What is this article about?

The impact of the Financial Conduct Authority’s (FCA) Consumer Duty on financial firms and consumers, focusing on positive changes and areas needing improvement.

Why is this important?

It represents a significant shift towards prioritising consumer outcomes, transparency, and fairness in financial services.

What’s next?

Further reviews on firms’ treatment of vulnerable customers, the inclusion of closed products in Consumer Duty scope, and the preparation of the first Consumer Duty Board report

More than six months have passed since the Financial Conduct Authority introduced its regulatory initiative, Consumer Duty. How has the regulation impacted both financial firms and consumers?

Initial findings from the FCA’s Consumer Duty firm survey, conducted in Autumn 2023, paint what Thistle Initiative’s head of payment services and The Payments Association’s (TPA) Regulator working group member, Lorraine Mouat, refers to as an “encouraging picture”. The majority of the firms responded positively, and Mouat notes that a significant majority of respondents have reassessed business practices and prioritised consumer outcomes.

Teresa Connors, managing director at Payment Matters and member of TPA’s Regulator working group observes that the assessment of a selection of firms’ Consumer Duty plans and activity by the FCA reveals examples of good implementation but also reveals that there’s more to be done. She says: “The feedback relates to the wider FS market, and not all of the feedback is specific to payment firms; nonetheless, the assessment shows where the FCA sees gaps or weaknesses in implementation. While the assessment gives helpful examples of good and bad practice across all Consumer Duty measures, the tone overall for FS is ‘improvement needed'”.

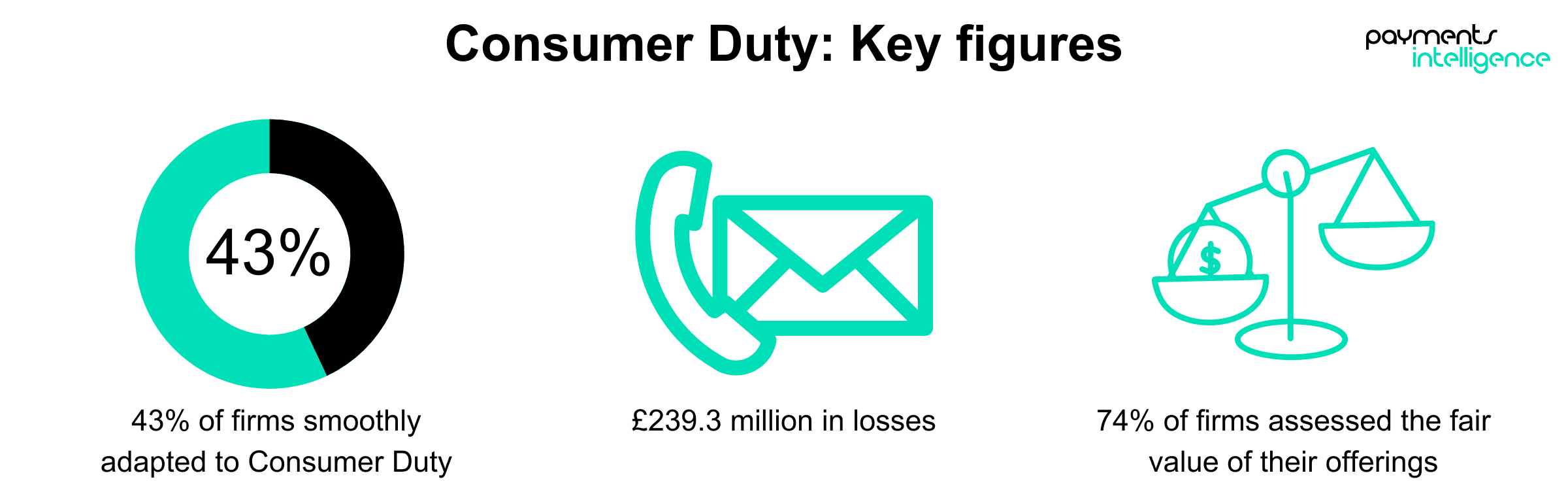

Data released by the FCA in February revealed that 43% of 1,230 firms surveyed by Ipsos UK reported no difficulty implementing any aspects of the Duty.

Mouat compounds this by claiming that firms have been genuine in their commitment to embracing the new regulatory framework’s “principles of fairness, transparency, and accountability”.

According to the FCA’s good and bad practice report, published in February, for the most part, firms have been seen to be so far:

Last month, FCA executive director of consumers and competition Sheldon Mills praised firms’ efforts in implementing the duty, saying: “We have seen board-level leaders giving serious consideration to what the Duty means for them culturally and operationally.”

He added that the regulator has “some firms offering fairer value too” by reducing fees and maximising customer benefits. Mouat observes that the implementation of the Duty has significantly impacted the entire financial services ecosystem. Firms are now re-evaluating their practices, from product design and distribution to customer service and complaints handling, focusing on improving consumer outcomes. This shift, she claims, represents a fundamental change in approach from a transactional model to a more comprehensive, relationship-based engagement with consumers.

Mouat says: “The Duty has served as a catalyst for innovation, prompting firms to rethink outdated practices and explore new ways of delivering value to consumers. From enhanced disclosure requirements to the development of tailored products and services that meet the diverse needs of consumers, the industry is experiencing a wave of innovation driven by a renewed focus on consumer outcomes.”

Despite positive regulator figures implying the majority of firms are complying with the new regulations, the need for the Duty is there for everybody to see. In November, a speech from Nisha Arora, director of cross-cutting policy and strategy at the FCA, outlined the difficulties faced by consumers who have been struggling to contact one or more of their financial services. This led to just 41% of adults having confidence in the UK’s financial services industry.

Data from the regulator found that 7.4 million people (14% of adults) unsuccessfully attempted to contact one or more of their financial services providers. A further 3.6 million people (7% of adults) were able to contact one of their financial services providers. However, they could not get the information or support they wanted.

According to the FCA’s survey findings, 74% of respondents have conducted a fair value assessment of its existing products and services. A further 66% said they had assessed the end-to-end consumer journey, and 69% have assessed the needs of consumers with characteristics of vulnerability.

While this shows marked improvement, it does leave areas for improvement, which the regulator has observed as being:

Mouat says that achieving true cultural transformation requires more than regulatory compliance. It requires a fundamental shift in mindset and behaviour at all organisational levels. She explains: “Additionally, the need for ongoing monitoring and enforcement to ensure firms adhere to the principles of the Consumer Duty cannot be overstated.”

The regulator has also found weaknesses in some frameworks that support vulnerable customers. This includes an inability to identify and provide them with the right support channels.

Jennifer Cahill, associate director, Cosegic, says: “Many firms still don’t recognise that some of their customers are vulnerable and don’t have the ability to deal with them appropriately.” The regulator announced that it would review how firms understand and respond to the needs of customers in vulnerable situations. It will publish its findings by the end of the year.

If the terms of Consumer Duty are duly met by the deadline of 31 July 2024, it could prove to be a pivotal moment for the UK’s payments space, helping to raise standards and healthier competition, Mills said. The importance of the duty is outlined by Thistle Initiatives senior associate Rohan Chakraborty. He states that it is a crucial initiative that aims to protect and promote the interests of retail consumers while ensuring that payment firms act with transparency, fairness, and accountability. By committing to this initiative, leaders of payment firms can build trust in their products and services, which is essential for the sustainability and growth of their businesses. Furthermore, the Duty helps to address the needs of vulnerable consumers and promotes good outcomes for all consumers, which is a win-win situation for both the firms and their customers.

He tells Payments Intelligence: "We have noticed an emerging pattern that can be traced across the industry – that of payment firms not recognising that they fall under the scope of the Duty, and so not taking the appropriate action to address this." Chakraborty points out that the FCA mentions how the Duty applies ‘to all firms who determine or have a material influence over consumer outcomes’, which extends the scope beyond firms who have a direct customer relationship.

Consumer Duty will soon be one year old. The FCA has been continuously producing updates, surveys, and questionnaires related to this initiative, which means that it is still one of their top priorities. Two significant changes are coming up: from the end of July, closed products and services will be included in the scope of Consumer Duty, and the first Consumer Duty Board report is due on the same date. Additionally, the FCA has recently announced a review of how firms are treating vulnerable customers.

Cahill recommends that all firms with books of business closed to new customers assess whether their products and services meet Consumer Duty requirements and apply those requirements by 31 July 2024.

According to Cahill, the Consumer Duty board report is generating a lot of questions. These mainly include:

She says: “The last question is a quick one to answer – the Consumer Duty board report is an annual report, similar to the MLRO report and should be incorporated into the annual compliance calendar.”

As far as the other questions, Cahill underlines that the report should not be a “simple attestation that firms are meeting Consumer Duty requirements” but a formal internal governance exercise “where firms are really challenging themselves on whether they are delivering good customer outcomes”.

She explains that for each cross-cutting rule and the four Consumer Duty outcomes. It should focus on:

Cahill has cautioned companies that the regulatory body will request copies of the board report after 31 July. The regulator will scrutinise the actions being taken by the firms and specifically look for evidence of their efforts to rectify mistakes. The extent to which boards are examining the report will also be taken into consideration.

Consumer Duty came into force for live products last July and comes into force for closed products on 31 July this year. Closed products are solutions that were sold before the 31st of July 2023 but have not been marketed or sold to new customers since.

Connors points out that while the FCA appreciates that firms incur costs and customers have received benefits up until July 2024, Consumer Duty adherence for closed products can bring extra considerations:

According to Chakraborty, "Firms do not necessarily need to be serving retail customers, nor do they require direct customer exposure at all, to be held accountable for ensuring good consumer outcomes." It is important to note that financial intermediaries, such as merchant acquiring services, may not have direct exposure to retail customers. This may lead to the belief that there is no relationship with retail customers. However, any delays or shortfalls in the delivery of funds at these stages can have a negative impact on the end consumer experience. Therefore, Chakraborty stresses that it is crucial for all financial firms to prioritise consumer outcomes and ensure that their practices are aligned with the principles of fairness, transparency, and accountability.

He says: "When businesses themselves are ‘vulnerable’ – small-to-medium sized businesses, for example, may have business models that are less resilient to financial shocks or their directors may lack experience– it is imperative for their leadership team to assess how it can mitigate risks to the end consumer further down the payment chain."

Mouat says that as firms diligently navigate implementation hurdles in their attempt to foster a culture of consumer-centricity, they must consider the challenges posed by the Duty's implementation, both currently and in the foreseeable future. She tells Payments Intelligence that "firms must grapple with the intricate balance between regulatory compliance and fostering an environment conducive to innovation and market dynamism. Striking this balance demands a cautious approach and collaborative engagement among stakeholders."

Chakraborty stresses that payments business leaders should consider how their business model, customer characteristics, and influence over consumer outcomes may redefine their understanding of whether it applies to them—even where a firm feels it has absolutely no direct contact with the consumer.

In the words of Sheldon Mills, “the prize is huge” if the firms can get consumer duty right.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.