The rise of self-checkouts and how they’ve changed retail

Self-checkout systems reduce wait times, boost efficiency, and enhance customer experience, becoming essential in modern retail.

Self-checkout systems reduce wait times, boost efficiency, and enhance customer experience, becoming essential in modern retail.

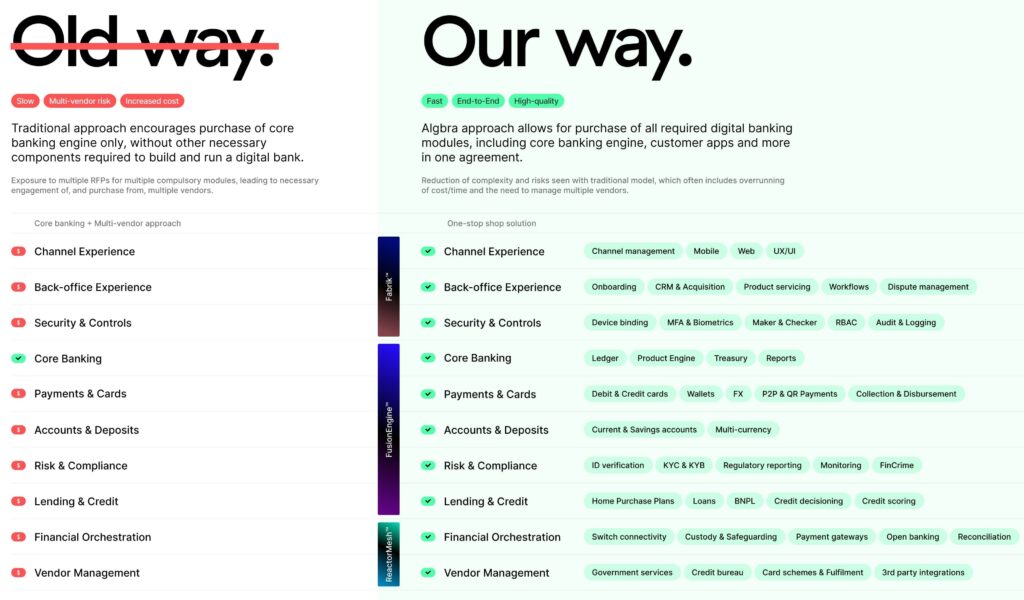

Algbra Labs’ fintech-as-a-service (FaaS) simplifies building digital financial platforms, cutting costs and time, as seen with Standard Chartered’s Shoal.

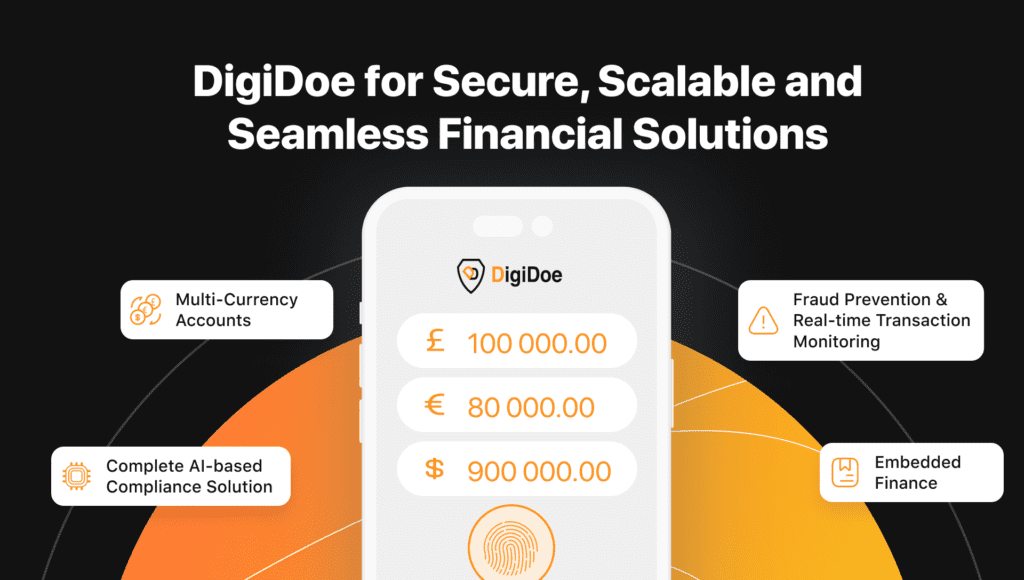

DigiDoe revolutionises global payments with AI-powered fraud prevention, multi-currency solutions, and simplified compliance for secure, efficient business growth.

Join your fellow members at our popular networking event – establish new contacts and sales leads. The event will run between 18:00 – 21:00 GMT on Tuesday 3 December 2024

The UK is undergoing a ‘seismic shift’ in how people pay (Nikhil Rathi, CEO, FCA), with wallets on the rise to become the default payment type for many. This raises

Trust Payments provides businesses with secure, modern payment solutions to adapt to evolving fintech trends such as digital wallets and mobile payments.

PostFinance improved dispute management and fraud prevention with Rivero’s Amiko solution, boosting efficiency by 500% and enhancing customer experience.

Financial House won the Most Innovative Fintech award and launched a global card-acquiring solution for seamless payments.

In the fast-moving payments industry, trust must be replaced by a “Protection Model” focused on safeguarding compliance, technology, and risk management.

Navigating the build vs. buy dilemma in fintech, Enfuce explores expert insights on striking the perfect balance between technology and partnerships to ensure long-term success in modern payment services

Progressive modernisation enables banks to quickly launch innovative products using modern cloud technology alongside existing systems, reducing costs and risks without full core replacement.

The Bank of England has recently published a paper on its approach to innovation in money and payments (click here to view). The paper aims to understand what the industry thinks

Breakfast in the Boardroom: The Product Edition Creating a successful product requires careful planning, research, and effective decision-making. As a product owner, you must constantly adjust to the changing market

Get the 360 experience with a delegate pass. Our mantra: We do not choose speakers who read from a PR script. We focus on programming complex challenges into fresh and

This two-day course covers the fundamentals of the card payments ecosystems. The first day covers the mechanics of card payments, introducing ecosystem actors and mechanisms (e.g. authorisation, clearing and settlement),

AI has the potential to solve some of the biggest challenges faced by financial institutions. But how can we navigate this ever-evolving landscape to our advantage? From machine learning, and

The PAY360 Awards celebrates innovation and collaboration by recognising companies that have made significant advances in how we pay today. Now in its 18th year, The PAY360 Awards is the

The world of payments is constantly evolving, offering consumers more choice and convenience. We have seen the rise of context-based payments, biometric authentication, wearables and mobile apps. In 2020, Amazon

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.