Bringing digital Assets to the masses: How Fintech can Unite Web3 and Daily Spending

Fintechs can accelerate mainstream adoption of digital assets by integrating them with traditional payment networks, enabling seamless everyday transactions.

Fintechs can accelerate mainstream adoption of digital assets by integrating them with traditional payment networks, enabling seamless everyday transactions.

Paymentology partners with Salaam Bank’s Waafi to launch the first tokenised tap-to-pay card in the Horn of Africa, advancing digital and contactless payments.

The move to ISO 20022 brings benefits like enriched data and improved fraud prevention, requiring a strategic approach and decisions between building in-house solutions or partnering with vendors.

Businesses face rising ESG demands, and Paynetics offers embedded solutions to manage environmental impact, social responsibility, and governance.

Trading 212 partners with Paynetics to integrate multi-currency accounts and card payments, allowing customers to spend directly from their account balance.

Paynetics has acquired Novus, the UK’s first “impact neobank,” to enhance ESG initiatives and allow users to support causes and track their carbon footprint with each transaction.

Early-stage fintech companies must navigate regulatory compliance, protect intellectual property, manage personal data, and maintain organised documentation to ensure smooth operations and growth.

Thistle Initiatives has announced the expansion of its financial crime services to support fraud challenges

With the UK at the forefront, the future of cross-border payments is being shaped by technological advancements, regulatory changes, and the growing demand for efficient, secure, and cost-effective solutions.

Banks and criminals are locked in competition for customers and transaction revenue, using advanced technologies as weapons of choice. Technologies that deliver speed and convenience in modern banking, if unprotected,

UK banks’ reduced lending and account closures stress SMEs, highlighting the need for multi-service apps (MSAs) to streamline financial services with open banking.

The first stablecoin was launched in July 2014, 10 years ago. A decade later, it has reached a market cap of $165 billion, with trillions in stablecoin payments settled each

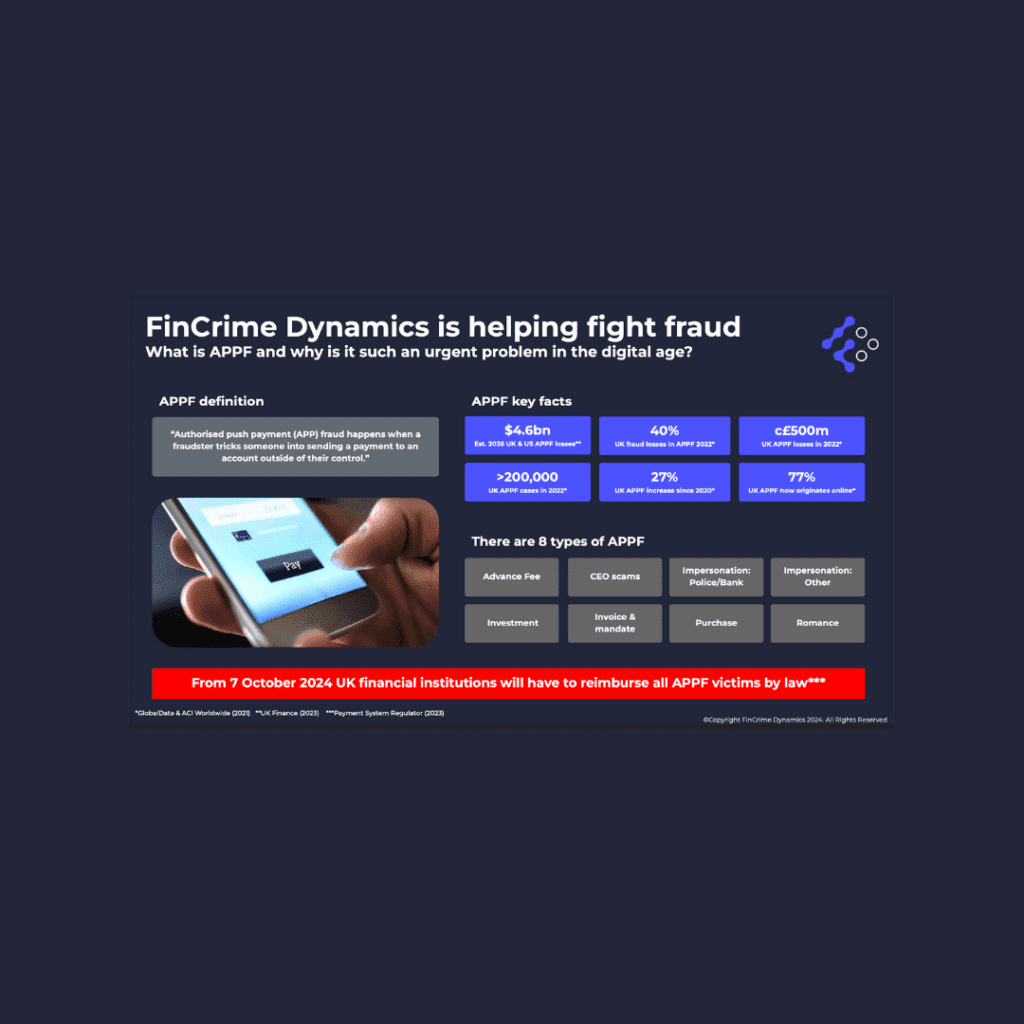

From 7 October 2024, UK financial institutions must reimburse APP fraud victims. FinCrime Dynamics’ SaaS service helps banks identify vulnerabilities, quantify losses, and improve fraud defences.

The “Redefining Community Finance: Unlocking Pathways to Financial Inclusion” whitepaper by the Payment Association provided crucial insights and recommendations emphasising the need for enhanced innovation and support for the community

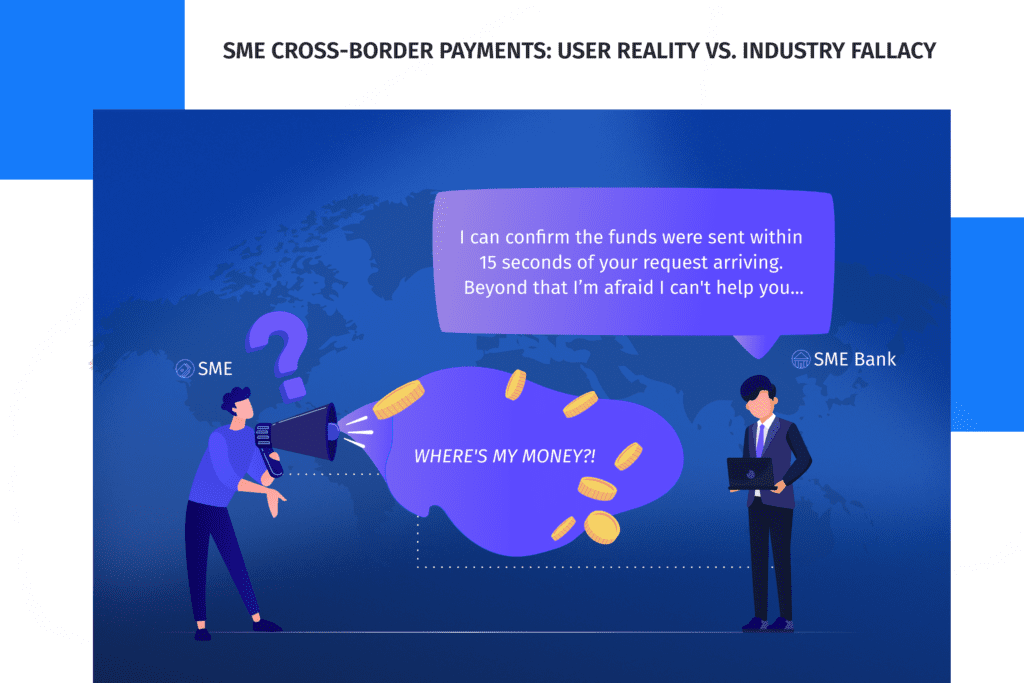

The white paper, “User Reality vs. Industry Fallacy,” examines cross-border payment challenges for SMEs and their crucial role in the global economy.

Mitto’s report shows increasing consumer demand for personalised, real-time communication via SMS and WhatsApp, aiding businesses in boosting satisfaction and engagement.

Issuers and merchants should adopt click-to-pay for a faster, safer eCommerce experience, reducing cart abandonment and enhancing security through tokenisation.

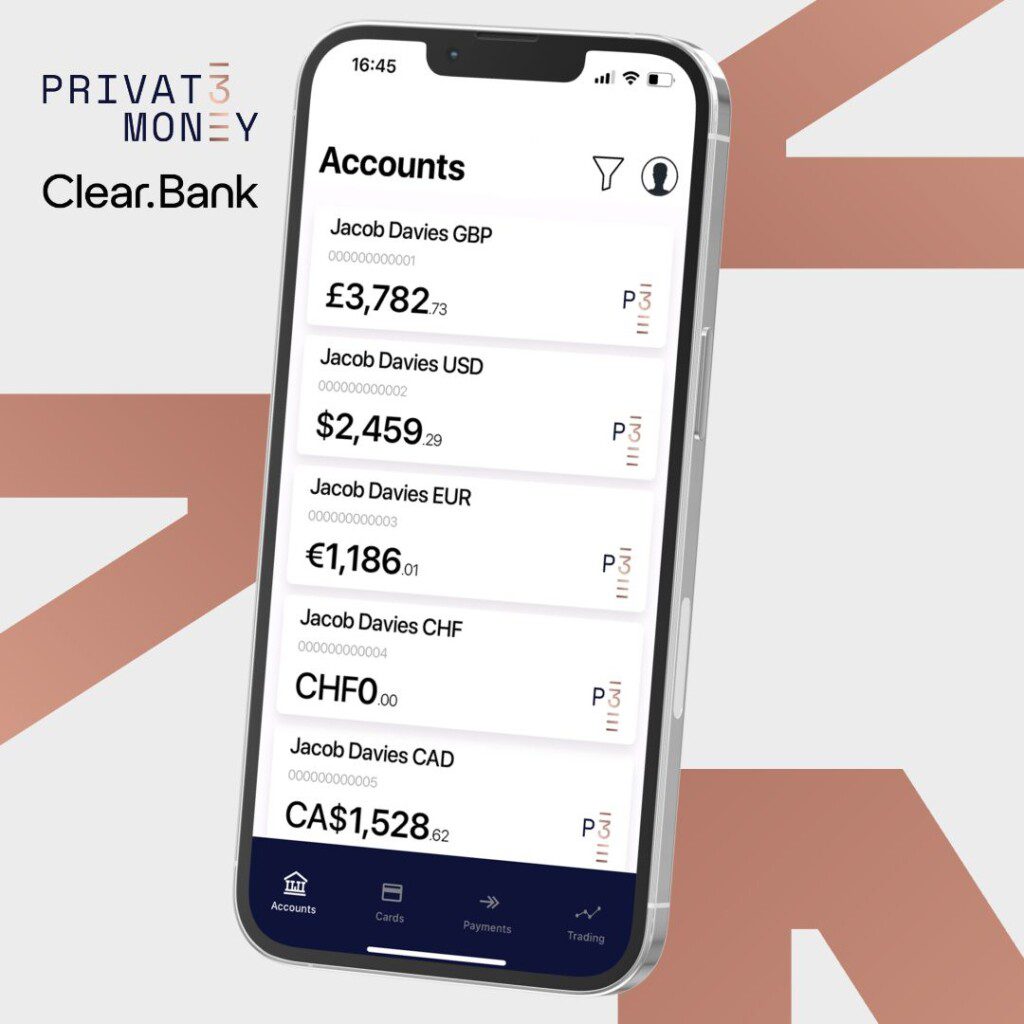

Privat 3 Money and ClearBank offer a multi-currency account with a single IBAN for seamless transactions and a new stainless steel P3 Debit Card, enhancing global financial management.

Paynetics has acquired Novus, the UK’s first “impact neobank,” to enhance ESG initiatives and expand its embedded finance offerings, empowering clients to integrate positive impact efforts with financial services across Europe.

Paynetics has been selected for TechRound’s FinTech 50 list for 2024, recognised for its innovative Embedded Finance solutions that seamlessly integrate payments into business offerings.

Swift’s updated CSP and IAF are essential for ensuring robust cybersecurity and compliance across the global banking community.

Key trends in the payments industry include AI for enhanced accuracy, blockchain for cross-border payments, tokenisation for security, digital wallets gaining popularity, and the growth of buy now pay later solutions.

The Convego Service Market platform by Giesecke+Devrient simplifies access to intelligent payment solutions, offering banks a unified, modular approach to manage physical and digital card issuance efficiently.

Giesecke+Devrient’s Convego payment card portfolio allows banks to use innovative and sustainable materials, such as wood and ceramic, to create unique and personalised payment cards.

The rise in online payment fraud has led nearly 98% of industry leaders to enhance security with identity verification and facial biometrics.

Digital wallet payments are projected to reach $19.6 trillion by 2027, and Thredd’s guide offers insights on trends, best wallets, tokenisation, and finding the right payments partner.

The Trust Retail partnership with Pennies and Well Pharmacy won the Retail Charity Partnership of the Year award for integrating micro-donations into purchases, benefiting the mental health charity Mind.

Trust Payments has partnered with Freepay to enable fast and secure payouts via Visa and Mastercard for Danish merchants, starting with Bingo.dk, enhancing payment processes and customer satisfaction.

Waitrose is partnering with Trust Retail to implement a dynamic inventory management system, improving stock visibility and freeing up Partner time for customer-facing activities, with full rollout expected by 2025.

Card issuer processors face integration, compliance, and fraud challenges but can stay competitive by streamlining processes and enhancing customer experiences.

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

CEOs discuss top challenges and priorities in a Payments Lab roundtable, focusing on technology, fraud prevention, and regulatory compliance.

The financial struggles of UK adults highlight the vital role and challenges of community finance institutions in promoting financial inclusion.

Enhancing the FCA’s complaints reporting process aims to swiftly identify consumer harm, improve regulatory compliance, and streamline operations for financial firms.

Firms must navigate complex payment service regulations and the often-overlooked EBA Guidelines on Remuneration Policies to ensure compliance and foster fair customer outcomes.

Griffin, a UK fintech bank, has achieved B Corp certification, demonstrating its commitment to high standards of social and environmental performance, transparency, and accountability.

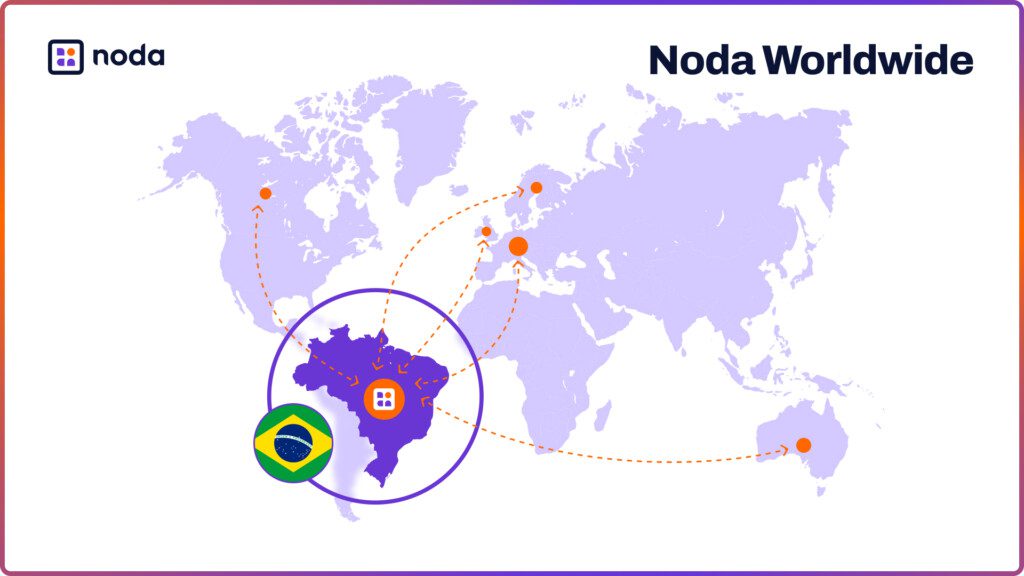

Noda is expanding its open banking network to Brazil, allowing merchants to access seamless cross-border payment services, unified reconciliation, and instant banking across Brazil, Europe, the UK, and Canada.

The payment operations sector is navigating significant challenges due to capped interchange fees, driving a need for digital transformation, cost reduction, and innovative revenue models to maintain profitability.

Navigating the complexities of global expansion in fintech requires strategic partnerships, innovative solutions, and a deep understanding of regional regulatory and cultural nuances.

The payments and fintech sectors are evolving at breakneck speed in 2024. This rapid change ushers in new technology that brings with it ever-advancing challenges in combating financial crime, where

New regulations will cap overdraft fees, drastically reducing them from around $30 to approximately $3, significantly impacting banks’ revenue streams.

Thames Technology, a leading provider of innovative payment solutions, has announced that it is one of the first card manufacturers to offer Mastercard-approved pre-paid paperboard cards. Designed exclusively for magnetic

The cross border payments landscape is experiencing rapid expansion. New corridors, new customers and new technology and processes are seeing more money than ever move across the globe. Consumer and

The digital payments landscape is rapidly transforming, driven by technological advancements and changing consumer preferences. Electronic money institutions (EMIs) facilitate secure and efficient digital transactions, enabling businesses and consumers to

As the CEO and founder of Sibstar, I am immensely proud to share our journey and the impactful work we’re doing to support people living with dementia. I recently had

Banks de-bank payment providers, disrupting cross-border transactions and financial inclusion.

How modernising legacy systems through outcome-driven strategies, cloud migration, and fintech partnerships enhances agility and innovation.

Open banking revolutionises financial services by enhancing user experience with seamless account integration, real-time transactions, and personalised services.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.