PrePay Solutions reacts to increased contactless limit

Following the news that the contactless payment limit has been raised from £20 to £30, Ray Brash, MD & Chairman at PrePay Solutions, predicts that contactless transactions will go up

Following the news that the contactless payment limit has been raised from £20 to £30, Ray Brash, MD & Chairman at PrePay Solutions, predicts that contactless transactions will go up

FIS has won a multi-year wealth technology and operations outsourcing commitment from Westwood Trust, a Texas-chartered trust company headquartered in Dallas. Read more here

Proxama is partnering with Stanchion Payment Services to enable Stanchion to resell Proxama solutions for NFC Mobile Payments, Tokenisation, Advanced PIN Management, and EMV Enablement. Read more here.

i2c’s global payments platform and UnionBank’s card issuance expertise deliver quick access to funds and basic financial services. Read more here.

Realex Payments is creating 50 new jobs in Dublin The company will be hiring across a variety of roles in sales, marketing, IT operations and software development as well as

IDT Finance is looking for an Implementation Manager, a Finance Assistant – Reconciliations and a Compliance Analyst Find out more here.

Retailers have an opportunity to improve sales of gift cards, both in-store and online, through better merchandising and other strategies, according to an executive from Stored Value Solutions, which advises

Research commissioned by Advanced Payment Solutions (APS) reveals the complexities that UK SMEs face when attempting to open a business bank account, to the extent that 60% of small businesses

KPMG’s annual customer experience research reveals that retailers now offer the best customer experience Read more here

For the third consecutive year, The Bancorp has been ranked as Top Issuer of Prepaid Cards in the US, according to The Nilson Report, one of the leading publications covering

Amazon has announced a new partnership with UK Trade & Investment (UKTI) designed to help small and media sized enterprises (SMEs) increase their exports and grow their e-commerce sales by

Locke Lord’s latest edition of its Privacy White Paper, Everyone’s Nightmare: Privacy and Data Breach Risks — developed in response to the need for a comprehensive overview of the growing body of

Annecto partnered with the Tickhill cycling Grand Prix in Yorkshire to offer wireless payment terminals to spectators purchasing merchandise. Read more here

Silicon Valley Bank and MasterCard are inviting start-ups from across the United States to apply for Commerce.Innovated., a program designed to help companies that are working in payments, fintech and

BNY Mellon is adding Bottomline Technologies’ Paymode-X payment network to its portfolio of payment solutions, which will help clients convert from paper to electronic payments. Read more here

MasterCard cardholders in the US will soon have even more ways to make safe and convenient mobile payments. Google is beginning to roll out Android Pay in the US, enabling

Bottomline Technologies has been named a top 100 global provider of financial technology on the 2015 IDC Financial Insights FinTech Rankings. The annual IDC FI FinTech Rankings is based on

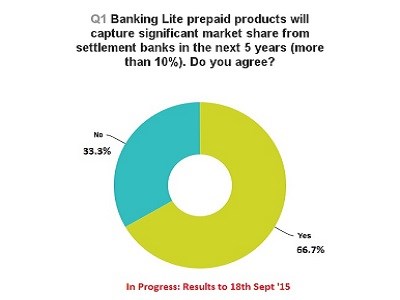

With the emergence of Banking Lite solutions, our latest poll asks “Banking Lite prepaid products will capture significant market share from settlement banks in the next 5 years (more than

The factors driving digital transformation in financial services fall into three categories: market drivers, consumer behaviours and technology advancements. For market drivers, one cannot ignore the booming fintech sector worldwide, if

VocaLink are sharing their report from a survey of users of British ATMs which took place in April 2015. Read the report here.

Irish Tech News shares Features sharing business insights and fintech tips from Paul Burmester, ValidSoft CEO, angel investor and serial entrepreneur. Read more here.

Mike Laven from Currency Cloud has been profiled in an interview with Payments Journal. Read more here.

The way the gaming industry views the payments sector will be an area of great interest for a senior representative of the latter at this year’s edition of EiG in

Standard Life, the leading pensions and savings provider, has signed up to use Callcredit Information Group’s CallValidate software to verify the identities of those drawing down their pensions. Read more

Creditcall, a payment gateway provider and EMV migration specialist, and Diners Club International, a business unit of Discover Financial Services and part of the Discover Global Network, have announced a signed agreement that

Optimal Payments Plc is pleased to announce that change of control approval from the Financial Conduct Authority relating to the acquisition of the Skrill Group has now been received and

Judo Payments, Europe’s only mobile-first payments platform, has partnered with Pennies, the digital charity box by which people can donate a few pence to charity when paying for goods and

MasterCard and Samsung Electronics Co., Ltd are extending their global partnership to deliver Samsung Pay in Europe. Samsung Pay is a mobile payment service that will enable consumers to use their Samsung flagship mobile

Gap is the latest retailer to join Sodexo’s growing retailer network for Money Boost and Simply Gift, now accepting both VISA cards in more than 130 of their Gap and

Following the acquisition by Emerchants Ltd, StoreFinancial Services UK Limited has started the transition to trading as Emerchants Europe and has begun offering the Emerchants suite of products in the

American Express has launched American Express Checkout, a fast and secure way for US card members to check out quickly at participating online merchants by using their americanexpress.com account login. Read

Security First Bank has selected FIS as its new core banking provider. Bank leaders selected FIS to improve service and enhance customer experience. Read more here.

PayPoint has announced a new programme of retail service improvements aimed at helping independent convenience retailers. Read more here.

WEX has been selected to provide its full suite of corporate payments solutions to ServiceMaster Global Holdings Inc. Through this agreement, all corporate and participating franchise vehicles within ServiceMaster’s network, with an

Wirecard Group has announced a partnership with MyOrder, an mCommerce platform, for the issuance of contactless mobile cards based on host card emulation (HCE) technology. Read more here.

Matt White, Senior Manager in KPMG’s cyber security practice, comments on new research on smartwatch security. Read more here.

MasterCard has opened its digital security facility, located in the UK, to its customers, driving further collaboration on key issues that can deliver greater payments peace of mind. Read more

Travellers on the London Underground can withdraw Euros at improved rates from Raphaels Bank cash points until 18th August 2015. To celebrate its second summer providing Euros on the Tube,

The Euro Currency Card by easyJet, which has been managed by PCT since 2013, has been announced as a nominated finalist for the Best Foreign Exchange/Travel Money Retailer in the

Mike Laven, CEO of Currency Cloud was recently interviewed by FINSMES. Read more here.

First Data has acquired digital gift card pioneer Transaction Wireless, the San Diego-based enterprise digital gift card distribution platform. First Data now provides its gift card clients, distributors, partners and resellers

Atom, the designed for digital challenger to the UK banking market, is partnering with FIS to serve banking customers on the go. The Bank of England’s Prudential Regulation Authority has recently

Pannovate has release its new Vid-AU Card web platform with everything you need to build a fully interactive card: from creating Vid(eo)-AU(dio) Card and editing content to Management and Analytics.

Advanced Payment Solutions (APS), a leading challenger to traditional banking service providers, have announced that they are partnering with TradePoint Building Supplies, the trade arm of B&Q. This will provide

Carta Worldwide has been selected to make tap-and-go payment services available to HP customers in Europe, the Middle East and Africa, Asia Pacific and Canada. Read more here.

What are the implications of the new EU anti-money laundering rules? Check out Credorax’s useful Smart Acquiring blog post here.

DigiSEq has developed the technology to remotely personalise wearable devices for contactless payments. DigiSEq is the first to have developed this technology and gained approval from MasterCard using the M/Chip™ Advance

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.