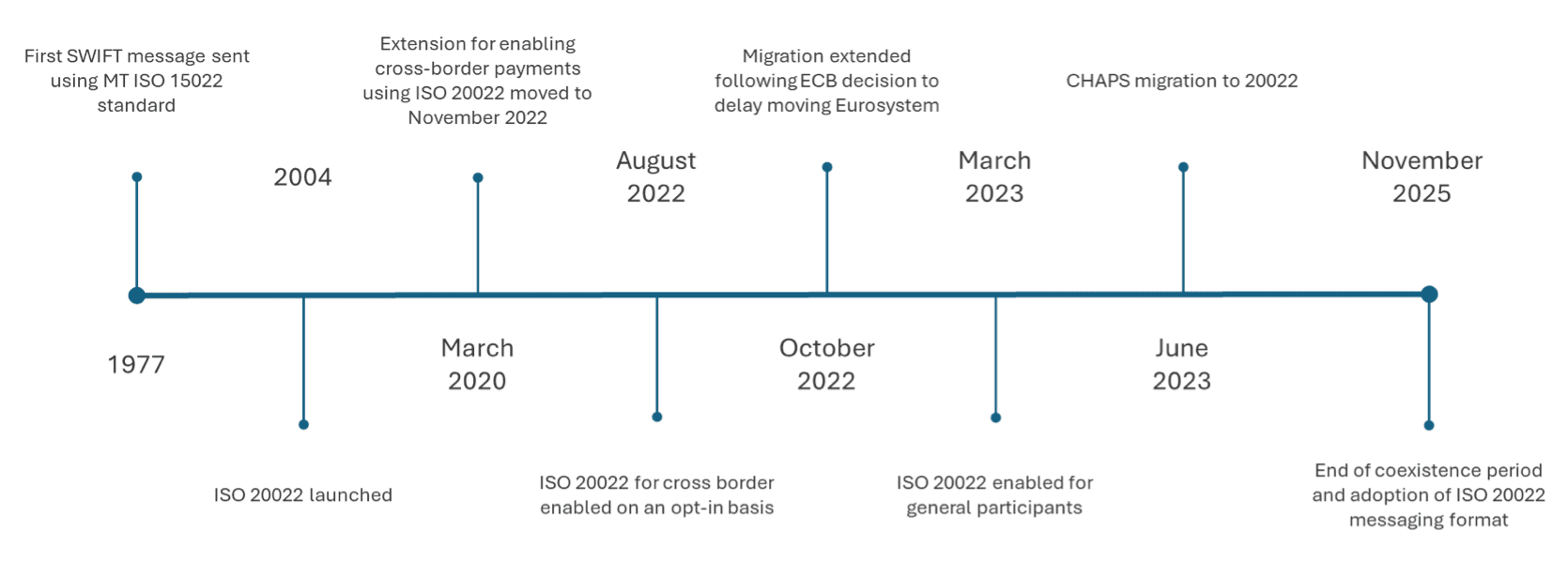

As the payments world moves closer to full adoption day by day, the move to ISO 20022 adoption from a strategic perspective becomes ever more relevant. A key principle to understand with the ISO migration is that it’s not just a technology/IT programme of work; it is a full financial institution roll-out, and underestimating the size of the challenge can prove a high-risk approach.

ISO 20022 is a complete set of standards for all financial institution (FI) messages. It will replace the existing MT ISO 15022 format with a data-rich MX ISO 20022 format, which will be able to carry data embedded within messages that have been difficult to send to date. Enrichment of this payment data, combined with additional data standards, will enable FIs to benefit from payment processing efficiency and economic gains.

Challenges of data enrichment

Instant payments continue their dominance of the payments market, with many regions already adopting or poised to adopt the medium to offer instant payments. The European Parliament has made instant payments mandatory under new regulations by the end of 2024 (inbound and outbound by September 2025).

Banks operating out of the eurozone must be ready not only for single euro payments area (SEPA) instant payments but also provide the OLO ‘one-leg-out’ service, where one account is outside the eurozone, bringing cross-border instant payments into play. As of April 2024, over 20% of global cross-border payments traffic on Swift was already utilising ISO 20022.

Many real-time gross settlement schemes (RTGS) schemes are already ISO 20022 native; to use these rails and offer instant payments, being ISO 20022 compliant is Hobson’s choice (there is simply no choice). Instant payments is just one of the new(er) technologies that will rely on ISO 20022 to operate and benefit from its capabilities.

Enriched payment data is both a blessing and a curse. Current systems may struggle to handle the additional data fields and volume introduced by the MX format.

The time for strategic adoption is now

While ISO 20022 will offer a wealth of benefits, it’s important to recognise that it isn’t an easy task. It is not as simple as mapping MT messages to MX messages. Banks must review the entire end-to-end stack and understand what systems and applications need to be migrated to newer infrastructure and systems. The programme needs to account for payment processing, but also reconciliation, investigations, sanctions, reporting, treasury, IT and risk all need to be studied, and the changes understood, and many hands need to be involved, it’s about bringing multiple stakeholders together as one (we all know this is much easier to write down and say than do).

Benefits of ISO 20022 compliance outweigh the challenges

Increased transparency (in line with one of the core objectives for the G20) by leveraging data contained within the enriched data sets will also support increased straight-through processing (STP). STP for payments remains a key priority for most institutions. A key benefit of ISO 20022 is faster processing of transactional and cash reporting messages, which provides a great advantage for financial institutions and final beneficiaries and helps institutions with cash management, forecasting, and liquidity.

More efficient reconciliation and returns can be achieved by reducing delays in processing that result from unstructured, incomplete, inconsistent data, and an additional gain in reconciliation and returns can be realised. With ISO 20022, it is anticipated that up to 84% of messages can be sorted automatically. Dedicated returns and investigations messages that all use standardised return codes and delays experienced by customers when banks apply returned funds to their accounts or respond to queries should also be reduced. The customer journey for reconciliation will be enhanced with dedicated reference fields in conjunction with structured, standardised remittance data.

Many use the phrase ‘data is the new oil’ when referring to the ISO 20022 change, but what good is oil without refinement? Firms can leverage analytics for evolving business models, improving automation, compliance, and customer orientation. Building a richer view of customers will also help spot ‘out-of-norm’ payments trends.

Fraud and financial crime remain constants. More effective sanctions screening with dedicated country fields and legal entity identifiers, enhanced fraud checking with five key data points collectively known as the EFD (enhanced fraud data), and the standardised format can combine to help institutions in their continued fight. The standardised format is also a primary candidate for automation.

Standardising messaging across the industry benefits from simplifying the operations processes for payments processing, investigations, data analytics, and reporting, which will help reduce these costs. With a universal message type, integration across schemes will open up across the industry faster. Several RTGS domestic schemes have already moved to ISO, and with most payments ending in RTGS, if you want to drive frictionless payments for your customers, being part of the e2e chain is paramount.

There are challenges but also rewards–how each institution adopts and approaches a migration will vary.

Build vs buy: Choosing the right path

Many have opted for a converter/translator to receive inbound MX messages and convert them back into MT messages for processing, then back to MX to send outbound. Reliance on this method can lead to truncation and loss of data, breaks in the STP, and, more importantly, making cross-border payments increasingly difficult. Without instant and cross-border payment capabilities, customers may seek other providers.

Building an in-house native solution might not be viable if this journey is not already underway, with timelines fast closing in on the November 2025 deadline. Often resource-intensive and time-consuming (especially combined with the volume of upcoming regulations—SEPA Inst, DORA, PSD3, PSR, IP, FiDA, the list is long), the ability to balance regulatory compliance, ISO 20022 compliance/migration, innovation, and BAU activities is difficult to face down.

The age-old ‘build vs buy’–an option remains to partner with a vendor to take the journey together, being able to leverage an out-of-the-box but highly configurable native solution, and understanding how to migrate services, or indeed enable new instant services for consumption, might be the most viable option.

Whatever option is being considered, now is the time to shift from a tactical to a strategic adoption approach.