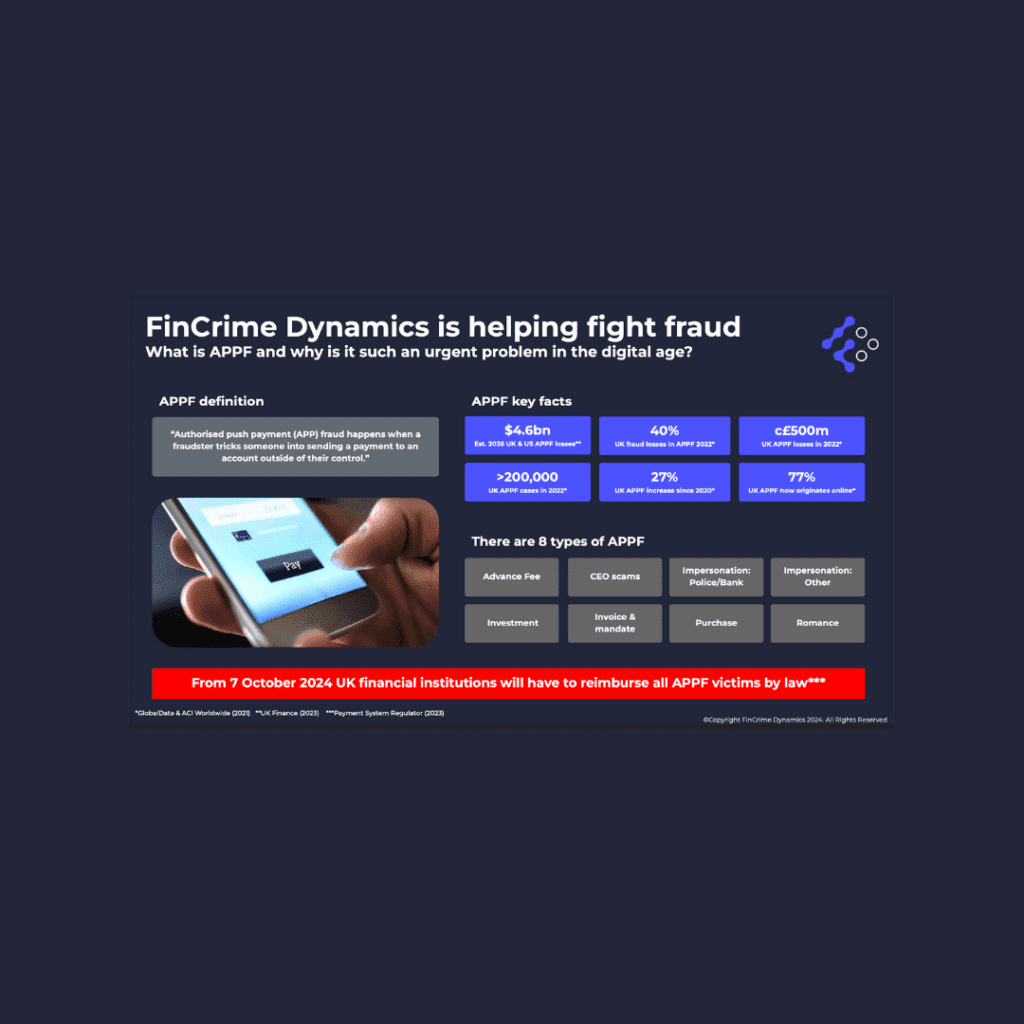

New rules mandate automatic reimbursement for APP fraud victims, raising concerns about industry costs and fraud exploitation.

The PSR has lowered the APP fraud reimbursement cap to £85,000, raising concerns over fraud prevention

The card payment industry must adapt to technological disruption, competition, and evolving consumer behaviours to stay competitive.

Lucinity’s new US patent enables secure sharing of AI insights between financial institutions, with the aim of improving global crime detection while protecting data privacy.

The Combatting APP Fraud report outlines how upcoming PSR rule changes will drive banks to adopt inbound transaction monitoring and collaborative intelligence.

There has been much discussion over the past year on the rise in APP fraud, and the potential impact of the regulations designed to combat it. The conversation often revolves

Join your fellow members at our popular networking event – establish new contacts and sales leads. The event will run between 18:00 – 21:00 GMT on Tuesday 3 December 2024

The Payments Association’s Cross-Border working group, with the support of Benefactor Payall, has launched its latest report: ‘The impact of APP fraud on cross-border payments’. The whitepaper presents the challenges

The new Reimbursement Claims Management System (RCMS) aims to simplify APP fraud claim processing, enhance PSP cooperation, and ensure adherence to updated compliance standards

The challenges financial institutions face under SEPA Instant Credit Transfer regulations and explores how advanced technologies can help overcome them.

The FCA’s latest guidance proposes a risk-based approach allowing payment service providers to delay outgoing payments to combat APP fraud, balancing fraud prevention with consumer protection.

As the threat of quantum computing looms, how can the payments industry safeguard against the quantum decryption capabilities that could undermine global financial security?

The Financial Crime 360 survey reveals how the industry is tackling evolving threats like AI-driven fraud, emphasising the need for collaboration, innovation, and updated regulations to effectively combat financial crime in 2024.

Join us as we propose changes responding to the PSR new consultation on the maximum reimbursement level for APP scams, effective from 7 October 2024. The new proposed cap is

As mobile wallets rise, so do fraud risks—this BPC guide highlights top threats and essential strategies to protect your digital transactions.

The PAY360 State of the Industry 2024 survey reveals key trends, challenges, and opportunities in the payments sector, emphasising the need for technological investment, enhanced security, and regulatory adaptation.

Banks must quickly adapt to ISO 20022, leveraging strategic partnerships to overcome legacy system challenges and meet the March 2025 compliance deadline.

Regulatory changes in BNPL, cVRPs, and digital wallets aim to boost e-commerce innovation and competition while safeguarding consumer protection and market stability.

The Bank of England has recently published a paper on its approach to innovation in money and payments (click here to view). The paper aims to understand what the industry thinks

From 7 October 2024, UK financial institutions must reimburse APP fraud victims. FinCrime Dynamics’ SaaS service helps banks identify vulnerabilities, quantify losses, and improve fraud defences.

The rise in online payment fraud has led nearly 98% of industry leaders to enhance security with identity verification and facial biometrics.

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

This event is a unique opportunity for members to debate de-banking and de-risking and understand the direction it may take within the realm of cross-border payments. Join The Payments Association,

APP fraud is surging, with UK Finance reporting £42.6 million lost in early 2023, prompting calls for stronger consumer protections.

Key findings from Cifas highlights the rising threat of identity fraud and the need for advanced, collaborative solutions.

The new APP fraud reimbursement policy mandates up to £415,000 per claim from October 2024, raising industry concerns over its implementation and impact on smaller fintech firms.

Payment businesses must leverage AI technologies to combat increasingly sophisticated fraud networks and protect digital transactions.

Adopting ISO 20022 is essential for modernising cross-border payments, enhancing fraud prevention, and ensuring seamless interoperability and efficiency in international financial transactions.

With Financial Crime 360 around the corner, Payments Review spoke to some of the leading figures working tirelessly to combat the growing issue of financial crime within the payments ecosystem.

Tony Sales, a former fraudster turned fraud prevention specialist and co-founder of WeFightFraud, shares his perspective on effective strategies and technologies businesses can use to protect against evolving threats.

Exploring the transformative impact of social commerce on consumer behaviour and the lurking risks of online scams.

Exploring Australia’s comprehensive strategy to tackle payment fraud and enhance security across the national payments system.

AI’s data analysis superpowers are revolutionising financial crime prevention, spotting fraud patterns in real-time, even for small transactions, but good data and industry collaboration are key.

From 7 October this year, all consumers who are victims of automated push payment (APP) fraud paid via faster payments must be reimbursed within 5 business days, with the cost split equally between the paying and receiving payment service providers (PSPs)

Get the 360 experience with a delegate pass. Our mantra: We do not choose speakers who read from a PR script. We focus on programming complex challenges into fresh and

This two-day course covers the fundamentals of the card payments ecosystems. The first day covers the mechanics of card payments, introducing ecosystem actors and mechanisms (e.g. authorisation, clearing and settlement),

In 2023, the UK government committed £100 million and 400 new fraud officers to reduce fraud by 10% by 2025, amid increasing social media and deepfake scams, according to IDnow’s UK Fraud Awareness Report.

The 2024 assessment reveals evolving financial crime trends, including AI fraud and social media exploitation, providing crucial insights for payment firms to fortify consumer trust and operational security.

ComplyAdvantage acquires Golden to enhance its AI-driven financial crime risk management solutions with advanced data integration capabilities

As real-time payment adoption grows, 50% of European firms are already involved, with another 42% planning to join, highlighting the balance of challenges and benefits in managing financial crime.

AI has the potential to solve some of the biggest challenges faced by financial institutions. But how can we navigate this ever-evolving landscape to our advantage? From machine learning, and

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.