Rewiring the cross-border payments paradigm: Risk and security in correspondent banking

May 8 @ 3:00 pm - 4:00 pm

Could a cross-border transaction ever be as low risk as a domestic one? While cross-border payments have typically been seen as more complex and risk-prone, due to the involvement of multiple parties, currencies and legal systems, new technologies and solutions are emerging to better support the process and upset the paradigm. In this webinar, we’ll explore how new counterparty risk software in particular is transforming cross-border payments and correspondent banking via tools including AI, machine learning, and real-time data analytics. We’ll discuss how these innovations could increase transparency, reduce fraud, and mitigate risk, ultimately driving efficiency and trust in global payment systems.

Join this webinar to explore the use cases, challenges and opportunities including:

- Filling the technology gaps in core bank systems and digital bank platforms by allowing rules to be automated across the cross-border ecosystem.

- Counterparty risk solutions that work with a new global single shared platform. Do these new solutions impact transparency and security in cross-border payments? Are we heading toward more decentralized payment systems or does this improve how we move funds today?

- With global regulatory requirements continuously evolving, how can organisations evolve their own best practices and adopt new software to remain compliant across markets?

- How has the development of AI and machine learning improved the accuracy and efficiency of risk assessments in cross-border payments? How could AI help manage legal risks, and how do we balance the benefits of using AI with the hazards of a rapidly evolving technology?

- Where are the biggest innovations happening in counterparty risk management in the near future?

- How could the evolution of counterparty risk software impact traditional correspondent banking relationships?

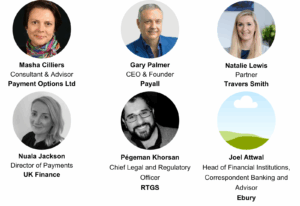

Speakers