EML Unveils A Spectacular Lineup For EML.CON Global 2021

EML.CON Global airs November 18 and 19.

EML.CON Global airs November 18 and 19.

FIS UK Pace Pulse Report 2021. How British lives have changed, including changing attitudes and behaviours around payments, banking and finance, in response to the global outbreak of COVID-19.

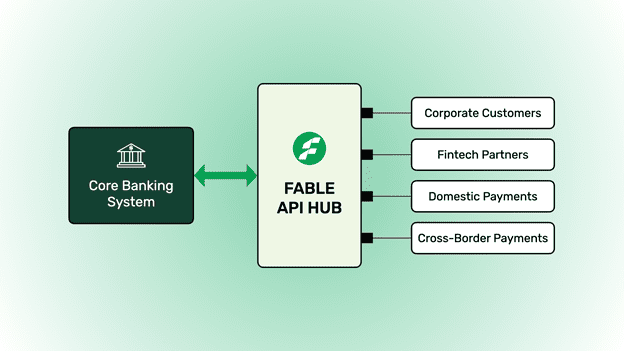

Banks all over the world publish their APIs for their corporate customers which allows them to take advantage of the financial products offered within their own ERP environments. Whilst this provides a great customer experience, it does incur costs given the high resources required from both parties to make this a success.

Fable’s API Hub makes open banking adoption easier, affordable, and interoperable for your customers – but how has Fable got this right?

Read more about Fable’s work to bring banks closer to their customers giving them back control of their own cross-border transactions

fscom’s Senior Compliance Associate, Eoin Kearns discusses the leak of the Pandora Papers and the lessons learned for financial institutions.

LONDON, United Kingdom – Paynetics, the regulated e-money services provider, has partnered with ClearBank to offer real-time payment and innovative banking services to customers.

12th October 2021, – LONDON, United Kingdom Paynetics, a regulated e-money services provider, today announced it has secured Visa Ready certification, which enables partners to build and launch payment solutions that meet Visa’s global standards. Securing this status marks a significant moment in Paynetics’ mission to make payments simple everywhere.

B2B Payments bank, Banking Circle, has joined the Danish national intraday clearing system. Through Banking Circle as a direct clearing participant, Payments businesses and Banks can now pay out and collect payments locally in Denmark on behalf of their customers more quickly and at lower cost than via traditional cross border payment methods. This will enable e-commerce businesses around the world to tap into the growing Danish market.

How can payment and e-money institutions meet regulatory requirements to safeguard consumers’ funds? fscom’s Director Alison Donnelly and Independent Payments Consultant Russell Burke, formerly Payment Authorisation Lead in the Central Bank of Ireland, tackled this key question at the Association of Compliance Officers in Ireland (ACOI) webinar hosted by Kathy Jacobs.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.