The role of artificial intelligence in enhancing AML and regulatory compliance in fintech

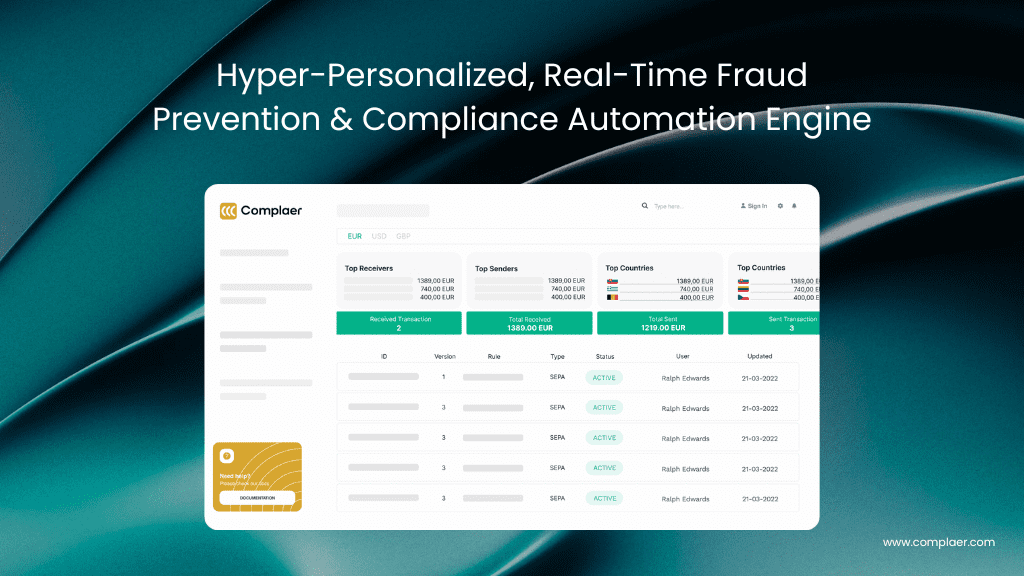

AI is transforming fintech compliance—boosting fraud detection, speeding onboarding, and ensuring regulatory alignment while demanding ethical oversight and balance.