Trust Payments joins Financial 1000

Trust Payments has been listed in the Financial1000 directory, a platform connecting users with a broad range of financial services providers.

Trust Payments has been listed in the Financial1000 directory, a platform connecting users with a broad range of financial services providers.

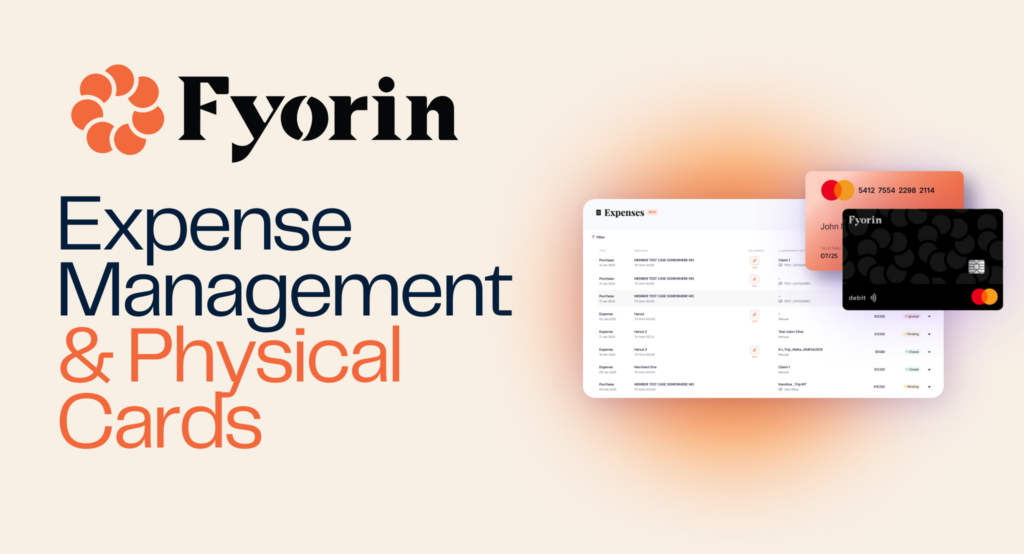

[London, March 2025] — Fyorin, a leading provider of innovative financial operations solutions, is excited to announce its strategic relationship with Discover® Global Network, a global payments network serving 345 million

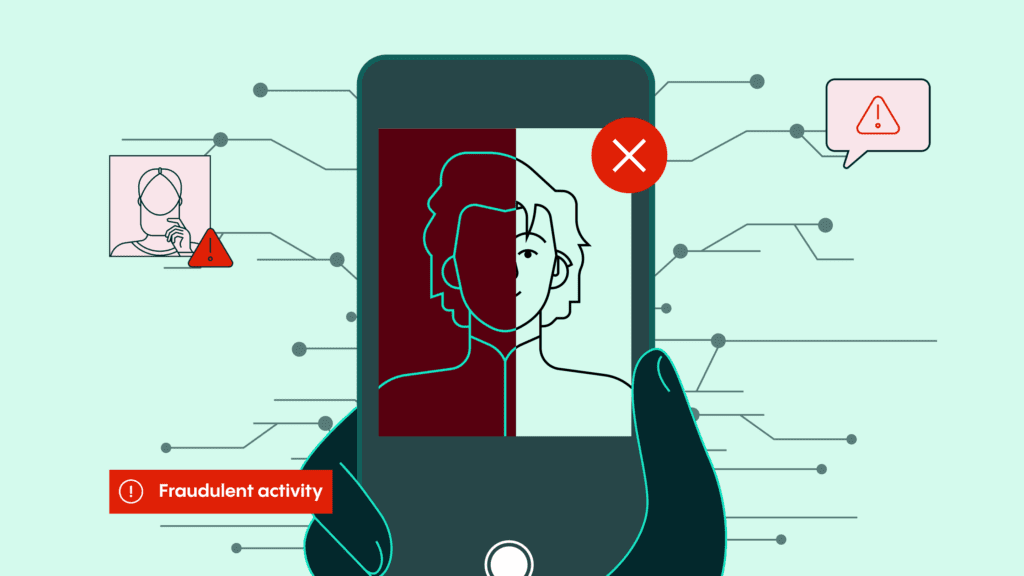

Online fraud is rising, with over 70% of UK payments platforms seeing revenue loss—firms are turning to AI, IDV, and biometrics to strengthen defences.

Integrating digital payments is becoming easier with tools that reduce technical complexity, enhance security, and support a wide range of platforms.

Worldpay’s 2025 Global Payments Report reveals digital methods now dominate, as mobile, fintech, and real-time payments reshape how the world transacts.

Staying compliant with fast-changing payment network rules is costly and complex—centralising updates can cut risk, save time, and turn compliance into advantage.

AI is transforming fintech compliance—boosting fraud detection, speeding onboarding, and ensuring regulatory alignment while demanding ethical oversight and balance.

AI-driven fraud prevention platforms are shifting from reactive to proactive, using full-session visibility and real-time detection to combat evolving threats.

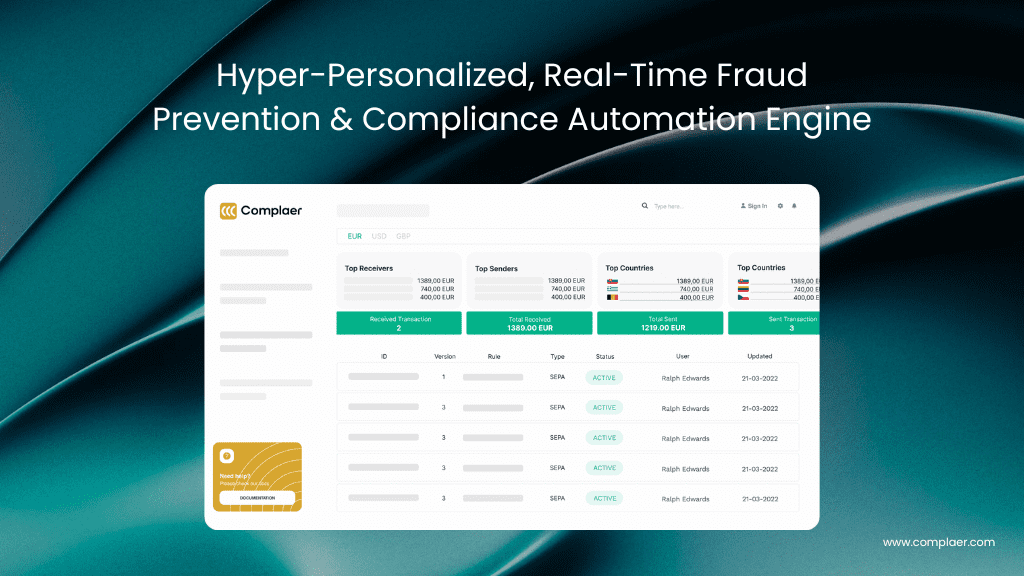

Complaer cuts false positives by 90% and detects fraud in under 10 seconds—empowering compliance teams with real-time, no-code AML across fiat and crypto.

Banks must ditch rigid legacy cores—modular, decentralised architectures enable agility, resilience, and innovation for a truly future-ready enterprise.

From the moon landing to AI-driven payments, technology has reshaped how we transact—quantum computing may be the next leap, but with power comes responsibility.

Edenred Payment Solutions’ new virtual card streamlines insurance claims, enabling instant payouts, reducing delays, and enhancing security for policyholders.

BPC’s latest report explores key trends reshaping acquiring, from soft POS and A2A payments to data-driven services and regulatory impacts.

A look at the FCA’s upcoming safeguarding rule changes for payments and e-money firms — and what businesses need to do to prepare.

Fyorin launches physical cards and smart expense management to help businesses streamline spending, improve control, and automate compliance.

PLIM offers flexible, interest-free payment solutions for aesthetic treatments, making self-care more accessible while supporting clinics to reach more clients.

Unlimit names Simu Liu as its first global brand ambassador, launching a major campaign on versatile payment solutions worldwide.

Lynx Tech launches AI-driven AML screening to help financial institutions combat money laundering with speed and accuracy.

Exactly.com showcases its full-stack payment solution at the Retail Technology Show 2025, helping e-commerce businesses scale and reduce costs.

What’s next for payments regulation in 2025? Hear from industry leaders at the EY Payments Forum in March.

How are Finastra and Salt Edge advancing open banking? Discover their partnership’s impact and future vision.

How is Optimus gearing up for growth in the payments industry? Discover their new strategy and product offerings at PAY360.

How is Flutterwave driving enterprise payment growth in Africa? Discover key insights from its 2024 report.

How does your fraud strategy compare to industry standards? Explore Sift’s Fraud Industry Benchmarking Resource to find out.

How can financial institutions de-risk digital transformation and maintain quality at pace? Discover insights at PAY360’s Disruption Zone.

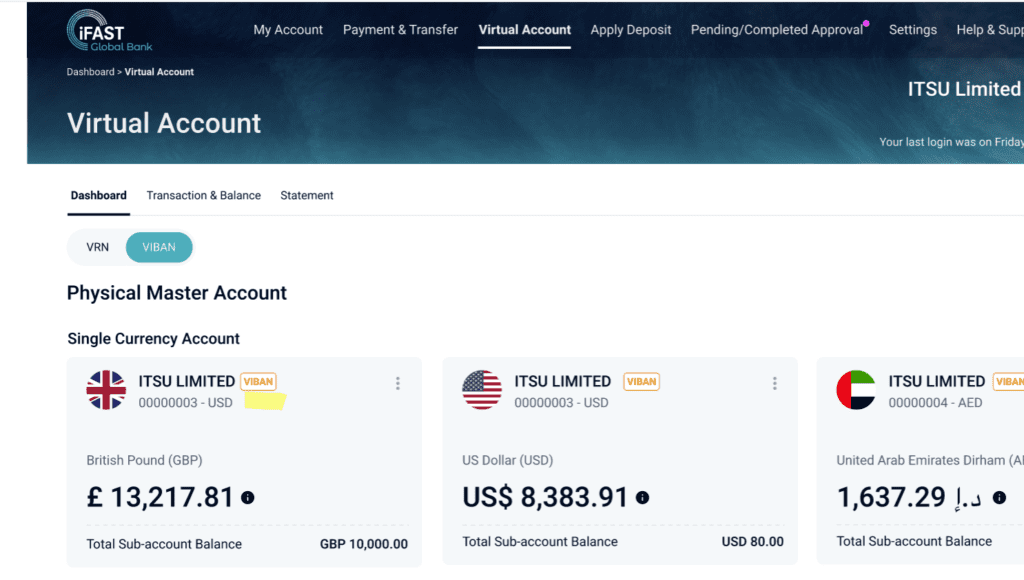

iFAST Global Bank pilots virtual IBANs, offering multi-currency solutions for EMIs, APIs, brokers, and large corporates.

Why must financial institutions rethink authentication to stay competitive post-PSD2? Explore the need for modern, risk-based solutions.

Discover how Mitto’s CRM integrations enable customer engagement across SMS, WhatsApp, and Viber.

Trudenty joins Mastercard’s Start Path to revolutionise fraud prevention with privacy-preserving data sharing and real-time consumer trust insights.

Discover how AI is transforming cybersecurity, both as a weapon for attackers and a shield for defenders, in this webinar.

Digital wallets are playing an increasing role in cross-border payments, shaping the way transactions are conducted globally.

Global survey reveals how 400 financial leaders are shaping digital payments strategies.

Seamless payment orchestration simplifies multi-provider management, optimises acceptance rates, and boosts conversions.

Intelligent chargeback management prevents fraud, resolves disputes, and protects revenue.

Trump’s 2025 order boosts US digital finance leadership, bans CBDCs, and plans a regulatory framework.

Baker McKenzie’s 2025 briefing covers UK financial regulation trends, including post-Brexit reforms, ESG, crypto, and enforcement.

NovitasFTCL’s monthly summary tracks key European FinTech M&A, equity, and VC deals across 11 verticals.

Regulatory fines in 2024 exposed persistent weaknesses in financial crime controls, highlighting issues in governance, transaction monitoring, sanctions screening, and compliance investment.

PXP strengthens its leadership team with the appointment of Alex Apergis as chief revenue officer.

From September, large organisations face criminal liability for fraud by employees or associates, requiring robust prevention measures.

myPOS acquires Toporder to enhance payment solutions and support SME growth in France.

Stablecoin solutions improve transaction speed, transparency, and regulatory compliance for modern financial management.

By 31 March 2025, UK financial services firms must fully comply with new operational resilience rules, safeguarding critical services and mitigating disruptions.

Social media is reshaping fintech by democratising finance, empowering individuals, and prompting new regulatory scrutiny.

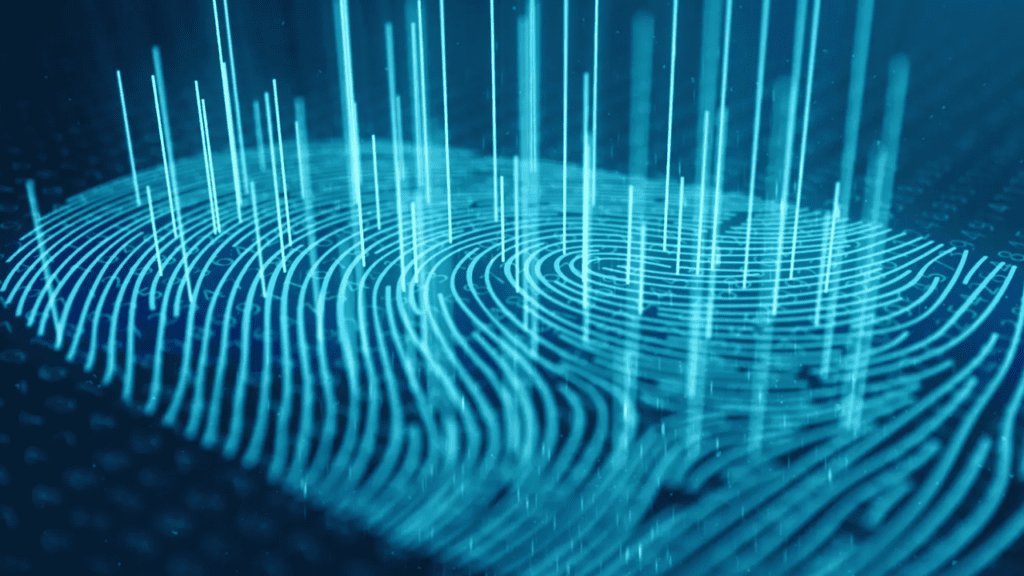

Digital identity is reshaping industries, offering benefits like streamlined processes and enhanced security, but also presenting data privacy and interoperability challenges.

CP24/20 aligns payment services regulations with the CASS regime, with key impacts to be discussed in an upcoming webinar.

Privat 3 Money partners with KYC360 to upgrade onboarding and compliance processes, aiming to improve efficiency and client experiences.

The 2025 Veriff Identity Fraud Report shows a 21% rise in online fraud, with financial services as primary targets.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.