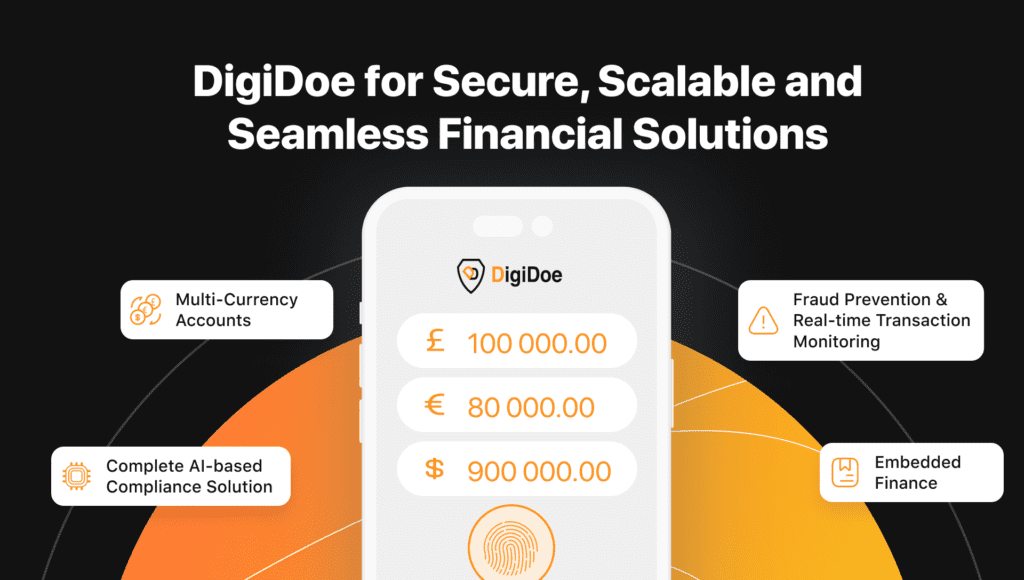

Businesses and individuals expect seamless, borderless financial services in today’s fast-paced world. DigiDoe leads the way by leveraging cutting-edge technology to transform global payments, AI-driven compliance and fraud prevention.

The evolving banking and EMI landscape

Electronic money institutions (EMIs) are transforming traditional banking services into digital-first experiences, offering a broad spectrum of payment solutions at competitive costs. EMIs are empowering businesses to expand globally with ease. But even with these advances, certain issues persist:

- Fraud risks continue to escalate, with cybercriminals evolving faster than traditional security measures.

- Regulatory compliance risk is one of the industry’s biggest headaches, causing significant losses for clients and financial institutions.

- Fragmented markets create friction for businesses operating across multiple currencies and regulatory landscapes.

At DigiDoe, we recognise these challenges. Our platform empowers businesses with the tools they need to thrive in the global marketplace. Here is how we are changing the game:

1) AI-driven fraud prevention and security

Fraud remains one of the most pressing issues in digital payments, especially for cross-border transactions. DigiDoe’s state-of-the-art AI-driven fraud prevention system uses advanced machine learning to scan and analyse transaction patterns in real-time. The patented AI-powered security solution proactively monitors and assesses transactions, studying account behaviour, geographical location, device usage, and spending patterns. Our system flags suspicious activities before they escalate into bigger threats.

The transaction monitoring and financial crime prevention system, paired with patented multi-factor biometric-based user authentication, ensures only authorised individuals access your account. Our AI-driven platform constantly evolves to stay ahead of new threats, keeping your and your client’s funds safe 24/7, including protection from Authorised Push Payments (APP) fraud.

2) Regulatory compliance without headaches

DigiDoe simplifies navigating the global regulatory landscape with an AI-driven compliance solution that keeps your business ahead of challenges and regulatory changes. By partnering with DigiDoe, you can significantly reduce the time and cost of entering the financial market, whether setting up a small fintech or a digital bank in the UK, Europe, and the US. DigiDoe enables your business to grow globally and reach worldwide clients, including Latin America, the Caribbean, Sub-Saharan Africa, and South Asia.

3) Seamless multi-currency solutions

Operating in different countries often means juggling multiple currencies, which can be time-consuming and costly. DigiDoe’s platform simplifies this by offering seamless multi-currency solutions, enabling businesses to receive, hold, and send payments in major currencies such as USD, GBP, and EUR, all from a single account. This provides full control and transparency over your finances.

Global businesses need quick, transparent currency exchange solutions with shorter waiting periods. DigiDoe offers competitive forex rates for 38 currencies, allowing users to buy or sell in real-time. With direct access to the FX market and quick settlement, you save time and gain liquidity.

The future of global payments is defined by security, transparency, cost and speed, principles that DigiDoe stands by. Our forward-thinking solutions help businesses scale securely and efficiently.