Merchants and the 2025 consumer: Adapting to evolving payment preferences

From cash to contactless, UK consumers are more fragmented than ever. Here’s what it means for your checkout strategy.

What is this article about?

The results of The Payments Association’s consumer behaviour survey focussing on payment preferences and trends.

Why is it important?

It highlights key insights into how different demographics prefer to pay, providing valuable information for businesses and policymakers.

What’s next?

The findings will help guide future decisions on payment methods and innovation in the financial sector.

In August, The Payments Association conducted a targeted survey to better understand the evolving payment preferences of UK consumers. The YouGov analysis institute conducted the survey, which engaged 2,069 participants and was undertaken between 19-20 August and representative of all UK adults 18+.* The findings provide a nuanced picture of how diverse demographic groups manage everyday transactions—whether through cash, cards, or emerging digital payment methods. The insights gathered offer payments professionals a comprehensive view of the trends shaping the current landscape, highlighting key variances in behaviour across age, region, and income.

For payments leaders, these findings are not just informative but essential for shaping future strategies. As digital solutions gain traction and the use of cash declines, understanding the underlying factors driving these changes is crucial. The results offer a clear direction for industry stakeholders, outlining opportunities for innovation while ensuring that financial inclusion remains a priority. This data-driven analysis will help guide the development of payment systems that are adaptable, inclusive, and aligned with the needs of today’s diverse consumer base.

The survey reveals clear trends in how UK consumers are adapting to changes in payment technologies. Contactless debit cards are the most widely used method for everyday transactions, particularly among younger consumers and women. Mobile wallets, such as Apple Pay and Google Pay, are also gaining popularity, especially with younger demographics, while cash use remains prevalent among older generations and lower-income groups. This shift towards digital payments highlights the growing reliance on convenience and speed.

Despite the increasing popularity of digital payments, cash remains a significant part of the payment landscape for many. Older consumers, lower-income households, and those in certain regions continue to favour cash, using it regularly for budgeting and financial control. There are also regional differences in payment preferences, with higher rates of cash usage in Northern Ireland and the Midlands, contrasting with greater digital adoption in London and the South East.

The data also indicates that while new technologies like wearable payment devices and cryptocurrencies are on the rise, their adoption remains limited. Most consumers have not yet integrated these methods into their daily routines, preferring more established digital or traditional payment methods. These findings paint a picture of a payment landscape in transition, where innovation is rapidly transforming consumer behaviour, but long-standing habits and preferences still play a crucial role.

Cash remains an important payment method for many consumers despite the rise of digital alternatives. The frequency of cash usage is shaped by factors like convenience, budgeting preferences, and access to digital payments. Understanding how often consumers use cash provides insight into its enduring role in everyday transactions amid a shifting payment landscape.

The data on cash usage highlights key differences across demographic groups. While 22% of respondents use cash more than once a week, 6% never use it, illustrating a divide in financial habits. This gap may be influenced by access to digital payment methods, personal preferences, or a reliance on cash for budgeting. As digital payments grow in popularity, those who depend on cash, particularly in rural or lower-income areas, could face potential exclusion if cash becomes less accessible.

Gender and age are notable factors in cash usage. Men (41%) use cash more frequently than women (33%), potentially due to different spending patterns or industries where cash is more common. Older individuals (55+) are also significantly more likely to use cash regularly (45%) compared to younger people (18-24) at 36%. This generational divide suggests that older adults, more familiar with cash, could face challenges as payment options shift toward digital alternatives.

Regional and social class differences also stand out. Northern Ireland has the highest rate of cash usage (58%), while the South has the lowest (30%). Cash use is more frequent among lower social grades (42% in C2DE) than higher ones (33% in ABC1), reflecting financial habits linked to managing tight budgets. Similarly, unemployed individuals (38%) and retirees (46%) rely more on cash compared to full-time workers (30%), indicating that those with fixed or lower incomes may find cash essential for daily management. These patterns underscore the potential for financial exclusion if the shift to cashless systems doesn’t consider these groups.

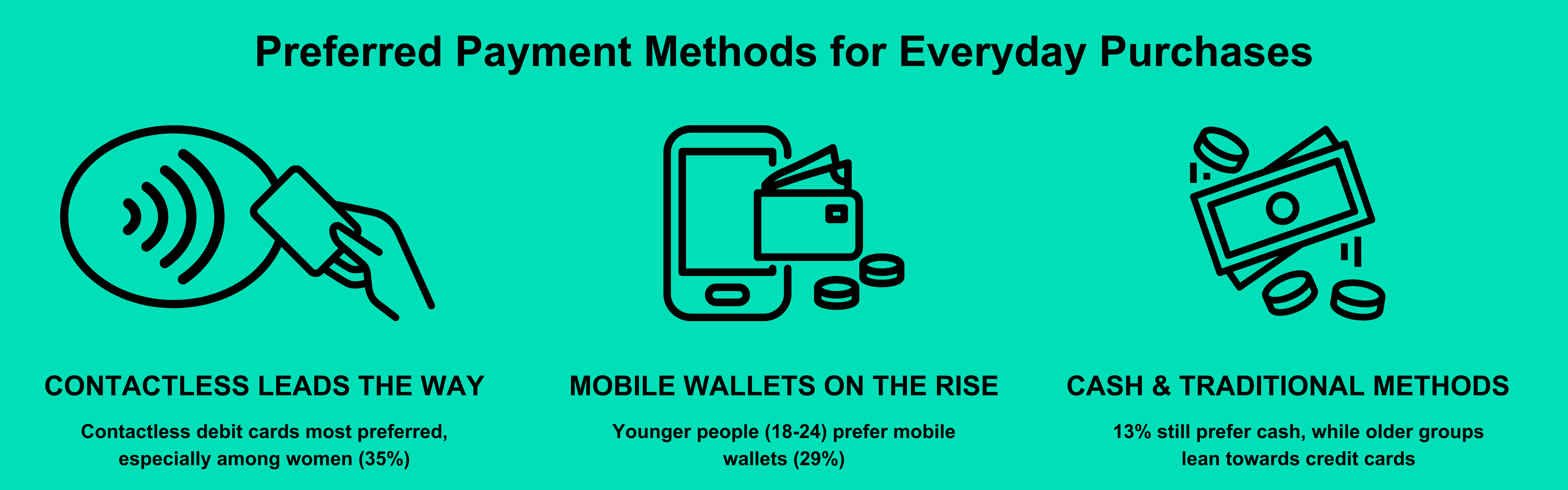

As consumers increasingly embrace convenience and speed, their choice of payment methods for everyday purchases reflects evolving habits and technological advancements. From contactless cards to mobile wallets, preferences are shifting towards more seamless digital solutions. However, traditional methods such as cash and credit cards still hold importance for certain segments of the population. Understanding the factors behind these choices provides insight into how consumers navigate the growing array of payment options available today.

The data reveals clear trends in payment preferences, with contactless debit cards being the most popular (29%), especially among women (35%) compared to men (24%). This convenience appeals to quick transactions but may leave behind those less familiar with digital payments, such as older or rural populations. Mobile wallets like Apple Pay and Google Pay are also on the rise, with 175 claiming they are their preferred payment method for everyday purchases, particularly among younger people (29% of 18-24-year-olds), who are more comfortable with digital technology. However, the shift towards mobile payments may deepen the digital divide, excluding those without access to smartphones.

Cash remains important for 13% of respondents, particularly men (15%) and lower-income groups (C2DE) (19%), who may rely on it for budgeting. Credit cards are less favoured overall, with 6% preferring chip and pin and 9% preferring contactless credit cards, primarily among older individuals. Regional differences are evident, with the South favouring contactless payments more than Northern Ireland, while socio-economic factors also influence preferences. For instance, higher-income groups and full-time students are more likely to adopt mobile wallets, while unemployed individuals remain more reliant on cash.

Family dynamics also affect payment choices. Larger households (with three or more children) are more likely to favour debit cards (52%) and contactless debit card options (33%), drawn to the convenience these methods offer. However, if cash options dwindle, some families may struggle to adapt, particularly when using cash to budget or teach financial habits.

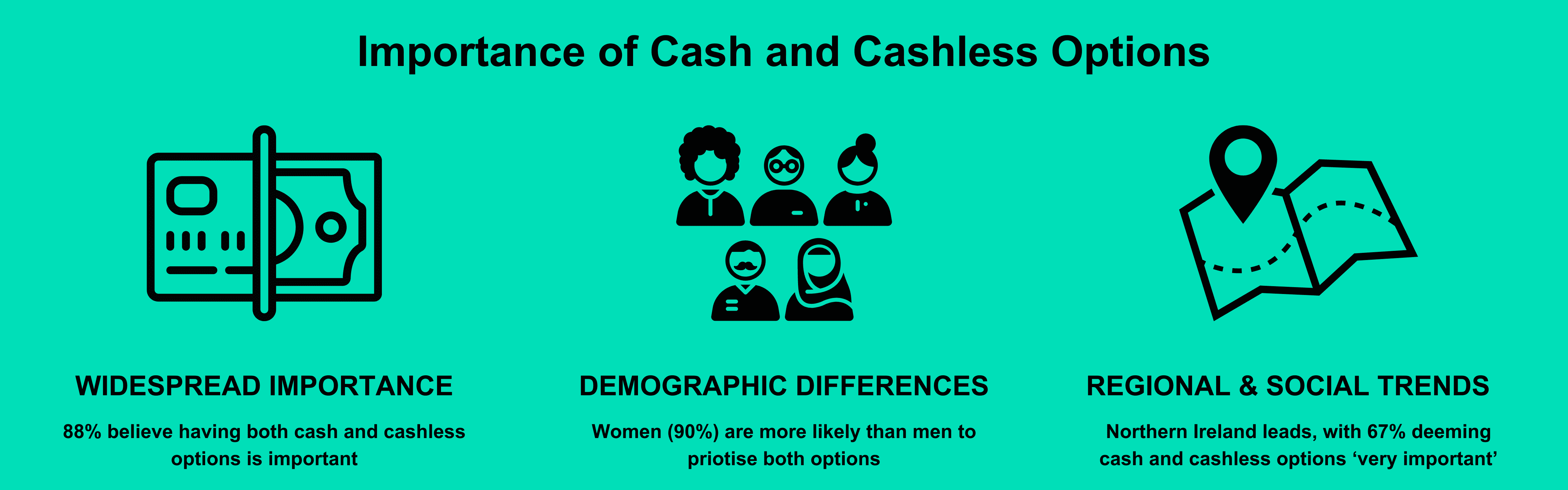

As the payments landscape continues to evolve, the balance between cash and cashless options remains a critical issue for consumers. While digital payments offer convenience and speed, cash still holds significant value for many, particularly for budgeting and accessibility. Ensuring that both options are available is vital in catering to a wide range of consumer needs and preferences, especially as different groups—by age, income, and region—rely on these methods in varying ways.

A notable 88% of respondents value having both cash and cashless payment options, with 62% considering it “very important.” This indicates a strong desire for flexibility, allowing consumers to choose payment methods that suit their needs, particularly in a rapidly changing digital landscape. Without this dual availability, those who rely on cash for budgeting or who lack access to digital payments could face difficulties.

Women (90%) are slightly more likely than men (86%) to prioritise both payment options to some degree, with 65% of women rating it as “very important.” Similarly, older respondents (55+) place a degree of importance on having both options (94%) compared to 25-34 year olds (81%). Lower-income groups (C2DE) also show a high lever of importance, with 90% prioritising both options to some degree, more than higher-income groups (87%).

Regional differences are evident, with Northern Ireland (67%) and Wales (66%) rating maintaining both cash and digital payments as ‘very important’ compared to London (57%). Retired individuals (75%) and households containing three or more children (64%) similarly say it’s very important to have both options.

Wearable payment devices, like smartwatches and fitness trackers, represent a growing trend in digital payments. These devices offer a quick and contactless way to make transactions, seamlessly integrating into everyday life. However, their adoption remains limited, influenced by factors such as cost, awareness, and preference for traditional payment methods. As technology becomes more integrated into daily routines, wearables have the potential to reshape future payment habits.

The low adoption rate of wearable payment devices (79% never using them) indicates a slow integration into daily life. Factors like the cost of wearables, limited awareness, and preference for established methods such as mobile wallets contribute to this hesitation. As a result, businesses may be cautious in investing in wearable payment infrastructure, which can further slow acceptance of this technology.

Younger individuals (18-24) use wearables more frequently (16% weekly), reflecting their comfort with technology and desire for convenience. In contrast, older adults (55+) remain reluctant, with 92% never using wearables. This generational gap suggests that widespread adoption could be challenging unless older demographics are better informed about the benefits of these devices.

Social grade plays a role, as those in higher-income brackets (ABC1) use wearables more often, likely due to greater disposable income and access to premium technology. Meanwhile, lower-income individuals may find wearable devices too expensive or unnecessary. This divide could widen inequality in access to emerging payment technologies if wearables become more prevalent.

Regional variations show London leading in wearable device usage (16% weekly), likely due to its tech-forward environment, while areas like Northern Ireland (7%) and Wales (6%). Similarly, wearable payment use is linked to social media engagement, particularly among younger, tech-savvy users. However, the low adoption among retired and widowed individuals suggests potential financial exclusion if wearables become more mainstream.

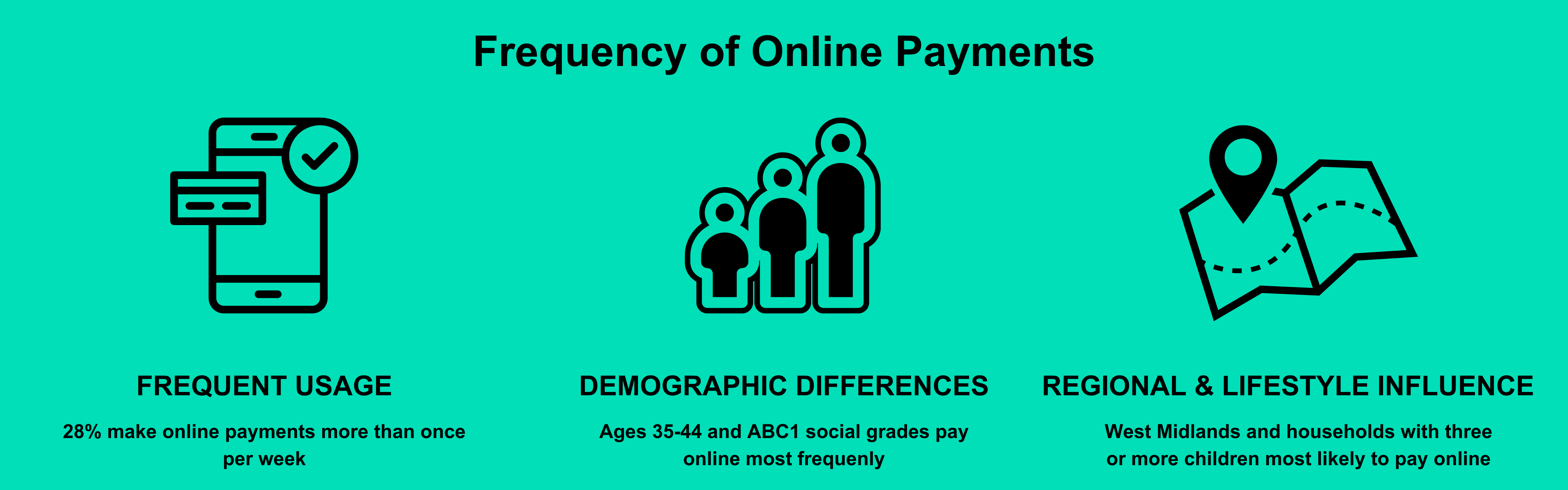

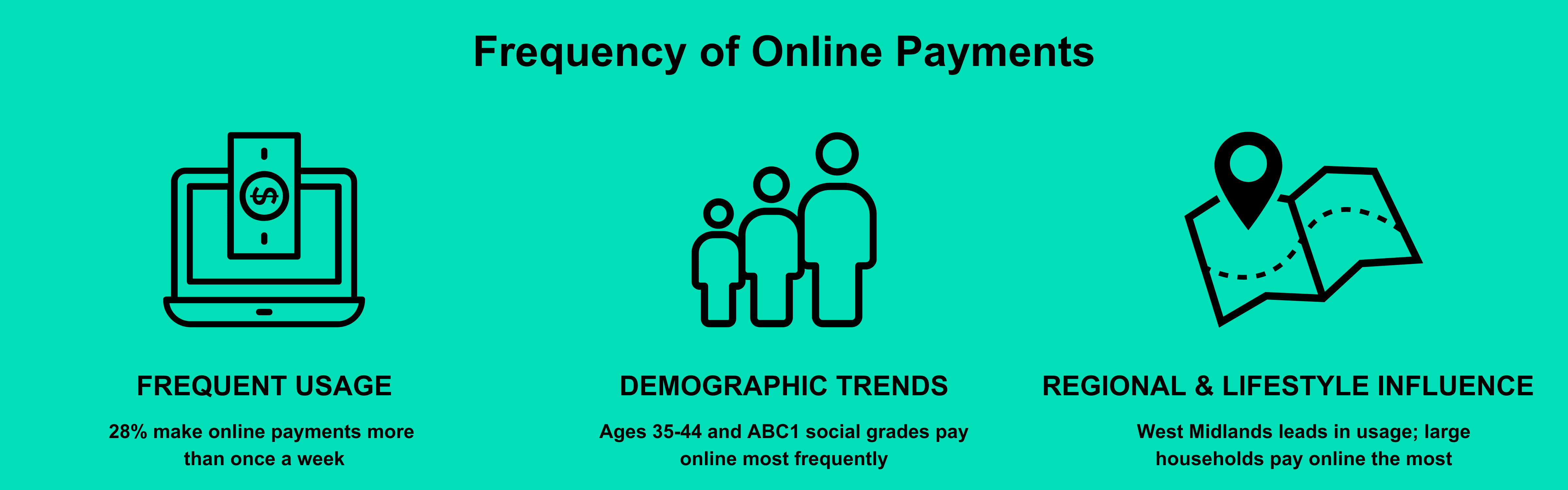

The frequency of making payments online has become a key aspect of modern consumer behaviour. As e-commerce and digital services continue to expand, more people are incorporating online transactions into their daily routines. This shift is driven by the convenience, speed, and variety of options that online payments provide. Understanding how often consumers engage in online payments can offer insights into their preferences and highlight areas for further innovation in the digital payment space.

There is a growing trend toward frequent online payments, with 27% of respondents making transactions more than once a week. This indicates that online payments have become a regular part of daily life, driven by the convenience of e-commerce. To keep pace, businesses may need to enhance their online payment platforms to ensure a smooth user experience and maintain customer loyalty.

Men and women show similar online payment behaviours, suggesting that digital payments have become equally accessible across genders. This lack of a gender gap allows companies to focus on broadening their services without needing to target one specific group over another.

Individuals aged 35-44 are more frequent online payment users, reflecting their active roles in family, work, and e-commerce. In contrast, older adults (55+) use online payments less frequently, likely due to a preference for traditional methods or discomfort with digital transactions. As online payments continue to dominate, addressing the digital needs of older adults becomes crucial to prevent exclusion.

Higher social grades (ABC1) are more likely to make frequent online payments, while lower-income groups (C2DE) lag behind, possibly due to financial constraints or limited access to digital services. Regional variations also exist, with the West Midlands leading in usage (33% use more often than once per week) and Northern Ireland and Scotland showing lower engagement (22%), highlighting disparities in access and infrastructure that may need targeted initiatives to ensure inclusivity.

The preferred payment method for online transactions is a crucial aspect of consumer behaviour in the digital marketplace. With various options available—from debit and credit cards to digital wallets and online banking platforms—consumers choose methods based on convenience, security, and familiarity. Identifying these preferences helps businesses tailor their payment offerings, enhancing customer experiences and building trust in an increasingly digital economy.

When it comes to online payments, debit cards emerge as the most preferred method, with 33% of respondents choosing them for their transactions. This popularity may stem from the straightforward nature and widespread acceptance of debit cards, offering a simple, direct way to manage funds. Credit cards rank second, preferred by 22% of respondents, indicating the appeal of added benefits like purchase protection and rewards points, especially for larger transactions.

Digital wallets and online payment platforms, such as Apple Pay, Google Pay, and PayPal, are equally favoured by 16% of respondents, showcasing a growing trend towards convenient, mobile-friendly payment options. Interestingly, alternative methods like cryptocurrency and Buy Now Pay Later services have minimal traction, with only 2% of respondents claiming they are their preferred method. This low adoption suggests a preference for more traditional and familiar payment methods in the online shopping space.

Gender and age play a role in payment preferences. Women slightly favour debit cards (34%), while men show a higher inclination towards credit cards (23%). Younger individuals (18-24) lean more towards digital wallets (24%), reflecting their comfort with mobile technology. In contrast, older adults (55+) prefer credit cards (29%) and debit cards (36%), indicating a reliance on more established payment methods.

Regional and social class differences also impact choices. In Northern Ireland, 38% prefer debit cards, the highest in any region, while credit cards are more popular in the East of England (28%). Higher social grades (ABC1) are more likely to prefer credit cards (24%) and digital wallets (17%), whereas lower-income individuals (C2DE) favour debit cards (30%) and digital wallets (22%), and larger households with three or more children prefer debit cards (32%) and digital wallets (22%), highlighting how lifestyle factors influence payment preferences.

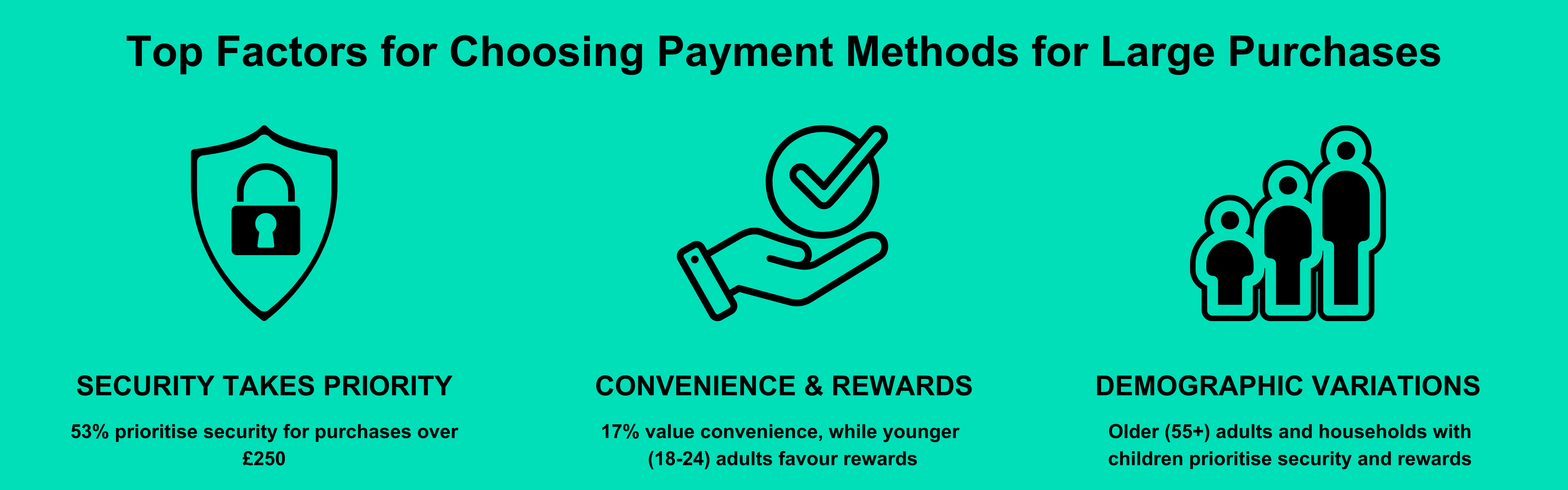

When choosing a payment method for large purchases over £250, security emerges as the top priority, with 53% of respondents considering it the most important factor. This strong emphasis on security indicates that consumers are particularly cautious when making significant financial decisions, seeking reassurance and protection against potential fraud. Regional differences are evident, with security being more crucial in Wales (61%) and East Midlands (59%), while London places less emphasis on it (41%).

Convenience is a secondary factor, valued by 17% of respondents. Men show a slightly higher preference for ease of use (21%) compared to women (14%), indicating some variation in priorities between genders. Social media users, especially those on TikTok (19%) and X (formerly Twitter) (21%), also highlight convenience, suggesting that younger, digitally engaged consumers may lean towards more streamlined payment methods.

Rewards points and cashback are particularly appealing to younger adults, with 20% of 25-34-year-olds prioritising these benefits. This preference diminishes with age, as only 9% of those aged 55+ view rewards as important. Households with children also show a higher interest in loyalty benefits, with those having one child placing the most importance on rewards (19%) compared to childless households (12%).

Interest rates seem to play a minor role in decision-making, with only 4% of respondents citing them as the most important factor. However, widowed individuals display a higher concern for interest rates (9%), possibly reflecting greater sensitivity to borrowing costs. There is also a notable uncertainty among some groups, particularly women (12%) and young adults aged 18-24 (20%), who are more likely to be unsure about their payment priorities for large purchases.

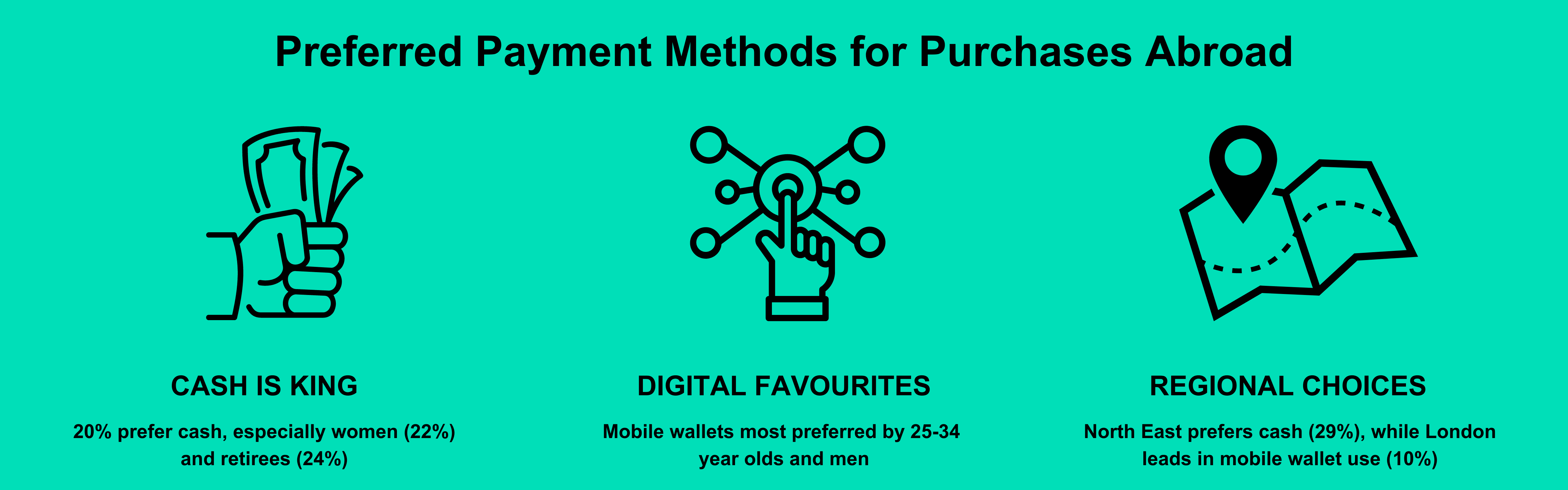

The preferred payment method for purchases abroad is influenced by a variety of factors, including convenience, security, and familiarity with the payment option. When travelling, consumers may opt for different methods, such as cash, credit cards, or mobile wallets, based on their comfort and the perceived acceptance of these methods in foreign locations. Understanding these preferences can help businesses and payment providers offer solutions that cater to the unique needs of travellers, ensuring smooth and secure transactions internationally.

Cash remains the most popular payment method when making purchases abroad, with 20% of respondents preferring it. Women show a higher preference for cash (22%) compared to men (17%). Retirees are more likely to prefer using cash abroad (24%), highlighting its role for those who may not be as comfortable with digital payment methods. Regional preferences also play a part, with cash being particularly popular in the North East (29%), while only 7% of respondents from Northern Ireland prefer to use cash abroad.

Mobile wallets, such as Apple Pay and Google Pay, are favoured by younger and male respondents. Overall, 7% of respondents use mobile wallets for purchases abroad, with 11% of 18-24-year-olds and 13% of 25-34-year-olds leading in adoption. Men are slightly more likely to use mobile wallets (8%) than women (6%), indicating a generational and gender divide in the use of digital payment methods abroad. London is the leading region in mobile wallet usage (10%), reflecting its tech-forward culture.

Travel debit cards appeal more to middle-aged travellers, with 11% of those aged 25-34 and 45-54 choosing this option. In contrast, younger and older age groups show less interest, with only 8% of 18-24 and 55+ age groups choosing travel debit cards. This preference extends to specific groups, such as separated or divorced individuals, where 12% favour travel debit cards over other payment methods.

Online banking platforms are another growing choice, particularly among full-time students (10%) and those in higher social grades (ABC1) (8%). Northern Ireland (14%) and Scotland (11%) strongly prefer these platforms, suggesting regional differences in payment behaviours. Interestingly, parents with children four and under still prefer cash (22%), while those aged 5-11 increasingly opt for contactless debit card payments (8%), reflecting changing needs based on family dynamics.

Experiencing fraud can significantly impact consumer trust in payment methods and digital transactions. The types of fraud individuals fall victim to, such as credit card and APP fraud, online scams, or identity theft, often shape their future payment behaviour and preferences. By understanding the common types of fraud affecting consumers, businesses and financial institutions can implement more effective security measures, provide better education on fraud prevention, and build a more secure payment environment.

Credit card fraud is the most commonly reported type of fraud, affecting 14% of respondents, with both males (13%) and females (14%) experiencing it at similar rates. Notably, credit card fraud incidents increase with age, as 18% of individuals aged 55+ report being victims compared to just 4% of those aged 18-24. Retired individuals appear particularly vulnerable, with 17% falling prey to credit card fraud.

Despite these figures, a significant 53% of respondents have not been victims of any type of fraud, indicating that over half of the surveyed population has successfully avoided such incidents. However, online shopping fraud is the second most common, impacting 12% of respondents and affecting males and females equally. Phishing scams also remain a consistent threat, affecting around 4-5% of respondents across all age groups.

Younger people, particularly those aged 18-24, are more susceptible to social media scams, with 10% reporting being victims. In contrast, only 5% of individuals aged 55+ have experienced such scams. Additionally, romance scams are reported more by males (3%) than females (1%), suggesting differing vulnerabilities across genders.

Regional variations show that Northern Ireland has the highest percentage of individuals who have never been victims of fraud (68%), whereas London has the lowest rate (46%). Households with three or more children report higher incidences of credit card fraud (15%) and social media scams (12%) compared to those with fewer or no children, indicating that family size may also influence exposure to fraud.

The likelihood of adopting a new payment method in the future reflects consumers’ openness to change and their trust in emerging technologies. This willingness can be influenced by factors such as convenience, perceived security, and familiarity with digital innovations. Understanding these attitudes helps businesses and payment providers anticipate market trends, address consumer concerns, and design payment solutions that cater to evolving preferences while ensuring ease of use and security.

There is a noticeable scepticism about adopting new payment methods, with 41% of respondents indicating they are not at all likely to change in the future. This resistance is particularly strong among older adults (55+), with 56% not likely at all to adopt new methods. On the other hand, younger individuals (18-24) show the most openness, with 38% very or fairly likely to try new payment options.

Gender differences are also apparent, as males are generally more open to adopting new payment methods (27% very/fairly likely) than females (15%). Conversely, 46% of females are not likely at all to consider new payment options, compared to 36% of males. Regional variations reflect a similar divide, with Londoners leading in openness (30% very/fairly likely), while residents of Northern Ireland are the most resistant, with 51% not likely at all to embrace new payment methods.

Social grade and working status further influence openness. ABC1 individuals are more likely (21%) to adopt new payment methods compared to those in the C2DE group (16%). Full-time students show the highest openness (33%), whereas retired individuals exhibit the most resistance, with 60% not likely to adopt new payment options.

Household dynamics also play a role. Families with three or more children are the most open, with 42% likely to adopt new payment methods. In contrast, households without children show greater resistance, with 71% not inclined to change. Parents of children aged four and under are notably more receptive (30%) than adults and guardians without children (62% unlikely). Social media use aligns with this trend, as Snapchat users are the most open to new methods (33%), while Facebook users are the least likely (21%) to adopt new payment options.

The consumer behaviour survey results reveal a payment landscape in transition, where traditional methods like cash and credit cards coexist with emerging digital payment options. While there is a clear shift toward convenience and digital solutions, preferences vary widely across demographics, regions, and social grades. Younger individuals and those in higher-income brackets are leading the adoption of mobile wallets and contactless payments, while older adults, retirees, and lower-income groups continue to rely heavily on cash and more established payment methods.

Security remains a paramount concern when choosing payment options for large purchases, reflecting a cautious consumer mindset in the face of increasing fraud incidents. Similarly, while there is openness to adopting new payment methods, a significant portion of the population remains hesitant, particularly among older adults and those with fixed incomes. These insights highlight the importance for businesses, financial institutions, and policymakers to strike a balance between promoting innovative payment technologies and ensuring inclusivity and accessibility for all consumer segments.

As digital payment solutions continue to evolve, understanding these nuanced consumer behaviours will be essential in shaping future strategies. Businesses must offer a variety of secure, convenient payment methods while addressing the barriers faced by those less inclined to adopt new technologies. By acknowledging and catering to these diverse preferences, the financial sector can navigate the ongoing transition toward a more inclusive and adaptable payment ecosystem.

From cash to contactless, UK consumers are more fragmented than ever. Here’s what it means for your checkout strategy.

Explore how acquirers and PSPs can align with evolving 2025 consumer payment trends by balancing innovation, inclusion, and trust.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.