With earnings trends and guidance discussed by the biggest payment firms globally during half year earnings, Jonathan Tyce analyses what this means for the industry and the outlook into 2024.

The global payments industry, ripe for further piecemeal for mergers and acquisitions (M&A) over the next 18-months, now has productivity gains firmly at the top of CEO’s agenda.

These will likely be delivered via a combination of synergies from M&A; exacting cost discipline and efficiency; and the application of new technologies and products to drive economies of scale and boost profitability.

A solid revenue outlook into next year was confirmed at half year earnings from PayPal to Fiserv and Mastercard in the US, and Klarna and Nexi in Europe, with 10-12% annual growth being a fair expectation. This is bang in line with industry leader Visa’s medium term recent experience and guidance.

Buy-now-pay-later (BNPL), instant payments, cloud-native-API-solutions and authentication-technologies were among some of the most discussed topics on earnings calls from late July through to August.

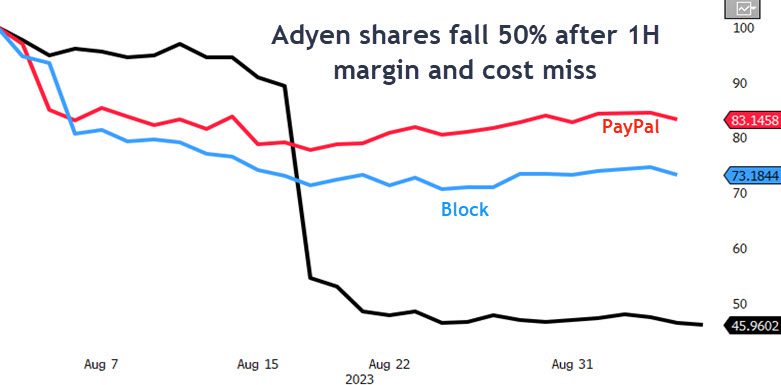

However, fierce competition, wage growth and investment spend still mean that margin and productivity remain very much the key deltas for profits into next year, and fears surrounding these were reflected most vividly in steep falls in the share prices of PayPal, Block and Adyen on their respective results days.

PayPal’s CEO Dan Schulman summed up the efficiency challenge most succinctly. He said: “As we look ahead to the rest of 2023 and into 2024, we expect to drive meaningful productivity improvements.

“Our initial experiences with AI and continuing advances in our processes, infrastructure, and product quality enable us to see a future where we do things better, faster, and cheaper.”

Company guidance and updated outlooks also confirmed that the revenue threat from falling inflation is, in fact, very manageable, even as average ticket sizes shrink on lower prices.

Falling inflation could mean there is a small drag on revenues for payment firms, but this would be more than manageable. This was largely borne out at half year earnings, with Visa’s CFO, Vasant Prabhu, quantifying this drag as “a 2% fall in average ticket size” as fuel prices declined and inflation moderates across multiple categories.

What is more of a concern is credit exposures and credit portfolios, which remain a watch-area, albeit with credit loss experience – as evidenced in the banking sector – still very benign.

Klarna’s half year results demonstrated significant improvement in credit losses, while Paypal’s operating margin guidance miss, which drove much of the share price fall on the day, was driven by increased loan loss provisions for and low revenues from its credit portfolio.

While operating margin was the most prevalent focus of questions and presentations, a widely anticipated rebound in e-commerce was a feature of many US and European payments earnings calls, with 5-8% growth rates forecast across a number of players.

Talk of e-commerce recovery inevitably led to much discussion about advances in digital wallet offerings, rewards innovations and check-out strategies. BNPL was another notable area of growth that many companies are looking to drive in 2024.

Greater use of the cloud and advances in customer authentication (the rollout of passkeys for passwordless security) were common among much discussion about how AI can be harnessed to improve retention, client experience and monetisation.

Klarna’s H1 2023 results marked an impressive rebound some 12 months after its valuation was written down 85%, or nearly $40 billion, as fears about credit losses and slowing growth abounded.

The self-labeled first AI-powered bank in Europe, Klarna returned to profitability and delivered 17% revenue growth for Q2 compared to the same period in 2022, with costs 26% lower and credit losses nearly halving.

PayPal’s innovative deal in June this year to sell up to €40 billion BNPL loans to Kohlberg Kravis Roberts (KKR) reflected the myriad unknowns surrounding BNPL products and, as inflation falls, a pick-up in origination volume and BNPL interest could vindicate KKR’s move and spur further deals.

BNPL’s growth trajectory means it is expected to capture 7% of e-commerce by 2026, according to estimates from eMarketer. This sounds feasible and would imply a gross merchandise value (GMV) approaching $150 billion within three years. Watch this space, with Europe and the UK the epicenter of investment and innovation

Opportunities for growth and customer acquisition through cloud-based API solutions and product is an increasingly hot topic among payments providers, as evidenced at Q2 earnings.

Fiserv Inc.’s leading position in this space, via Clover and its 2022 acquisition of Finxact, was discussed at length. The scalability and cross-border capacity that cloud-native operating systems offer will remain at the forefront of tech-led payments innovation.

Simplification of the compliance process, near-unlimited scalability and technological cloud advances from the likes of Microsoft, Amazon and Google suggest that we will be hearing more and more about how payments solutions are harnessing the cloud to escape point-of-sale limitations and deliver real-time, instant payments and customer solutions.

Further consolidation appears inevitable next year, with the largest European payments companies – Nexi and Worldline – most likely continuing to purchase merchant acquiring books from Europe’s banks.

Fidelity National’s spin from Worldpay, due to be completed by Q1 2024, may kick off further piecemeal deals. We do not, however, anticipate mega-deals of the size of FIS’ ill-fated $43 billion purchase of Worldpay, or Worldline’s $9 billion acquisition of Ingenico in Europe. JVs, small deals and partnerships seems likely to remain the order of the day.

One of the key payments’ takeaways from the H1 2023 earnings season, across processors, banks and big tech remains that competition will continue to squeeze pricing in a race to the bottom.

The shift to digital continues at pace, but profitably growing share of the wallet remains a Herculean task. With the biggest banks and big tech so dominant, innovation, speed and efficiency are the most critical qualities for success.

Over investment in engineers was one of the key fears manifest in Adyen’s precipitous share price fall at Q2 earnings. Ingo Uytdehaage, Adyen’s co-CEO discussed the strategy at a Goldman Sachs Tech conference on 5 September.

He said: “Consistently, we’ve been focusing on building a global platform. We fully control our platform. We’re not dependent upon any third party there […] for instance, we have our own private clouds that we build out globally that gives us full control.”

Whether the huge investment in growth has positioned Adyen to rebuild its Ebitda margin from 43% at H1 2023 to its long-term goal of 65% remains to be seen. What is clear is that being able to justify spending and prove return-on-investment is a growing requirement and in a very competitive marketplace.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.