PAY360 2025 unpacked: Key survey findings shaping the future of payments

This report presents data-driven insights from a major industry survey, highlighting the key trends, risks, and priorities shaping payments in 2025.

What is this article about?

The findings of The Payments Association’s State of the Industry 2024 survey, which examines the current state and future challenges of the payments industry.

Why is it important?

It provides crucial insights into emerging trends, challenges, and opportunities in the payments sector, helping stakeholders make informed decisions.

What’s next?

The industry must focus on technological investments, enhancing security, and addressing regulatory and interoperability challenges to stay competitive.

The Payments Association recently published its State of the Industry 2024 survey, which gauged the current state of the payments industry. This survey, encompassing responses from key industry players worldwide, provides valuable insights into the sector’s evolving landscape, challenges, and opportunities. The findings reflect professionals’ perspectives across various seniority levels and industry segments, including banking, digital assets, and financial crime prevention, among others.

The survey results offer a detailed analysis of critical areas such as the adoption of emerging technologies, regulatory compliance, financial crime, and customers’ evolving needs. Furthermore, the survey highlights the key challenges faced by the industry, such as cyber-security threats and the need for interoperability between different payment systems. Additionally, it explores the industry’s outlook, with a significant focus on technological investments and customer experience enhancements.

This report aims to provide a comprehensive overview of the survey findings, offering a snapshot of the current trends and future directions in the payments industry. It serves as a valuable resource for stakeholders seeking to navigate the complexities of this dynamic sector.

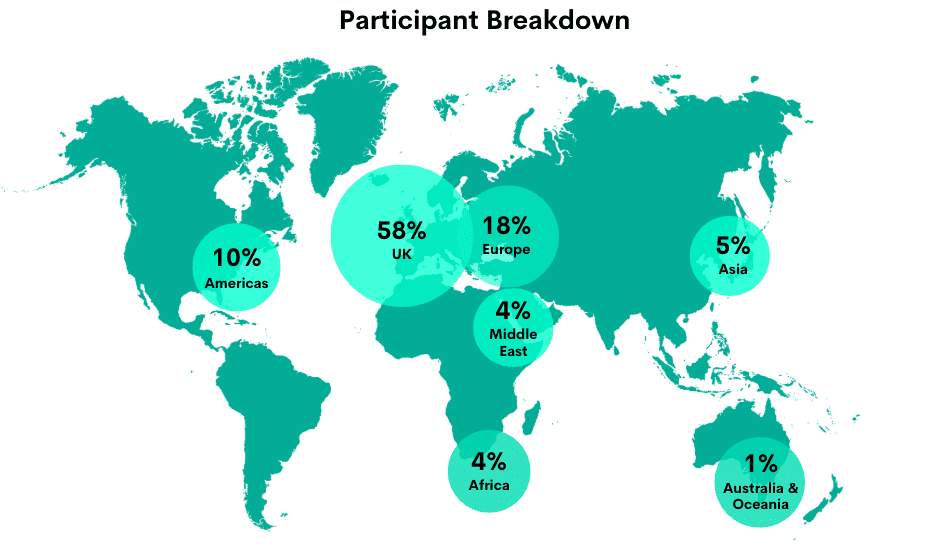

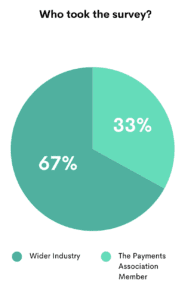

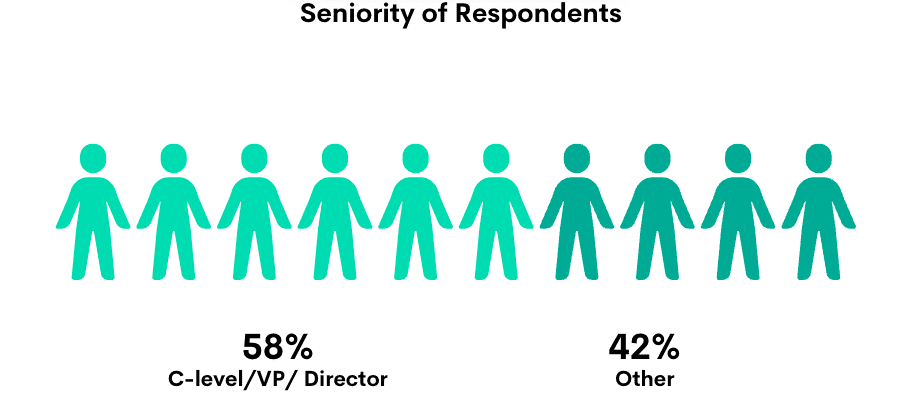

The survey findings paint a comprehensive picture of the current and future state of the payments industry. Among the respondents, 54% were from the United Kingdom, followed by 7% from the United States and 3% from Germany. The survey had a strong representation from senior roles, with 58% of participants holding C-level, VP, or director positions, indicating that the insights gathered are from those with significant decision-making power.

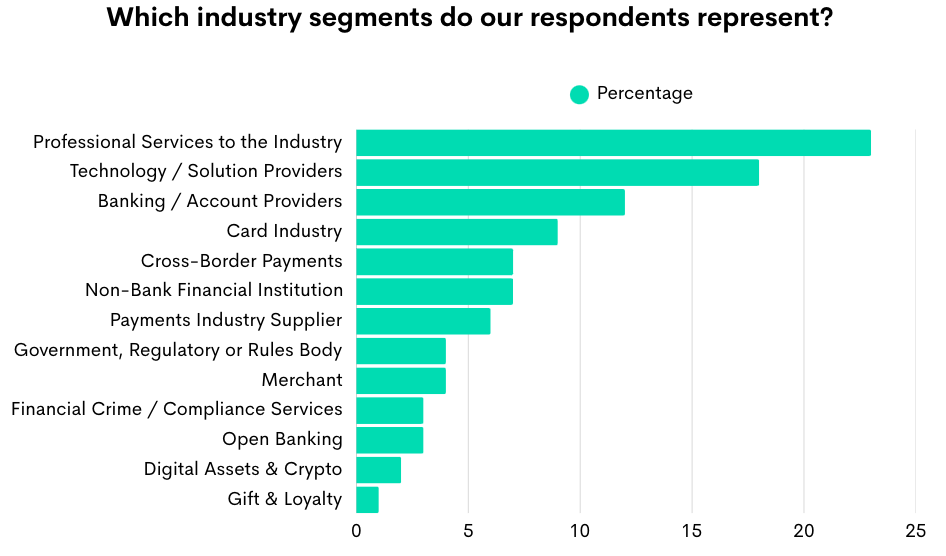

Regarding industry breakdown, 12% of respondents came from Banking and Account Providers, 23% from Professional Services, and 18% from Technology/Solution Providers. The survey results show that financial crime and cyber-security threats are the industry’s most significant challenges, with 28% of respondents highlighting this issue. Compliance with new regulations remains a critical concern for 18%, while 11% see the need for better interoperability between different payment systems as a pressing challenge.

The survey also highlights opportunities in the sector, with 13% of respondents identifying connected and embedded commerce as a significant area of growth, followed closely by open banking and AI, each noted by 13% and 12%, respectively. When considering the skills needed for the future, 22% of respondents emphasized the importance of customer experience management, while 20% highlighted technical skills, and 17% pointed to data analytics.

Budgetary trends are positive, with 49% of respondents indicating an increase in their budgets over the next 12 months. This suggests a continued investment in areas such as technological capabilities and digitalisation. In terms of emerging technologies, generative AI and machine learning are anticipated to be widely adopted, with 51% and 19% of respondents, respectively, planning to integrate these technologies into their operations. Despite these advancements, the overall outlook for the industry is predominantly positive, with 60% of respondents expressing optimism, while 20% remain neutral and a minimal 3% expressing a negative outlook.

The survey’s broad participant base, with 54% from the UK and notable contributions from other regions, reflects a well-rounded perspective on the payments industry. The significant presence of senior leaders—58% in C-level or VP roles—adds considerable weight to the findings, ensuring they represent the views of key decision-makers. The diversity of industry segments is also notable, with 23% of respondents from professional services and 18% from technology and solution providers, underscoring the importance of innovation and service delivery in shaping the sector’s future. Other key segments include banking and account providers (12%), the card industry (9%), and cross-border payments (7%), highlighting the broad representation of the payments ecosystem in the survey. This diverse participation ensures that the survey findings are comprehensive and reflect the industry’s varied landscape.

State of the Industry 2024 survey reveals key trends, challenges, and opportunities in the payments industry. Join The Payments Association to read the full article.

This report presents data-driven insights from a major industry survey, highlighting the key trends, risks, and priorities shaping payments in 2025.

Your quarterly overview of the key regulatory changes impacting payments—what’s happening, what’s coming, and what actions to take

AI is reshaping the fight against payment fraud, prompting financial leaders to adapt with smarter tools, better data, and cross-sector collaboration.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.