TPA | PSR – Innovation Engagement Roundtable

Event OverviewInnovation is rightly a big focus across the payments ecosystem — including for the PSR, which has a primary objective to promote the development of, and innovation in, payment

Event OverviewInnovation is rightly a big focus across the payments ecosystem — including for the PSR, which has a primary objective to promote the development of, and innovation in, payment

Get the 360 experience with a delegate pass. Our mantra: We do not choose speakers who read from a PR script. We focus on programming complex challenges into fresh and

Join us for a focused engagement session with the Financial Conduct Authority (FCA) as they present their proposals under Consultation Paper CP25/13, aimed at improving the way firms report customer

Today’s consumers demand seamless, instant and transparent payment experiences, whether they’re sending money abroad or making international purchases. Yet, cross-border payment processes are still often very clunky and slow. With

This two-day course covers the fundamentals of the card payments ecosystems. The first day covers the mechanics of card payments, introducing ecosystem actors and mechanisms (e.g. authorisation, clearing and settlement),

Cross-border payments are being reshaped by new tech, regulation, and partnerships—but legacy risks still demand smarter compliance.

What is this event?A 1.5-hour member session diving into recent UK regulatory developments on crypto. We’ll be discussing two key publications: HMT Draft Statutory Instrument – Future financial services regulatory

Join your fellow members back in London at our popular networking event – establish new contacts and sales leads The event will run between 18:00 – 20:00 BST and is

This report presents data-driven insights from a major industry survey, highlighting the key trends, risks, and priorities shaping payments in 2025.

As the global economy becomes more interconnected, the demand for seamless cross-border payments and innovative digital wallet solutions is reaching new heights. Staying ahead in this fast-evolving landscape requires an

Please note: This event is designed specifically for C-level professionals or equivalent. In order for this to be as valuable as possible, we may decline your registration if we feel

This Regulations 101 training course will cover payments regulations and frameworks (e.g. SEPA, PSD2, IFR, Open Banking, AML and other financial crime related regulations) as well as privacy and security

In this episode of the Insights podcast from The Payments Association, Director General Tony Craddock sits down with Gary Palmer, CEO of Payall, to explore the sweeping changes underway in cross-border payments and correspondent banking. Gary shares hard-hitting insights from his 25+ years in the industry, highlighting why the current trust-based, manual processes are no longer fit for purpose and how technology is finally catching up.

Members are invited to join our evidence session to gather members’ views on the future of the regulatory set-up for payments. Why Attend? Contributing to the design of regulatory frameworks

Could a cross-border transaction ever be as low risk as a domestic one? While cross-border payments have typically been seen as more complex and risk-prone, due to the involvement of

A Submission for HMT from Tony Craddock, Director General of The Payments Association (TPA) and Vision Engagement Group member. Working with UK Finance and Innovate Finance we have adapted the

Members of The Payments Association are invited to join the Payment Systems Regulator’s (PSR) roundtable at PAY360 to discuss where future innovation in payments is coming from in the UK

As the global economy becomes more interconnected, the demand for seamless cross-border payments and innovative digital wallet solutions is reaching new heights. Staying ahead in this fast-evolving landscape requires an

The FCA is considering its approach to the future regulation of contactless payments and the current regulatory limits. This is an opportunity for payment providers, third party providers and others

This two-day course covers the fundamentals of the card payments ecosystems. The first day covers the mechanics of card payments, introducing ecosystem actors and mechanisms (e.g. authorisation, clearing and settlement),

This Regulations 101 training course will cover payments regulations and frameworks (e.g. SEPA, PSD2, IFR, Open Banking, AML and other financial crime related regulations) as well as privacy and security

In May, we travel to Leeds… We are hitting the road once again May’s edition of PA@TheCity… introducing PA@Leeds! We are delighted to be partnering with EY and Fintech North

Join your fellow members back in London at our popular networking event – establish new contacts and sales leads The event will run between 18:00 – 20:00 BST and is

The urgency to mitigate climate change means an increasing demand for accountability from companies, including those in the digital payments sector. As this sector expands, so too does its carbon footprint,

Discover how AI-driven innovation, blockchain advancements, and evolving consumer behaviours are reshaping the payments industry.

Presenting The Payments Manifesto 2025 The Payments Association exclusively welcomes members to a networking reception event held at the House of Commons, to present The Payments Manifesto 2025. PA@Westminster sponsored

In an increasingly competitive space, building brand and influence (both internally and externally) are essential tools for success. This Breakfast in the Boardroom session will examine effectively utilising influence in

The urgency to mitigate climate change means an increasing demand for accountability from companies, including those in the digital payments sector. As this sector expands, so too does its carbon footprint,

The dream of fostering a borderless financial ecosystem is slowly becoming a reality as we transform the way we move money with mobile wallets. One of the latest steps forward

Payments Association has released a report, “Transforming the UK’s Payments Infrastructure,” proposing a revamp of the UK’s payments. The paper argues that the current system of account-to-account (A2A) payments hinders

An independent paper setting out how to build commercial parity between card scheme and account-to-account rails that creates better outcomes for consumers and merchants. From a group of members of

De-risking endangers financial inclusion, driving MSBs out and boosting unregulated markets, calling for urgent reform.

Explore how decentralised finance is transforming the payment industry by offering transparency, efficiency, and access, amid regulatory challenges.

This two-day course covers the fundamentals of the card payments ecosystems. The first day covers the mechanics of card payments, introducing ecosystem actors and mechanisms (e.g. authorisation, clearing and settlement),

In this episode of The Insights Podcast, we explore the fast-evolving world of cross-border payments and the crucial role of fintech in global trade. Host George Iddenden sits down with Convera’s Head of Market Insights, Steven Dooley, to explore innovations like real-time payments, blockchain, and open banking. Together, they discuss why these developments are essential for businesses of all sizes and how new technology is helping to meet growing demands for speed, security, and transparency in international transactions. Whether you’re in finance or simply curious about the future of money, this episode offers a clear view into the shifts shaping global commerce.

Convera’s “Are You Ready for 2025?” report offers insights on global economic trends and FX risk management for businesses.

The dream of fostering a borderless financial ecosystem is slowly becoming a reality as we transform the way we move money with mobile wallets. One of the latest steps forward

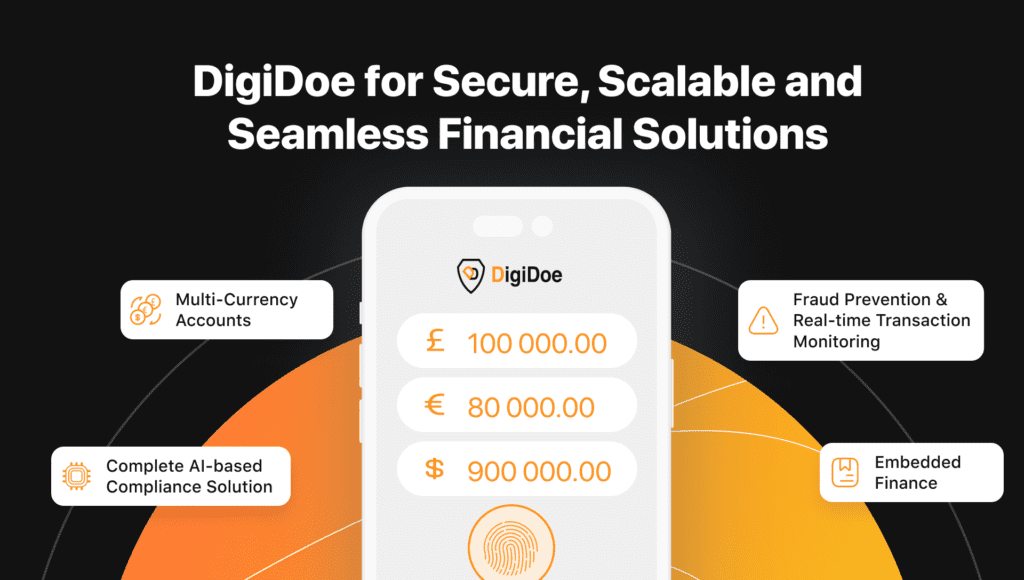

DigiDoe revolutionises global payments with AI-powered fraud prevention, multi-currency solutions, and simplified compliance for secure, efficient business growth.

There has been much discussion over the past year on the rise in APP fraud, and the potential impact of the regulations designed to combat it. The conversation often revolves

Join your fellow members at our popular networking event – establish new contacts and sales leads. The event will run between 18:00 – 21:00 GMT on Tuesday 3 December 2024

The Payments Association’s Cross-Border working group, with the support of Benefactor Payall, has launched its latest report: ‘The impact of APP fraud on cross-border payments’. The whitepaper presents the challenges

The UK is undergoing a ‘seismic shift’ in how people pay (Nikhil Rathi, CEO, FCA), with wallets on the rise to become the default payment type for many. This raises

The challenges financial institutions face under SEPA Instant Credit Transfer regulations and explores how advanced technologies can help overcome them.

As the cross-border payments industry contends with de-banking and stringent regulations, can emerging technologies and alternative solutions pave the way for a more efficient and accessible global payments landscape?

In this episode, George Iddenden from the Payments Association sits down with Hugo Remi, CEO of Cardaq, to discuss the complexities of cross-border payments. They explore key issues like currency exchange risks, regulatory compliance, fraud prevention, and the role of advanced technologies such as blockchain and real-time payment systems. Remi offers insights into the practical challenges businesses face in managing these areas and shares strategies for navigating this evolving landscape.

The payments industry must address cross-border inefficiencies to support SMEs, which are critical to global economic growth and financial inclusion.

Cross-border payments expand a business’s global reach, but their success hinges on secure, efficient processes, versatile payment methods, and strong partnerships with payment providers who offer seamless integration and robust fraud protection.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.