How central bank digital currencies (CBDCs) can enhance cross-border payments

Central bank digital currencies (CBDCs) could transform cross-border payments by reducing costs, improving efficiency, and enhancing transparency.

Central bank digital currencies (CBDCs) could transform cross-border payments by reducing costs, improving efficiency, and enhancing transparency.

The FCA’s latest guidance proposes a risk-based approach allowing payment service providers to delay outgoing payments to combat APP fraud, balancing fraud prevention with consumer protection.

Paymentology’s cloud-first card issuing platform supports ChitChat growth journey in Zambia and beyond

Open banking enhances financial convenience and transparency, but security depends on using regulated providers and careful data sharing.

Firms throughout the payments world have set net zero targets and put decarbonisation at the centre of new sustainability strategies. But what is actually being done?

Payabl. has launched its new cloud-based, API-first Payment Accounts solution, enabling businesses to streamline financial management, reduce transaction fees, and facilitate instant, multi-currency settlements across borders.

As the threat of quantum computing looms, how can the payments industry safeguard against the quantum decryption capabilities that could undermine global financial security?

Central bank digital currencies (CBDCs) are exciting many in the digital assets world, but what can these mean for those who are less engaged and on the fringes of financial services altogether?

The Financial Crime 360 survey reveals how the industry is tackling evolving threats like AI-driven fraud, emphasising the need for collaboration, innovation, and updated regulations to effectively combat financial crime in 2024.

As the cross-border payments industry contends with de-banking and stringent regulations, can emerging technologies and alternative solutions pave the way for a more efficient and accessible global payments landscape?

Trust frameworks are the cornerstone of a secure and competitive open finance ecosystem, ensuring safe data sharing and fostering innovation across the financial services landscape.

As banks migrate to the cloud, they must strengthen security with AI, zero-trust, and continuous education to combat growing cyber threats.

Trust Payments provides businesses with secure, modern payment solutions to adapt to evolving fintech trends such as digital wallets and mobile payments.

Explore the must-attend conferences and expos for card issuers and payments professionals to stay ahead of industry trends and enhance networking opportunities.

PostFinance improved dispute management and fraud prevention with Rivero’s Amiko solution, boosting efficiency by 500% and enhancing customer experience.

FMPay offers UK small businesses secure, cost-effective payment solutions with no monthly fees and advanced fraud protection.

Discover how moving sales online can transform your business and unlock new growth opportunities.

Financial House won the Most Innovative Fintech award and launched a global card-acquiring solution for seamless payments.

The UK Finance Annual Mortgage Conference highlighted the need for ethical AI use and innovative solutions to address challenges in the evolving housing market.

In the fast-moving payments industry, trust must be replaced by a “Protection Model” focused on safeguarding compliance, technology, and risk management.

As mobile wallets rise, so do fraud risks—this BPC guide highlights top threats and essential strategies to protect your digital transactions.

Navigating the build vs. buy dilemma in fintech, Enfuce explores expert insights on striking the perfect balance between technology and partnerships to ensure long-term success in modern payment services

PXP Financial’s new Partner Portal streamlines the merchant application process, enabling partners to focus on growth with faster, more efficient approvals.

Matt Komorowski, with 12 years of experience, joins myPOS to lead revenue growth and sales strategy as the company aims to expand its presence in Europe.

Join Deloitte’s webinar on 12 September to review CESOP challenges and discuss upcoming changes. Email Dawn Neill to register.

The PAY360 State of the Industry 2024 survey reveals key trends, challenges, and opportunities in the payments sector, emphasising the need for technological investment, enhanced security, and regulatory adaptation.

PXP Financial joins Zebra’s PartnerConnect programme to enhance mobile payment capabilities, leveraging Zebra’s innovative solutions and global partner network.

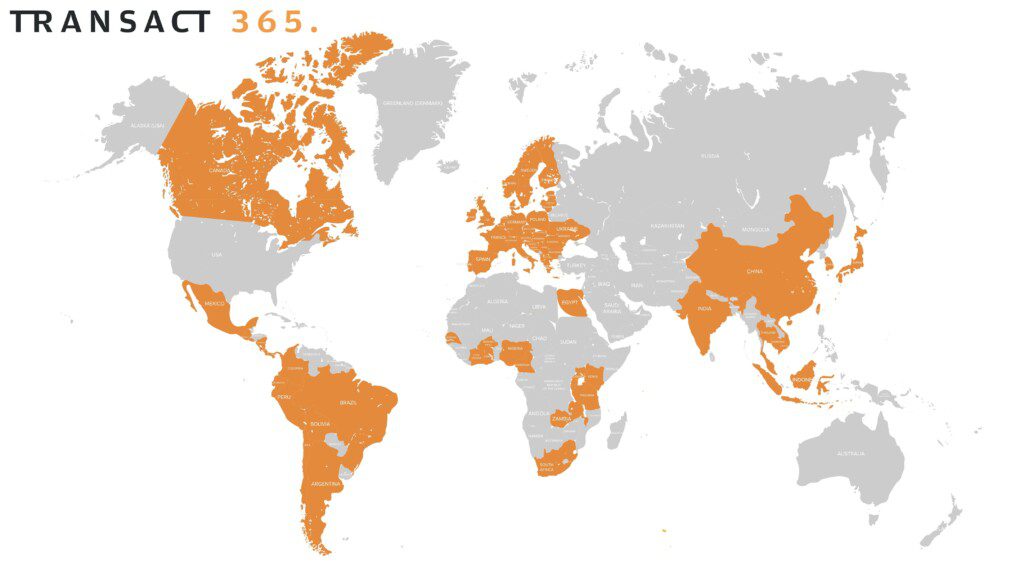

Transact365 updates its global payment solutions, improving stability, success rates, and coverage in regions like China, India, Germany, and Brazil.

Payment companies are accelerating KYB with AI and APIs, enhancing onboarding speed and competitiveness while maintaining strict compliance.

The fintech industry remains male-dominated, but fostering mentorship, challenging stereotypes, and supporting gender equality initiatives can pave the way for more women to rise into leadership roles and create a more inclusive future.

Choosing the right custody solution is vital for institutions to securely navigate the evolving digital asset landscape and future-proof their financial operations.

Unrecognised transactions due to confusing billing descriptors are costing U.K. merchants over £128 million annually, highlighting the urgent need for clear descriptors and proactive chargeback management.

Outsourcing customer support allows companies to focus on growth while ensuring high-quality service through experienced partners who personalise solutions, maintain brand consistency, and leverage advanced technology.

The payments industry must address cross-border inefficiencies to support SMEs, which are critical to global economic growth and financial inclusion.

Cross-border payments expand a business’s global reach, but their success hinges on secure, efficient processes, versatile payment methods, and strong partnerships with payment providers who offer seamless integration and robust fraud protection.

The evolution of payments has seen a journey from physical currency to digital transactions, with mobile payments now leading the way in revolutionising how we handle money in a rapidly growing market.

Digital wallets are reshaping payments with convenience and security, but face challenges like device reliance and regional limits; with increasing regulatory focus, their growth and innovation are set to continue.

Banks must quickly adapt to ISO 20022, leveraging strategic partnerships to overcome legacy system challenges and meet the March 2025 compliance deadline.

Regulatory changes in BNPL, cVRPs, and digital wallets aim to boost e-commerce innovation and competition while safeguarding consumer protection and market stability.

The shift from virgin PVC to recycled PVC (rPVC) and paperboard payment cards is revolutionising the financial industry, reducing environmental impact while offering business advantages, and positioning financial institutions as leaders in sustainability.

The Bank of England’s exploration of a digital pound and its integration with existing payment systems could modernise the UK’s financial landscape, enhancing efficiency, security, and inclusivity.

Toqio partners with Visa to enhance corporate liquidity and efficiency by integrating financial services directly into business networks through embedded finance solutions.

Rethinking the approach to banking silos, this article explores how connecting, rather than breaking down, silos can foster innovation and efficiency in financial institutions.

AI-driven solutions are transforming dispute management in the payments industry, enhancing efficiency, reducing costs, and improving customer satisfaction in an increasingly digital landscape.

PAYSTRAX and CatalystPay’s partnership exemplifies the power of collaboration in delivering efficient, secure payment solutions.

Despite significant advances, cross-border payments still face challenges like delays, high costs, and inefficiencies, but innovative projects like BIS’s Project Rialto and Nexus offer hope for a more seamless global payment system.

Entersekt has been recognised as a leading vendor and the highest-rated authentication-focused vendor in the July 2024 Liminal Link Index for Account Takeover (ATO) Prevention in Banking report.

The PSR’s July 2024 report on APP scams highlights growing fraud sophistication and the challenges for financial institutions, stressing the need for improved regulations and consumer protection.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.