Cashplus voted best challenger bank on Paybefore.com

The results of Paybefore.com’s survey of best challenger banks has just been announced with APS’ Cashplus voted best challenger bank. Read more here.

The results of Paybefore.com’s survey of best challenger banks has just been announced with APS’ Cashplus voted best challenger bank. Read more here.

Pilatus Bank argues that, for as long as cash remains the primary method of payment, the ATMs will survive. And considers why bank branches are becoming a thing of the

paysafecard, a global leader in online prepaid payment methods and part of Paysafe Group plc, enters the United Arab Emirates, offering a secure and fast prepaid payment solution that will

PayPoint has announced positive news for retailers wanting to save money on their banking charges. PayPoint research has shown that the cost of banking remains the top issue facing retailers

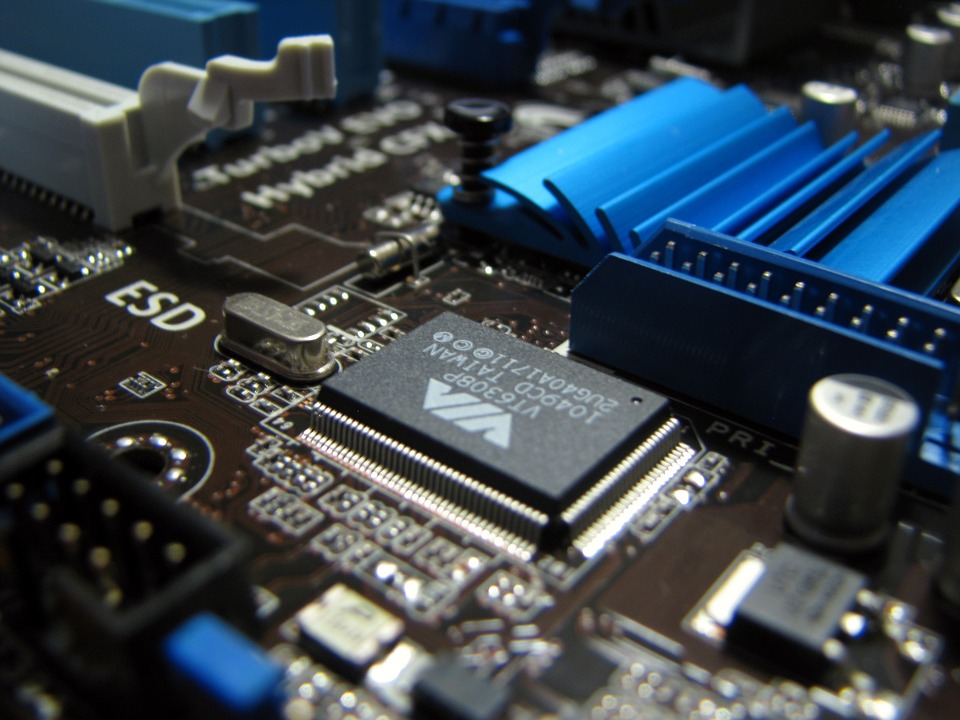

With more and more banks scrapping proprietary hardware for cloud-based solutions, Payment Cloud Technologies have looked at three of the key benefits of banking in the cloud. Read more here.

The Paybase team have produced this jargon-busting guide to ensure that when FinTech (or more precisely the world of eMoney) comes up in conversation, you can confidently stand your ground.

An omni-channel payments strategy is key to creating a seamless customer experience for 79 percent of merchants and retailers, per new benchmark data, “2017 Global Payments Insight Survey: Merchants and

The insurance industry may historically have been largely hidebound by legacy IT, but digital transformation is bringing of new opportunities to better meet changing customer demand, as well as boosting

Telit, a global enabler of the Internet of Things (IoT), together with OT-Morpho, a world leader in digital security & identification technologies, announced today that the companies are partnering together

Nick Kennett, Chief Executive, Financial Services & Telecoms, Post Office Ltd, comments on the FCA’s findings regarding the overdraft market as part of its review of the high-cost short-term credit

Winner of an international call for tenders, Edenred has been selected by the International Air Transport Association (IATA) as one of its partners, to develop and manage the new generation

The findings from the latest Financial Stability Board (FSB) underlines the ongoing challenges faced by businesses, when trading internationally, reinforcing the findings produced in Saxo Payments White Paper Cross Border

W2, the Global AML, age and identify verification provider, has launched a new dashboard which supports all of their services, offering customers faster and improved search functionality. Read more here.

Starling Bank will become a Direct Agency sponsor for Vocalink’s PayPort Service, enabling access to Faster Payments for Starling Bank customers, other Financial Institutions and Payment Service Providers using the

Europe has a new mobile payment method: Wirecard will enable European retailers to accept WeChat Pay, one of the leading mobile payment solutions in China. European retailers can target over

WEX’s first annual ‘Payments Pulse’ survey reveals more than three-quarters of responding CFOs agree payments providers should offer more innovative technologies. The data uncovered five key trends… Read more here.

Valitor, a global leader in Fintech payment service provision has announced the acquisition of Chip & PIN Solutions, one of the UK’s most innovative card based payment providers. The move

Tola Mobile announced a collaboration with Phonovation, an interactive SMS and voice services company, that allows players to instantly purchase Xbox and PlayStation games, season passes and gift cards via

David Craig, president of Thomson Reuters’ Financial & Risk business is delighted to be recognized this year as number #7 in the top 40 global leaders in financial technology, rising

Thames Card Technology has completed a project with Tesco to launch the UK’s first contactless loyalty card programme. With 66% of global shoppers enrolled in loyalty programmes (Nielsen) and cardholders

Mastercard has unveiled the Digital Evolution Index 2017, an in-depth look at technology adoption and the state of digital trust around the world. Read more here.

TGI Fridays, Oracle and Mastercard have announced the launch of Bar Tab at their Leicester Square location, with plans to deploy the app to 80 additional TGI Fridays locations in

Small businesses shift from hiring experts in ‘traditional’ fields to taking on specialists for the digital world like cybersecurity and new payments technology. Read more here.

The growing popularity of music events and festivals is offering merchants a lucrative opportunity to tap into pop-up commerce (expected to be worth £3.5bn by 2020) – but in a

Tech-savvy Brits are adopting and becoming increasingly reliant upon new ways to pay, but small businesses are struggling to keep up with changing consumer demands. Read more here.

The latest figures for the Current Account Switch Service show that almost 4 million (3,986,630) successful switches have taken place since the service launched in 2013. Read more here.

The UK’s smaller businesses are facing a total bill of £2.16 billion to chase overdue payments, according to Bacs Payment Schemes Limited (Bacs), the company behind Direct Debit and Bacs

With London Fintech Week 2017 showcasing the exceptional talent and innovation within the City, one of the founders of Fintech, Cashplus (through its parent company Advanced Payment Solutions Ltd) has

allpay Limited, the UK’s leading payment specialist, has helped the NHS Business Services Authority (NHSBSA)– an arm’s length body of the Department of Health – to reduce administration time and

AEVI and Epos Now have announced a partnership to bring customizable, cloud-based POS systems to AEVI’s Global Marketplace, the B2B app store for smart business management. This collaboration will allow

Bottomline Technologies has launched the 2nd edition of its annual report, the UK Business Payments Barometer: Payments for a new economy, which reveals that fraud and the need for greater

Now live with its first customer, innovative Dublin-based fintech company Cambrist is proceeding with plans to disrupt the way foreign exchange is managed in the card payments industry. Cambrist recently

A public debate over the future of Bitcoin and its transaction capacity, often referred to as the ‘Bitcoin Scaling’ debate, has now been going on among the various actors in

Kompli-Global has developed a tool to help companies deal with the more time-consuming customer due diligence challenges of the 4th Anti-Money Laundering Directive (4th AMLD). The 4th AMLD, which came

Kemp Little has, the technology and digital law firm, announced a 12% increase in revenues for its 2016-17 financial year, taking fee revenue to £13.7million and marking three consecutive years

For consumers and businesses around the world, from emerging markets such as Bangladesh to advanced ones such as the United States or Germany, going online to shop is becoming a

London is the second largest financial centre in the world and financial services is the largest industry in the UK, therefore it is logical to expect the financial services industry

Silicon Valley analytics firm FICO has announced that its new release of the FICO® Enterprise Security Score quantifies the breach risks introduced by 4th parties — a partner or vendor’s

Payments AssociationM Systems have announced that it has been named censhare’s first Global Premium Partner. Through the partnership, Payments AssociationM and censhare clients can manage digital assets and product information

Discover is offering a free service that monitors risky websites known to illegally sell or trade personal data and alerts Discover cardmembers if their Social Security numbers are found. In

Finastra today announced that its UK-based service bureau (formerly part of D+H) has been awarded the SWIFT Shared Infrastructure Program (SIP) version 2 for 2016 label. It is the first

ACI Worldwide electronic payment and banking solutions, has announced the official opening of its new Timişoara, Romania office. Read more here.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.