The new EU AML framework: Guide to key changes for financial institutions

Baker McKenzie outlines key changes to the EU AML framework, including the new AMLA authority and a single rulebook replacing national implementation.

Baker McKenzie outlines key changes to the EU AML framework, including the new AMLA authority and a single rulebook replacing national implementation.

Quickly assess your firm’s GRC maturity with fscom’s new self-assessment tool—receive a tailored scorecard, heatmap, and peer benchmark in under five minutes.

Ten key regulatory developments merchants must track in 2025–26, from fraud liability to fee reform, stablecoins, and accessibility.

The UK’s new stablecoin rules offer regulatory clarity for issuers, setting the stage for future integration into mainstream payments.

The UK’s new crypto regulation redefines compliance for payments firms, requiring FCA authorisation and raising standards across the sector.

Bondora has selected Tuum’s cloud-native core banking platform to support its transition to a licensed digital bank and unify operations across the EU.

On Wednesday 14th May, Sumsub, a global full-cycle verification platform, will host its ‘Multiverse’ community event, in London. Sumsub Multiverse is an exclusive global event series that converges key players

A Consumer Duty webinar on 15 May will provide insights into FCA priorities, industry practices, and key considerations for firms in the payments sector.

Your quarterly overview of the key regulatory changes impacting payments—what’s happening, what’s coming, and what actions to take

The PSR’s upcoming consultation on the Reimbursement Claims Management System (RCMS) explores if and when its adoption should be mandated for payment firms.

Visa’s new VAMP program introduces stricter dispute thresholds—merchants must adopt tools like RDR, OI, and CE 3.0 now to stay compliant and avoid penalties.

Staying compliant with fast-changing payment network rules is costly and complex—centralising updates can cut risk, save time, and turn compliance into advantage.

AI is transforming fintech compliance—boosting fraud detection, speeding onboarding, and ensuring regulatory alignment while demanding ethical oversight and balance.

As payments data shifts to strategic intelligence, firms must harness its power for growth or risk being overwhelmed by complexity and compliance.

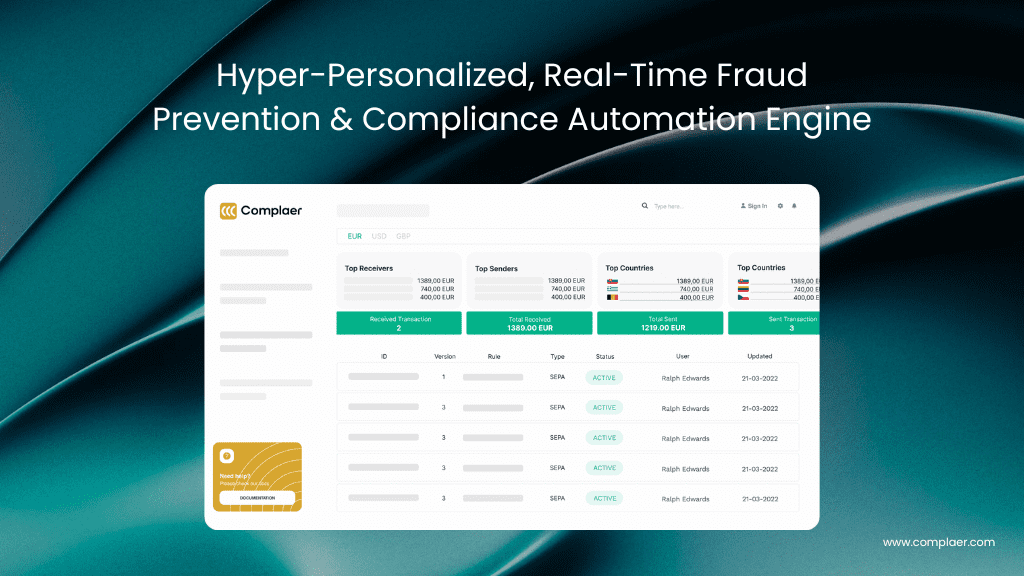

Complaer cuts false positives by 90% and detects fraud in under 10 seconds—empowering compliance teams with real-time, no-code AML across fiat and crypto.

The payments landscape is evolving with digital assets, real-time transactions, and new regulations—businesses must adapt to stay efficient and compliant.

How UK payments regulation can adapt to support innovation, investment, and growth while managing emerging risks.

Merchant category codes (MCCs) impact fees, chargebacks, compliance, and payment approvals—understanding your MCC can help optimise costs and reduce risks.

Why merchant category codes (MCCs) matter—and how choosing the right one can reduce fees, manage risk, and improve payment approvals.

The EBA’s redefinition of e-money challenges traditional models, raising regulatory uncertainties and requiring compliance reassessment.

The Economic Crime and Corporate Transparency Act 2023 holds businesses accountable for fraud unless they prove strong prevention measures.

As crypto reshapes finance, the FATF’s Travel Rule struggles to keep pace—can global regulators close the gap on illicit transactions?

Many payment firms assume they need an FCA licence, but exemptions may allow them to operate with fewer regulatory burdens.

Baker McKenzie’s 2025 briefing covers UK financial regulation trends, including post-Brexit reforms, ESG, crypto, and enforcement.

Regulatory fines in 2024 exposed persistent weaknesses in financial crime controls, highlighting issues in governance, transaction monitoring, sanctions screening, and compliance investment.

By 31 March 2025, UK financial services firms must fully comply with new operational resilience rules, safeguarding critical services and mitigating disruptions.

CP24/20 aligns payment services regulations with the CASS regime, with key impacts to be discussed in an upcoming webinar.

Privat 3 Money partners with KYC360 to upgrade onboarding and compliance processes, aiming to improve efficiency and client experiences.

Clear Junction reveals key challenges payment leaders face in navigating the EU’s new MiCA crypto regulation framework.

The FCA’s safeguarding reforms introduce stricter compliance requirements for payments and e-money firms, aiming to enhance consumer protection and operational resilience.

The Digital Assets Bill introduces opportunities and challenges for PSPs, from stablecoin clarity to operational overhauls, as firms navigate legal uncertainty and evolving compliance standards.

Operational resilience is crucial as FCA and EU regulations push firms to guard against disruptions and cyber threats.

PSD3 and PSR reshape EU payments with stronger protection, competition, and stricter fraud rules, influencing banks and providers.

Payment firms must balance innovation with compliance, while regulators support growth and trust.

Compliance in payment communications is key to trust; AI solutions and customised frameworks ensure secure, global adherence to regional regulations.

The FCA’s CP24/20 proposes significant changes to safeguarding rules for payment and e-money firms, requiring operational and compliance upgrades.

Gladius Assurance has launched a Safeguarding microsite to help firms navigate the FCA’s proposed changes to the Safeguarding Regime outlined in Consultation Paper 24/20.

Webinar: Join Linklaters LLP to learn how upcoming FCA safeguarding rule changes will impact payments firms on Wednesday, 2 October 2024, at 2:00 pm BST.

The merged R&D tax credit scheme in April 2024 introduces new rules for contracted-out R&D, benefiting larger businesses but requiring careful planning and documentation.

The new Reimbursement Claims Management System (RCMS) aims to simplify APP fraud claim processing, enhance PSP cooperation, and ensure adherence to updated compliance standards

New SEPA regulations in 2024 will require instant payments, fee parity, and improved fraud prevention, posing compliance challenges for financial institutions.

Payment companies are accelerating KYB with AI and APIs, enhancing onboarding speed and competitiveness while maintaining strict compliance.

Banks must quickly adapt to ISO 20022, leveraging strategic partnerships to overcome legacy system challenges and meet the March 2025 compliance deadline.

Thistle Initiatives has announced the expansion of its financial crime services to support fraud challenges

Swift’s updated CSP and IAF are essential for ensuring robust cybersecurity and compliance across the global banking community.

Fscom is hosting a webinar session discussing the FCA’s upcoming safeguarding consultation, exploring key implications and considerations for the industry.

Sanctions and counter-terror finance (CTF) screening have become a more demanding area of compliance. Sanctions lists used to be relatively static. Following the Russian invasion of Ukraine, they are now

ProID and Monet+’s free virtual conference will delve into the evolving landscape of digitalisation in critical sectors, focusing on the impact of new EU eIDAS 2.0 regulations on digital identity and electronic signatures.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.