Ordo is on a mission to make paying and getting paid easy, helping everyone control their finances, from large enterprises to small businesses and consumers. Using Open Banking technology, Ordo has digitised the process from buying goods or a service, invoicing, payment, reconciliation and confirmation to make it seamless for business and easy for payers.

Ordo has partnered with CGI, independent IT and business consulting services firm delivering an end-to-end portfolio of capabilities, from strategic IT and business consulting to systems integration, managed IT and business process services and intellectual property solutions.

Together they helped PFP energy, a not-for-profit energy company, or as they like to call it ‘Profit for Purpose’….a partnership with that warm fuzzy feeling.

Having launched with its Neighbour2Neighbour campaign on 23 March 2020, Ordo is coming up to its first birthday of being live, and never have UK businesses needed an integrated Open Banking request-for-payment service more. Whilst businesses have had to find ways to survive, adjusting to staff working from home, furloughed employees and colleagues who had become teachers overnight, they were offering a lifeline of payment holidays while their customers financially struggled.

With cash tight, businesses are going to need efficient and effective, but polite, payment solutions.

We all appreciate our key workers on the front line, and there are also essential services like energy, the staff for which are, for the foreseeable future, now scattered into their individual (hopefully warm!) homes.

How do you support a nation’s energy supply and collecting payment from people in a crisis, with staff that are also in the same boat, working at home amidst unprecedented change?

The answer is, to look at what your customer needs, how your business deliver it, finding the right partner and creating a solution together.

Lockdown has meant:

| Customers want:

|

PFP Energy wants:

|

| * Support

|

* Lower costs

|

| * Certainty

|

* Security

|

| * Security

|

* Auto reconciliation

|

| * Convenience

|

* Liquidity |

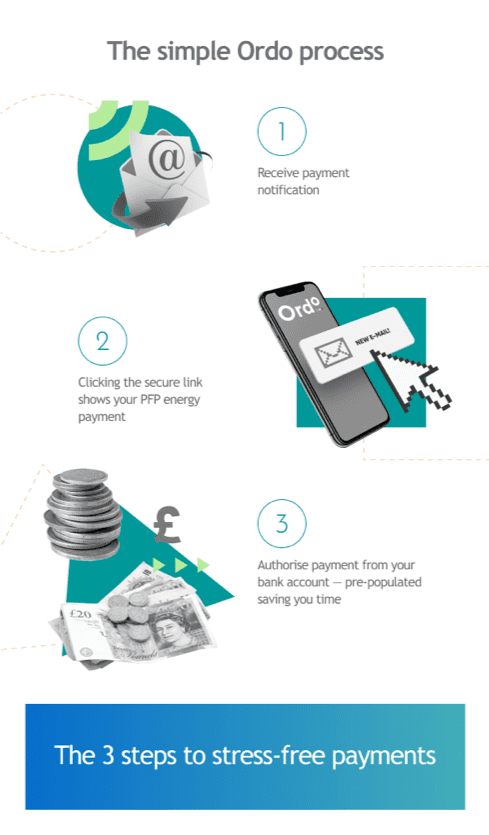

Ordo, utilising its channel partnership with CGI, worked with PFP to enable PFP call centre staff to have access to a fully secure payment platform, myordo.com, allowing them to easily take instant payment from their customers giving both parties confidence the right amount has been paid and received into the right account. Ordo uses Open Banking to be able to transfer money directly and instantly from a customer’s bank account to the businesses bank account, by the business sending a pre-populated digital request for payment to their customer. The customer immediately receives a secure link or text message which, within a few taps from their smart phone, they can authorise payment, directly from their own bank account.

All this was with minimal integration. All PFP needed to do was register at myordo.com, (which takes 3 minutes, we’ve timed it!), connect the account they want to be paid into, and use either the Ordo App and Web solution, or the Ordo bulk upload capability when sending out mulitiple requests for payment.

PFP also utilised the Ordo Bridge tool for automatic upload of requests for payment to be distributed, saving even more time and money and taking the pressure off their business, staff and ultimately customers.

At a time when people and businesses are under stress from all directions, ease, security and certainty are what people crave, and that is exactly what Ordo delivers. Partner with us Check Ordo out, book a short demo or try for free

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.