Top 5 fraud trends affecting high-risk merchants in 2025

From AI-driven scams to rising chargebacks, five key fraud trends are reshaping risk exposure for high-risk merchants in 2025.

From AI-driven scams to rising chargebacks, five key fraud trends are reshaping risk exposure for high-risk merchants in 2025.

SMEB appoints Amanda Harrison as chief revenue officer to lead commercial strategy and drive growth across its fintech and digital banking services.

Paysend expands card payout support in Uzbekistan, enabling instant transfers to Humo and Uzcard through its global cross-border payments network.

A new partnership enables Paysend to enhance its Open Banking capabilities, aiming to improve transaction speed, coverage, and security for fund transfers.

Eric Bierry, CEO of SBS, reflects on leadership, trust, and the evolving banking landscape—touching on AI, cybersecurity, diversity, and open finance.

As AI reshapes finance, the concept of a proactive, personalised “banking consciousness” emerges—offering tailored insights, automation, and hands-on financial support.

Merchants are navigating complex markets and higher acquisition costs, yet payment systems are often treated as back-end infrastructure rather than drivers of growth. The decade-long era of effortless e-commerce growth

A Consumer Duty webinar on 15 May will provide insights into FCA priorities, industry practices, and key considerations for firms in the payments sector.

Visa’s new VAMP program introduces stricter dispute thresholds—merchants must adopt tools like RDR, OI, and CE 3.0 now to stay compliant and avoid penalties.

A new partnership enables UK merchants to accept Alipay+ and WeChat Pay, expanding access for international customers and enhancing payment flexibility.

Gen Z favours instant, digital-first payments—mobile wallets, biometrics, and wearables are reshaping checkout expectations across retail and travel sectors.

Ecommpay wins Payments Innovation of the Year at the FStech Awards 2025, recognised for its seamless, inclusive payment solutions that empower global merchants.

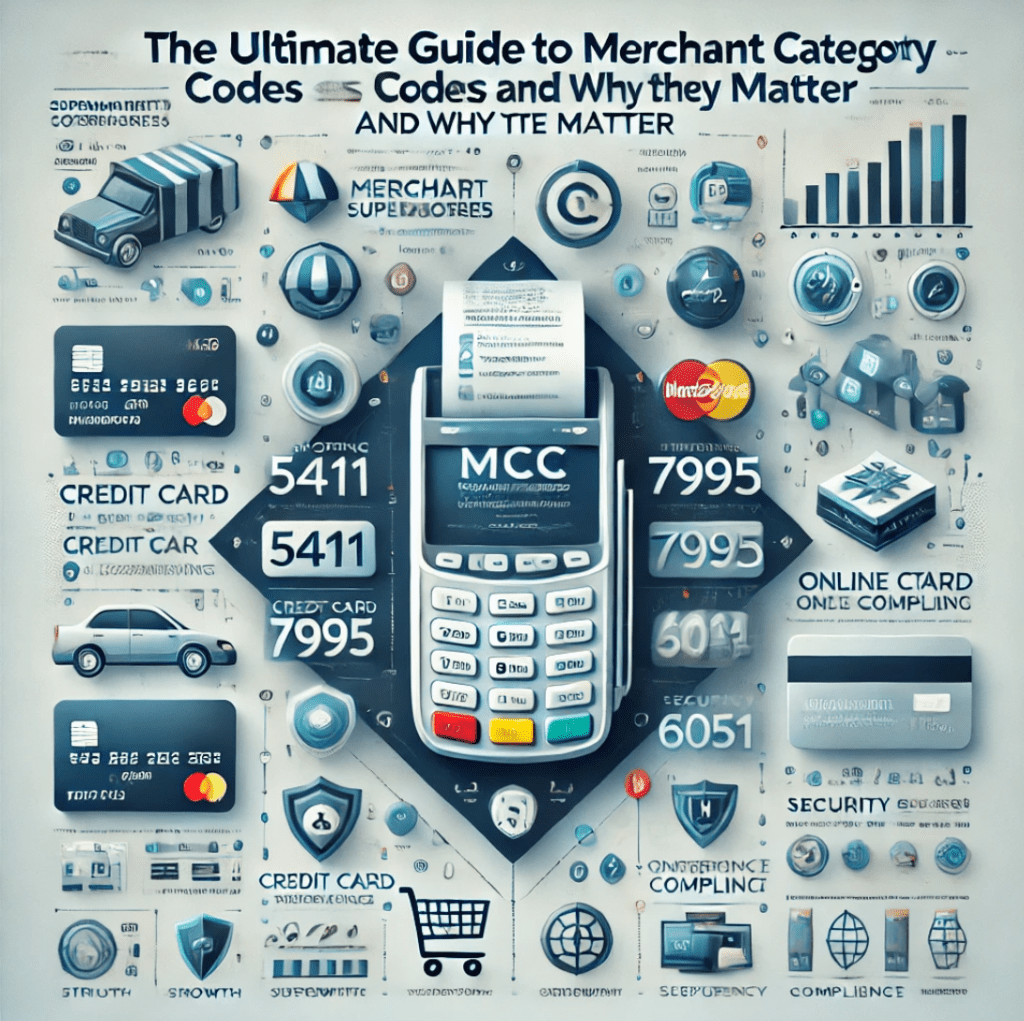

Merchant category codes (MCCs) impact fees, chargebacks, compliance, and payment approvals—understanding your MCC can help optimise costs and reduce risks.

PXP partners with Snowflake to deliver real-time data insights for merchants, combining advanced analytics with payment platform innovation.

Shape and PXP partner to deliver a turnkey payments solution for ISOs, ISVs, and Payfacs, combining automation, customisation, and scalability.

How smaller landlords can improve rent arrears collection with automated engagement and simple payment tools—without adding to workloads.

SEON’s 2025 Digital Fraud Report explores how businesses are adapting to rising AI-driven fraud with increased spending, tech, and specialist teams.

Why merchant category codes (MCCs) matter—and how choosing the right one can reduce fees, manage risk, and improve payment approvals.

Chargebacks911 and Prommt partner to offer end-to-end solutions that help businesses prevent chargebacks and secure remote payments.

Mastercard and Thought Machine expand their partnership to modernise banking with cloud-native core and payment solutions.

Chargebacks and fraud are rising, causing financial losses and operational strain for businesses navigating digital transactions.

How are changing consumer habits shaping the peak shopping season? Discover Tink’s insights and catch them at PAY360 2025.

Are financial institutions risking payment glitches with DIY testing? Explore the benefits of specialist payment testing solutions.

Bottomline has been named ‘Cross-Border Payment Company of the Year: North America’ for its global connectivity solutions.

How can fleet and mobility businesses outsmart payment fraud? Find out in this upcoming webinar.

Can banks and fintechs balance seamless payments with robust security? Explore the debate in this upcoming webinar.

Dialect partners with Kaldi to provide customer support and transaction monitoring.

PXP’s survey finds 64% of UK and US merchants view payment technology as a strategic growth driver.

PXP research reveals the payment preferences, priorities, and frustrations of more than 4,000 consumers across the UK and US

PXP has teamed up with direct booking solutions provider Net Affinity, enabling hotels to streamline reservations and payments.

Global payment platform, PXP, has forged a new strategic partnership with digital solutions platform Xolvis.

Dialect Communications partners with Committee to provide multilingual customer support for their app, digitising traditional committee collections with a focus on community and accessibility.

Paytently names Isabelle Delisle as Chief Payment Officer to strengthen payment solutions in regulated sectors.

Dialect and Synalogik partner to provide combined APP fraud prevention and customer management solutions for the payments sector.

Ripple launches RLUSD, a backed USD stablecoin designed for global financial adoption, offering secure, compliant, and scalable solutions across payments, liquidity, and DeFi.

Skipify and Mastercard partner to offer seamless, flexible instalment payments at checkout, enhancing shopper convenience and merchant conversions.

A2A payments, enabled by open banking, provide faster, cheaper, and more secure direct bank transactions, transforming industries like e-commerce and gaming.

Dialect teams up with FinPay to provide multilingual customer support, enhancing service and enabling market growth.

Dialect Communications, an award-winning Business Process Outsourcer (BPO) that provides front and back office solutions in the Payments sector across the globe is thrilled to partner with Yordex, a provider

Loyalty schemes boost customer retention, and a customer-centric approach helps retailers maximise their benefits.

The Combatting APP Fraud report outlines how upcoming PSR rule changes will drive banks to adopt inbound transaction monitoring and collaborative intelligence.

Self-checkout systems reduce wait times, boost efficiency, and enhance customer experience, becoming essential in modern retail.

Chargebacks911 appoints fintech veteran Mike Elliff as Chief Revenue Officer and EMEA CEO to drive global expansion and tackle rising post-transaction fraud.

Open banking enhances financial convenience and transparency, but security depends on using regulated providers and careful data sharing.

As mobile wallets rise, so do fraud risks—this BPC guide highlights top threats and essential strategies to protect your digital transactions.

Navigating the build vs. buy dilemma in fintech, Enfuce explores expert insights on striking the perfect balance between technology and partnerships to ensure long-term success in modern payment services

Join Deloitte’s webinar on 12 September to review CESOP challenges and discuss upcoming changes. Email Dawn Neill to register.

PXP Financial joins Zebra’s PartnerConnect programme to enhance mobile payment capabilities, leveraging Zebra’s innovative solutions and global partner network.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.